Bri-Chem Announces 2019 Second Quarter Financial Results

08 August 2019 - 12:39PM

Bri-Chem Corp. (“Bri-Chem” or “Company”) (TSX:

BRY), a leading North American oilfield chemical

distribution and blending company, is pleased to announce its 2019

second quarter financial results.

|

|

|

Three months ended |

|

|

|

|

Six months ended |

|

|

|

|

|

|

|

|

June 30 |

|

Change |

|

|

June 30 |

|

Change |

|

|

(in '000s except per share amounts) |

|

2019 |

|

|

2018 |

|

|

$ |

|

% |

|

|

2019 |

|

|

2018 |

|

|

$ |

|

% |

|

|

|

Sales |

$ |

22,721 |

|

$ |

27,255 |

|

$ |

(4,534 |

) |

(17 |

%) |

$ |

48,619 |

|

$ |

62,572 |

|

$ |

(13,953 |

) |

(22 |

%) |

|

|

Adjusted EBITDA(1) |

|

447 |

|

|

(366 |

) |

|

813 |

|

222 |

% |

|

2,028 |

|

|

559 |

|

|

1,469 |

|

263 |

% |

|

|

Adjusted EBITDA as a % of revenue |

|

2 |

% |

|

-1 |

% |

|

|

|

4 |

% |

|

1 |

% |

|

|

|

|

Adjusted operating (loss) income (1) |

|

(30 |

) |

|

(640 |

) |

|

610 |

|

95 |

% |

|

940 |

|

|

331 |

|

|

609 |

|

184 |

% |

|

|

Adjusted (loss) / net earnings (1) |

|

(717 |

) |

|

(1,101 |

) |

|

384 |

|

35 |

% |

|

(358 |

) |

|

(1,207 |

) |

|

849 |

|

70 |

% |

|

|

Net loss |

$ |

(741 |

) |

$ |

(3,740 |

) |

$ |

2,999 |

|

80 |

% |

$ |

(382 |

) |

$ |

(3,846 |

) |

$ |

3,464 |

|

90 |

% |

|

|

Diluted per share |

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA |

$ |

0.02 |

|

$ |

(0.02 |

) |

$ |

0.03 |

|

222 |

% |

$ |

0.08 |

|

$ |

0.02 |

|

$ |

0.06 |

|

(263 |

%) |

|

|

Adjusted (loss) / net earnings |

$ |

(0.00 |

) |

$ |

(0.03 |

) |

$ |

0.03 |

|

95 |

% |

$ |

(0.01 |

) |

$ |

(0.05 |

) |

$ |

0.04 |

|

70 |

% |

|

|

Net loss |

$ |

(0.03 |

) |

$ |

(0.16 |

) |

$ |

0.13 |

|

80 |

% |

$ |

(0.02 |

) |

$ |

(0.16 |

) |

$ |

0.14 |

|

90 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets |

|

|

|

|

$ |

59,150 |

|

$ |

81,232 |

|

$ |

(22,082 |

) |

(27 |

%) |

|

|

Working capital |

|

|

|

|

|

16,560 |

|

|

24,336 |

|

|

(7,776 |

) |

(32 |

%) |

|

|

Long-term debt |

|

|

|

|

|

9,016 |

|

|

9,625 |

|

|

(609 |

) |

(6 |

%) |

|

|

Shareholders equity |

|

|

|

|

$ |

19,325 |

|

$ |

28,756 |

|

$ |

(9,431 |

) |

(33 |

%) |

|

| |

|

|

|

|

|

|

|

|

|

Key Q2 2019 & YTD highlights include:

- Bri-Chem generated consolidated

sales of $22.7 million, a decrease of 17% from the second quarter

of 2018. The reduced revenue mainly resulted from the closure of

two underperforming West Texas warehouses in Q2 2018 and weaker

Canadian drilling activity;

- Adjusted EBITDA for the second

quarter was $447 thousand versus negative $366 thousand in the

comparable period in 2018. This 222% increase was due to

improved margins in all divisions as the Company is selling less

low margin inventory products and we are operating with lower

infrastructure costs as a result of the Company’s right sizing

initiatives based on current demand levels. In addition, we

incurred a reduction in selling general and administration costs as

a result of the adoption of IFRS 16 whereby the new IFRS standard

creates right of use assets that generates depreciation, when

previously these assets would have recorded as monthly rent.

- Adjusted operating loss was $30

thousand for the three months ended June 30, 2019 compared to a

loss of $640 thousand in the prior year comparable quarter, which

represented a 95% increase.

- Bri-Chem reported a net loss of

$741 thousand or $0.03 loss per share compared to a net loss of

$3.7 million or $0.16 loss per share in Q2 2018;

- As at June 30, 2019, working

capital was $16.6 million compared to $24.3 million at June 30,

2018, a decrease of 32%. This was due to management’s efforts

to reduce inventory levels and realize cash flow. In

addition, the adoption of IFRS 16 generated a current liability for

the obligations under finance lease for the right of use

assets. Bri-Chem’s current ratio, defined as current assets

divided by current liabilities, was 1.53 as at June 30,

2019.

Summary for the three and six months ended June 30,

2019:

Bri-Chem’s Q2 2019 consolidated sales were $22.7

million for the three months ended June 30, 2019 which was $4.5

million lower than the same prior year period. This decline

was mainly due to lower Canadian drilling activity levels in the

second quarter and the wet late start to the summer drilling

program along with the loss of revenue due to the closure of two

underperforming West Texas warehouses in Q2 2018. The revenue

decline was partially offset by an increase in well abandonment and

new cementing work in our division located in the state of

California.

Bri-Chem’s Canadian drilling fluids distribution

division generated sales of $3.6 million and $8.9 million for the

three and six months ended June 30, 2019 compared to $3.7 million

and $15.5 million in the comparable periods in 2018. The Q2

and year to date sales were lower due to the overall decline in

Canadian drilling activity and the wet late start to the summer

drilling program. The number of wells drilled in Western

Canada for the second quarter of 2019 was 806 compared to 906 in

the same period last year, representing a decrease of 11% (Source:

Petroleum Services Association of Canada “PSAC”). Bri-Chem’s

United States drilling fluids distribution division generated sales

of $14.0 million and $29.4 million compared to sales of $18.7

million and $36.7 million for the same comparable period of 2018,

representing decreases of 25% and 20% respectively. The

decreases were the result of the loss of revenue due to the closure

of two underperforming West Texas warehouses in Q2 2018.

Demand for Bri-Chem’s products and services is largely driven by

current and future North American oil and gas prices which impact

the capital drilling programs and corresponding rig activity of

Bri-Chem’s customers.

Bri-Chem’s Canadian Blending and Packaging

division generated sales of $2.0 million and $4.9 million for three

and six months ended June 30, 2019 compared to Q2 2018 sales of

$2.9 million and 2018 six month sales of $7.0 million, representing

decreases of 29% and 30% respectively. The decreases relate

to the overall decline in Canadian drilling activity which affected

demand for toll blending and bulk packaging of products over the

first half of the 2019. Conversely, Bri-Chem’s US Fluids

Blending and Packaging division experienced increases of 62%

quarter over prior year quarter and 59% year over year, as the

division recorded sales of $3.1 million and $5.4 million for the

three and six months ended June 30, 2019. These increases are

due to the increase in well abandonment work and new cementing work

in the state of California as well as the division providing cement

to customers working offshore.

Adjusted operating loss for the three months

ended June 30, 2019 was $50 thousand compared to a loss of $640

thousand during the same period last year. The infrastructure

and inventory reductions that have taken place over the first half

of 2019 have led to improved financial performance in the quarter

and year to date.

Adjusted EBITDA was $447 thousand and $2.0

million for the three and six months ended June 30, 2019 compared

to a loss of $366 thousand and positive $559 thousand for the same

comparable periods in 2018, representing increases of 222% quarter

over comparable quarter and 263% year over year. Adjusted

EBITDA as percentage of sales was 2% for Q2 2019 compared to

negative 1% for the same quarter in 2018. This increase was

due to increased sales in the US blending division, higher margins

in both fluids distribution divisions, a reduction of

infrastructure costs as part of the Company’s right sizing

initiatives implemented over the past 6 months, and the adoption of

IFRS 16 causing a reduction in rental expense for the right of use

assets.

Management’s plan to reduce debt, lower

inventory and curtail infrastructure has been on track for the

first half of 2019. Inventories have been reduced by 22%

while bank indebtedness has been reduced by 35% over the first half

of 2019.

OUTLOOK

Oilfield activity in Canada will continue to be

impacted by the limited pipeline take away capacity, lower customer

spending constraints relative to historical levels and the

corresponding lack of development of new resource plays in western

Canada. PSAC has forecasted 2,771 oil and gas wells will be drilled

in Canada for the back half of 2019, a decrease of 27% compared to

the back half of 2018 when 3,777 wells were drilled. US

drilling activity has remained consistent and therefore Bri-Chem

will continue to operate in all regions that it currently services.

We will continue to monitor drilling activity levels in Canada and

the USA and will adjust inventory levels and infrastructure based

on demand for our products.

Bri-Chem’s priorities will be to continue to

focus on controlling fixed and variable costs, improving overall

margins while maintaining a strong balance sheet. Where possible,

we will examine warehouse locations to determine if we can better

reach our customers as warehouse leases become due. We will

continue to streamline and find efficiencies in operations and

prudently manage working capital until a better business

environment emerges.

About Bri-Chem

Bri-Chem has established itself, through a

combination of strategic acquisitions and organic growth, as the

North American industry leader for wholesale distribution and

blending of oilfield drilling, completion, stimulation and

production chemical fluids. We sell, blend, package and distribute

a full range of drilling fluid products from 24 strategically

located warehouses throughout Canada and the United States.

Additional information about Bri-Chem is available at www.sedar.com

or at Bri-Chem's website at www.brichem.com.

To receive Bri-Chem news updates send your email to

ir@brichem.com.

For further information, please contact:

| Jason

TheissBri-Chem Corp.CFOT: (780)

571-8587E: jtheiss@brichem.com |

|

|

|

Neither the TSX nor its Regulation Services

Provider (as that term is defined in the policies of the TSX)

accepts responsibility for the adequacy or accuracy of this

release.

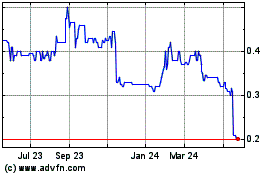

Bri Chem (TSX:BRY)

Historical Stock Chart

From Nov 2024 to Dec 2024

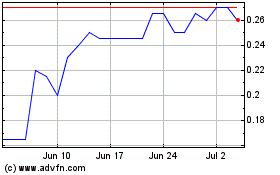

Bri Chem (TSX:BRY)

Historical Stock Chart

From Dec 2023 to Dec 2024