Capital Power announces commencement of a consent solicitation process for the 7.95% Fixed-to-Fixed Rate Subordinated Notes, Series 1

29 July 2024 - 11:00PM

Capital Power Corporation (“Capital Power”, the “Company”, “we”,

“us” or “our”) (TSX: CPX) announced today that it has commenced a

solicitation of consents (the “Consent Solicitation”) from holders

of its C$350M 7.95% Fixed-to-Fixed Rate Subordinated Notes, Series

1, due September 9, 2082 (the “Series 1 Notes”).

The purpose of the Consent Solicitation is to

seek approval from the holders (“Holders”) of record of the Series

1 Notes as of July 26, 2024 (being the record date for the purposes

of the Consent Solicitation), of certain proposed amendments (the

“Proposed Amendments”) to the Indenture dated as of September 9,

2022 (the “Series 1 Indenture”) pursuant to which the Series 1

Notes were issued and which would be given effect pursuant to a

supplemental indenture to the Series 1 Indenture (the “Series 1

Supplemental Indenture”) and which would amend the Series 1

Indenture to include:

- an exchange right (the “Exchange

Right”) that would allow Holders to exchange all outstanding

principal amount of their Series 1 Notes for an equal principal

amount of a new series of notes (the “Series 3 Notes”) issued under

a supplemental indenture to the indenture dated as of June 5, 2024

(the “Series 3 Supplemental Indenture”) having the same economic

terms, including but not limited to the interest rate, interest

payment dates, maturity date and redemption provisions as the

Series 1 Notes (but excluding provisions of the Series 1 Notes

regarding delivery of preferred shares upon the occurrence of

certain bankruptcy and related events), together with an

entitlement under the Series 3 Notes for an amount equal to the

interest accrued on the Series 1 Notes that are exchanged (the

“Note Exchange”), and

- a provision that if Holders of not

less than 66 2/3% of the aggregate outstanding principal amount of

the Series 1 Notes have exercised the resulting Exchange Right, all

Series 1 Notes will be automatically exchanged for Series 3

Notes.

In addition to consenting to the Proposed

Amendments, each Holder of the Series 1 Notes that consents to the

Proposed Amendments will be deemed to have exercised the resulting

Exchange Right, subject to the approval of the Proposed Amendments,

and to the execution of the Series 1 Supplemental Indenture and the

Series 3 Supplemental Indenture.

The removal of the provisions for delivery of

preferred shares upon the occurrence of certain bankruptcy and

related events from Series 3 Notes would ensure the Series 3 Notes

rank equally in right of payment with the C$450M 8.125%

Fixed-to-Fixed Subordinated Notes, Series 2, due June 5, 2054 upon

the occurrence of certain bankruptcy and related events. Following

the completion of the Note Exchange, Morningstar DBRS is expected

to confirm the instrument rating of the Series 3 Notes at BB with a

Stable trend.

The adoption of the Proposed Amendments requires

that an extraordinary resolution be approved by written consent of

the Holders of at least 66 2/3% of the aggregate principal amount

of the Series 1 Notes.

The deadline for the submission of consents by

Holders of Series 1 Notes is no later than 5:00 pm (Toronto Time)

on August 14, 2024 (the “Consent Deadline”) subject to

modification, waiver, postponement or extension by Capital Power in

its sole discretion.

The Proposed Amendments to the Series 1

Indenture and the exercise of the resulting Exchange Right are

described in the Consent Solicitation Statement dated July 29,

2024. Holders of the Series 1 Notes are urged to read and carefully

consider the information contained in the Consent Solicitation

Statement for the detailed terms of the consent solicitations and

the procedures for consenting to the Proposed Amendments and the

exercise of the resulting Exchange Right.

Capital Power reserves the right to terminate,

withdraw, extend or modify the terms of the Consent Solicitation in

its sole discretion.

This press release is for informational purposes

only and the Consent Solicitation is being made solely on the terms

and subject to the conditions set forth in the Consent Solicitation

Statement. Further, this press release does not constitute an offer

to sell or the solicitation of an offer to buy the Series 1 Notes

or any other securities. The Consent Solicitation Statement does

not constitute a solicitation of consents in any jurisdiction in

which, or to or from any person to or from whom, it is unlawful to

make such solicitation under applicable securities laws. Copies of

the Consent Solicitation Statements may be obtained from RBC

Capital Markets or Scotiabank, the Solicitation Agents for the

Consent Solicitation. Computershare Trust Company of Canada has

been appointed the tabulation agent with respect to the Consent

Solicitation.

Any persons with questions regarding the Consent

Solicitation should contact the Solicitation Agents as follows:

|

RBC CAPITAL MARKETS200 Bay Street, Royal Bank

Plaza North Tower, 2nd Floor Toronto, Ontario M5J 2W7 Attention:

Liability Management Group Telephone (Local): (416)

842-6311Telephone (Toll-Free): (877) 381-2099 E-Mail:

liability.management@rbccm.com |

SCOTIABANK40 Temperance Street, 4th FloorToronto,

Ontario M5H 0B4Attention: Scotiabank Debt SyndicationTelephone:

(416) 863-7438E-Mail: syndicate.toronto@scotiabank.com |

Territorial AcknowledgementIn

the spirit of reconciliation, Capital Power respectfully

acknowledges that we operate within the ancestral homelands,

traditional and treaty territories of the Indigenous Peoples of

Turtle Island, or North America. Capital Power’s head office is

located within the traditional and contemporary home of many

Indigenous Peoples of the Treaty 6 Territory and Métis Nation of

Alberta Region 4. We acknowledge the diverse Indigenous communities

that are located in these areas and whose presence continues to

enrich the community.

About Capital PowerCapital

Power (TSX: CPX) is a growth-oriented power producer committed to

net zero by 2045, with approximately 9,300 MW of power generation

at 32 facilities across North America. We prioritize delivering

reliable and affordable power communities can depend on today,

building clean power systems needed for tomorrow, and creating

balanced solutions for our energy future. We are Powering Change by

Changing PowerTM.

Forward-looking InformationCertain information

in this news release is forward-looking within the meaning of

Canadian securities law. Forward-looking information or statements

included in this press release are provided to inform the Company’s

shareholders and potential investors about possible or assumed

future results of operations, descriptions of our business plans

and strategies, financial position and the effect of the Proposed

Amendments and the Note Exchange on the Series 1 Notes, the Series

3 Notes or on us, including expectations regarding the ratings to

be assigned thereto by Morningstar DBRS. This information may not

be appropriate for other purposes. The forward-looking information

in this press release is generally identified by words such as

will, anticipate, believe, plan, intend, target, and expect or

similar words that suggest future outcomes.

These statements are based on certain assumptions and analyses

made by the Company in light of its experience and perception of

historical trends, current conditions and expected future

developments, and other factors it believes are appropriate.

Although we believe that these statements are based on reasonable

assumptions, the Holders should be aware that many important

factors could affect our actual financial results, results of

operations, the Proposed Amendments, the Note Exchange, the Series

1 Notes or the Series 3 Notes, and could cause actual results to

differ materially from those expressed in these forward-looking

statements. Such factors include, but are not limited to, those set

forth in our integrated annual report for the fiscal year ended

December 31, 2023.

Whether actual results, performance or achievements will conform

to the Company’s expectations and predictions is subject to a

number of known and unknown risks and uncertainties which could

cause actual results and experience to differ materially from the

Company’s expectations.

Readers are cautioned not to place undue reliance on any such

forward-looking statements, which speak only as of the specified

approval date. The Company does not undertake or accept any

obligation or undertaking to release publicly any updates or

revisions to any forward-looking statements to reflect any change

in the Company’s expectations or any change in events, conditions

or circumstances on which any such statement is based, except as

required by law.

For more information, please

contact:

| Investor and Media

Relations: Media

RelationsKatherine Perron(780)

392-5335 kperron@capitalpower.comInvestor RelationsRoy

Arthur(403) 736-3315investor@capitalpower.com |

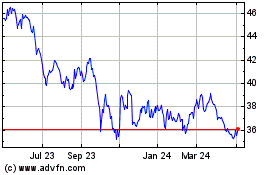

Capital Power (TSX:CPX)

Historical Stock Chart

From Nov 2024 to Dec 2024

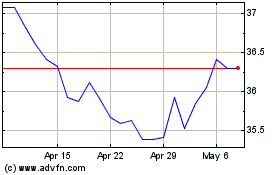

Capital Power (TSX:CPX)

Historical Stock Chart

From Dec 2023 to Dec 2024