Parex Resources Announces Timing of Q1 2022 Results and 2022 Virtual Annual General Meeting of Shareholders

04 May 2022 - 7:00AM

Parex Resources Inc. (“Parex” or the “Company”) (TSX: PXT) has

announced that it will release its first quarter 2022 financial and

operating results after markets close on Wednesday, May 11, 2022.

On the following day (Thursday, May 12, 2022),

Parex will hold its Annual General Meeting of Shareholders at

9:30AM MT (11:30AM ET) in a virtual-only format. The meeting will

be conducted via webcast and provide all shareholders an

opportunity to participate regardless of their geographic

location.

Webcast registration:

https://meetnow.global/M29ZXQF

In advance of the meeting, Parex would like to

provide clarification regarding external auditor service fees as

reported in its December 31, 2021, Annual Information Form (“AIF”).

Additional disclosure as it specifically relates to Tax Fees

related to Compliance and Consulting work performed by the

Company’s auditor can be found in the below table. Consulting Tax

Fees and All Other Fees together represent less than 50% of total

fees paid to the Company’s auditor in 2021 at 47%.

|

Fees Paid to Auditor in the Year Ended December 31, 2021

(US$) |

|

Nature of Services |

Clarified |

As Stated in AIF |

|

Audit Fees(1) |

$522,260 |

$522,260 |

|

Audit-Related Fees(2) |

- |

- |

|

Tax Fees – Compliance(3) |

$185,579 |

$273,482 |

|

Tax Fees – Consulting(4) |

$87,903 |

|

All Other Fees(5) |

$540,378 |

$540,378 |

|

Total |

$1,336,120 |

$1,336,120 |

(1) "Audit Fees" include fees necessary to

perform the annual audit and quarterly reviews of the Company's

consolidated financial statements. Audit Fees also include audit or

other attest services required by legislation or regulation, such

as comfort letters, consents, reviews of securities filings and

statutory audits.(2) "Audit-Related Fees" include services that are

traditionally performed by the auditor. These audit-related

services include the review and assistance with the transition to

IFRS.(3) "Tax – Compliance" includes fees related to tax compliance

work for statutory tax obligations in the international

jurisdictions that the Company operates in. (4) "Tax Fees –

Consulting" include fees for all tax services other than those

included in "Audit Fees" and "Audit-Related Fees." This category

includes fees for tax planning and tax advice.(5) "All Other Fees"

include all other non-audit products and services. In 2021 the

Company engaged PricewaterhouseCoopers to assist with a one-time

human resources information system implementation. The fees for

this specific project represent the majority of the non-audit,

non-tax fees paid in 2021. In 2022, it is projected that Parex's

non-audit fees will be reduced.Further information regarding the

Annual General Meeting, including meeting materials, can be found

at www.parexresources.com under Investors.

About Parex Resources Inc.

Parex is the largest independent oil and gas

company in Colombia, focusing on sustainable, conventional

production. Parex’s corporate headquarters are in Calgary, Canada,

and the Company has an operating office in Bogotá, Colombia. Parex

is a member of the S&P/TSX Composite ESG Index and its shares

trade on the Toronto Stock Exchange under the symbol PXT.

For more information, please contact:

Mike KruchtenSenior Vice President, Capital Markets &

Corporate PlanningParex Resources Inc.

403-517-1733investor.relations@parexresources.com

Steven EirichInvestor Relations & Communications

AdvisorParex Resources

Inc.587-293-3286investor.relations@parexresources.com

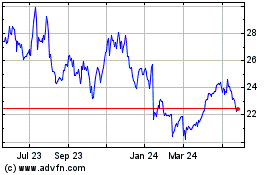

Parex Resources (TSX:PXT)

Historical Stock Chart

From Dec 2024 to Jan 2025

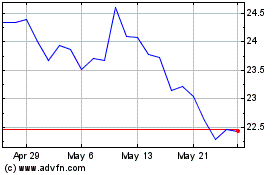

Parex Resources (TSX:PXT)

Historical Stock Chart

From Jan 2024 to Jan 2025