Capital Power Corporation (TSX: CPX) today released financial

results for the quarter and year ended December 31, 2024.

Strategic highlights

- Achieved COD of Genesee Repowering project resulting in a

reduction of ~3.4 million tonnes (MT) per annum1 of CO2 emissions

(Scope 1) and increasing capacity by 512 megawatts (MW)

- Enhanced geographic diversification through successful

execution of U.S. based acquisitions of La Paloma and Harquahala

and advanced development of 3 U.S. solar projects

- Enhanced financial flexibility and crystallized returns on

renewable assets through a sell-down transaction for $340 million

of gross proceeds

- Successfully executed an equity financing for total gross

proceeds of $460 million, including the exercise of the option

- Record generation of ~38 terawatt hours across the Company’s

strategically positioned fleet

- Continued to advance five long-term fully contracted

development projects in Ontario representing ~350 MW of incremental

capacity

Financial highlights

- In the fourth quarter of 2024, generated:

- Adjusted funds from operations (AFFO) of $182 million and net

cash flow from operating activities of $438 million

- Adjusted EBITDA of $330 million and net income of $242

million

- For full-year 2024, generated:

- AFFO of $817 million and net cash flows from operating

activities of $1,144 million

- Adjusted EBITDA of $1,333 million and net income of $701

million

“In Q4 2024, we proudly completed our Genesee Repowering

project, transitioning Capital Power and the Province of Alberta

off coal. This project dramatically reduced our carbon emissions

and added significant lower heat rate capacity – making our Genesee

1 and 2 Canada’s most efficient natural gas combined cycle units2.

In addition to growing our capacity in Alberta, we diversified our

fleet through U.S. acquisitions while advancing development across

our renewables and flexible generation assets in Canada and the

U.S. We are set up for success, with a fleet of well-maintained and

optimized assets and access to multiple sources of attractively

priced capital. With our expanded North American presence, Capital

Power is positioned to continue growing to meet this unprecedented

era of energy expansion,” said Avik Dey, President and CEO of

Capital Power.

“Our financial results continue to demonstrate the prudence of

our strategy and focus on geographic diversification, pro-active

risk management and long-term contractedness. These efforts

stabilize our cash flows which, along with the

dividend, offer a compelling total return. Our strong

financial position means our 2025 capital spend, including the

advancement of fully contracted projects and maintenance capital,

is fully funded along with our dividend. This strong financial

position is driven by our base cash flows that are almost entirely

long-term contracted or hedged; our cash on hand derived from

selling down renewable assets, and successfully executing our

largest ever bought deal equity financing. This positions us better

than ever to pursue acquisitions as part of our growth strategy

while maintaining financial stability,” stated Sandra Haskins,

SVP Finance and CFO of Capital Power.

Operational and Financial

Highlights1

|

($ millions, except per share amounts) |

Three months endedDecember 31 |

Year endedDecember 31 |

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

Electricity generation (Gigawatt hours) |

9,408 |

|

8,692 |

|

37,821 |

|

32,487 |

|

|

Generation facility availability |

89% |

|

93% |

|

92% |

|

95% |

|

|

Revenues and other income |

853 |

|

984 |

|

3,776 |

|

4,282 |

|

|

Adjusted EBITDA 2 |

330 |

|

313 |

|

1,333 |

|

1,455 |

|

|

Net income 3 |

242 |

|

95 |

|

701 |

|

737 |

|

|

Net income attributable to shareholders of the Company |

240 |

|

97 |

|

699 |

|

744 |

|

|

Basic earnings per share ($) |

1.76 |

|

0.74 |

|

5.16 |

|

6.07 |

|

|

Diluted earnings per share ($) |

1.75 |

|

0.74 |

|

5.15 |

|

6.04 |

|

|

Net cash flows from (used in) operating activities |

438 |

|

(18 |

) |

1,144 |

|

822 |

|

|

Adjusted funds from operations 2 |

182 |

|

162 |

|

817 |

|

819 |

|

|

Adjusted funds from operations per share ($) 2 |

1.38 |

|

1.38 |

|

6.34 |

|

6.99 |

|

|

Purchase of property, plant and equipment and other assets,

net |

395 |

|

244 |

|

1,070 |

|

723 |

|

|

Dividends per common share, declared ($) |

0.6519 |

|

0.6150 |

|

2.5338 |

|

2.3900 |

|

|

1 |

The operational and financial highlights in this press release

should be read in conjunction with the Business Report and the

audited consolidated financial statements for the year ended

December 31, 2024. |

|

2 |

Earnings before net finance expense, income tax expense,

depreciation and amortization, impairments, foreign exchange gains

or losses, finance expense and depreciation expense from joint

venture interests, gains or losses on disposals and other

transactions and unrealized changes in fair value of commodity

derivatives and emissions credits and other items that are not

reflective of the long-term performance of the Company’s underlying

business (adjusted EBITDA) and AFFO are used as non-GAAP financial

measures by the Company. The Company also uses AFFO per share which

is a non-GAAP ratio. These measures and ratios do not have

standardized meanings under GAAP and are, therefore, unlikely to be

comparable to similar measures used by other enterprises. See

Non-GAAP Financial Measures and Ratios. |

|

3 |

Includes depreciation and amortization for the three months ended

December 31, 2024 and 2023 of $137 million and $142 million,

respectively, and for the year ended December 31, 2024 and 2023 of

$503 million and $574 million, respectively. Budgeted depreciation

and amortization for 2025 is $128 million per quarter. |

Significant Events

Renewable power asset sell-down

On December 20, 2024, the Company closed its sale of 49%

interests in the Quality Wind facility in British Columbia and the

Port Dover and Nanticoke Wind facility in Ontario to Axium

Infrastructure. Total pre-tax cash proceeds from the transaction

are $333 million, inclusive of working capital. At December 31,

2024, transaction fees of $7 million have been recorded within

trade and other payables.

The two wind facilities are fully contracted with investment

grade counterparties and have a remaining weighted average contract

life of ~11 years. Capital Power will continue to manage and

operate the assets on behalf of the newly formed partnership under

a long-term asset management agreement. Consistent with its

strategy, the transaction represents the crystallization of a

levered equity return in excess of Capital Power’s capital

allocation thresholds and enhances its financial flexibility.

$460 million bought offering of common

shares

On December 17, 2024, the Company completed a public offering of

7,820,000 common shares (inclusive of the full exercise of a

1,020,000 common shares over-allotment option), at an issue price

of $58.80 per common share for total gross proceeds of

approximately $460 million (the Offering) less issue costs of $19

million.

The Company intends to use the net proceeds from the Offering to

fund future potential acquisitions and growth opportunities and for

general corporate purposes.

Genesee is off coal and repowering achieves commercial

operations

On June 18, 2024, the Company reached a significant milestone

for the Genesee Repowering project with the announcement that the

Genesee Generating Station is off coal and now 100% natural

gas-fueled, resulting in the facility being off coal more than 5

years ahead of the Alberta government mandate.

On December 13, 2024, the Company announced that its Genesee

Repowering project as Genesee Unit 2 achieved combined cycle

commercial operations. This milestone marked a significant phase in

the Genesee Repowering project resulting in Genesee Units 1 and 2

becoming Canada’s most efficient natural gas combined cycle

facility3. The advancement of this project increases overall

capacity at the Genesee Generating Station by 512 MW and reduces

CO2 emissions (Scope 1) by 3.4 MT annually4 – representing a

~60% increase in capacity while reducing emissions (Scope 1) by

~40%.

The approximately $1.5 billion project began construction in

summer 2021 requiring more than 5.8 million hours of labour with a

peak of ~1,250 workers on site. Located entirely within the

footprint of the existing Genesee Generating Station, the project

involved installing two new Mitsubishi M501JAC gas-fired combustion

turbines and Vogt triple-pressure heat recovery steam generators,

while utilizing the units’ existing steam turbine generators.

The Genesee Generating Station is now capable of delivering

up to 1,857 MW of reliable, affordable and lower-carbon power for

Alberta’s thriving economy. The significant baseload generation

available on the 26,000+ acre site supports grid-wide reliability

while presenting opportunities for future development, energizing

the Alberta advantage for new technologies, industries and growth.

With the project now complete, Capital Power will be referring to

the Genesee Generating Station as a single facility in our

portfolio (30 total facilities instead of 32 when counting all

three units separately).

Refinancing of York Energy

On November 27, 2024, York Energy successfully refinanced and

upsized its existing term loan for an additional approximately

ten-year term maturing April 30, 2035. The $315 million term loan

bears interest at a fixed rate of 5.34% and is repayable in

quarterly installments. This refinancing creates interest savings

of approximately 0.66% and extends the maturity to align with the

power purchase agreements expiring in 2035.

Organizational review - voluntary departure

program

On October 24, 2024, the Company announced the rollout of the

voluntary departure program (VDP) and achieved a reduction in its

Canada-based corporate employees of approximately 40% (165

positions). The VDP is the result of a strategic organizational

review to optimize the organization to scale and grow efficiently,

inclusive of decentralizing corporate functions, reducing headcount

in certain areas and expanding in key growth areas.

In connection with the restructuring, the Company incurred a

total cost of $49 million, which includes $10 million related to

employee benefit costs that would have otherwise been incurred in

future periods. The total restructuring costs are expected to be

paid within the next six months as the employees participating in

the VDP will depart the Company by June 2025.

Analyst conference call and

webcast

Capital Power will be hosting a conference call and live webcast

with analysts on February 26, 2025 at 9:00 am (MT) to discuss the

fourth quarter and 2024 year-end financial results. The webcast can

be accessed at: https://edge.media-server.com/mmc/p/vvu8g99s/.

Conference call details will be sent directly to analysts.

An archive of the webcast will be available on the Company’s

website at www.capitalpower.com following the conclusion of the

analyst conference call.

Non-GAAP Financial Measures and

Ratios

Capital Power uses (i) earnings before net finance expense,

income tax expense, depreciation and amortization, impairments,

foreign exchange gains or losses, finance expense and depreciation

expense from our joint venture interests, gains or losses on

disposals and unrealized changes in fair value of commodity

derivatives and emission credits (adjusted EBITDA), and (ii) AFFO

as specified financial measures. Adjusted EBITDA and AFFO are both

non-GAAP financial measures.

Capital Power also uses AFFO per share as a specified

performance measure. This measure is a non-GAAP ratio determined by

applying AFFO to the weighted average number of common shares used

in the calculation of basic and diluted earnings per share.

These terms are not defined financial measures according to GAAP

and do not have standardized meanings prescribed by GAAP and,

therefore, are unlikely to be comparable to similar measures used

by other enterprises. These measures should not be considered

alternatives to net income, net income attributable to shareholders

of Capital Power, net cash flows from operating activities or other

measures of financial performance calculated in accordance with

GAAP. Rather, these measures are provided to complement GAAP

measures in the analysis of our results of operations from

management’s perspective.

Adjusted EBITDA

Capital Power uses adjusted EBITDA to measure the operating

performance of facilities and categories of facilities from period

to period. Management believes that a measure of facility operating

performance is more meaningful if results not related to facility

operations are excluded from the adjusted EBITDA measure such as

impairments, foreign exchange gains or losses, gains or losses on

disposals and other transactions, unrealized changes in fair value

of commodity derivatives and emission credits and other items that

are not reflective of the long-term performance of the Company’s

underlying business.

A reconciliation of adjusted EBITDA to net income is as

follows:

|

($ millions) |

Year endedDecember 31 |

|

Three months ended |

|

|

2024 |

|

2023 |

|

|

Dec 2024 |

|

Sep 2024 |

|

Jun 2024 |

|

Mar 2024 |

|

Dec 2023 |

|

Sep 2023 |

|

Jun 2023 |

|

Mar 2023 |

|

|

Revenues and other income |

3,776 |

|

4,282 |

|

|

853 |

|

1,030 |

|

774 |

|

1,119 |

|

984 |

|

1,150 |

|

881 |

|

1,267 |

|

|

Energy purchases and fuel, other raw materials and operating

charges, staff costs and employee benefits expense, and other

administrative expense |

(2,451 |

) |

(2,657 |

) |

|

(658 |

) |

(612 |

) |

(504 |

) |

(677 |

) |

(694 |

) |

(626 |

) |

(614 |

) |

(723 |

) |

| Remove unrealized changes in

fair value of commodity derivatives and emission credits |

(238 |

) |

(321 |

) |

|

48 |

|

(78 |

) |

(8 |

) |

(200 |

) |

(14 |

) |

(151 |

) |

23 |

|

(179 |

) |

| Remove other non-recurring

items 1 |

47 |

|

5 |

|

|

43 |

|

- |

|

4 |

|

- |

|

1 |

|

4 |

|

- |

|

- |

|

| Adjusted EBITDA from joint

ventures 2 |

199 |

|

146 |

|

|

44 |

|

61 |

|

57 |

|

37 |

|

36 |

|

37 |

|

37 |

|

36 |

|

|

Adjusted EBITDA |

1,333 |

|

1,455 |

|

|

330 |

|

401 |

|

323 |

|

279 |

|

313 |

|

414 |

|

327 |

|

401 |

|

| Depreciation and

amortization |

(503 |

) |

(574 |

) |

|

(137 |

) |

(124 |

) |

(120 |

) |

(122 |

) |

(142 |

) |

(148 |

) |

(143 |

) |

(141 |

) |

| Unrealized changes in fair

value of commodity derivatives and emission credits |

238 |

|

321 |

|

|

(48 |

) |

78 |

|

8 |

|

200 |

|

14 |

|

151 |

|

(23 |

) |

179 |

|

| Other non-recurring items

1 |

(47 |

) |

(5 |

) |

|

(43 |

) |

- |

|

(4 |

) |

- |

|

(1 |

) |

(4 |

) |

- |

|

- |

|

| Impairment |

(27 |

) |

- |

|

|

- |

|

(27 |

) |

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

| Foreign exchange (losses)

gains |

(29 |

) |

(6 |

) |

|

(20 |

) |

5 |

|

(4 |

) |

(10 |

) |

(2 |

) |

(9 |

) |

4 |

|

1 |

|

| Net finance expense |

(221 |

) |

(166 |

) |

|

(61 |

) |

(65 |

) |

(53 |

) |

(42 |

) |

(49 |

) |

(35 |

) |

(34 |

) |

(48 |

) |

| Gain on divestiture |

309 |

|

- |

|

|

309 |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

| (Losses) gains on disposals

and other transactions |

(31 |

) |

(3 |

) |

|

(11 |

) |

(5 |

) |

(17 |

) |

2 |

|

(5 |

) |

5 |

|

(3 |

) |

- |

|

| Other items2,3 |

(123 |

) |

(81 |

) |

|

(32 |

) |

(32 |

) |

(34 |

) |

(25 |

) |

(22 |

) |

(19 |

) |

(19 |

) |

(21 |

) |

| Income

tax expense |

(198 |

) |

(204 |

) |

|

(45 |

) |

(53 |

) |

(23 |

) |

(77 |

) |

(11 |

) |

(83 |

) |

(24 |

) |

(86 |

) |

|

Net income |

701 |

|

737 |

|

|

242 |

|

178 |

|

76 |

|

205 |

|

95 |

|

272 |

|

85 |

|

285 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss)

attributable to: |

|

|

|

|

|

|

|

|

|

|

|

| Non-controlling interests |

2 |

|

(7 |

) |

|

2 |

|

(1 |

) |

1 |

|

- |

|

(2 |

) |

(2 |

) |

(2 |

) |

(1 |

) |

|

Shareholders of the Company |

699 |

|

744 |

|

|

240 |

|

179 |

|

75 |

|

205 |

|

97 |

|

274 |

|

87 |

|

286 |

|

|

Net income |

701 |

|

737 |

|

|

242 |

|

178 |

|

76 |

|

205 |

|

95 |

|

272 |

|

85 |

|

285 |

|

|

1 |

For the three months and year ended December 31, 2024, other

non-recurring items reflects restructuring costs of $39 million

(see Significant events) and costs related to the end-of-life of

Genesee coal operations of $4 million and $8 million,

respectively. |

|

|

For the year ended December 31, 2023, other non-recurring items

reflects restructuring costs of $3 million and costs related to the

end-of-life of Genesee coal operations of $2 million. For the three

months ended December 31, 2023, this reflects costs related to the

end-of-life of Genesee coal operations of $1 million. |

|

2 |

Total income from joint ventures as per our consolidated statements

of income (loss). |

|

3 |

Includes finance expense, depreciation expense and unrealized

changes in fair value of derivative instruments from joint

ventures. |

Adjusted funds from operations and adjusted funds from

operations per share

AFFO and AFFO per share are measures of the Company’s ability to

generate cash from its operating activities to fund growth capital

expenditures, the repayment of debt and the payment of common share

dividends.

AFFO represents net cash flows from operating activities

adjusted to:

- remove timing impacts of cash

receipts and payments that may impact period-to-period

comparability which include deductions for net finance expense and

current income tax expense, the removal of deductions for interest

paid and income taxes paid and removing changes in operating

working capital,

- include the Company’s share of the

AFFO of its joint venture interests and exclude distributions

received from the Company’s joint venture interests which are

calculated after the effect of non-operating activity joint venture

debt payments,

- include cash from off-coal

compensation that will be received annually,

- remove the tax equity financing

project investors’ shares of AFFO associated with assets under tax

equity financing structures so only the Company’s share is

reflected in the overall metric,

- deduct sustaining capital

expenditures and preferred share dividends,

- exclude the impact of fair value

changes in certain unsettled derivative financial instruments that

are charged or credited to the Company’s bank margin account held

with a specific exchange counterparty, and

- exclude other typically

non-recurring items affecting cash from operating activities that

are not reflective of the long-term performance of the Company’s

underlying business.

A reconciliation of net cash flows from operating activities to

adjusted funds from operations is as follows:

|

($ millions) |

Year endedDecember 31 |

Three months endedDecember 31 |

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

Net cash flows from (used in) operating activities per

consolidated statements of cash flows |

1,144 |

|

822 |

|

438 |

|

(18 |

) |

|

Add (deduct) items included in calculation of net cash flows from

operating activities per consolidated statements of cash

flows: |

|

|

|

|

|

|

|

|

|

Interest paid |

163 |

|

111 |

|

31 |

|

8 |

|

|

Realized gains on settlement of hedged interest rate

derivatives |

(42 |

) |

(20 |

) |

- |

|

(10 |

) |

|

Change in fair value of derivatives reflected as cash

settlement |

(13 |

) |

(249 |

) |

4 |

|

(38 |

) |

|

Distributions received from joint ventures |

(120 |

) |

(36 |

) |

(96 |

) |

(11 |

) |

|

Miscellaneous financing charges (received) paid 1 |

(6 |

) |

13 |

|

- |

|

7 |

|

|

Income taxes paid |

38 |

|

214 |

|

21 |

|

178 |

|

|

Change in non-cash operating working capital |

(173 |

) |

226 |

|

(166 |

) |

100 |

|

|

|

(153 |

) |

259 |

|

(206 |

) |

234 |

|

|

Net finance expense 2 |

(186 |

) |

(134 |

) |

(50 |

) |

(37 |

) |

|

Current income tax expense |

(31 |

) |

(155 |

) |

(2 |

) |

(20 |

) |

|

Sustaining capital expenditures 3 |

(152 |

) |

(92 |

) |

(56 |

) |

(20 |

) |

|

Preferred share dividends paid |

(31 |

) |

(32 |

) |

(7 |

) |

(9 |

) |

|

Cash received for off-coal compensation |

50 |

|

50 |

|

- - |

|

- |

|

|

Remove tax equity interests’ respective shares of adjusted funds

from operations |

(6 |

) |

(7 |

) |

(2 |

) |

(2 |

) |

|

Adjusted funds from operations from joint ventures |

117 |

|

92 |

|

18 |

|

22 |

|

|

Other non-recurring items 4 |

65 |

|

16 |

|

49 |

|

12 |

|

|

Adjusted funds from operations |

817 |

|

819 |

|

182 |

|

162 |

|

|

Weighted average number of common shares outstanding

(millions) |

128.9 |

|

117.1 |

|

132.1 |

|

117.4 |

|

|

Adjusted funds from operations per share ($) |

6.34 |

|

6.99 |

|

1.38 |

|

1.38 |

|

|

1 |

Included in other cash items on the consolidated statements of cash

flows to reconcile net income to net cash flows from operating

activities. |

|

2 |

Excludes unrealized changes on interest rate derivative contracts,

amortization, accretion charges and non-cash implicit interest on

tax equity investment structures. |

|

3 |

Includes sustaining capital expenditures net of: (i) partner

contributions of $9 million and $1 million for the year and three

months ended December 31, 2024, respectively, compared with $6

million and $1 million for the year and three months ended December

31, 2023, respectively and (ii) insurance recoveries of $1 million

and $3 million for the year ended December 31, 2024 and 2023

respectively. |

|

4 |

For the year ended December 31, 2024 other non-recurring items

reflect restructuring costs of $39 million, costs related to the

end-of-life of Genesee coal operations of $9 million and a

provision of $18 million for discontinuation of the Genesee CCS

project related to termination of sequestration hub evaluation work

net of current income tax recovery of $1 million related to other

non-recurring items recognized in the prior and current periods.

For the three months ended December 31, 2024 other non-recurring

items reflect restructuring costs of $39 million, costs related to

the end-of-life of Genesee coal operations of $4 million, net of

current income tax expense of $6 million related to other

non-recurring items recognized in the prior and current periods.

Restructuring costs above exclude related employee benefit costs

that would have otherwise been incurred in future periods. |

|

|

For the year ended December 31, 2023, other non-recurring items

reflects restructuring costs of $3 million, costs related to the

end-of-life of Genesee coal operations of $8 million and dividend

equivalent payments for the subscription receipt offering of $7

million, net of current income tax recovery of $2 million. For the

three months ended December 31, 2023, other non-recurring items

reflects costs related to the end-of-life of Genesee coal

operations of $7 million and dividend equivalent payments for the

subscription receipt offering of $7 million, net of current income

tax recovery of $2 million. |

Forward-looking InformationForward-looking

information or statements included in this press release are

provided to inform the Company’s shareholders and potential

investors about management’s assessment of Capital Power’s future

plans and operations. This information may not be appropriate for

other purposes. The forward-looking information in this press

release is generally identified by words such as will, anticipate,

believe, plan, intend, target, and expect or similar words that

suggest future outcomes.

Material forward-looking information in this press release

includes disclosures regarding (i) forecasted 2025 depreciation,

(ii) the timing of, funding of, generation capacity of, costs of

technologies selected for, environmental benefits or commercial and

partnership arrangements regarding existing, planned and potential

development projects and acquisitions (including the repowering of

Genesee 1 and 2, and La Paloma and Harquahala acquisitions), (iii)

the financial impacts of the La Paloma and Harquahala acquisitions,

(iv) the ability of profit-sharing arrangements to support partner

communities, (v) the performance of future projects and the

performance of such projects in comparison to the market, and (vi)

the future energy needs of certain jurisdictions.

These statements are based on certain assumptions and analyses

made by the Company considering its experience and perception of

historical trends, current conditions, expected future developments

and other factors it believes are appropriate including its review

of purchased businesses and assets. The material factors and

assumptions used to develop these forward-looking statements relate

to: (i) electricity, other energy and carbon prices, (ii)

performance, (iii) business prospects (including potential

re-contracting of facilities) and opportunities including expected

growth and capital projects, (iv) status of and impact of policy,

legislation and regulations and (v) effective tax rates.

Whether actual results, performance or achievements will conform

to the Company’s expectations and predictions is subject to a

number of known and unknown risks and uncertainties which could

cause actual results and experience to differ materially from the

Company’s expectations. Such material risks and uncertainties are:

(i) changes in electricity, natural gas and carbon prices in

markets in which the Company operates and the use of derivatives,

(ii) regulatory and political environments including changes to

environmental, climate, financial reporting, market structure and

tax legislation, (iii) disruptions, or price volatility within our

supply chains, (iv) generation facility availability, wind capacity

factor and performance including maintenance expenditures, (v)

ability to fund current and future capital and working capital

needs, (vi) acquisitions and developments including timing and

costs of regulatory approvals and construction, (vii) changes in

the availability of fuel, (viii) ability to realize the anticipated

benefits of acquisitions, (ix) limitations inherent in the

Company’s review of acquired assets, (x) changes in general

economic and competitive conditions and (xi) changes in the

performance and cost of technologies and the development of new

technologies, new energy efficient products, services and programs.

See Risks and Risk Management in the Company’s Integrated Annual

Report for the year ended December 31, 2024, prepared as of

February 25, 2025, for further discussion of these and other

risks.

Readers are cautioned not to place undue reliance on any such

forward-looking statements, which speak only as of the specified

approval date. The Company does not undertake or accept any

obligation or undertaking to release publicly any updates or

revisions to any forward-looking statements to reflect any change

in the Company’s expectations or any change in events, conditions

or circumstances on which any such statement is based, except as

required by law.

Territorial Acknowledgement

In the spirit of reconciliation, Capital Power respectfully

acknowledges that we operate within the ancestral homelands,

traditional and treaty territories of the Indigenous Peoples of

Turtle Island, or North America. Capital Power’s head office is

located within the traditional and contemporary home of many

Indigenous Peoples of the Treaty 6 region and Métis Nation of

Alberta Region 4. We acknowledge the diverse Indigenous communities

that are located in these areas and whose presence continues to

enrich the community.

About Capital Power

Capital Power is a growth-oriented power producer with

approximately 10 GW of power generation at 30 facilities across

North America. We prioritize safely delivering reliable and

affordable power communities can depend on, building clean power

systems, and creating balanced solutions for our energy future. We

are Powering Change by Changing Power™.

For more information, please

contact:

| Media

Relations: Katherine

Perron(780)

392-5335 kperron@capitalpower.com |

Investor

Relations: Noreen

Farrell(403)

461-5236 investor@capitalpower.com |

_______________________1 Anticipated GHG emission reductions

from Genesee Repowering project and transition off-coal compared to

2019 facility emissions.2 Repowered Units 1 and 2 at Genesee

Generating Station use Mitsubishi M501JAC turbines and Vogt heat

recovery steam generators in combined cycle mode are the most

efficient combined cycle units currently operating in Canada.3

Repowered Units 1 and 2 at Genesee Generating Station use

Mitsubishi M501JAC turbines and Vogt heat recovery steam generators

in combined cycle mode are the most efficient combined cycle units

currently operating in Canada.4 Anticipated GHG emission reductions

from Genesee Repowering project and transition off-coal compared to

2019 facility emissions.

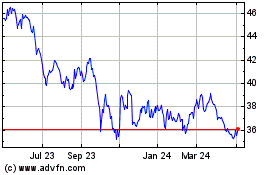

Capital Power (TSX:CPX)

Historical Stock Chart

From Feb 2025 to Mar 2025

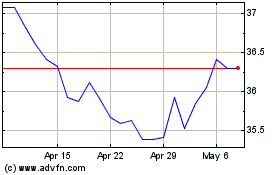

Capital Power (TSX:CPX)

Historical Stock Chart

From Mar 2024 to Mar 2025