Capital Power announces C$850 million medium term notes offering

30 November 2023 - 9:39AM

Capital Power Corporation (“Capital Power”) (TSX: CPX) announced

today that it has priced a public offering in Canada of unsecured

medium term notes in the aggregate principal amount of C$850

million (the “Offering”). The Offering consists of C$400 million of

5.378% medium term notes maturing on January 25, 2027 and C$450

million of 5.973% medium term notes maturing on January 25, 2034

(collectively, the "

Notes").

The Offering is expected to close on or about December 15,

2023.

The net proceeds from the Offering will be used to partially

finance Capital Power’s previously announced acquisitions of (i) a

50% interest in New Harquahala Generating Company, LLC, which owns

a 1,092 MW natural gas generation facility located in Arizona, and

(ii) a 100% interest in CXA La Paloma, LLC, which owns a 1,062 MW

natural gas generation facility located in California

(collectively, the “Acquisitions”), and related expenses, or for

general corporate purposes. Details of the Acquisitions were

announced on November 20, 2023.

The Notes to be issued and sold under the Offering have been

rated BBB- by S&P Global Ratings and BBB (low) by DBRS

Limited.

The Notes are being offered in the provinces and territories of

Canada through a syndicate of investment dealers co-led by TD

Securities and CIBC Capital Markets under Capital Power’s short

form base shelf prospectus dated June 10, 2022, a prospectus

supplement dated June 13, 2022 and pricing supplements to be dated

November 29, 2023 relating to the offering of each series of Notes.

Copies of these documents may be obtained over the Internet under

our profile at the Canadian Securities Administrators’ website at

www.sedarplus.ca.

This press release does not constitute an offer to sell or the

solicitation of an offer to buy the Notes in any jurisdiction. The

Notes have not been approved or disapproved by any regulatory

authority. The Notes have not been and will not be registered under

the United States Securities Act of 1933, as amended, or any state

securities law, and may not be offered or sold within the United

States, or to or for the account of, United States persons.

Forward-looking Information

Forward-looking information or statements included in this press

release are provided to inform Capital Power’s shareholders and

potential investors about management’s assessment of Capital

Power’s future plans and operations. This information may not be

appropriate for other purposes. The forward-looking information in

this press release is generally identified by words such as will,

anticipate, believe, plan, intend, target, and expect or similar

words that suggest future outcomes. Specific forward-looking

information in this press release includes expectations regarding

the timing of the closing of the Offering and the anticipated use

of the net proceeds of the Offering. By their nature, such

statements are subject to significant risks and uncertainties,

which include, but are not limited to, regulatory and government

decisions, economic conditions, and availability and cost of

financing. Forward-looking information or statements included in

this news release are provided to inform Capital Power’s

securityholders and potential investors about management’s

assessment of Capital Power’s future plans and operations. This

information may not be appropriate for other purposes.

All forward-looking information or statements reflect Capital

Power’s assumptions and analyses made by Capital Power in light of

its experience and perception of historical trends, current

conditions and expected future developments, and other factors it

believes are appropriate. Readers are cautioned not to place undue

reliance on this forward-looking information. Capital Power

undertakes no obligation to update or revise any forward-looking

information except as required by law. For additional information

on the assumptions made, and the risks and uncertainties which

could cause actual results to differ from the anticipated results,

see Risks and Risk Management in Capital Power’s 2022 Integrated

Annual Report, under Capital Power’s profile on SEDAR+

(www.sedarplus.ca), and other reports filed by Capital Power with

Canadian securities regulators.

Territorial Acknowledgement

In the spirit of reconciliation, Capital Power respectfully

acknowledges that we operate within the ancestral homelands,

traditional and treaty territories of the Indigenous Peoples of

Turtle Island, or North America. Capital Power’s head office is

located within the traditional and contemporary home of many

Indigenous Peoples of the Treaty 6 Territory and Métis Nation of

Alberta Region 4. We acknowledge the diverse Indigenous communities

that are located in these areas and whose presence continues to

enrich the community.

About Capital Power

Capital Power is a growth-oriented power producer committed to

net zero by 2045. Our balanced approach to the energy transition

prioritizes reliable, affordable and decarbonized power that

communities across North America can depend on.

Capital Power owns approximately 7,500 megawatts (MW) of power

generation capacity at 29 facilities across North America. Projects

in advanced development include approximately 213 MW of renewable

generation capacity in Alberta and North Carolina, 512 MW of

incremental natural gas combined cycle capacity from the repowering

of Genesee 1 and 2 in Alberta, and approximately 350 MW of natural

gas and battery energy storage systems in Ontario.

For more information, please

contact:

| Investor and Media

Relations: Katherine

Perron(780)

392-5335 investor@capitalpower.com

& kperron@capitalpower.com |

|

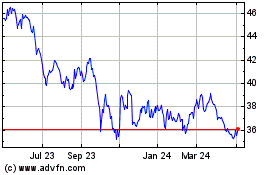

Capital Power (TSX:CPX)

Historical Stock Chart

From Nov 2024 to Dec 2024

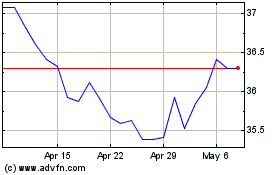

Capital Power (TSX:CPX)

Historical Stock Chart

From Dec 2023 to Dec 2024