Currency Exchange International, Corp. (the “Group” or “CXI”) (TSX:

CXI; OTCBB: CURN), today reported its financial results and

Management’s Discussion and Analysis (“MD&A”) for the three and

nine-month periods ended July 31, 2024 (all figures are in U.S.

dollars except where otherwise indicated). The complete financial

statements and MD&A can be found on the Company's SEDAR profile

at www.sedarplus.ca.

Randolph Pinna, CEO of the Group, stated, “CXI

group delivered revenue growth over the prior period keeping our

balance sheet strong while managing expenses. CXI’s business is

very strong in the USA as its model is diverse with both its

wholesale and direct-to-consumer customers. CXI remains committed

to executing against our strategy of profitable growth while

maintaining adequate capital levels. The management team and I are

confident in our ability to continue to grow and become a global

leader in the supply of foreign currency and payment services.”

Financial Highlights for the

three-months ended July 31, 2024 compared to the three-months ended

July 31, 2023:

- Revenue increased

by 2% or $0.4 million to $24.0 million compared to $23.6 million.

Payments revenue grew 5% or $0.2 million over the prior period and

Banknotes revenue grew by 1% or $0.2 million;

- Net operating

income increased by 5% or $0.3 million to $6.7 million from $6.4

million;

- Net income

decreased by 3% or $0.1 million to $3.9 million from $4.0

million;

- Earnings per share

were $0.61 and $0.59 on a basic and fully diluted basis,

respectively, compared to reported earnings per share of $0.63 and

$0.60, respectively; and

- The Group had

strong liquidity and capital positions of $74.9 million in net

working capital and $83.1 million in total equity as at July 31,

2024.

Financial Highlights for the nine-months ended July 31,

2024 compared to the nine-months ended July 31, 2023:

- Revenue increased

by 5% or $3.0 million to $62.2 million compared to $59.2 million.

Banknotes revenue grew 4% or $2.0 million over the prior period and

Payments revenue grew by 9% or $1.0 million;

- Net operating

income decreased by 1% or $0.1 million to $12.8 million from $12.9

million;

- Reported net income

declined by 33% or $2.6 million to $5.3 million from $7.9 million

primarily related to the deferred tax expense recorded in the

second quarter;

- Reported earnings

per share was $0.84 on a basic basis and $0.80 on a fully diluted

basis (adjusted earnings per share1 was $1.06 and $1.02 on a basic

and a fully diluted basis, respectively) compared to reported

earnings per share of $1.23 and $1.18, respectively; and

- Cash flows from

operating activities, excluding the changes in working capital

amounted to $13.9 million compared to $13.6 million.

________________________1 This is a non-GAAP measure. For

further information, refer to the non-GAAP financial metrics and

measures section on page 3 of this document

Corporate Highlights for the three-months ended July 31,

2024:

- The Group continued

to grow its Payments product line benefiting from the recent

investments in core banking platform integration which enabled the

Company to expand its reach and increase its volumes in the United

States

- The Company

maintained its strong volumes in the Banknotes product line as a

result of the strong consumer demand for foreign currencies in the

third quarter as international travel continued to strengthen in

the United States. This is supported by the increased rate of

travelers passing through TSA check points in United States

airports;

- The financial

institutions sector in the United States continued to grow with the

addition of 98 new clients, representing 123 transacting

locations;

- The Group continued

expanding its OnlineFX platform, adding Maryland and Iowa to its

network. The platform now provides its services in 43 states and

the District of Columbia; and

- The Payments

product line processed 39,779 payments transactions, representing

$3.38 billion in volume compared to 32,675 transactions and $2.57

billion in volume in the prior period.

Selected Financial Data

The following table summarizes the performance

of the Group over the last eight fiscal quarters2:

|

Three-monthperiod ended |

Revenue |

Net operatingincome |

Net income |

Total assets |

Total equity |

Earnings pershare (diluted) |

|

|

$ |

$ |

$ |

$ |

$ |

$ |

|

7/31/2024 |

23,993,252 |

6,747,390 |

3,935,350 |

163,224,374 |

83,103,393 |

0.59 |

|

4/30/2024 |

20,095,168 |

3,818,275 |

506,522 |

159,910,390 |

79,940,478 |

0.08 |

|

1/31/2024 |

18,106,918 |

2,247,267 |

849,874 |

133,780,438 |

80,520,993 |

0.13 |

|

10/31/2023 |

22,786,072 |

5,818,667 |

2,303,822 |

132,049,444 |

79,232,981 |

0.34 |

|

7/31/2023 |

23,587,589 |

6,438,354 |

4,056,478 |

129,643,409 |

77,590,126 |

0.60 |

|

4/30/2023 |

18,694,919 |

3,743,069 |

2,243,708 |

134,697,253 |

73,104,851 |

0.33 |

|

1/31/2023 |

16,886,189 |

2,734,159 |

1,589,499 |

133,072,968 |

71,448,732 |

0.24 |

|

10/31/2022 |

19,800,463 |

5,401,678 |

4,383,876 |

125,528,832 |

69,305,509 |

0.66 |

________________________2 Certain historical numbers in this

table have been restated to conform with the numbers presented in

the current period’s financial statements

Earnings Conference Call Details

The Company plans to host a conference call on

Thursday, September 12, 2024, at 8:30 AM

EST.

To participate in or listen to the call, please

dial the appropriate number:

Toll Free - North America: (+1) 800 717

1738

Conference ID Number: 53171

About Currency Exchange International,

Corp.

Currency Exchange International is in the

business of providing comprehensive foreign exchange technology and

processing services for banks, credit unions, businesses, and

consumers in the United States and select clients globally. Primary

products and services include the exchange of foreign currencies,

wire transfer payments, Global EFTs, and foreign cheque clearing.

Wholesale customers are served through its proprietary FX software

applications delivered on its web-based interface, www.cxifx.com

(“CXIFX”), its related APIs with core banking

platforms, and through personal relationship managers. Consumers

are served through Group-owned retail branches, agent retail

branches, and its e-commerce platform, order.ceifx.com

(“OnlineFX”).

The Group’s wholly-owned Canadian subsidiary,

Exchange Bank of Canada, based in Toronto, Canada, provides foreign

exchange and international payment services in Canada and select

international foreign jurisdictions. Customers are served through

the use of its proprietary software, www.ebcfx.com

(“EBCFX”), related APIs to core banking platforms,

and personal relationship managers.

Contact Information

For further information please contact: Bill

MitoulasInvestor Relations(416) 479-9547Email:

bill.mitoulas@cxifx.comWebsite: www.cxifx.com

NON-GAAP FINANCIAL METRICS AND

MEASURES

The Company measures and evaluates its

performance in this document using a number of financial metrics

and measures, such as adjusted net income, which do not have

standardized meanings under generally accepted accounting

principles (GAAP) and may not be comparable to other companies. The

Company’s management believes that these measures are more

reflective of its operating results and provide the readers of this

document with a better understanding of management’s perspective on

the performance. These measures enhance the comparability of our

financial performance for the current period with the corresponding

period in the prior year.

CAUTIONARY STATEMENT REGARDING

FORWARD-LOOKING INFORMATION

This press release includes forward-looking

information within the meaning of applicable securities laws. This

forward-looking information includes, or may be based upon,

estimates, forecasts, and statements as to management’s

expectations with respect to, among other things, demand and market

outlook for wholesale and retail foreign currency exchange products

and services, future growth, the timing and scale of future

business plans, results of operations, performance, and business

prospects and opportunities. Forward-looking statements are

identified by the use of terms and phrases such as “anticipate”,

“believe”, “could”, “estimate”, “expect”, “intend”, “may”, “plan”,

“predict”, “preliminary”, “project”, “will”, “would”, and similar

terms and phrases, including references to assumptions.

Forward-looking information is based on the

opinions and estimates of management at the date such information

is provided, and on information available to management at such

time. Forward-looking information involves significant risks,

uncertainties and assumptions that could cause the Company’s actual

results, performance, or achievements to differ materially from the

results discussed or implied in such forward-looking information.

Actual results may differ materially from results indicated in

forward-looking information due to a number of factors including,

without limitation, the competitive nature of the foreign exchange

industry, the impact of COVID-19 or the evolving situation in

Ukraine on factors relevant to the Company’s business, currency

exchange risks, the need for the Company to manage its planned

growth, the effects of product development and the need for

continued technological change, protection of the Company’s

proprietary rights, the effect of government regulation and

compliance on the Company and the industry in which it operates,

network security risks, the ability of the Company to maintain

properly working systems, theft and risk of physical harm to

personnel, reliance on key management personnel, global economic

deterioration negatively impacting tourism, volatile securities

markets impacting security pricing in a manner unrelated to

operating performance and impeding access to capital or increasing

the cost of capital as well as the factors identified throughout

this press release and in the section entitled “Risks and

Uncertainties” of the Company’s Management’s Discussion and

Analysis for the three and nine-month periods ended July 31, 2024

and 2023. Forward-looking information contained in this press

release represents management’s expectations as of the date hereof

(or as of the date such information is otherwise stated to be

presented) and is subject to change after such date. The Company

disclaims any intention or obligation to update or revise any

forward-looking information whether as a result of new information,

future events or otherwise, except as required under applicable

securities laws.

The Toronto Stock Exchange does not accept

responsibility for the adequacy or accuracy of this press release.

No stock exchange, securities commission or other regulatory

authority has approved or disapproved the information contained in

this press release.

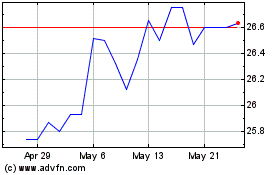

Currency Exchange (TSX:CXI)

Historical Stock Chart

From Nov 2024 to Dec 2024

Currency Exchange (TSX:CXI)

Historical Stock Chart

From Dec 2023 to Dec 2024