B2Gold Corp. (TSX: BTO, NYSE AMERICAN: BTG, NSX: B2G) (“B2Gold” or

the “Company”) is pleased to announce its gold production and

revenue results for the fourth quarter and full year 2024, as well

as its 2025 total gold production guidance and 2025 cost guidance

for its current operating mines. All dollar figures are in United

States dollars unless otherwise indicated.

Q4 and Full Year 2024

Highlights

- Total gold production of

186,001 ounces in Q4 2024: Total gold production in the

fourth quarter of 2024 was 186,001 ounces. At the Fekola Mine,

production was lower than expected due to the continued delays in

accessing higher-grade ore from Fekola Phase 7, a result of lower

realized mine production from the Fekola Phase 7 and Cardinal pits

during the period. Mining and processing of these higher-grade

tonnes is now expected in 2025 as equipment availability had

returned to full capacity and mining rates were at expected levels

at the end of 2024. The Fekola Mine and mill are operating

without limitations and gold production is being exported for

refining as per its regular planned schedule. Masbate and Otjikoto

both continued to outperform expectations in the fourth quarter of

2024, which partially offset a portion of the lower than expected

production levels at Fekola during the fourth quarter.

- Total annual consolidated

gold production of 804,778 ounces: Total consolidated gold

production for 2024 was 804,778 ounces (including 19,644 ounces of

attributable production from Calibre Mining Corp. (“Calibre”)), at

the low end of the Company’s revised 2024 guidance range.

- Strong quarterly gold

revenue to finish 2024: Consolidated gold revenue in the

fourth quarter of 2024 was $500 million on sales of 187,793 ounces

at an average realized gold price of $2,661 per gold ounce. For the

full year 2024, consolidated gold revenue was $1.90 billion on

sales of 801,524 ounces at an average realized gold price of $2,373

per gold ounce.

- Re-affirm full year 2024

total consolidated cost guidance: Total consolidated cash

operating costs (see “Non-IFRS Measures”) for the year (including

attributable results for Calibre) are still expected to be at the

upper end of the guidance range of between $835 and $895 per ounce

and total consolidated all-in sustaining costs (“AISC”) (see

“Non-IFRS Measures”) for the year (including attributable results

for Calibre) are still forecast to be at the upper end of the

revised guidance range of between $1,420 and $1,480 per ounce.

- Achieved significant safety

milestone of 6 years without a Lost Time Injury at

Masbate: On November 17, 2024, the Masbate Mine, located

in the Philippines, achieved a major safety milestone, six years

without a Lost Time Injury (“LTI”). Further, Masbate has only seen

one LTI in approximately the last ten years. B2Gold has a

longstanding commitment to continuous safety improvement at all of

its sites, and its goal of sending everyone home safe at each of

its operations and projects.

- Renewed revolving credit

facility in December 2024, increasing the total borrowing capacity

to $800 million: On December 17, 2024, B2Gold completed

the renewal of its revolving credit facility, increasing the total

available amount from $700 million to $800 million, plus a $200

million accordion feature. The new revolving credit facility has a

term until December 17, 2028. The revolving credit facility was

completed with a syndicate of banks: Canadian Imperial Bank of

Commerce, ING Bank N.V., The Bank of Nova Scotia, Bank of Montreal,

National Bank of Canada, HSBC Bank USA, National Association and

Citibank N.A., Canadian Branch.

2025 Guidance Highlights

- Total gold production is

anticipated to be between 970,000 and 1,075,000 ounces:

Total gold production for 2025 is expected to be between 970,000

and 1,075,000 ounces. The expected increase in gold production

relative to 2024 is predominantly due to the scheduled mining and

processing of higher-grade ore from the Fekola Phase 7 and Cardinal

pits made accessible by the meaningful deferred stripping campaign

that was undertaken throughout 2024, the expected contribution from

Fekola Regional starting in mid-2025, the commencement of mining of

higher-grade ore at Fekola underground, and the commencement of

gold production at the Goose Project by the end of the second

quarter of 2025, partially offset by the scheduled conclusion of

open pit mining activities at the Otjikoto Mine in the third

quarter of 2025.

- Total consolidated cash

operating costs and all-in sustaining costs remain stable:

Total consolidated cash operating cost guidance (see “Non-IFRS

Measures”) for the Fekola Complex, Masbate Mine, and Otjikoto Mine

for 2025 of between $835 and $895 per gold ounce. Total all-in

sustaining cost guidance (see “Non-IFRS Measures”) for the Fekola

Complex, Masbate Mine, and Otjikoto Mine for 2025 of between $1,460

and $1,520 per gold ounce. Operating cost guidance for the Goose

Project will be released in the second quarter of 2025 (prior to

the commencement of initial production), after publication in the

first quarter of 2025 of B2Gold’s initial Goose Project life of

mine plan based on updated Mineral Reserves.

- B2Gold’s initial Goose

Project life of mine plan to be released at the end of the first

quarter of 2025 based on updated Mineral Reserves: The

Company continues to estimate that gold production in calendar year

2025 will be between 120,000 and 150,000 ounces and that average

annual gold production for the six year period from 2026 to 2031

inclusive will be approximately 310,000 ounces per year, with the

latest published Mineral Reserves supporting a long mine life

beyond 2031.

- Total Goose Project

construction and mine development cash expenditure estimate before

first production remains at C$1,540 million: As of

September 30, 2024, C$1,176 million of construction and mine

development cash expenditures (or 76% of the total estimated cash

expenditures) had been incurred. Based on its unaudited November

2024 cost report, the Company estimates that approximately 83% of

the total estimated cash expenditures to first gold had been

incurred as of November 30, 2024. Reconciled total cash

expenditures as of December 31, 2024, will be published with the

Company’s year-end financial statements to be released in February

2025. Based on the construction and mine development cash

expenditures incurred to date, combined with the estimated

expenditures to be incurred through to the first gold pour in the

second quarter of 2025, the Company reiterates the total Goose

Project construction and mine development cash expenditure estimate

of C$1,540 million.

- Goose Project construction

and development remains on schedule for first gold pour in the

second quarter of 2025: All planned construction

activities for 2024 were completed and project construction and

development continue to progress on track to achieve first gold

pour at the Goose Project in the second quarter of 2025. Following

the successful completion of the 2024 sea lift, the construction of

the 163 kilometer (“km”) Winter Ice Road (“WIR”) is well underway

and expected to be completed on schedule and fully operational

before March 2025, allowing for the transportation of all materials

from the Marine Laydown Area (“MLA”) to the Goose Project site by

the end of May 2025.

- Mining and trucking

operations anticipated to commence at Fekola Regional in 2025, with

first gold production expected in mid-2025; initial gold production

at Fekola underground also expected in mid-2025: Following

the expected receipt of the exploitation license for Fekola

Regional in the first quarter of 2025, mining and trucking

operations will commence, with gold production expected in

mid-2025. The contribution of higher-grade open pit ore from Fekola

Regional, to be trucked to the Fekola mill, is anticipated to

contribute between 20,000 and 25,000 ounces in 2025 with average

contribution of approximately 180,000 ounces of additional annual

gold production in its first four full years of production from

2026 through 2029. The approval of the exploitation phase to mine

the higher-grade ore at Fekola underground is expected to be

received in the second quarter of 2025 with initial gold production

from Fekola underground expected in mid-2025. Significant

exploration potential remains across the Fekola Complex to further

extend mine life.

- Preliminary economic

assessment (“PEA”) on the Antelope deposit at Otjikoto expected

early in the first quarter of 2025: Following the

successful completion in 2024 of an initial Inferred Mineral

Resource Estimate for the Springbok Zone, which is the southernmost

shoot of the recently discovered Antelope deposit located

approximately three km south of the Otjikoto Phase 5 open pit at

the Otjikoto Mine in Namibia, the Company commenced a PEA which is

expected to be completed early in the first quarter of 2025.

Subject to receipt of a positive PEA and necessary permits and

approvals, mining of the Springbok Zone could begin to contribute

to gold production at Otjikoto as early as 2028. An initial budget

of up to $10 million has been approved to de-risk the Antelope

deposit development schedule by advancing early work planning,

project permits and long lead orders. Exploration of the greater

Antelope deposit has the potential to supplement the processing of

low-grade stockpiles at Otjikoto, with an initial goal of adding

between 80,000 and 90,000 ounces of additional gold production

per year from 2029 through 2032, with potential to extend mine life

further through additional drilling at the Springbok and Oryx Zones

at the Antelope deposit.

- Feasibility Study on the

Gramalote Project in Colombia targeted for completion in

mid-2025: The positive PEA results on the Company’s 100%

owned Gramalote Project, completed in the second quarter of 2024,

outlined a significant production profile with average annual gold

production of 234,000 ounces per year for the first five years of

production, and strong project economics over a 12.5 year project

life. As a result, B2Gold commenced work on a feasibility study

with the goal of completion in mid-2025. Feasibility work including

geotechnical investigation, processing design and site

infrastructure design is underway and the study remains on

schedule.

- Continued focus on

exploration investment across B2Gold’s prospective land

packages: $61 million is budgeted for exploration in 2025

to support organic growth by advancing the Company’s pipeline of

development, brownfield and greenfield exploration projects, with a

considerable portion allocated to continue the significant

exploration campaign at the Back River Gold District.

Fourth Quarter and Full Year 2024 Gold

Production

Mine-by-mine production in the fourth quarter

and full year 2024 was as follows:

|

|

Gold Production (ounces) |

|

Mine |

Q4 2024 |

FY 2024 |

FY 2024 Revised Guidance |

|

Fekola |

84,015 |

392,946 |

420,000 - 450,000 |

|

Masbate |

49,534 |

194,046 |

175,000 - 195,000 |

|

Otjikoto |

52,452 |

198,142 |

185,000 - 205,000 |

|

Equity interest in Calibre (1) |

- |

19,644 |

20,000 |

|

Total |

186,001 |

804,778 |

800,000 – 870,000 |

(1) Subsequent to June 20, 2024, B2Gold no longer recorded

attributable production for Calibre.

Fekola Mine – Mali

|

|

Q4 2024 |

|

Tonnes of ore milled |

2,442,390 |

|

Grade (grams/tonne) |

1.17 |

|

Recovery (%) |

91.9 |

|

Gold production (ounces) |

84,015 |

|

Gold sold (ounces) |

86,453 |

The Fekola Mine in Mali (owned 80% by the

Company and 20% by the State of Mali) produced 84,015 ounces in the

fourth quarter, lower than anticipated largely due to delays

experienced in accessing higher-grade ore in Fekola Phase 7, a

result of lower realized mine production from the Fekola Phase 7

and Cardinal pits during the period. Damage to an excavator and the

subsequent need for replacement equipment impacted equipment

availability for the first nine months of 2024, reducing tonnes

mined, which continued to affect the availability of higher-grade

ore of Fekola Phase 7 during the fourth quarter of 2024 resulting

in less higher-grade ore processed. Mining and processing of these

higher-grade tonnes is now expected in 2025 as equipment

availability had returned to full capacity and mining rates were at

expected levels at the end of 2024. Despite short term variations,

overall mined ore volumes and grades continue to reconcile

relatively well with modelled values. The Fekola processing

facilities continued to perform as expected with 2.4 million tonnes

processed during the fourth quarter of 2024.

For the full year 2024, the Fekola Mine produced

392,946 ounces of gold, below the low-end of its revised annual

guidance range of between 420,000 and 450,000 ounces due to the

significant delays in accessing the higher-grade ore from Fekola

Phase 7. At the end of 2024, equipment availability was at full

capacity and mining rates were as expected, positioning Fekola for

strong operational performance in 2025. The Fekola Mine and

mill are operating without limitations and gold production is being

exported for refining as per its regular planned schedule.

Masbate Mine – The Philippines

|

|

Q4 2024 |

|

Tonnes of ore milled |

2,190,610 |

|

Grade (grams/tonne) |

0.95 |

|

Recovery (%) |

74.1 |

|

Gold production (ounces) |

49,534 |

|

Gold sold (ounces) |

51,010 |

The Masbate Mine in the Philippines continued

its strong performance in the fourth quarter of 2024, producing

49,534 ounces of gold, ahead of expectations, as a result of higher

than anticipated mill throughput and slightly higher ore grade than

budgeted, partially offset by slightly lower than expected gold

recovery.

For the full year 2024, the Masbate Mine

produced 194,046 ounces of gold, at the upper end of its revised

guidance range of between 175,000 and 195,000 ounces.

Otjikoto Mine – Namibia

|

|

Q4 2024 |

|

Tonnes of ore milled |

788,536 |

|

Grade (grams/tonne) |

2.10 |

|

Recovery (%) |

98.6 |

|

Gold production (ounces) |

52,452 |

|

Gold sold (ounces) |

50,330 |

The Otjikoto Mine in Namibia, in which the

Company holds a 90% interest, also had a strong performance,

producing 52,452 ounces of gold in the fourth quarter of 2024, with

production from the Wolfshag underground mine remaining consistent

through the quarter.

For the full year 2024, the Otjikoto Mine

produced 198,142 ounces of gold, near the mid-point of its revised

guidance range of between 185,000 and 205,000 ounces.

Fourth Quarter and Full Year 2024 Gold

Revenue / Year-End 2024 Cash and Revolving Credit Facility

Balance

For the fourth quarter of 2024, consolidated

gold revenue was $500 million on sales of 187,793 ounces at an

average realized gold price of $2,661 per ounce. For the full year

2024, consolidated gold revenue was $1.90 billion on sales of

801,524 ounces at an average realized gold price of $2,373 per

ounce.

As of December 31, 2024, unaudited cash and cash

equivalents totaled approximately $340 million and $400 million had

been drawn on the Company’s revolving credit facility, leaving $400

million available for future drawdowns, plus a $200 million

accordion feature.

2025 Production and Cost

Guidance

|

Guidance (100% Basis) (1) |

FekolaComplex(2) |

Masbate |

Otjikoto |

Existing Operations Total |

Goose |

Other |

Operations & Projects Total |

|

Period |

Full Year |

Full Year |

Full Year |

Full Year |

H1 |

H2 (3) |

Full Year |

Full Year |

|

Gold Production (koz) |

515 – 550 |

170 - 190 |

165 – 185 |

850 - 925 |

- |

120 - 150 |

- |

970 – 1,075 |

|

Cash Operating Costs ($/oz

produced) |

845 - 905 |

955 – 1,015 |

695 – 755 |

835 – 895

(4) |

- |

- |

- |

- |

|

Sustaining Capital Expenditures ($M) |

77 |

22 |

13 |

112 |

8 |

- |

- |

120 |

|

Deferred Stripping / Underground Development ($M) |

120 |

8 |

16 |

144 |

- |

- |

- |

144 |

|

Sustaining Mine Exploration Expenditures ($M) |

4 |

- |

- |

4 |

- |

10 |

- |

14 |

|

General & Administrative (incl. Stock Based Compensation)

($M) |

15 |

7 |

6 |

28 |

- |

- |

66 |

94 |

|

All-In Sustaining Costs ($/oz sold) |

1,550 – 1,610 |

1,310 – 1,370 |

980 –1,040 |

1,460 –1,520 (4) |

- |

- |

- |

- |

|

Growth / Construction Capital Expenditures ($M) |

16 |

17 |

- |

33 |

101 |

- |

28 |

162 |

|

Deferred Stripping / Underground Development ($M) |

21 |

- |

10 |

31 |

69 |

- |

- |

100 |

|

Growth Exploration Expenditures ($M) |

5 |

3 |

7 |

15 |

15 |

7 |

11 |

48 |

|

Total Growth / Non-Sustaining Capital Expenditures

($M) |

42 |

20 |

17 |

79 |

185 |

7 |

39 |

310 |

(1) Totals may not add due to rounding.

Estimates are based on a $2,250 gold price assumption for 2025.(2)

The Fekola Complex comprises of the Fekola Mine (Medinandi permit

hosting the Fekola and Cardinal pits and the Fekola underground)

and Fekola Regional (Anaconda Area (Bantako, Menankoto and Bakolobi

permits) and the Dandoko permit).(3) Goose Mine operating cash

costs, all-in sustaining costs, and capital expenditures estimates

for the second half of 2025 will be released in Q2 2025 after the

release of B2Gold’s initial Goose life of mine plan.(4) Total cash

operating costs and all-in sustaining costs do not include

estimates for the Goose Mine, which will be updated in Q2 2025

prior to commencement of initial gold production at the Goose

Mine.

In 2025, B2Gold expects total gold production to

be between 970,000 and 1,075,000 ounces, a significant increase

from 2024 production levels primarily due to the scheduled mining

and processing of higher-grade ore from the Fekola and Cardinal

pits made accessible by the meaningful stripping campaign that was

undertaken throughout 2024, the expected contribution from Fekola

Regional, the commencement of mining of higher-grade ore at Fekola

underground, and the commencement of gold production at the Goose

Project by the end of the second quarter of 2025.

The Company’s full year total cash operating

costs for the Fekola Complex, Masbate, and Otjikoto are forecast to

be between $835 and $895 per ounce and total AISC are forecast to

be between $1,460 and $1,520 per ounce. Operating cost guidance for

the Goose Project will be released in the second quarter of 2025

(prior to the commencement of initial production), after

publication in the first quarter of 2025 of B2Gold’s initial Goose

Project life of mine plan based on updated Mineral Reserves.

The Company’s total gold production is expected

to be significantly higher in the second half of 2025, with the

commencement of gold production from Fekola Regional and Fekola

underground in mid-2025, and the commencement of gold production at

the Goose Project expected by the end of the second quarter of

2025.

Fekola Complex – Mali

The Fekola Complex comprises of the Fekola Mine

(Medinandi permit hosting the Fekola and Cardinal pits and Fekola

underground) and Fekola Regional (Anaconda Area (Bantako,

Menankoto, and Bakolobi permits) and the Dandoko permit). The

Fekola Complex’s total 2025 gold production is anticipated to

increase significantly relative to 2024, predominantly due to the

contribution of higher-grade ore from Fekola Regional and

Fekola underground in mid-2025. Fekola Regional is anticipated

to contribute between 20,000 and 25,000 ounces of additional gold

production in 2025 through the trucking of open pit ore to the

Fekola mill, and between 25,000 and 35,000 ounces of gold

production is expected from the mining of higher-grade ore at

Fekola underground, with production expected to commence in

mid-2025.

The development of Fekola Regional will enhance

the overall Fekola Complex life of mine production profile and is

expected to extend the mine life of the Fekola Complex. Fekola

Regional is anticipated to contribute approximately 180,000 ounces

of additional annual gold production in its first four full years

of production from 2026 through 2029. Significant exploration

potential remains across the Fekola Complex to further extend mine

life.

At the Fekola Mine, ore will continue to be

mined from the Fekola and Cardinal pits with production of

higher-grade ore at Fekola underground expected to commence in

mid-2025. Mining and trucking operations at Fekola Regional will

commence following the expected receipt of the exploitation license

in the first quarter of 2025, with initial gold production expected

in mid-2025.

The Fekola Complex is projected to process 9.56

million tonnes of ore during 2025 at an average grade of 1.84 grams

per tonne (“g/t”) gold with a process gold recovery of 93.4%. Gold

production is expected to be weighted approximately 40% to the

first half of 2025 and 60% to the second half of 2025.

Capital expenditures in 2025 at Fekola are

expected to total approximately $234 million, nearly a $75 million

reduction from total estimated capital expenditures in 2024.

Approximately $197 million would be classified as sustaining

capital expenditures and $37 million would be classified as growth

capital expenditures. Sustaining capital expenditures are expected

to include approximately:

- $106 million for deferred

stripping;

- $44 million for new and replacement

Fekola mining equipment;

- $15 million for tailings storage

facility construction;

- $14 million for underground

development;

- $7 million for other mining

costs;

- $5 million for general site

expenses;

- $4 million for powerhouse; and

- $2 million for process plant.

Growth capital expenditures are expected to

include approximately:

- $21 million for underground

development;

- $14 million for regional

development; and

- $2 million for mining

equipment.

Masbate Mine – The Philippines

Gold production at Masbate is expected to be

relatively consistent throughout 2025. Masbate is projected to

process 8.0 million tonnes of ore at an average grade of 0.88 g/t

gold with a process gold recovery of 79.9%. Mill feed will be a

blend of mined fresh ore from the Main Vein pit and low-grade ore

stockpiles.

Capital expenditures for 2025 at Masbate are

expected to total $47 million, similar to total estimated capital

expenditures in 2024. Approximately $30 million would be classified

as sustaining capital expenditures and $17 million would be

classified as growth capital expenditures. Sustaining capital

expenditures are expected to include approximately:

- $8 million for deferred

stripping;

- $7 million for mining equipment

rebuilds and replacements;

- $6 million for construction of a

new solar plant;

- $5 million for tailings storage

facility construction;

- $3 million for processing; and

- $1 million for general site

expenses.

Growth capital expenditures are expected to

include approximately $13 million for Pajo pit land acquisition and

$4 million for Pajo development.

Otjikoto Mine – Namibia

Gold production at Otjikoto will be weighted

towards the first half of 2025 due to the conclusion of open pit

mining activities in the third quarter of 2025. For the full year

2025, Otjikoto is projected to process a total of 3.4 million

tonnes of ore at an average grade of 1.63 g/t gold with a process

gold recovery of 98.0%. Processed ore will be sourced from the

Otjikoto pit and the Wolfshag underground mine, supplemented by

existing ore stockpiles. Open pit mining operations are scheduled

to conclude in the third quarter of 2025, while underground mining

operations at Wolfshag are expected to continue into 2027.

Exploration results received to date indicate the potential to

extend underground production at Wolfshag past 2027, supplementing

the processing operations into 2032 when economically viable

stockpiles are forecast to be exhausted.

Following the 2024 release of an initial

Inferred Mineral Resource Estimate for the Springbok Zone, the

southernmost shoot of the recently discovered Antelope deposit,

located approximately three km south of the Otjikoto Phase 5 open

pit at the Otjikoto Mine in Namibia, the Company commenced a PEA

which is expected to be completed early in the first quarter of

2025. Subject to receipt of a positive PEA and necessary permits

and approvals, mining of the Springbok Zone could begin to

contribute to gold production at Otjikoto as early as 2028. An

initial budget of up to $10 million has been approved to de-risk

the Antelope deposit development schedule by advancing early work

planning, project permits and long lead orders. Exploration of the

greater Antelope deposit has the potential to supplement the

processing of ore stockpiles at the Otjikoto Mine, with an initial

goal of adding between 80,000 and 90,000 ounces of additional

gold production per year from 2029 through 2032, with potential to

extend mine life further through additional drilling at the

Springbok and Oryx Zones at the Antelope deposit.

Capital expenditures in 2025 at Otjikoto are

expected to total $39 million, a small increase from total

estimated capital expenditures in 2024. Approximately $29 million

would be classified as sustaining capital expenditures and $10

million would be classified as growth capital expenditures.

Sustaining capital expenditures are expected to include

approximately:

- $16 million for underground

development;

- $7 million for tailings storage

facility construction; and

- $6 million for mining equipment

replacement and rebuilds.

Growth capital expenditures are expected to

include approximately $10 million to initiate Antelope deposit

development.

Goose Project – Canada

The Back River Gold District consists of eight

mineral claims blocks along an 80 km belt. Construction is underway

at the most advanced project in the district, the Goose Project,

and has been de-risked with significant infrastructure currently in

place.

B2Gold recognizes that respect and collaboration

with the Kitikmeot Inuit Association (“KIA”) is central to the

license to operate in the Back River Gold District and will

continue to prioritize developing the project in a manner that

recognizes Inuit priorities, addresses concerns, and brings

long-term socio-economic benefits to the Kitikmeot Region. B2Gold

looks forward to continuing to build on its strong collaboration

with the KIA and Kitikmeot Communities.

All planned construction activities in 2024 were

completed and project construction and development continue to

progress on track for first gold pour at the Goose Project in the

second quarter of 2025 followed by ramp up to commercial production

in the third quarter of 2025. The Company continues to estimate

that gold production in calendar year 2025 will be between 120,000

and 150,000 ounces and that average annual gold production for the

six year period from 2026 to 2031 inclusive will be approximately

310,000 ounces per year, with the latest published Mineral Reserves

supporting a long mine life beyond 2031. The Company remains on

track to complete B2Gold’s initial Goose Project life of mine plan

based on updated Mineral Reserves by the end of the first quarter

of 2025.

Following the successful completion of the 2024

sea lift, the construction of the WIR is well underway and expected

to be completed on schedule and fully operational before March

2025, allowing for the transportation of all materials from the MLA

to the Goose Project site by the end of May 2025.

Development of the open pit and underground

remain the Company’s primary focus to ensure that adequate material

is available for mill startup and that the Echo pit is available

for tailings placement. Mining of the Echo pit continues to meet

production targets and is anticipated to be ready to receive

tailings when the mill starts. The Umwelt underground development

remains on schedule for commencement of production by the end of

the second quarter of 2025.

As of September 30, 2024, C$1,176 million of

construction and mine development cash expenditures (or 76% of the

total estimated cash expenditures) had been incurred. Based on its

unaudited November 2024 cost report, the Company estimates that

approximately 83% of the total estimated cash expenditures to first

gold had been incurred as of November 30, 2024. Reconciled total

cash expenditures as of December 31, 2024, will be published with

the Company’s year-end financial statements to be released in

February 2025. Based on the construction and mine development cash

expenditures incurred to date, combined with the estimated

expenditures to be incurred through to the first gold pour in the

second quarter of 2025, the Company reiterates the total Goose

Project construction and mine development cash expenditure estimate

of C$1,540 million, as announced on September 12, 2024.

Gramalote Project – Colombia

On June 18, 2024, the Company announced the

results of a positive PEA on its 100% owned Gramalote Project

located in the Department of Antioquia, Colombia. The PEA outlines

a significant production profile of 234,000 ounces of annual gold

production for the first five years, with average annual gold

production of 185,000 ounces over a 12.5 year project life with a

low-cost structure and favorable metallurgical characteristics.

Additionally, the PEA outlines strong project economics with an

after-tax NPV 5% of $778 million and an after-tax

internal rate of return of 20.6%, with a project payback on

pre-production capital of 3.1 years at a long-term gold price of

$2,000 per ounce.

The pre-production capital cost for the project

was estimated to be $807 million (including approximately $93

million for mining equipment and $63 million for contingency). A

robust amount of historical drilling and engineering studies have

been completed on the Gramalote Project, which significantly

de-risks future project development. Based on the positive results

from the PEA, B2Gold believes that the Gramalote Project has the

potential to become a medium-scale, low-cost open pit gold

mine.

B2Gold has commenced feasibility work with the

goal of completing a feasibility study in mid-2025. Due to the work

completed for previous studies, the work remaining to finalize a

feasibility study for the updated medium-scale project is not

expected to be extensive. The main work programs for the

feasibility study include geotechnical and environmental site

investigations for the processing plant and waste dump footprints,

as well as capital and operating cost estimates. Those work

programs, as well as processing engineering and site infrastructure

design, are underway and the study is on schedule.

The Gramalote Project will continue to advance

resettlement programs, establish coexistence programs for small

miners, work on health, safety and environmental projects and

continue to work with the government and local communities on

social programs.

Due to the desired modifications to the

processing plant and infrastructure locations, a Modified

Environment Impact Study is required. B2Gold has commenced work on

the modifications to the Environment Impact Study and expect it to

be completed and submitted shortly following the completion of the

feasibility study. If the final economics of the feasibility study

are positive and B2Gold makes the decision to develop the Gramalote

Project as an open pit gold mine, B2Gold would utilize its proven

internal mine construction team to build the mine and mill

facilities.

Capital expenditures in 2025 at Gramalote are

expected to be relatively stable throughout the year, totaling $28

million related primarily to feasibility study costs and ongoing

care and maintenance.

Exploration

B2Gold is planning another year of extensive

exploration in 2025 with a budget of approximately $61 million. A

significant focus will be on exploration at the Back River Gold

District, with the goal of enhancing and growing the significant

resource base at the Goose Project and surrounding regional

targets. In Namibia, the exploration program at the Otjikoto Mine

will be focused on enhancing and increasing the resources at the

Antelope deposit. In Mali, an ongoing focus will be on discovery of

additional high-grade, sulphide mineralization across the Fekola

Complex. In the Philippines, the exploration program at Masbate

will continue to focus on new targets located south of the Masbate

Mine infrastructure. Early stage exploration programs will continue

in the Philippines, Cote d’Ivoire and Kazakhstan in 2025. Finally,

the search for new joint ventures and strategic investment

opportunities will continue, building on existing equity

investments in Snowline Gold Corp., Founders Metals Inc., AuMEGA

Metals Ltd., and Prospector Metals Corp.

Canada Exploration

A total of $32 million is budgeted for

exploration at the Back River Gold District in 2025, of which $21

million is planned for the more advanced Goose Project. A total of

12,000 meters (“m”) of drilling will target extensions of the Llama

and Umwelt deposits, the largest and highest-grade resources at the

Goose Project. In addition, follow up drilling of significant

results returned at the Nuvuyak, Mammoth and Hook targets are

planned.

Regional exploration including geophysics,

mapping, prospecting and till sampling will be undertaken on the

George, Boot, Boulder, Del, Beech and Needle projects. This

regional work will also include an estimated 13,000 m of diamond

drilling to follow up drill ready targets defined during the 2024

summer regional exploration program. A significantly increased

budget of $11 million is being allocated for the regional

projects.

Mali Exploration

A total of $9 million is budgeted for

exploration in Mali in 2025 with an ongoing focus on discovery of

additional high-grade, sulphide mineralization across the Fekola

Complex to supplement feed to the Fekola mill. A total of 16,000 m

of diamond and reverse circulation drilling is planned for Mali in

2025.

Namibia Exploration

A total of $7 million is budgeted for

exploration at Otjikoto in 2025. The focus of the exploration

program will be drilling to expand and refine the recently

discovered Antelope deposit, located approximately 3 km south of

Phase 5 of the Otjikoto open pit, with a total of 44,000 m of

drilling planned.

The Philippines Exploration

The total budget for the Philippines in 2025 is

approximately $5 million, of which the Masbate exploration budget

is $3 million, including approximately 4,200 m of drilling. The

2025 exploration program will continue to focus on exploration of

new regional targets located south of the main mine infrastructure

at Masbate.

An additional $2 million will be allocated to

targeting new regional projects in highly prospective areas in the

Philippines, leveraging off B2Gold’s presence and operational

experience in the country. A total of 2,000 m is allocated to

testing new projects.

Grassroots Exploration

B2Gold has allocated approximately $9 million to

other grassroots exploration projects in 2025. This includes $2

million (7,200 m) in Kazakhstan, $2 million in Finland, and $1

million (1,000 m) in Cote d’Ivoire. In addition to the defined

programs noted above, the Company has allocated approximately $4

million for the generation and evaluation of new greenfield

targets.

About B2Gold

B2Gold is a low-cost international senior gold

producer headquartered in Vancouver, Canada. Founded in 2007,

today, B2Gold has operating gold mines in Mali, Namibia and the

Philippines, the Goose Project under construction in northern

Canada and numerous development and exploration projects in various

countries including Mali, Colombia and Finland. B2Gold forecasts

total consolidated gold production of between 970,000 and 1,075,000

ounces in 2025.

Qualified Persons

Bill Lytle, Senior Vice President and Chief

Operating Officer, a qualified person under NI 43-101, has approved

the scientific and technical information related to operations

matters contained in this news release.

Andrew Brown, P. Geo., Vice President,

Exploration, a qualified person under NI 43-101, has approved the

scientific and technical information related to exploration and

mineral resource matters contained in this news release.

ON BEHALF OF B2GOLD CORP.

“Clive T.

Johnson”President and Chief Executive

Officer

Source: B2Gold Corp.

The Toronto Stock Exchange and NYSE American LLC

neither approve nor disapprove the information contained in this

news release.

Production results and production guidance

presented in this news release reflect total production at the

mines B2Gold operates on a 100% project basis. Please see our

Annual Information Form dated March 14, 2024 for a discussion of

our ownership interest in the mines B2Gold operates.

This news release includes certain

"forward-looking information" and "forward-looking statements"

(collectively forward-looking statements") within the meaning of

applicable Canadian and United States securities legislation,

including: projections; outlook; guidance; forecasts; estimates;

and other statements regarding future or estimated financial and

operational performance, gold production and sales, revenues and

cash flows, and capital costs (sustaining and non-sustaining) and

operating costs, including projected cash operating costs and AISC,

and budgets on a consolidated and mine by mine basis; future or

estimated mine life, metal price assumptions, ore grades or

sources, gold recovery rates, stripping ratios, throughput, ore

processing; statements regarding anticipated exploration, drilling,

development, construction, permitting and other activities or

achievements of B2Gold; and including, without limitation:

remaining well positioned for continued strong operational and

financial performance in 2025; projected gold production, cash

operating costs and all-in sustaining costs (“AISC”) on a

consolidated and mine by mine basis in 2025 for the Fekola Complex,

the Otjikoto Mine, the Masbate Gold Project and the Goose Project;

total consolidated cash operating costs of between $835 and $895

per ounce and AISC of between $1,420 and $1,480 per ounce in 2024;

total consolidated gold production of between 970,000 and 1,075,000

ounces in 2025, with cash operating costs of between $835 and $895

per ounce and AISC of between $1,460 and $1,520 per ounce; B2Gold's

continued prioritization of developing the Goose Project in a

manner that recognizes Indigenous input and concerns and brings

long-term socio-economic benefits to the area; the Goose Project

capital cost being approximately C$1,190 million and the net cost

of open pit and underground development, deferred stripping, and

sustaining capital expenditures to be incurred prior to first gold

production being approximately C$350 million and the cost for

reagents and other working capital items being C$330 million; the

Goose Project producing approximately 310,000 ounces of gold per

year for the first six years; the potential for first gold

production in the second quarter of 2025 from the Goose Project and

the estimates of such production; trucking of selective

higher-grade saprolite material from the Anaconda Area to the

Fekola mill having the potential to generate approximately 80,000

to 100,000 ounces of additional gold production per year from

Fekola Regional sources; the receipt of the exploitation permit for

Fekola Regional and Fekola Regional production expected to commence

in the second quarter of 2025; the receipt of a permit for Fekola

underground and Fekola underground commencing operation in

mid-2025; the potential for the Antelope deposit to be developed as

an underground operation and contribute gold during the low-grade

stockpile processing in 2029 through 2032; the results and

estimates in the Gramalote PEA, including the project life, average

annual gold production, processing rate, capital cost, net present

value, after-tax net cash flow, after-tax internal rate of return

and payback; the timing and results of a feasibility study on the

Gramalote Project; the potential to develop the Gramalote Project

as an open pit gold mine; and planned 2025 exploration budgets for

Canada, Mali, Namibia, The Philippines, Finland, Cote D’Ivoire and

other grassroots projects. All statements in this news release that

address events or developments that we expect to occur in the

future are forward-looking statements. Forward-looking statements

are statements that are not historical facts and are generally,

although not always, identified by words such as "expect", "plan",

"anticipate", "project", "target", "potential", "schedule",

"forecast", "budget", "estimate", "intend" or "believe" and similar

expressions or their negative connotations, or that events or

conditions "will", "would", "may", "could", "should" or "might"

occur. All such forward-looking statements are based on the

opinions and estimates of management as of the date such statements

are made.

Forward-looking statements necessarily involve

assumptions, risks and uncertainties, certain of which are beyond

B2Gold's control, including risks associated with or related to:

the volatility of metal prices and B2Gold's common shares; changes

in tax laws; the dangers inherent in exploration, development and

mining activities; the uncertainty of reserve and resource

estimates; not achieving production, cost or other estimates;

actual production, development plans and costs differing materially

from the estimates in B2Gold's feasibility and other studies; the

ability to obtain and maintain any necessary permits, consents or

authorizations required for mining activities; environmental

regulations or hazards and compliance with complex regulations

associated with mining activities; climate change and climate

change regulations; the ability to replace mineral reserves and

identify acquisition opportunities; the unknown liabilities of

companies acquired by B2Gold; the ability to successfully integrate

new acquisitions; fluctuations in exchange rates; the availability

of financing; financing and debt activities, including potential

restrictions imposed on B2Gold's operations as a result thereof and

the ability to generate sufficient cash flows; operations in

foreign and developing countries and the compliance with foreign

laws, including those associated with operations in Mali, Namibia,

the Philippines and Colombia and including risks related to changes

in foreign laws and changing policies related to mining and local

ownership requirements or resource nationalization generally;

remote operations and the availability of adequate infrastructure;

fluctuations in price and availability of energy and other inputs

necessary for mining operations; shortages or cost increases in

necessary equipment, supplies and labour; regulatory, political and

country risks, including local instability or acts of terrorism and

the effects thereof; the reliance upon contractors, third parties

and joint venture partners; the lack of sole decision-making

authority related to Filminera Resources Corporation, which owns

the Masbate Project; challenges to title or surface rights; the

dependence on key personnel and the ability to attract and retain

skilled personnel; the risk of an uninsurable or uninsured loss;

adverse climate and weather conditions; litigation risk;

competition with other mining companies; community support for

B2Gold's operations, including risks related to strikes and the

halting of such operations from time to time; conflicts with small

scale miners; failures of information systems or information

security threats; the ability to maintain adequate internal

controls over financial reporting as required by law, including

Section 404 of the Sarbanes-Oxley Act; compliance with

anti-corruption laws, and sanctions or other similar measures;

social media and B2Gold's reputation; risks affecting Calibre

having an impact on the value of the Company's investment in

Calibre, and potential dilution of our equity interest in Calibre;

as well as other factors identified and as described in more detail

under the heading "Risk Factors" in B2Gold's most recent Annual

Information Form, B2Gold's current Form 40-F Annual Report and

B2Gold's other filings with Canadian securities regulators and the

U.S. Securities and Exchange Commission (the "SEC"), which may be

viewed at www.sedarplus.ca and www.sec.gov, respectively (the

"Websites"). The list is not exhaustive of the factors that may

affect B2Gold's forward-looking statements.

B2Gold's forward-looking statements are based on

the applicable assumptions and factors management considers

reasonable as of the date hereof, based on the information

available to management at such time. These assumptions and factors

include, but are not limited to, assumptions and factors related to

B2Gold's ability to carry on current and future operations,

including: development and exploration activities; the timing,

extent, duration and economic viability of such operations,

including any mineral resources or reserves identified thereby; the

accuracy and reliability of estimates, projections, forecasts,

studies and assessments; B2Gold's ability to meet or achieve

estimates, projections and forecasts; the availability and cost of

inputs; the price and market for outputs, including gold; foreign

exchange rates; taxation levels; the timely receipt of necessary

approvals or permits; the ability to meet current and future

obligations; the ability to obtain timely financing on reasonable

terms when required; the current and future social, economic and

political conditions; and other assumptions and factors generally

associated with the mining industry.

B2Gold's forward-looking statements are based on

the opinions and estimates of management and reflect their current

expectations regarding future events and operating performance and

speak only as of the date hereof. B2Gold does not assume any

obligation to update forward-looking statements if circumstances or

management's beliefs, expectations or opinions should change other

than as required by applicable law. There can be no assurance that

forward-looking statements will prove to be accurate, and actual

results, performance or achievements could differ materially from

those expressed in, or implied by, these forward-looking

statements. Accordingly, no assurance can be given that any events

anticipated by the forward-looking statements will transpire or

occur, or if any of them do, what benefits or liabilities B2Gold

will derive therefrom. For the reasons set forth above, undue

reliance should not be placed on forward-looking statements.

Non-IFRS Measures

This news release includes certain terms or

performance measures commonly used in the mining industry that are

not defined under International Financial Reporting Standards

("IFRS"), including "cash operating costs" and "all-in sustaining

costs" (or "AISC"). Non-IFRS measures do not have any standardized

meaning prescribed under IFRS, and therefore they may not be

comparable to similar measures employed by other companies. The

projected range of AISC is anticipated to be adjusted to include

sustaining capital expenditures, corporate administrative expense,

mine-site exploration and evaluation costs and reclamation cost

accretion and amortization, and exclude the effects of expansionary

capital and non-sustaining expenditures. Projected GAAP total

production cash costs for the full year would require inclusion of

the projected impact of future included and excluded items,

including items that are not currently determinable, but may be

significant, such as sustaining capital expenditures, reclamation

cost accretion and amortization. Due to the uncertainty of the

likelihood, amount and timing of any such items, B2Gold does not

have information available to provide a quantitative reconciliation

of projected AISC to a total production cash costs projection.

B2Gold believes that this measure represents the total costs of

producing gold from current operations, and provides B2Gold and

other stakeholders of the Company with additional information of

B2Gold’s operational performance and ability to generate cash

flows. AISC, as a key performance measure, allows B2Gold to assess

its ability to support capital expenditures and to sustain future

production from the generation of operating cash flows. This

information provides management with the ability to more actively

manage capital programs and to make more prudent capital investment

decisions.

The data presented is intended to provide

additional information and should not be considered in isolation or

as a substitute for measures of performance prepared in accordance

with IFRS and should be read in conjunction with B2Gold's

consolidated financial statements. Readers should refer to B2Gold's

Management Discussion and Analysis, available on the Websites,

under the heading "Non-IFRS Measures" for a more detailed

discussion of how B2Gold calculates certain such measures and a

reconciliation of certain measures to IFRS terms.

Cautionary Statement Regarding Mineral Reserve

and Resource Estimates

The disclosure in this news release was prepared

in accordance with Canadian standards for the reporting of mineral

resource and mineral reserve estimates, which differ in some

material respects from the disclosure requirements of United States

securities laws. In particular, and without limiting the generality

of the foregoing, the terms “mineral reserve”, “proven mineral

reserve”, “probable mineral reserve”, “inferred mineral

resources,”, “indicated mineral resources,” “measured mineral

resources” and “mineral resources” used or referenced in this

prospectus, any prospectus supplement and the documents

incorporated by reference herein or therein are Canadian mineral

disclosure terms as defined in accordance with Canadian National

Instrument 43-101 - Standards of Disclosure for Mineral Projects

(“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and

Petroleum (the “CIM”) - CIM Definition Standards on Mineral

Resources and Mineral Reserves, adopted by the CIM Council, as

amended (the “CIM Definition Standards”). The definitions of these

terms, and other mining terms and disclosures, differ from the

definitions of such terms, if any, for purposes of the SEC’s

disclosure rules the SEC for domestic United States Issuers (the

“SEC Rules”), (the “Exchange Act”). Accordingly, mineral reserve

and mineral resource information and other technical information

contained in this news release may not be comparable to similar

information disclosed by United States companies subject to the

SEC’s reporting and disclosure requirements for domestic United

States issuers.

Historical results or feasibility models

presented herein are not guarantees or expectations of future

performance. Mineral resources that are not mineral reserves do not

have demonstrated economic viability. Due to the uncertainty of

measured, indicated or inferred mineral resources, these mineral

resources may never be upgraded to proven and probable mineral

reserves. Investors are cautioned not to assume that any part of

mineral deposits in these categories will ever be converted into

reserves or recovered. In addition, United States investors are

cautioned not to assume that any part or all of B2Gold’s measured,

indicated or inferred mineral resources constitute or will be

converted into mineral reserves or are or will be economically or

legally mineable without additional work.

For more information on B2Gold please visit the Company website at www.b2gold.com or contact:

Michael McDonald

VP, Investor Relations & Corporate Development

+1 604-681-8371

investor@b2gold.com

Cherry De Geer

Director, Corporate Communications

+1 604-681-8371

investor@b2gold.com

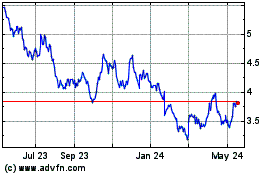

B2Gold (TSX:BTO)

Historical Stock Chart

From Jan 2025 to Feb 2025

B2Gold (TSX:BTO)

Historical Stock Chart

From Feb 2024 to Feb 2025