Aura Minerals Inc. (TSX

: ORA) (B3: AURA33)

(OTCQX: ORAAF) (“

Aura” or the

“

Company”) is pleased to announce updated Mineral

Resources and Mineral Reserves for the Apoena Mines

(

“Apoena” or the

“Project”)

located in Mato Grosso, Brazil, incorporating exploration and

infill drilling completed during 2022 and 2023. Apoena (formerly

known as EPP) consists of three active open pit mines (Ernesto,

Lavrinha and Nosde), two past producing mines (Japones open pit and

Pau-a-Pique underground mine) and several exploration targets

(Figure 1). The current estimate brings material updates for the

Nosde and Lavrinha mines. The technical report (the

“

Technical Report”) titled “Apoena Mines Mineral

Resource and Reserve”, prepared by Aura will be filed on SEDAR+ and

CVM within 45 days of this press release.

Highlights

- Largest increase

in Proven & Probable Mineral Reserves (“P&P” or

“2P”) in its operating history since 2017, supporting more

than 5 years of Life of Mine (“LOM”) based on 2P

Reserves only.

- P&P at

Apoena increased to 276,000 ounces (“oz”) of

contained gold at the end of 2023, after depletion from

production.

- Measured and

Indicated (“M&I”) Mineral Resources also

continue to increase, now at 478,000 oz of contained gold after

2023 depletion.

- Future

exploration efforts will now focus on increasing Inferred Mineral

Resources down dip and along strike, including expansion drilling

to delineate possible connections between the pits.

- Additionally,

multiple targets remain surrounding the entire complex, and

regionally.

Rodrigo Barbosa, President and CEO of Aura,

commented, “Increasing Apoena’s Life of Mine has been an important

initiative for Aura given its high potential and limited

exploration history. We initiated the ramp-up of Apoena in 2016

with about 233,000 Oz in P&P Reserves. We have since operated

for 7 years and produced over 420,000 Oz of recovered gold, and

only recently dedicated a significant portion of our drilling

budget to its expansion. We have now successfully increased our

P&P Reserves again, to over 276,000 Ozs, increasing its life to

more than 5 years and demonstrating that increased drilling can add

ounces quickly. In addition to our infill and expansion program, we

continued to advance several targets both within the complex, and

regionally across the prolific Guapore gold belt, with our projects

spanning across 200 km of strike. Our focus for the remainder

of 2024 will shift to adding Inferred ounces to the overall

inventory, as indicated by the targets currently being defined, to

subsequently keep increasing P&P Mineral Reserves."

Figure 1: Apoena open pit mines and near

mine exploration targets

2023 Summary of Changes in Proven &

Probable Mineral Reserves, Measured and Indicated Mineral Resources

and Inferred Mineral Resources are shown in Figure 2.

Figure 2. Changes in Mineral Resources

and Mineral Reserves compared to the end of 2022 in terms of tonnes

and contained ounces in Apoena mines

Nosde and Lavrinha Mines Mineral

Resource and Reserve Estimates

Exploration and drilling at Apoena continued to

deliver significant growth and extension of LOM. The recent

drilling campaigns incorporate approximately 53,315 meters of both

expansion and infill drilling between 2022 and 2023, focused

primarily on the Lavrinha and Nosde mines (see Figure 3).

Gold mineralization in Apoena mines and

surrounding areas occurs in four zones, which consists of the Lower

Trap (Ernesto mine), Middle Trap (Ernesto mine and Ernesto

connection deposit), Upper Trap (Lavrinha and Nosde mines) and

Bonus Trap (Nosde mine).

The Upper Trap is widely developed in the

Lavrinha and Nosde deposits and occurs in metapelitic rocks

(hematite sericite schist) in dilation zones of the intensely

deformed synclinal troughs. The Upper and Middle Traps share

similar alteration and mineralization suites between the two

deposits, though the Upper Trap seems to be eroded in the Ernesto

deposit area.

Aura’s recent exploration successfully confirmed

the connection of the Upper Trap zone between the Nosde and

Lavrinha mines and added additional resources to the Mineral

Resources inventory at Apoena. At the Nosde mine, infill drilling

successfully converted Mineral Resources, and tested the continuity

of mineralized bodies at 300 and 450 meters (Middle and Lower

Traps, respectively), confirming an average depth of 380 meters.

The exploratory holes in the connection region between the Nosde

and Lavrinha pits provided better understanding of local

mineralization. Infill drilling at Lavrinha successfully converted

Mineral Resources in the central area and NE ends of the pit and

exploratory drilling tested and successfully confirmed the extent

of the mineralized bodies at depth and between the Lavrinha and

Nosde deposits.

Figure 3: Summary of Aura’s Exploration

Drilling in Nosde and Lavrinha

The geological layout of the Nosde and Lavrinha

deposits is subdivided into 7 lithological domains from which two

of them are mineralized. The mineralized domains are Metarenites

(MAR) of Bonus and Upper Traps and schists of Upper Trap.

Within these two lithological domains, four

mineralized models were constructed using 0.35 g/t Au (for Upper

Trap domains) and 0.2 g/t Au (for Bonus Trap domain) gold grades as

well as alteration and mineralogical constraints which were logged

during several diamond drilling campaigns.

Raw assay drilling data was composted to 2.0 m

lengths with upper capping applied after compositing at 10.0 g/t Au

for metarenites domains and 13.0 g/t Au for schist domain. Ordinary

Kriging method was used to interpolate the grade.

Mineral Resources are classified in accordance

with NI 43-101 and CIM definitions into Indicated and Inferred

categories based on identified uncertainly and risks.

Mineral Reserves amenable to open pit mining

methods were estimated through an open pit optimization exercise

using the Measured and Indicated Mineral Resources in the block

model provided by Aura. Mineral Reserves were reported within

detailed engineered pit designs and life-of-mine (LOM) plans based

on this pit shell.

Figure 4 shows a longitudinal cross-section

showing the changes in the Mineral Reserve compared to the previous

year. The majority of mineralized schist in Nosde and Lavrinha

became amenable for open pit mining while mineralization in Lower

Trap (Below Resource and Reserve pits) is also now more feasible to

consider for additional inferred Mineral Resources at depth.

Figure 4: Nosde and Lavrinha Mines Cross

Section showing the Changes in Mineral Reserve Pit Outlines 2022

vs. 2023 (Looking SW)

The Mineral Resources of the Nosde and Lavrinha

Mines as of October 31, 2023, are as follows:

|

Mineral Resource Estimate for Nosde and Lavrinha

Mines |

|

Effective October 31, 2023 |

|

Mines |

Category |

Tonnage (t) |

Grade |

Contained Au (oz) |

|

Au (g/t) |

|

Nosde |

Measured |

2,322,823 |

0.75 |

56.062 |

|

Indicated |

6,780,515 |

1.04 |

226.133 |

|

M&I |

9,103,338 |

0.96 |

282.195 |

|

Inferred |

194.516 |

1.33 |

8.305 |

|

Lavrinha |

Measured |

231.684 |

0.89 |

6.661 |

|

Indicated |

857.797 |

1.10 |

30.25 |

|

M&I |

1,089,482 |

1.05 |

36.911 |

|

Inferred |

213.39 |

1.37 |

9.382 |

|

Nosde & Lavrinha |

Total (M&I) |

10,192,820 |

0.97 |

319.106 |

|

Total (Inferred) |

407.907 |

1.35 |

17.7 |

Mineral Resource Notes and

Assumptions(1) The mineral resource estimate has an

effective date of October 31, 2023. (2) Mineral resources do not

have demonstrated economic viability. (3) The mineral resources in

this estimate were calculated with the Canadian Institute of

Mining, Metallurgy and Petroleum (“CIM”), CIM Standards on Mineral

Resources and Reserves, Definitions and Guidelines prepared by the

CIM Standing Committee on Reserve Definitions. (4) The base case

cut-off grade for the estimate of mineral resources is 0.39 g/t Au

(5) The Measured, indicated and inferred mineral resources are

contained within a limiting pit shell (using 1900 $ /oz. gold

price) and comprise a coherent body. (6) A density model based on

alteration and rock type was established for volume to tonnes

conversion averaging 2.74 tonnes /m3.(7) Contained metal figures

may not add due to rounding.(8) Surface Topography as of October

31, 2023.(9) The Mineral Resource estimate for the Nosde and

Lavrinha deposit was prepared under supervision of Farshid

Ghazanfari, P.Geo., Aura;s Geology and Mineral Resources director,

a Qualified Person as that term is defined in NI 43-101.

The Mineral Reserves of the Nosde and Lavrinha

Mines as of October 31, 2023, are as follows:

|

Mineral Reserve Estimate for Nosde and Lavrinha

Mines |

|

Effective October 31, 2023 |

|

Mines |

Category |

Tonnage (t) |

Grade |

Contained Au (oz) |

|

Au (g/t) |

|

Nosde |

Proven |

1,793,007 |

0.74 |

42.738 |

|

Probable |

5,362,391 |

0.97 |

168.089 |

|

P&P |

7,155,399 |

0.92 |

210.828 |

|

Lavrinha |

Proven |

216.395 |

0.78 |

5.447 |

|

Probable |

188.618 |

0.87 |

5.412 |

|

P&P |

405.013 |

0.83 |

10.859 |

|

Nosde & Lavrinha |

Total (2P) |

7,560,412 |

0.91 |

221.687 |

Mineral Reserve Notes and

Assumptions(1) CIM (2014) definitions were followed for

Mineral Reserves. (2) Mineral Reserves have an effective date of

October 31,2023. (3) Mineral Reserves was prepared under the

supervision of Luiz Pignatari, P.Eng. as an independent Qualified

Person, competent to sign as defined by NI 43-101.(4) The base case

cut-off grade for the estimate of mineral resources is 0.45 g/t

Au(5) Mineral Reserves are confined within an optimized pit shell

that uses the following parameters: gold price 1800 US$, exchange

rate of 5.1 : US$ 1, total process cost: US$ 11.8/t ; mining costs:

US$ 2.26/t, general and administrative costs: US$ 3.79/t;

sustaining costs: US$ 0.39/t processed; metallurgical recovery of

93.5%; mining recovery 95% for metarenite and 98% for schist,

mining dilution of 10%; overall slope angle 38°. (6) Tonnages and

grades have been rounded in accordance with reporting guidelines.

Totals may not sum due to rounding. (7) Surface Topography as of

October 31, 2023.

The Combined Mineral Resources of the Apoena

Mines as of December 31, 2023, are as follows:

|

Apoena Resources 2023 |

|

Measured |

Tonnes (t) |

Au (g/t) |

Contained Au oz |

|

Lavrinha |

231.684 |

0.89 |

6.661 |

|

Ernesto |

0 |

0.00 |

0 |

|

Ernesto-Lavrinha Connection |

0 |

0.00 |

0 |

|

Pau-A-Pique |

242.18 |

3.19 |

24.85 |

|

Japonês |

0 |

0.00 |

0 |

|

Nosde |

2,322,823 |

0.75 |

56.062 |

|

Total Measured |

2,796,687 |

0.97 |

87.573 |

|

Indicated |

Tonnes (t) |

Au (g/t) |

Contained Au oz |

|

Lavrinha |

857.797 |

1.10 |

30.25 |

|

Ernesto |

427.1 |

2.11 |

24.72 |

|

Ernesto-Lavrinha Connection |

1,232,480 |

1.18 |

46.84 |

|

Pau-A-Pique |

601.66 |

2.71 |

52.45 |

|

Japonês |

215.325 |

1.40 |

9.69 |

|

Nosde |

6,780,515 |

1.04 |

226.133 |

|

Total Indicated |

10,114,878 |

1.20 |

390.083 |

|

Total Measured & Indicated |

12,911,565 |

1.15 |

477.656 |

|

Inferred |

Tonnes (t) |

Au (g/t) |

Contained Au oz |

|

Lavrinha |

213.39 |

1.37 |

9.382 |

|

Ernesto |

542 |

1.94 |

33.76 |

|

Ernesto-Lavrinha Connection |

99.037 |

0.87 |

2,770 |

|

Pau-A-Pique |

71.33 |

2.47 |

5.66 |

|

Japonês |

4.37 |

1.37 |

190 |

|

Nosde |

194.516 |

1.33 |

8.305 |

|

Total Inferred |

1,124,643 |

1.58 |

57.107 |

*Notes(1) Mineral Resources are

reported based on the Annual Information Form for the year ended

DeI agreecember 31, 2022, dated as of March of 2023 except for

Nosde, Lavrinha, and Ernesto mines,(2) Mineral Resources for

Ernesto mines are reported minus 2023 depletion,(3) Surface

Topography Surface Topography as of October 31, 2023, for Nosde and

Lavrinha and as of December 31, 2023, for rest of the mines,(4) The

Mineral Resources estimate was prepared under the supervision of

Farshid Ghazanfari, P.Geo., a Qualified Person as that term is

defined in NI 43-101.

The Combined Mineral Reserves of the Apoena

Mines as of December 31, 2023, are as follows:

|

Apoena Mines Mineral Reserves 2023 |

|

Proven |

Tonnes (t) |

Au (g/t) |

Contained Au oz |

|

Lavrinha |

216.395 |

0.78 |

5.447 |

|

Ernesto |

- |

- |

- |

|

Ernesto-Lavrinha Connection |

- |

- |

- |

|

Japonês |

- |

- |

- |

|

Nosde |

1,793,007 |

0.74 |

42.738 |

|

Total Proven |

2,009,402 |

0.75 |

48.185 |

|

Probable |

Tonnes (t) |

Au (g/t) |

Contained Au oz |

|

Lavrinha |

188.618 |

0.87 |

5.412 |

|

Ernesto |

379.26 |

1.79 |

21.84 |

|

Ernesto-Lavrinha Connection |

801.15 |

0.95 |

24.5 |

|

Japonês |

245.23 |

1.04 |

8.2 |

|

Nosde |

5,362,391 |

0.97 |

168.089 |

|

Total Probable |

6,976,649 |

1.02 |

228.041 |

|

Total Proven + Probable |

8,986,051 |

0.96 |

276.226 |

*Notes(1) Mineral Reserves are

reported based on the Annual Information Form for the year ended

December 31, 2022, dated as of March of 2023 except for Nosde,

Lavrinha, and Ernesto mines,(2) Mineral Reserves for Ernesto mines

are reported minus 2023 depletion,(3) Surface Topography Surface

Topography as of October 31, 2023, for Nosde and Lavrinha and as of

December 31, 2023, for the rest of the mines,(4) The Mineral

Reserves estimate for Nosde and Labrinha mines was prepared under

the supervision of Luiz Pignatari, P.Eng., a Qualified Person as

that term is defined in NI 43-101.(5) The Mineral Reserve estimate

for Ernesto mine was prepared under the supervision of Farshid

Ghazanfari, P.Geo., a Qualified Person as that term is defined in

NI 43-101.

Exploration Potential

The Apoena mines are situated in the Middle

Proterozoic Aguapeí belt, along the southwestern margin of the

Amazon Craton, in the Sunsás-Aguapeí Province. The Guaporé gold

belt exhibits a potential stretch of approximately 200 km in a

NW-SE trend with an average width of 15 km. The region boasts a

history of four major mines that are currently operational or have

been in operation previously, in addition to identified targets

such as artisanal occurrences (Figure 5).

Figure 5: Location of Guapore Gold belt

and Apoena gold Mines, Mato Grosso, Brazil

Exploration and drilling are underway for near

mine targets (proximal to the Ernesto Complex), such as the

Cantina, Japones West, and Pombinhas targets (Figures 1). These

targets show promising potential through indications of historical

artisanal pits, grab samples, and some historical drill holes. Aura

expects that with additional drilling, particularly the in Japones

West and Pombinhas targets, the Company can potentially establish

Inferred Mineral Resources in 2024.

Mapping, trenching, channel sampling, and

drilling activities of regional targets (south and north of the

complex) are underway to advance additional promising targets.

Southern targets like BP and GP3, along with the Guaporé-Sararé

target to the north, will be prioritized based on the latest

results (Figure 4).

Data Verification and QAQC

Measures

Aura performed data verification and validation

procedures on the drilling database prior to modeling and

estimation. QP of Geology and Mineral Resources (Farshid

Ghazanfari, P.Geo) reviewed the geological, drilling, and Au

analytical data which was used to support Mineral Resources and

confirmed that underlying data are suitable for Mineral Resource

Estimation. It is the QP’s opinion that the raw drilling data used

for estimating Mineral Resources have been adequately reviewed and

any identified potential risks are accounted for in resource

classified, in-line with CIM guidelines.

The QP has conducted numerous visits and

inspections to the local analytical laboratories which provided

some of the analytical data supporting Mineral Resources. The

independent accredited laboratories used are considered reputable

and suitable for the analyses performed. QP did not visit the SGS

lab in Belo Horizonte, Brazil where majority of exploration samples

were analyzed. The Qualified Person did not verify drill hole

collar locations in the field but relied on work of survey

contractors and Apoena technical team. Collar locations were

checked against LiDAR topography and satellite imagery and deemed

acceptable. No independent samples were collected nor analyzed for

verification purposes by the Qualified Person.

Analytical work was carried out by SGS Geosol

Lab (“SGS”), in Belo Horizonte, Brazil. Drill core samples were

shipped to SGS’s Lab. All samples were analyzed for gold values

determined by fire assay method with atomic absorption spectrometry

finish on 50g aliquots. SGS has routine quality control procedures

which are independent from the Company’s.

The Company has established a standard QA/QC

procedure for the drilling programs in Apoena mines and all

exploration targets as below: Each batch of samples sent to the lab

is composed of approximately 40 core samples and four QA/QC samples

(two blanks and two standards). The number of control standards

should reflect the size of the analytical batch used by the

laboratory. These QA/QC samples are randomly spaced into each

batch. The bags labeled with these numbers are filled with 50 grams

of one of the control standards and the sample tag is inserted in

the bag. Records of which control standard was put in each bag in

the sample log or sample cards are kept.

Qualified Person

The scientific and technical information

contained in this press release has been reviewed and approved by

Farshid Ghazanfari, P.Geo., Geology and Mineral Resources Director,

an employee of Aura and by Luiz Eduardo Pignatari, Professional

Engineer, EDEM Mining Consultants (Engenharia de Minas ME), both

are a “qualified person” within the meaning of NI 43-101.

About Aura 360° Mining Aura is

focused on mining in complete terms – thinking holistically about

how its business impacts and benefits every one of our

stakeholders: our company, our shareholders, our employees, and the

countries and communities we serve. We call this 360° Mining.

Aura is a mid-tier gold and copper production

company focused on operating and developing gold and base metal

projects in the Americas. The Company has 4 operating mines

including the Aranzazu copper-gold-silver mine in Mexico, the EPP

and Almas gold mines in Brazil, and the San Andres gold mine in

Honduras. The Company’s development projects include Borborema and

Matupá both in Brazil. Aura has unmatched exploration potential

owning over 650,000 hectares of mineral rights and is currently

advancing multiple near-mine and regional targets along with the

Serra da Estrela copper project in the prolific Carajás region of

Brazil.

Caution Regarding Mineral Resource and

Mineral Reserve Estimates

The figures for mineral resources and reserves

contained herein are estimates only and no assurance can be given

that the anticipated tonnages and grades will be achieved, that the

indicated level of recovery will be realized or that the mineral

resources and reserves could be mined or processed profitably.

Actual reserves, if any, may not conform to geological,

metallurgical or other expectations, and the volume and grade of

ore recovered may be below the estimated levels. There are numerous

uncertainties inherent in estimating mineral resources and

reserves, including many factors beyond the Company’s control. Such

estimation is a subjective process, and the accuracy of any reserve

or resource estimate is a function of the quantity and quality of

available data and of the assumptions made and judgments used in

engineering and geological interpretation. Short-term operating

factors relating to the mineral resources and reserves, such as the

need for orderly development of the ore bodies or the processing of

new or different ore grades, may cause the mining operation to be

unprofitable in any particular accounting period. In addition,

there can be no assurance that metal recoveries in small scale

laboratory tests will be duplicated in larger scale tests under

on-site conditions or during production. Lower market prices,

increased production costs, the presence of deleterious elements,

reduced recovery rates and other factors may result in revision of

its resource and reserve estimates from time to time or may render

the Company’s resources and reserves uneconomic to exploit.

Resource and reserve data is not indicative of future results of

operations. If the Company’s actual mineral resources and reserves

are less than current estimates or if the Company fails to develop

its resource base through the realization of identified mineralized

potential, its results of operations or financial condition may be

materially and adversely affected.

All forward-looking statements herein are

qualified by this cautionary statement. Accordingly, readers should

not place undue reliance on forward-looking statements. The Company

undertakes no obligation to update publicly or otherwise revise any

forward-looking statements whether as a result of new information

or future events or otherwise, except as may be required by law. If

the Company does update one or more forward-looking statements, no

inference should be drawn that it will make additional updates with

respect to those or other forward-looking statements.

Forward-Looking Information

This press release contains “forward-looking

information” and “forward-looking statements”, as defined in

applicable securities laws (collectively, “forward-looking

statements”) which include, without limitation, mineral resources

and mineral reserve estimates.

Known and unknown risks, uncertainties and other

factors, many of which are beyond the Company’s ability to predict

or control, could cause actual results to differ materially from

those contained in the forward-looking statements if such risks,

uncertainties or factors materialize. The Company has made numerous

assumptions with respect to forward-looking information contain

herein, including among other things, assumptions from the

Feasibility Study, which may include assumptions on gold prices and

exchange rates, which could also cause actual results to differ

materially from those contained in the forward-looking statements

if such assumptions prove wrong. Specific reference is made to the

Company’s most recent AIF on file with certain Canadian provincial

securities regulatory authorities and the Technical Reports for a

discussion of some of the risk factors underlying forward-looking

statements, which include, without limitation the ability of the

Company to achieve its longer-term outlook and the anticipated

timing and results thereof, the ability to lower costs and increase

production, the ability of the Company to successfully achieve

business objectives, copper and gold or certain other commodity

price volatility, changes in debt and equity markets, the

uncertainties involved in interpreting geological data, increases

in costs, environmental compliance and changes in environmental

legislation and regulation, interest rate and exchange rate

fluctuations, general economic conditions and other risks involved

in the mineral exploration and development industry. Readers are

cautioned that the foregoing list of factors is not exhaustive of

the factors that may affect the forward-looking statements.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/ab1e8d31-4c2a-4d51-b08f-891a4532bb4f

https://www.globenewswire.com/NewsRoom/AttachmentNg/fd285f38-0a22-4205-bf9b-6bc564d81312

https://www.globenewswire.com/NewsRoom/AttachmentNg/9f56622e-5933-4176-b6fb-46c124b76558

https://www.globenewswire.com/NewsRoom/AttachmentNg/9cb7af49-9b2c-42a0-a31b-09451005b58c

https://www.globenewswire.com/NewsRoom/AttachmentNg/57bc679d-29b1-4fb5-b2c6-7f1e501f7793

For more information, please contact:

Investor Relations

ir@auraminerals.com

www.auraminerals.com

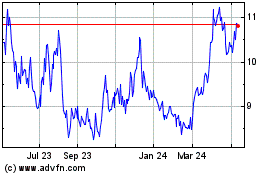

Aura Minerals (TSX:ORA)

Historical Stock Chart

From Dec 2024 to Jan 2025

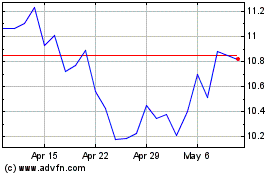

Aura Minerals (TSX:ORA)

Historical Stock Chart

From Jan 2024 to Jan 2025