Kolibri Global Energy Inc. (the “Company” or

“KEI”) (TSX: KEI, OTCQX: KGEIF) is pleased to provide an

operations update for its Tishomingo field in Oklahoma.

Initial Flow Rates

The Barnes 7-4H and 7-5H wells, which were drilled and completed

in the Lower Caney Formation are still flowing back fracture

stimulation fluid. Over the last seven days the Barnes 7-4H well

has averaged 686 Barrels of oil equivalent per day (“BOEPD”) (534

barrels of oil per day (“BOPD”)) and the Barnes 7-5H well has

averaged 624 BOEPD (472 BOPD). These two wells are producing at

higher rates than the Barnes 8-1H and 8-2H Caney wells did at this

stage. These wells are the second group of down-spaced wells in the

Caney and were drilled at a 6-well per section spacing pattern,

just like the Caney Barnes 8-1H and 8-2H wells.

Drilling and Completion Operations

The Company has finished drilling the Emery 17-3H and 17-4H

wells and is currently drilling the Emery 17-5H. The Emery 17-3H

and 17-5H are Lower Caney formation wells, while the Emery 17-4H is

a T-Zone well. Completion operations for all three wells are

expected to begin in the first week of November.

Wolf Regener, President and CEO commented, “We are excited that

the two new Lower Caney Barnes 7-4H and Barnes 7-5H wells are

performing so well, and we are looking forward to bringing on the

Emery 17-3H, 17-4H, and 17-5H wells to increase our production

further and to demonstrate the repeatability of production from the

T-zone. If achieved, another economic T-zone well will hopefully

lead to increased reserves in our year end reserve report.

"We anticipate spudding the next set of wells sometime in

December for production in early 2024.”

Field Update

The gathering system issues (reported in the Company’s press

release dated September 6, 2023) have been mainly resolved. The

Company has requested some additional optimization of the gathering

system as it is still having a minor impact on the Company’s

production.

Guidance Update

The Company is updating its annual forecasted guidance as

follows:

Revised 2023

Forecast

% Increase from

Fiscal Year 2022

Exit rate production

5,000 to 6,000 boepd

25% to 50%

Average production

3,100 to 3,400 boepd

89% to 107%

Revenue(1)

US$57 million to US$62

million

52% to 65%

Adjusted EBITDA(2)

US$45 million to US$50

million

79% to 99%

(1)

Assumptions include on forecasted pricing

from September 2023 through December 2023 of WTI US $80/bbl, $3

Henry Hub and NGL pricing of $32/boe and includes the impact of the

Company’s existing hedges.

(2)

Adjusted EBITDA is considered a non-GAAP

measure. Refer to the section entitled “Non-GAAP Measures” of this

news release

The increased exit rate forecast is due to the additional eighth

well that wasn’t included in the Company’s original forecast, in

addition to some of the wells starting production later than

originally planned.

The average production, revenue and Adjusted EBITDA guidance

shows significant growth from 2022 even though this guidance has

been revised lower from the Company’s initial guidance due to a few

factors. The main factor is timing, as new wells started producing

later than originally forecasted. Since we added an additional well

to our original planned drilling program the timing of the

production from the Emery 3 well pad was pushed back. In addition,

the field gathering system issues discussed above impacted

production, and the upper Caney well that the Company tested came

in below the Company’s expected production range.

The Company expects annual capital expenditures to be in the

range of US$51 million to US$56 million and net debt to be US$24

million to US$26 million. This guidance is being revised higher due

to the extra well the Company added to the original drilling

program and because the Company is planning to start the drilling

of a ninth well at the end of the year that will be part of a new 3

well pad that we expect to start producing in early 2024. The

Company continues to anticipate that its Debt to Adjusted EBITDA

ratio will be less than 1 times at the end of 2023.

NASDAQ TRADING

The Company is still expecting to begin trading on the Nasdaq

Stock Market on Wednesday, October 11th, 2023 under the symbol

“KGEI”. The Company will be dual listed as its shares will also

continue to be listed on the TSX under the symbol of “KEI”.

NON-GAAP MEASURES

Adjusted EBITDA is not a measure recognized under Canadian

generally accepted accounting principles ("GAAP") and does

not have any standardized meaning prescribed by IFRS. Management of

the Company believes that Adjusted EBITDA is relevant for

evaluating returns on the Company's project as well as the

performance of the enterprise as a whole. Adjusted EBITDA may

differ from similar computations as reported by other similar

organizations and, accordingly, may not be comparable to similar

non-GAAP measures as reported by such organizations. Adjusted

EBITDA should not be construed as an alternative to net income,

cash flows related to operating activities, working capital or

other financial measures determined in accordance with IFRS, as an

indicator of the Company's performance.

An explanation of how Adjusted EBITDA provides useful

information to an investor and the purposes for which the Company’s

management uses Adjusted EBITDA is set out in the management's

discussion and analysis under the heading “Non-GAAP Measures” which

is available under the Company's profile at www.sedar.com and is

incorporated by reference into this news release.

Adjusted EBITDA is calculated as net income before interest,

taxes, depletion and depreciation and other non-cash and

non-operating gains and losses. The Company considers this a key

measure as it demonstrates its ability to generate cash from

operations necessary for future growth excluding non-cash items,

gains and losses that are not part of the normal operations of the

Company and financing costs. The following is the reconciliation of

the non-GAAP measure Adjusted EBITDA:

(US $000)

Three months ended

June 30,

Six months ended

June 30,

2023

2022

2023

2022

Net income

4,268

7,007

12,164

4,551

Depletion and depreciation

3,375

2,087

7,713

3,226

Accretion

44

6

89

12

Interest expense

375

212

860

437

Unrealized (gain) loss on commodity

contracts

(777

)

(746

)

(2,167

)

3,040

Share based compensation

356

32

374

157

Interest income

-

(1

)

-

(3

)

Other income

-

(28

)

(1

)

(29

)

Foreign currency loss (gain)

5

3

10

(7

)

Adjusted EBITDA

7,646

8,572

19,042

11,384

About Kolibri Global Energy Inc.

Kolibri Global Energy Inc. is a North American energy company

focused on finding and exploiting energy projects in oil, gas, and

clean and sustainable energy. Through various subsidiaries, the

Company owns and operates energy properties in the United States.

The Company continues to utilize its technical and operational

expertise to identify and acquire additional projects. The

Company's shares are traded on the Toronto Stock Exchange under the

stock symbol KEI and on the OTCQX under the stock symbol KGEIF.

Cautionary Statements

In this news release and the Company’s other public disclosure:

The references to barrels of oil equivalent ("Boes") reflect

natural gas, natural gas liquids and oil. Boes may be misleading,

particularly if used in isolation. A Boe conversion ratio of 6

Mcf:1 Bbl is based on an energy equivalency conversion method

primarily applicable at the burner tip and does not represent a

value equivalency at the wellhead. Given that the value ratio based

on the current price of crude oil as compared to natural gas is

significantly different from the energy equivalency of 6:1,

utilizing a conversion on a 6:1 basis may be misleading as an

indication of value. Possible reserves are those additional

reserves that are less certain to be recovered than probable

reserves. There is a 10% probability that the quantities actually

recovered will equal or exceed the sum of proved plus probable plus

possible reserves.

Readers should be aware that references to initial production

rates and other short-term production rates are preliminary in

nature and are not necessarily indicative of long-term performance

or of ultimate recovery. Readers are referred to the full

description of the results of the Company's December 31, 2022

independent reserves evaluation and other oil and gas information

contained in its Form 51-101F1 Statement of Reserves Data and Other

Oil and Gas Information for the year ended December 31, 2022, which

the Company filed on SEDAR on March 13, 2023.

Caution Regarding Forward-Looking Information

Certain statements contained in this news release constitute

"forward-looking information" as such term is used in applicable

Canadian securities laws and “forward-looking statements” within

the meaning of United States securities laws (collectively,

“forward looking information”), including statements regarding the

timing of and expected results from planned wells development,

including the drilling of a ninth well and the timing thereof,

projected exit rate and average production, revenue and Adjusted

EBITDA for 2023 and projected total capital expenditures, net debt

and debt to Adjusted EBITDA ratio for 2023 and the listing of the

Company’s common shares on NASDAQ. Forward-looking information is

based on plans and estimates of management and interpretations of

data by the Company's technical team at the date the data is

provided and is subject to several factors and assumptions of

management, including forecasted pricing from September 2023

through December 2023 of WTI US $80/bbl, $3 Henry Hub and NGL

pricing of $32/boe, that the Company’s shares will begin trading on

NASDAQ when expected, that indications of early results are

reasonably accurate predictors of the prospectiveness of the shale

intervals, that required regulatory approvals will be available

when required, that no unforeseen delays, unexpected geological or

other effects, including flooding and extended interruptions due to

inclement or hazardous weather conditions, equipment failures,

permitting delays or labor or contract disputes are encountered,

that the necessary labor and equipment will be obtained, that the

development plans of the Company and its co-venturers will not

change, that the offset operator’s operations will proceed as

expected by management, that the demand for oil and gas will be

sustained, that the price of oil will be sustained or increase,

that the gathering system issues will be resolved, that the Company

will continue to be able to access sufficient capital through cash

flow, debt, financings, farm-ins or other participation

arrangements to maintain its projects, and that global economic

conditions will not deteriorate in a manner that has an adverse

impact on the Company's business, its ability to advance its

business strategy and the industry as a whole. Forward-looking

information is subject to a variety of risks and uncertainties and

other factors that could cause plans, estimates and actual results

to vary materially from those projected in such forward-looking

information. Factors that could cause the forward-looking

information in this news release to change or to be inaccurate

include, but are not limited to, the risk that any of the

assumptions on which such forward looking information is based vary

or prove to be invalid, including that the Company or its

subsidiaries is not able for any reason to obtain and provide the

information necessary to secure required approvals or that required

regulatory approvals are otherwise not available when required,

that unexpected geological results are encountered, that equipment

failures, permitting delays, labor or contract disputes or

shortages of equipment, labor or materials are encountered, the

risks associated with the oil and gas industry (e.g. operational

risks in development, exploration and production; delays or changes

in plans with respect to exploration and development projects or

capital expenditures; the uncertainty of reserve and resource

estimates and projections relating to production, costs and

expenses, and health, safety and environmental risks, including

flooding and extended interruptions due to inclement or hazardous

weather conditions), the risk of commodity price and foreign

exchange rate fluctuations, that the offset operator’s operations

have unexpected adverse effects on the Company’s operations, that

completion techniques require further optimization, that production

rates do not match the Company’s assumptions, that very low or no

production rates are achieved, that the gathering system operator

doesn’t get the issues resolved, that the price of oil will

decline, that the Company is unable to access required capital,

that occurrences such as those that are assumed will not occur, do

in fact occur, and those conditions that are assumed will continue

or improve, do not continue or improve, and the other risks and

uncertainties applicable to exploration and development activities

and the Company's business as set forth in the Company's management

discussion and analysis and its annual information form, both of

which are available for viewing under the Company's profile at

www.sedar.com, any of which could result in delays, cessation in

planned work or loss of one or more leases and have an adverse

effect on the Company and its financial condition. The Company

undertakes no obligation to update these forward-looking

statements, other than as required by applicable law.

Caution Regarding Future-Oriented Financial Information and

Financial Outlook

This news release may contain information deemed to be

“future-oriented financial information” or a “financial outlook”

(collectively, “FOFI”) within the meaning of applicable securities

laws. The FOFI has been prepared by management to provide an

outlook of the Company’s activities and results and may not be

appropriate for other purposes. The FOFI has been prepared based on

a number of assumptions including the assumptions discussed above

under “Caution Regarding Forward-Looking Information”. The actual

results of operations of the Company and the resulting financial

results may vary from the amounts set forth herein, and such

variations may be material. The Company and management believe that

the FOFI has been prepared on a reasonable basis, reflecting

management’s best estimates and judgments. FOFI contained in this

news release was made as of the date of this news release and the

Company disclaims any intention or obligations to update or revise

any FOFI contained in this news release, whether as a result of new

information, future events or otherwise, unless required pursuant

to applicable law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231010569863/en/

Wolf E. Regener +1 (805) 484-3613 Email:

wregener@kolibrienergy.com Website: www.kolibrienergy.com

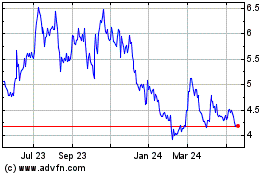

Kolibri Global Energy (TSX:KEI)

Historical Stock Chart

From Mar 2024 to Apr 2024

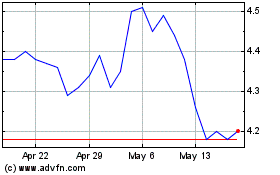

Kolibri Global Energy (TSX:KEI)

Historical Stock Chart

From Apr 2023 to Apr 2024