(All amounts in US$ unless otherwise

specified)

Capstone Mining Corp. (“Capstone” or the “Company”) (TSX:CS)

announces its production and financial results for the three months

(“Q1 2020”) ended March 31, 2020. Copper production totaled 35.5

million pounds of copper at consolidated C1 cash costs1 of $2.05

per payable pound produced.

“I am proud of Capstone’s response to the COVID-19 pandemic. Our

top priority is to ensure the health of our employees and our

communities in which we operate, while maintaining the health of

our business,” said Darren Pylot, President & CEO of Capstone.

“Our quick mitigation measures positioned Capstone to weather this

current low copper price environment without delaying the 2021

growth targets we have set.”

“We were well positioned to face the abrupt economic downturn

during Q1 2020, having cut nearly $30 million in annual costs from

the business last year,” said Raman Randhawa, SVP & CFO of

Capstone. “We were fortunate to have the flexibility to defer

another $32 million in capital costs this year, while having

preserved multiple levers that could be triggered to increase

liquidity, if necessary. Also, we have taken actions on additional

operating cost savings of $22 million which include locking in

contract purchases and hedges on very low diesel prices,

transportation and the Mexican Peso for the remainder of 2020. This

is expected to result in consolidated C1 operating costs and all-in

sustaining costs of ~$1.80 and ~$2.20 per pound, respectively, for

the balance of this year.”

COZAMIN UPDATE On April 7, the Company safely commenced

ramping down operations at Cozamin to comply with a Mexican Federal

Government decree which was extended from April 30, 2020 to until

May 30, 2020. The decree allows for normal operations to resume on

May 18, 2020 in municipalities which present low or null

transmission of COVID-19. Zacatecas is a low-risk jurisdiction

based on current statistics. The Company is taking all steps

necessary to be able to quickly and safely ramp production back up

to full capacity by May 18, 2020.

Q1 2020 HIGHLIGHTS AND SIGNIFICANT ITEMS

- Q1 2020 copper production of 35.5 million pounds and C1 cash

costs1 of $2.05 per payable pound produced. Copper sales were

lower at 30.4 million pounds due to timing of shipments at Pinto

Valley.

- Q1 2020 net loss of $21.9 million impacted significantly

by two items, non-cash inventory write-downs ($6.7 million) and

provisional pricing adjustments ($9.8 million) related to COVID-19.

(Q1 2019 – net income of $8.3 million).

- Q1 2020 operating cash flow of $6.9 million (Q1 2019 of

$28.7 million). Operating cash flow was impacted by approximately

$10 million due to one less shipment at Pinto Valley and the

build-up of concentrate inventory during Q1 2020.

- In January and April, Cozamin further announced the results

from its 2019/2020 step-out and infill drilling program, aiming to

double the current reserve base. 177 holes of the 200 planned

holes are now released, with updated Mineral Resource and Mineral

Reserve estimates expected in late 2020. Positive drill results are

pointing to expected higher grades and wider intercepts than in the

current reserve, as well as a potentially expanded high-grade

resource.

- A positive update to Santo Domingo’s Feasibility Study

was released in February. The update included a higher

level of capital and operating cost certainty, the receipt of

additional key permits and the development of a Preliminary

Economic Assessment with respect to cobalt production.

- The World Health Organization declared the

coronavirus (COVID-19) a global pandemic in early March.

Capstone has taken the following measures in response to

COVID-19; refer to the Corporate Update below for more

details:

- Implemented rigorous control and prevention measures in

order to ensure the health of our workers at all our offices and

operations.

- Safely ramped down operations at Cozamin on April 7, to

comply with a government decree.

- Withdrew its full-year 2020 production guidance, due to

Cozamin’s temporary ramp down of operations and the ongoing

uncertainty regarding COVID-19. The Company will re-evaluate its

full-year 2020 guidance as the pandemic evolves.

- 2020 cost reduction actions taken to manage liquidity and

deliver margins:

- Reduced discretionary capital and exploration expenditures

by $32 million.

- Actions taken by management to reduce operating costs for

the remainder of 2020 by $22 million. These reductions include

lower diesel prices and transportation costs, hedging foreign

exchange and interest rate swaps.

- Operating cost reductions are expected to reduce C1 cash

costs to $1.75/lb to $1.85/lb thus delivering margins at spot

copper prices.

- Executed financial hedges on foreign exchange and interest

rates to protect approximately half of the Company’s Mexican

Peso exposure from August 2020 through December 2021 and swapped

the floating for fixed rate on the LIBOR portion of our revolving

credit facility (RCF) at 0.355%. Resulting in estimated expected

savings against plan of $4 million and $4 million respectively over

the term of the contracts.

CORPORATE UPDATE

COVID-19 In response to

the World Health Organization declaring novel coronavirus

(COVID-19) a global pandemic in early March,

Capstone has taken the following

measures to ensure the health and safety of our people and the

communities in which we operate:

- We have a global COVID-19

response team in place and are assessing any potential health and

business impacts across all our operations.

- Implemented rigorous control and prevention measures at all our

offices and operations in order to ensure the health of our

workers, including remote working from home where possible and

limiting all non-essential travel.

- In response to COVID-19 negatively affecting global markets and

putting downward pressure on metal prices, Capstone has taken

prudent financial measures to reduce discretionary capital and

exploration expenditures by $32 million in 2020.

- The Company’s financial position as at December 31, 2019 was at

a position of strength with low net debt/EBITDA of 1.56x, net debt

of $165 million and total available liquidity of $135 million

consisting of $90 million undrawn on the revolving credit facility

(“RCF”) plus cash and short-term investments of $45 million. As at

March 31, 2020, the Company had total available liquidity of $112

million consisting of $80 million of undrawn credit on the RCF and

cash and short-term investments of $32 million. Subsequent to

quarter-end, the Company drew $30 million on the RCF as a

precautionary measure for working capital purposes. The Company is

closely monitoring future cash flow projections to ensure that we

can take appropriate further actions as required.

- On April 7, the Company safely commenced ramping down

operations at Cozamin to comply with a Mexican Federal Government

decree which was extended from April 30, 2020 to until May 30,

2020. The decree allows for the normal operations to resume on May

18, 2020 in municipalities which present low or null transmission

of COVID-19. Zacatecas is a low-risk jurisdiction based on current

statistics. The Company is taking all steps necessary to be able to

quickly and safely ramp production back up to full capacity by May

18, 2020.

2020 Cost Reductions At the end of December 2019, the

Company achieved its target of sustainable annualized cost savings

of $27.5 million from the business, using 2018 as a baseline.

In response to COVID-19, Capstone has taken prudent financial

measures to reduce discretionary capital and exploration

expenditures by $32 million in 2020.

In addition, in relation to current financial markets, the

Company is targeting the following cost reductions in 2020 expected

to be reflected in our future operating results. These are

additional cost saving measures which would enable Capstone to

reduce our cash operating costs by approximately $22 million over

the remainder of 2020.

Operating Cost Items

Projected Annualized Cost

Savings ($ million)

Projected 2020 Savings (Q2 to

Q4) ($ million)

Diesel

$10

$8

Transportation costs

$3

$2

Contractor management freeze

$4

$3

Consumables and other inputs

costs

$4

$3

Mexican peso @ 24.00 versus

guidance 19.50

$5

$4

Canadian dollar @ 1.40 versus

guidance 1.30

$1

$1

Fixed interest rate swap

$1

$1

TOTAL

$28

$22

Pinto Valley Cost Reductions As a result of these cost

reduction measures and expected improvements to production compared

to Q1 2020 (primarily related to grades reverting back to average

of 0.31% copper), we expect the C1 cash costs1 for Pinto Valley to

reduce dramatically in the remaining quarters in 2020, compared to

Q1 results, to below $2.00/lb. This is a result of the following

key factors illustrated in the waterfall chart. (Refer to the Risks

and Uncertainties section in Capstone’s Q1 2020 Management’s

Discussion and Analysis (“MD&A”) and Financial Statements for

updated COVID-19 related risks.)

Pinto Valley: PV3 Optimization PV3 Optimization is an initiative that aims

to enhance performance via a series of low capital, quick payback,

high impact debottlenecking steps and operational tweaks. The goal

is to sustainably boost throughput, enhance recovery and lower

costs. All required permits are in place to operate at levels up to

79,500 tonnes per day.

The first phase of PV3

Optimization aims to increase reliability and improve performance

in the fine crushing plant and grinding circuit (“Phase 1”). In Q1

2020, the first of two secondary crushers and screen decks arrived

and are scheduled to be installed in July. Also in July, the first

of two new ball mill shells are expected to be installed, with the

second scheduled for Q1 2021. The second secondary crusher and six

tertiary screen decks are scheduled to arrive in Q4 2020. Once

completed, the expected result is for throughput to reliably

achieve higher throughput levels in the 56,000 to 57,000 tonnes per

day range in 2021. During Q1 2020, a mineral processing consultant

was hired to assist in reviewing historical reports and operational

data and identify operational improvements to advance in the short

term (“Phase 2”).

Pinto Valley: PV4 Expansion Preliminary work on Pinto

Valley’s potential future expansion to 100,000+ tonnes per day

(“PV4 Expansion”) continues but at a slower rate given COVID-19

restrictions. The update has been delayed for an indeterminate

period. The study is focused on evaluating potential scenarios to

take advantage of the one billion tonnes of Mineral Resources not

currently scheduled in the current mine plan pit shell (“PV3”).

Cozamin: Near-Term Expansion Update In early April 2020,

Cozamin completed two major projects that represent a significant

achievement on our path to expanding copper and silver production

in 2021. The final key component of this expansion, the Calicanto

one-way ramp, continues as scheduled and on budget to be completed

in December 2020. (Refer to the Risks and Uncertainties section in

Capstone’s Q1 2020 MD&A and Financial Statements for updated

COVID-19 related risks.) The 818-meter raisebore was completed 52

days ahead of schedule, which immediately improved ventilation and

decreased the temperature in the deepest area of the mine. The

second milestone is completion of an upgrade to the underground

electrical substation, to boost the mine from 7.5MW to 9.5MW. In

addition, an additional underground maintenance shop has been

completed, increasing fleet maintenance capacity by 50%. Once

completed, the underground expansion is expected to increase

production to a new annual run rate of approximately 50-55 million

pounds of copper and 1.5 million ounces of silver in 2021.

Cozamin: Targeting Doubling Mine Life Updated Mineral

Resource and Mineral Reserve estimates for Cozamin are still

expected to be completed in late 2020. The 2019/2020 step-out and

infill drilling program was progressing well at 85% completed and

approximately three months ahead of schedule, until it was

suspended as a non-essential activity by Mexican national decree.

The drilling completed to date will be used to upgrade Inferred

Mineral Resources to the Indicated category and subsequent

conversion to Mineral Reserves to target doubling the mine life.

Positive drill results pointing to higher grades and wider

intercepts than in the current Mineral Reserve estimates were

released on January 16, 2020 and April 23, 2020.

Santo Domingo Technical Report Update In February 2020, a

positive update to Santo Domingo’s Feasibility Study-level

Technical Report, originally published on January 3, 2019 (“Base

Case”), was released on February 19, 2020 and filed on SEDAR on

March 24, 2020. The update included a higher level of Capital

(“CAPEX”) and Operating Cost (“OPEX”) certainty, receipt of

additional key permits and the development of a Preliminary

Economic Assessment with respect to cobalt production (the “2020

PEA Opportunity”). Highlights included:

- Higher level of CAPEX/OPEX certainty due to confirmation of

certain capital and operating costs with the negotiation of a power

purchase agreement, indicative offers for desalinated water

purchase from third parties, firm-fixed-price (lump sum) proposal

for the construction of plant and mine facilities and firm

actionable quotes for key process equipment.

- Base Case copper-iron-gold project has a post-tax net present

value at an 8% discount rate (“NPV8%”) of $1.03 billion. Initial

construction costs are estimated to be $1.51 billion which includes

a $197 million contingency on total costs.

- The 2020 PEA Opportunity considers a conceptual plan to mine

and process copper, iron-ore and gold at the onset of the mine.

Subsequent to the decision of building the copper-iron-gold mine, a

follow-on phase to initiate engineering and permitting is presented

for a cobalt recovery circuit. The 2020 PEA Opportunity assumes two

years for additional permitting and detailed engineering. During

this development period, the cobalt laden pyrite will be stockpiled

as a high-density slurry. Copper, iron and gold are mined for the

18-year mine life and processed over 18 years, and cobalt is mined

for 18 years but processed over the last 16 years.

- The copper-iron project with the phased cobalt opportunity has

a NPV8% of $1.66 billion after tax.

- Incremental CAPEX for a cobalt refining complex of $0.67

billion, for combined construction costs of $2.18 billion, timed to

begin two years after construction begins for the copper-iron-gold

plant.

- Production of an average of 10.4 million pounds of cobalt per

annum in the form of 22,600 tonnes per annum (“tpa”) battery-grade

cobalt sulfate, at incremental operating costs of $3.70 per pound

of cobalt production costs and incremental C1 cash costs1 of

negative -$4.11 per pound of cobalt production (including

by-product sulfuric acid produced in the cobalt operation).

OPERATIONAL OVERVIEW Refer to Capstone’s Q1 2020 MD&A

and Financial Statements for detailed operating results.

Q1 2020

Q1 2019

Copper production (million

pounds)

Pinto Valley

26.8

32.7

Cozamin

8.7

8.7

Total copper production

(million pounds)

35.5

41.4

Copper sales

Total copper sales (from

continuing operations)2 (million pounds)

30.4

35.3

Realized copper price ($/lb.)

$2.29

$2.99

C1 cash costs1 ($/lb.)

produced

Pinto Valley

$2.41

$1.79

Cozamin

$0.95

$0.70

Consolidated C1 cash costs1

($/lb.) produced

$2.05

$1.56

1 This is an alternative performance

measure; please see "Alternative Performance Measures" at the end

of this release.

2 Sales from continuing operations has

been utilized due to the Minto mine being classified as a

discontinued operation in the comparative period until the point of

its sale on June 3, 2019.

Consolidated Production of 35.5 million pounds was at the

lower end of the original guidance range of 140 to 155 million

pounds. Production levels are expected to ramp up through the year

as Pinto Valley mined a lower grade area of the upper portion of

the pit during the quarter. A focus on maximizing mill throughput

continued in Q1 2020 following the successful December 2019

operational test, announced with the 2019 results in February 2020.

A total of 28 days of over 60,000 tonnes per day was realized

during Q1 2020 and an average daily throughput rate during Q1 2020

of 54,900 tonnes per day, or approximately 5% higher than the

three-year average from 2017 to 2019. Sustainable high mill

throughput rates are expected in the second half of 2020, helped by

the installation of the first of two secondary crushers and screen

decks planned for July 2020. Recoveries during the quarter of 82.4%

were impacted by the low feed grade of 0.284% plus an expected

higher than average oxide component. Grade and recovery are both

planned to be higher for the balance of the year.

C1 cash costs1 were impacted by Pinto Valley costs, overall

lower production and less capitalized stripping resulting from the

increased ore delivery to the mill.

The realized copper price in Q1 2020 of $2.29 per pound was

lower than the LME average of $2.56 per pound due to three

provisionally priced shipments at March 31, 2020, which were priced

at an average of $2.24 per pound. In addition, there was a ($0.10)

per pound negative provisional adjustment on prior shipments due to

copper prices decreasing throughout the quarter. Sales volumes in

Q1 2020 were lower than production due to timing of shipments at

Pinto Valley.

Pinto Valley Mine C1 cash costs1 of $2.41 per pound in Q1

2020 were higher than Q1 2019, primarily due to 18% lower copper

production compared to the same period last year, as well as higher

operating costs (site costs were $56 million in Q1 2020 compared to

$216 million in 2019 or a run rate of $54 million per quarter). C1

cash costs1 were also impacted by lower capitalized stripping in Q1

2020 of $5.3 million or $0.20 per pound.

Property cost per tonne milled1 of $10.87 was $0.30/tonne lower

(-3%) versus the average cost per tonne milled in 2019 and

$0.76/tonne lower (-6.5%) than in 2018. This reflects the cost cuts

implemented over the course of last year.

During Q1 2020, the mill was able to achieve mill throughput of

54,899 tonnes per day (highest quarterly total since Q4 2017) as a

result of operational improvements tied to maintenance

programs.

Cozamin Mine Production in Q1 2020 remained consistent at

Cozamin compared to Q1 2019. C1 cash costs1 of $0.95 per pound were

higher than Q1 2019. The primary cause of this is a decrease in

by-product credits during the quarter due to declining commodity

prices as a result of current market conditions, as well as less

San Rafael zinc ore mined during the quarter. This was offset by

decreases in overall operating costs from cost management efforts,

as well as lower treatment and selling costs.

FINANCIAL OVERVIEW Refer to Capstone’s Q1 2020 MD&A

and Financial Statements for detailed financial results.

Q1 2020

Q1 2019

Revenue2 ($ millions)

70.4

108.9

Net income (loss) ($

millions)

(21.9)

8.3

Adjusted net income

(loss)1 ($ millions)3

(17.7)

12.0

Adjusted EBITDA1,4 from

continuing operations2,3 ($ millions)

11.1

35.6

Cash flow from operating

activities2 ($ millions)

6.9

28.7

Operating cash flow before

changes in working capital1,2 ($ millions)

(3.5)

30.7

March 31, 2020

December 31, 2019

Total assets ($

millions)

1,309.9

1,331.4

Long term debt (excluding

financing fees) ($ millions)

219.9

209.9

Net debt1 ($ millions)

188.0

165.5

1 This is an alternative performance

measure; please see "Alternative Performance Measures" at the end

of this release.

2 In accordance with IFRS 5, Minto’s

results are excluded from revenue but included within cash flow

amounts in the comparative period. The Minto mine was sold on June

3, 2019.

3 Certain prior period amounts have been

restated to conform with current period classification.

4 EBITDA is earnings before interest,

taxes, depletion and amortization.

OUTLOOK – 2020 PRODUCTION, COST AND CAPITAL GUIDANCE In

light of the temporary ramp-down at Cozamin to comply with a

Mexican Federal Government decree which was extended from April 30,

2020 to until May 30, 2020, and the ongoing uncertainty regarding

COVID-19, Capstone has decided to withdraw its full-year 2020

production guidance. The Company will continue to target safe

execution of its operation plans and will re-evaluate its full-year

2020 guidance as the pandemic evolves.

Prior to the temporary ramp-down at the Cozamin mine, Capstone

had taken prudent financial measures, due to the recent drop in

copper prices, to reduce discretionary capital and exploration

expenditures of $32 million in 2020, as shown in the table below.

The Company does not expect that these reductions will materially

impact its growth plans for 2021 and beyond.

Refer to the Corporate Update section for revised 2020 operating

cost expectations.

2020 Expenditure

Guidance

Original Guidance

Revised Guidance

Pinto Valley

Sustaining

$28

$18

Capitalized stripping

$8

$3

Expansionary

$19

$12

Total Pinto Valley

Capital

$55

$33

Cozamin

$26

$24

Santo Domingo

$93

$64

Total Capital

$90

$63

Total Exploration

$10

$5

3 On a 100% basis, the figure is $12

million; ownership is 70% Capstone and 30% Korea Resources

Corporation.

4 On a 100% basis, the figure is $9

million; ownership is 70% Capstone and 30% Korea Resources

Corporation.

CONFERENCE CALL AND WEBCAST DETAILS

Date:

Wednesday, April 29, 2020

Time:

11:30

am Eastern Time (8:30 am Pacific Time)

Dial

in:

North

America: 1-877-823-8676, International:

+825-312-2240

Webcast:

https://event.on24.com/wcc/r/2218097/7C9FE2184A36B0D28729C5A8FBF1B50B

The conference call replay will be available

until May 13, 2020.

Replay:

North

America: 800-585-8367, International: +416-621-4642

Passcode:

5215689

Following the replay, an audio file will be

available on Capstone's website at

https://capstonemining.com/investors/events-and-presentations/default.aspx.

This release is not suitable on a standalone basis for readers

unfamiliar with Capstone and should be read in conjunction with the

Company’s MD&A and Financial Statements for the three months

ended March 31, 2020, which are available on Capstone’s website and

on SEDAR, all of which have been reviewed and approved by

Capstone's Board of Directors.

1 This is an alternative performance measure; please see

"Alternative Performance Measures" at the end of this release.

ABOUT CAPSTONE MINING CORP. Capstone Mining Corp. is a

Canadian base metals mining company, focused on copper. We are

committed to the responsible development of our assets and the

environments in which we operate. Our two producing mines are the

Pinto Valley copper mine located in Arizona, US and the Cozamin

copper-silver mine in Zacatecas State, Mexico. In addition,

Capstone has the large scale 70% owned copper-iron Santo Domingo

development project in Region III, Chile in partnership with Korea

Resources Corporation, as well as a portfolio of exploration

properties. Capstone's strategy is to focus on the optimization of

operations and assets in politically stable, mining-friendly

regions, centred in the Americas. Our headquarters are in

Vancouver, Canada and we are listed on the Toronto Stock Exchange

(TSX). Further information is available at

www.capstonemining.com.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING INFORMATION

This document may contain “forward-looking information” within the

meaning of Canadian securities legislation and “forward-looking

statements” within the meaning of the United States Private

Securities Litigation Reform Act of 1995 (collectively,

“forward-looking statements”). These forward-looking statements are

made as of the date of this document and the Company does not

intend, and does not assume any obligation, to update these

forward-looking statements, except as required under applicable

securities legislation.

Forward-looking statements relate to future events or future

performance and reflect our expectations or beliefs regarding

future events and the impacts of the ongoing and evolving COVID-19

pandemic. Forward-looking statements include, but are not limited

to, statements with respect to the estimation of Mineral Resources

and Mineral Reserves, the realization of Mineral Reserve estimates,

the timing and amount of estimated future production, costs of

production and capital expenditures, the success of our mining

operations, the continuing success of mineral exploration,

Capstone’s ability to fund future exploration activities,

environmental risks, unanticipated reclamation expenses and title

disputes. The potential effects of the COVID-19 pandemic on our

business and operations are unknown at this time, including

Capstone’s ability to manage challenges and restrictions arising

from COVID-19 in the communities in which Capstone operates and our

ability to continue to safely operate and to safely return our

business to normal operations. The impact of COVID-19 to Capstone

is dependent on a number of factors outside of our control and

knowledge, including the effectiveness of the measures taken by

public health and governmental authorities to combat the spread of

the disease, global economic uncertainties and outlook due to the

disease, and the evolving restrictions relating to mining

activities and to travel in certain jurisdictions in which we

operate.

In certain cases, forward-looking statements can be identified

by the use of words such as “plans”, “expects”, “budget”,

“scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”,

“believes” or variations of such words and phrases, or statements

that certain actions, events or results “may”, “could”, “would”,

“might” or “will be taken”, “occur” or “be achieved” or the

negative of these terms or comparable terminology. In this document

certain forward-looking statements are identified by words

including “anticipated”, “guidance”, “plan” and “expected”. By

their very nature, forward-looking statements involve known and

unknown risks, uncertainties and other factors that may cause our

actual results, performance or achievements to be materially

different from any future results, performance or achievements

expressed or implied by the forward-looking statements. Such

factors include, amongst others, risks related to inherent hazards

associated with mining operations and closure of mining projects,

future prices of copper and other metals, compliance with financial

covenants, surety bonding, our ability to raise capital, Capstone’s

ability to acquire properties for growth, counterparty risks

associated with sales of our metals, use of financial derivative

instruments and associated counterparty risks, foreign currency

exchange rate fluctuations, market access restrictions or tariffs,

changes in general economic conditions, accuracy of Mineral

Resource and Mineral Reserve estimates, operating in foreign

jurisdictions with risk of changes to governmental regulation,

compliance with governmental regulations, compliance with

environmental laws and regulations, reliance on approvals, licenses

and permits from governmental authorities, acting as Indemnitor for

Minto Exploration Ltd.’s surety bond obligations post divestiture,

impact of climatic conditions on our Pinto Valley and Cozamin

operations, aboriginal title claims and rights to consultation and

accommodation, land reclamation and mine closure obligations, risks

relating to widespread epidemics or pandemic outbreak including the

COVID-19 pandemic; the impact of COVID-19 on our workforce,

suppliers and other essential resources and what effect those

impacts, if they occur, would have on our business, including our

ability to access goods and supplies, the ability to transport our

products and impacts on employee productivity, the risks in

connection with the operations, cash flow and results of Capstone

relating to the unknown duration and impact of the COVID-19

pandemic, uncertainties and risks related to the potential

development of the Santo Domingo Project, increased operating and

capital costs, challenges to title to our mineral properties,

maintaining ongoing social license to operate, dependence on key

management personnel, potential conflicts of interest involving our

directors and officers, corruption and bribery, limitations

inherent in our insurance coverage, labour relations, increasing

energy prices, competition in the mining industry, risks associated

with joint venture partners, our ability to integrate new

acquisitions into our operations, cybersecurity threats, legal

proceedings, and other risks of the mining industry as well as

those factors detailed from time to time in the Company’s interim

and annual financial statements and MD&A of those statements,

all of which are filed and available for review under the Company’s

profile on SEDAR at www.sedar.com. Although the Company has

attempted to identify important factors that could cause our actual

results, performance or achievements to differ materially from

those described in our forward-looking statements, there may be

other factors that cause our results, performance or achievements

not to be as anticipated, estimated or intended. There can be no

assurance that our forward-looking statements will prove to be

accurate, as our actual results, performance or achievements could

differ materially from those anticipated in such statements.

Accordingly, readers should not place undue reliance on our

forward-looking statements.

NATIONAL INSTRUMENT 43-101 COMPLIANCE Unless otherwise

indicated, Capstone has prepared the technical information in this

News Release (“Technical Information”) based on information

contained in the technical reports, Annual Information Form and

news releases (collectively the “Disclosure Documents”) available

under Capstone Mining Corp.’s company profile on SEDAR at

www.sedar.com. Each Disclosure Document was prepared by or under

the supervision of a qualified person (a “Qualified Person”) as

defined in National Instrument 43-101 – Standards of Disclosure for

Mineral Projects of the Canadian Securities Administrators (“NI

43-101”). Readers are encouraged to review the full text of the

Disclosure Documents which qualifies the Technical Information.

Readers are advised that Mineral Resources that are not Mineral

Reserves do not have demonstrated economic viability. The

Disclosure Documents are each intended to be read as a whole, and

sections should not be read or relied upon out of context. The

Technical Information is subject to the assumptions and

qualifications contained in the Disclosure Documents.

Disclosure Documents include the National Instrument 43-101

compliant technical reports titled "NI 43-101 Technical Report on

the Cozamin Mine, Zacatecas, Mexico" effective October 24, 2018,

“Pinto Valley Mine Life Extension – Phase 3 (PV3) Pre-Feasibility

Study” effective January 1, 2016 and “Santo Domingo Project, Region

III, Chile, NI 43-101 Technical Report” effective February 19,

2020.

The disclosure of scientific and Technical Information in this

News Release was reviewed and approved by Brad Mercer, P. Geol.,

Senior Vice President, Operations and Exploration (technical

information related to mineral exploration activities and to

Mineral Resources at Cozamin), Clay Craig, P.Eng, Superintendent

Mine Technical Services – Pinto Valley Mine (technical information

related to Mineral Reserves and Mineral Resources at Pinto Valley),

Tucker Jensen, Senior Technical Advisor – Cozamin Mine, P.Eng

(technical information related to Mineral Reserves at Cozamin) and

Albert Garcia III, PE, Vice President, Projects (technical

information related to project updates at Santo Domingo) all

Qualified Persons under NI 43-101.

ALTERNATIVE PERFORMANCE MEASURES Alternative performance

measures are furnished to provide additional information. These

non-GAAP performance measures are included in this News Release

because these statistics are key performance measures that

management uses to monitor performance, to assess how the Company

is performing, and to plan and assess the overall effectiveness and

efficiency of mining operations. These performance measures do not

have a standard meaning within IFRS and, therefore, amounts

presented may not be comparable to similar data presented by other

mining companies. These performance measures should not be

considered in isolation as a substitute for measures of performance

in accordance with IFRS.

These alternative performance measures are presented in

Highlights and discussed further in other sections of the Q1 2020

MD&A for the three months ended March 31, 2020. These measures

provide meaningful supplemental information regarding operating

results because they exclude certain significant items that are not

considered indicative of future financial trends either by nature

or amount. As a result, these items are excluded for management

assessment of operational performance and preparation of annual

budgets. These significant items may include, but are not limited

to, restructuring and asset impairment charges, individually

significant gains and losses from sales of assets, share based

compensation, unrealized gains or losses, and certain items outside

the control of management. These items may not be non-recurring.

However, excluding these items from GAAP or Non-GAAP results allows

for a consistent understanding of the Company's consolidated

financial performance when performing a multi-period assessment

including assessing the likelihood of future results. Accordingly,

these Non-GAAP financial measures may provide insight to investors

and other external users of the Company's consolidated financial

information

C1 Cash Costs Per Payable Pound of Copper Produced C1

cash costs per payable pound of copper produced is a key

performance measure that management uses to monitor performance.

Management uses this measure to assess how well the Company’s

producing mines are performing and to assess overall efficiency and

effectiveness of the mining operations.

All-in Sustaining Costs Per Payable Pound of Copper

Produced All-in sustaining costs per payable pound of copper

produced is an extension of C1 cash costs measure discussed above

and is also a key performance measure that management uses to

monitor performance. Management uses this measure to analyze

margins achieved on existing assets while sustaining and

maintaining production at current levels. Consolidated All-in

sustaining costs includes Corporate general and administrative

costs.

Net Debt Net debt is a performance measure used by the

Company to assess its financial position.

Operating Cash Flow before Working Capital Changes per Common

Share Operating Cash Flow before working capital changes per

common share is a performance measure used by the Company to assess

its ability to generate cash from its operations, while also taking

into consideration changes in the number of outstanding shares of

the Company.

Adjusted Net Income (Loss) Adjusted net income (loss) is

net income (loss) attributable to shareholders as reported,

adjusted for certain types of transactions that in our judgment are

not indicative of our normal operating activities or do not

necessarily occur on a regular basis.

EBITDA EBITDA is net income (loss) attributable to

shareholders before net finance expense, tax expense, and depletion

and amortization.

Adjusted EBITDA Adjusted EBITDA is EBITDA before the

pre-tax effect of the adjustments made to adjusted net income

(above) as well as certain other adjustments required under the

Company’s RCF agreement in the determination of EBITDA for covenant

calculation purposes.

The adjustments made to Adjusted net income (loss) and adjusted

EBITDA allow management and readers to analyze our results more

clearly and understand the cash generating potential of the

Company.

Property Cost per Tonne Milled Property cost per tonne

milled is a key performance measure that management uses to monitor

performance. Management uses this measure to assess how well the

Company’s producing mines are performing and to monitor costs and

assess overall efficiency and effectiveness of the mining

operations.

CAUTIONARY NOTE TO UNITED STATES INVESTORS This news

release contains disclosure that has been prepared in accordance

with the requirements of Canadian securities laws, which differ

from the requirements of US securities laws. Without limiting the

foregoing, this news release may refer to technical reports that

use the terms "indicated" and "inferred" resources. US investors

are cautioned that, while such terms are recognized and required by

Canadian securities laws, the SEC does not recognize them. Under US

standards, mineralization may not be classified as a "reserve"

unless the determination has been made that the mineralization

could be economically and legally produced or extracted at the time

the reserve determination is made. US investors are cautioned not

to assume that all or any part of indicated resources will ever be

converted into reserves. US investors should also understand that

"inferred resources" have a great amount of uncertainty as to their

existence and as to whether they can be mined legally or

economically. It cannot be assumed that all or any part of

"inferred resources" will ever be upgraded to a higher category.

Therefore, US investors are also cautioned not to assume that all

or any part of inferred resources exist, or that they can be mined

legally or economically. Accordingly, information concerning

descriptions of mineralization and resources contained in this news

release may not be comparable to information made public by US

companies subject to the reporting and disclosure requirements of

the SEC.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200428006060/en/

Jerrold Annett, VP, Strategy and Capital Markets 647-273-7351

jannett@capstonemining.com

Virginia Morgan, Manager, IR and Communications 604-674-2268

vmorgan@capstonemining.com

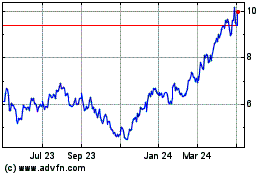

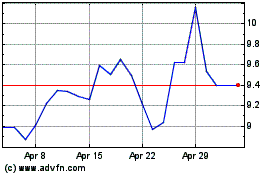

Capstone Copper (TSX:CS)

Historical Stock Chart

From Oct 2024 to Nov 2024

Capstone Copper (TSX:CS)

Historical Stock Chart

From Nov 2023 to Nov 2024