Melcor to purchase up to $15 million worth of Melcor REIT Class B LP Units

11 October 2019 - 10:19AM

Melcor Developments Ltd. (TSX: MRD) today announced that it intends

to complete a private placement of between $10 million and $15

million worth of Melcor REIT Limited Partnership (the

“Partnership”) Class B LP units. The Partnership is a subsidiary of

Real Estate Investment Trust (TSX: MR.UN – “the REIT”).

The private placement agreement was reached in conjunction with

the $54.8 million third-party acquisition of a 283,000 square foot

retail power centre in Grande Prairie, Alberta that the REIT

announced today and a $40 million convertible debenture “bought

deal” offering undertaken by the REIT (the “Offering”).

Darin Rayburn, President and Chief Executive Officer of both

Melcor and the REIT commented: “The REIT’s acquisition increases

our portfolio gross leasable area by 9.7% and is expected to be

immediately accretive to Unitholders, demonstrating the REIT’s

strong accretive growth potential. The private placement, to be

completed by Melcor, demonstrates Melcor’s ongoing support of the

REIT in achieving its growth objectives, and Melcor’s recognition

that the intrinsic value of the REIT far exceeds recent trading

ranges.”

The aggregate subscription for the private placement will be

equal to the greater of: (i) $15 million less the REIT’s gross

proceeds from the exercise of the over-allotment option granted in

connection with the Offering (if any); and (ii) $10 million.

The private placement is conditional upon the successful completion

of the acquisition. Each Class B LP unit will be issued at a 1.5%

premium to the market price of the REIT’s units based on the 5 day

volume weighted average immediately prior to close of the

acquisition.

Melcor currently holds an approximate 53.1% effective interest

in the REIT through ownership of all of the Class B LP Units of the

Partnership. Each Class B LP Unit is exchangeable at the option of

the holder for one Unit and has attached a Special Voting Unit,

providing for voting rights in the REIT. As a result of the

foregoing relationship, the private placement constitutes a

“related party transaction” under MI 61-101. MI 61-101 provides a

number of circumstances in which a transaction between an issuer

and a related party may be subject to valuation and minority

approval requirements. However, an exemption from such

requirements is available under MI 61-101 where the fair market

value of the transaction does not exceed 25% of the market

capitalization of the issuer. Given that the gross proceeds to the

REIT from the private placement will not exceed $15.0 million, the

private placement will not be subject to the valuation and minority

approval requirements of MI 61-101.

About Melcor Developments Ltd.

Melcor is a diversified real estate development and asset

management company that transforms real estate from raw land

through to high-quality finished product in both residential and

commercial built form. Melcor develops and manages mixed-use

residential communities, business and industrial parks, office

buildings, retail commercial centres and golf courses. Melcor owns

a well-diversified portfolio of assets in Alberta, Saskatchewan,

British Columbia, Arizona and Colorado.

Melcor has been focused on real estate since 1923. The company

has built over 140 communities across western Canada and today

manages over 4 million sf in commercial real estate assets and over

600 residential rental units. Melcor is committed to building

communities that enrich quality of life - communities where people

live, work, shop and play.

Melcor’s headquarters are located in Edmonton,

Alberta, with regional offices throughout Alberta and in British

Columbia and Phoenix, Arizona. Melcor has been a public company

since 1968 and trades on the Toronto Stock Exchange (TSX:MRD).

www.melcor.ca

Contact Information:

Media & Investor RelationsNicole

Forsythe780.945.4707ir@melcor.ca

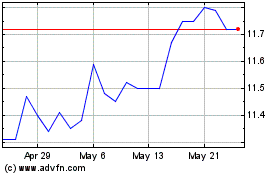

Melcor Developments (TSX:MRD)

Historical Stock Chart

From Nov 2024 to Dec 2024

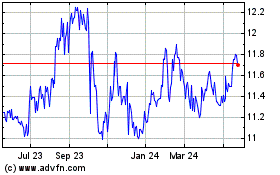

Melcor Developments (TSX:MRD)

Historical Stock Chart

From Dec 2023 to Dec 2024