Parex Resources Inc. (“Parex” or the “Company”) (TSX: PXT) is

pleased to announce that the Toronto Stock Exchange ("TSX") has

approved the Company commencing a normal course issuer bid ("Bid").

Pursuant to the Bid, Parex will purchase for

cancellation, from time to time, as it considers advisable, up to a

maximum of 10,675,555 common shares of the Company ("Common

Shares"). The Bid will commence on January 4, 2023 and will

terminate on January 3, 2024 or such earlier time as the Bid is

completed or terminated at the option of Parex.

The maximum number of Common Shares to be

purchased pursuant to the Bid represents 10% of the public float,

as of December 22, 2022. Purchases pursuant to the Bid will be made

on the open market through the facilities of the TSX and/or

alternative trading systems. The number of Common Shares that can

be purchased pursuant to the Bid is subject to a daily maximum of

141,763 Common Shares (which is equal to 25% of the average daily

trading volume of 567,053 from June 1, 2022 to November 30, 2022).

The price that Parex will pay for any Common Shares under the Bid

will be the prevailing market price on the TSX at the time of such

purchase. Common Shares acquired under the Bid will be

cancelled.

RBC Dominion Securities Inc. has agreed to act

on the Company's behalf to make purchases of Common Shares pursuant

to the Bid.

A copy of the Form 12 Notice of Intention to

Make a Normal Course Issuer Bid filed by the Company with the TSX

can be obtained from the Company upon request without charge.

Parex believes that the Common Shares have been

trading in a price range which does not adequately reflect their

value in relation to the Company's current operations and its

growth prospects, and that, at such times, the purchase of Common

Shares for cancellation will increase the proportionate interest

of, and be advantageous to, all remaining shareholders. As of the

close of business on December 22, 2022, the Company had 109,108,590

Common Shares issued and outstanding and a public float of

106,755,557 Common Shares.

Under a previous notice of intention to conduct

a normal course issuer bid, the Company sought and received

approval of the TSX to purchase 11,820,533 Common Shares for the

period from January 4, 2022 to January 3, 2023. From January 4,

2022 to September 30, 2022, the Company purchased 11,820,533 Common

Shares on the open market at a weighted-average price of $20.58 per

Common Share.

Further, the Company has entered into an

automatic share purchase plan with RBC Dominion Securities Inc. in

order to facilitate repurchases of its Common Shares. Under the

Company's automatic share purchase plan, RBC Dominion Securities

Inc. may repurchase Common Shares under the Bid during the

Company's self-imposed blackout periods. Purchases will be made by

RBC Dominion Securities Inc. based upon the parameters prescribed

by the TSX and applicable securities laws and the terms of the plan

and the parties' written agreement. The automatic share purchase

plan has been approved by the Toronto Stock Exchange and will be

implemented effective January 4, 2023.

This news release does not constitute an

offer to sell securities, nor is it a solicitation of an offer to

buy securities, in any jurisdiction.

About Parex Resources Inc.

Parex is the largest independent oil and gas

company in Colombia, focusing on sustainable, conventional

production. The Company’s corporate headquarters are in Calgary,

Canada, with an operating office in Bogotá, Colombia. Parex is a

member of the S&P/TSX Composite ESG Index and its shares trade

on the Toronto Stock Exchange under the symbol PXT.

For more information, please contact:

Mike KruchtenSenior Vice President, Capital Markets &

Corporate PlanningParex Resources Inc.

403-517-1733investor.relations@parexresources.com

Steven EirichInvestor Relations & Communications

AdvisorParex Resources

Inc.587-293-3286investor.relations@parexresources.com

NOT FOR DISTRIBUTION FOR DISSEMINATION

IN THE UNITED STATES

Advisory on Forward-Looking

Statements

Certain information regarding Parex set forth in

this document contains forward-looking statements that involve

substantial known and unknown risks and uncertainties. The use of

any of the words "plan", "expect", "intend", "believe", "should",

"anticipate" or other similar words, or statements that certain

events or conditions "may" or "will" occur are intended to identify

forward-looking statements. These statements are only predictions

and actual events or results may differ materially. Many factors

could cause Parex's actual results to differ materially from those

expressed or implied in any forward-looking statements made by, or

on behalf of, Parex. In particular, forward-looking statements

contained in this document include, but are not limited to,

statements with respect to the anticipated advantages to

shareholders of the Bid and the commencement date of the automatic

share purchase plan and the anticipated benefits to be derived

therefrom. These forward-looking statements are subject to numerous

risks and uncertainties, including but not limited to, the risk

that the anticipated benefits of the Bid and the automatic share

repurchase plan may not be achieved. Readers are cautioned that the

foregoing list of factors is not exhaustive. Although the

forward-looking statements contained in this document are based

upon assumptions which Management believes to be reasonable, the

Company cannot assure investors that actual results will be

consistent with these forward-looking statements. With respect to

forward-looking statements contained in this document, Parex has

made assumptions regarding, among other things, the ability of the

Company to achieve the benefits of the Bid. These forward-looking

statements are made as of the date of this document and Parex

disclaims any intent or obligation to update publicly any

forward-looking statements, whether as a result of new information,

future events or results or otherwise, other than as required by

applicable securities laws.

PDF

available: http://ml.globenewswire.com/Resource/Download/3bc15def-0590-4616-8121-21af6c82459b

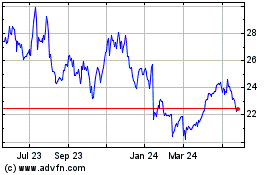

Parex Resources (TSX:PXT)

Historical Stock Chart

From Dec 2024 to Jan 2025

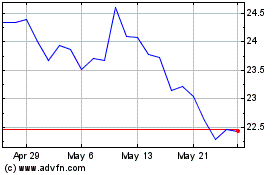

Parex Resources (TSX:PXT)

Historical Stock Chart

From Jan 2024 to Jan 2025