Stella-Jones Inc. (TSX: SJ) (“Stella-Jones” or the “Company”) today

announced financial results for its fourth quarter and year ended

December 31, 2024.

“We concluded another year of sales and EBITDA

growth, reflecting the enduring strength of our business and

unwavering customer-centric approach,” said Eric Vachon, President

and Chief Executive Officer of Stella-Jones. “We achieved solid

results in our infrastructure product categories, even in the face

of softer market demand for utility poles. We acquired new

customers, maintained our expanded EBITDA margin of over 18%, and

delivered strong operating cashflows. Given our conviction in the

long-term fundamentals of our business, we have also increased the

quarterly dividend for the 21st consecutive year.”

“As we turn to 2025, we remain confident in the

growth prospects of our current infrastructure business, supported

by the accelerated need to strengthen North America’s aging

electrical grid, and the opportunities in railway ties to drive

increased profitability. We also look to build even stronger

customer relationships by expanding our offering to our

infrastructure customers. As we drive forward, we will continue to

focus on optimizing our operating model and generating a healthy

EBITDA margin. With our strong cash flow-generating business and

disciplined capital allocation strategy, we are confident that our

actions will continue to enhance shareholder value.”

|

Financial Highlights (in millions of Canadian

dollars, except ratios and per share data) |

Three-month periods ended December

31, |

|

Years ended December

31, |

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

Sales |

730 |

|

688 |

|

3,469 |

|

3,319 |

|

|

Gross profit(1) |

138 |

|

137 |

|

724 |

|

688 |

|

|

Gross profit margin(1) |

18.9% |

|

19.9% |

|

20.9% |

|

20.7% |

|

|

Operating income |

81 |

|

89 |

|

503 |

|

499 |

|

|

Operating income margin(1) |

11.1% |

|

12.9% |

|

14.5% |

|

15.0% |

|

|

EBITDA(1) |

115 |

|

120 |

|

633 |

|

608 |

|

|

EBITDA margin(1) |

15.8% |

|

17.4% |

|

18.2% |

|

18.3% |

|

|

Net income |

52 |

|

56 |

|

319 |

|

326 |

|

|

Earnings per share (“EPS”) - basic and diluted |

0.93 |

|

0.98 |

|

5.66 |

|

5.62 |

|

|

Weighted average shares outstanding (basic, in ‘000s) |

55,966 |

|

57,076 |

|

56,403 |

|

57,963 |

|

|

Net debt-to-EBITDA(1) |

|

|

2.6x |

|

2.6x |

|

(1) These indicated terms have no standardized

meaning under GAAP and are not likely to be comparable to similar

measures presented by other issuers. For more information, please

refer to the section entitled “Non-GAAP and Other Financial

Measures” of this press release for an explanation of the non-GAAP

and other financial measures used and presented by the Company and

a reconciliation of non-GAAP financial measures to the most

directly comparable GAAP measures.

FOURTH QUARTER RESULTS

Sales for the fourth quarter of 2024 amounted to

$730 million, up 6% from sales of $688 million for the same period

in 2023. Excluding the currency conversion of $14 million,

pressure-treated wood sales rose $31 million, or 5% due to higher

railway ties sales attributable to an increase in Class 1 volumes

and improved residential lumber sales, while utility poles sales

were relatively unchanged. Lower logs and lumber sales were driven

by a decrease in log sales activity, compared to the fourth quarter

last year.

Pressure-treated wood

products:

- Utility

poles (53% of Q4-24 sales): Utility poles sales totaled

$385 million in the fourth quarter of 2024, compared to sales of

$383 million in the corresponding period last year. Excluding the

currency conversion effect, sales decreased by 2%, due to lower

volumes from non-contract business, offset in large part by

favourable price adjustments to cover increased costs.

- Railway ties (26% of Q4-24

sales): Sales of railway ties amounted to $193 million,

compared to $165 million in the same period last year. Excluding

the currency conversion effect, railway ties sales rose 15%,

largely explained by the timing of Class 1 shipments. For the year,

Class 1 volumes increased modestly when compared to 2023.

-

Residential lumber (13% of Q4-24

sales): Residential lumber sales totaled $93 million, up

from $82 million of sales generated in the same period in 2023,

reflecting a 12% organic sales growth. The increase in residential

lumber sales stemmed from favourable pricing attributable to the

increase in the market price of lumber, as well as higher sales

volumes, when compared to the same period last year.

- Industrial

products (4% of Q4-24 sales): Industrial

products sales amounted to $31 million, up from $27 million last

year. The organic sales growth of 11% was mainly attributable to

higher sales for railway bridges and crossings.

Logs and lumber:

- Logs and lumber (4% of

Q4-24 sales): Logs and lumber sales totaled $28 million,

down 10% compared to the same period last year.

Gross profit was $138 million in the fourth

quarter of 2024, relatively unchanged compared to the gross profit

of $137 million in the fourth quarter of 2023. As a percentage of

sales, gross profit decreased from 19.9% in the fourth quarter of

2023 to 18.9% in the fourth quarter of 2024 due to a less

favourable sales mix.

Net income for the period amounted to $52

million, or $0.93 per share, compared with $56 million, or $0.98

per share, in the corresponding period of 2023.

2024 RESULTS

Sales for the year ended December 31, 2024

reached $3,469 million, up 5%, versus sales of $3,319 million in

2023. Excluding the contribution from the acquisition of the

Baldwin assets of $25 million and the currency conversion effect of

$36 million, pressure-treated wood sales rose $110 million, or 3%.

Infrastructure sales, namely utility poles, railway ties and

industrial products, grew organically by $144 million or 6%, while

residential lumber sales decreased by $34 million. Favourable

pricing across all the infrastructure product categories and higher

railway ties volumes were partially offset by lower volumes for

utility poles and residential lumber. The decrease in logs and

lumber sales compared to last year was largely attributable to less

logs sales.

Pressure-treated wood

products:

- Utility poles (49% of 2024

sales): Utility poles sales increased to $1,705 million in

2024, compared to sales of $1,571 million in 2023. Excluding the

contribution from the acquisition of assets of Baldwin in July 2023

and the currency conversion effect, utility poles sales increased

by $88 million, or 6%, driven by sales price adjustments to cover

increased costs. This increase was offset in part by lower volumes

when compared to last year. Incremental multi-year commitments were

secured from new and existing customers but volumes were impacted

by the slower pace of purchases and a deferral in the execution of

projects by utilities, largely influenced by economic factors,

including inflation and utilities’ supply chain constraints, as

well as timing of utilities’ rate-based funding.

- Railway ties (26% of 2024

sales): Railway ties sales were $890 million in 2024,

compared to sales of $828 million in 2023. Excluding the currency

conversion effect, railway ties sales increased $51 million, or 6%.

The increase was attributable to higher volumes, mainly for

non-Class 1 business due to the replenished level of railway ties

inventory, as well as improved pricing, when compared to last

year.

- Residential lumber (18% of

2024 sales): Sales in the residential lumber category

decreased to the lower end of the Company's $600 to $650 million

target range for this product category, at $614 million in 2024,

compared to sales of $645 million in 2023. Excluding the currency

conversion effect, residential lumber sales decreased $34 million,

or 5%, all explained by lower sales volumes due to softer consumer

demand. The average market price of lumber remained relatively

unchanged in 2024 when compared to 2023.

- Industrial products (4% of

2024 sales): Industrial products sales were $154 million

in 2024 compared to sales of $148 million in 2023. Excluding the

currency conversion effect, industrial product sales increased five

million dollars, or 3%, mainly driven by higher sales for railway

bridges and crossings.

Logs and lumber:

- Logs and lumber (3% of

2024 sales): Sales in the logs and lumber

product category were $106 million in 2024, down from $127 million

in 2023. The decrease in sales was explained by less logs sales

activity.

Gross profit increased to $724 million in 2024,

compared to $688 million in 2023, representing a margin of 20.9%

and 20.7% respectively. Similarly, EBITDA increased to $633 million

in 2024 compared to $608 million in 2023, largely due to the sales

growth of the Company’s infrastructure product categories. EBITDA

margin remained relatively unchanged at 18.2% in 2024, compared to

18.3% in 2023.

Net income in 2024 was $319 million, compared to

net income of $326 million in 2023. Despite the lower net income,

earnings per share in 2024 was higher at $5.66 versus $5.62 in 2023

due to the continued repurchase of shares through the Company’s

normal course issuer bids.

LIQUIDITY AND CAPITAL

RESOURCES

During the year ended December 31, 2024,

Stella-Jones used the cash generated from operations of $408

million to invest in its network as well as return

$153 million to shareholders. In 2024, the Company invested a

net amount of $88 million to maintain its assets and enhance

productivity and $34 million to complete its growth

investments for utility poles. Over the 2022 to 2024 period,

approximately $130 million was invested in growth capital

expenditures. The dividend paid in 2024 amounted to $1.12 per

share, representing a 22% increase compared to 2023. As at December

31, 2024, the Company had returned to shareholders

$348 million out of the $500 million committed for the 2023 to

2025 period.

As at December 31, 2024, the Company maintained

a healthy financial position with available liquidity of

$802 million. Its net debt-to-EBITDA ratio stood slightly

above the target range at 2.6x, as the appreciation of the closing

rate of the U.S. dollar relative to the Canadian dollar resulted in

a higher value of the Company’s net debt denominated in U.S.

dollars, when expressed in Canadian dollars.

Subsequent to year-end, the Company amended the

U.S. Farm Credit Agreement in order to, among other things, extend

the term of the Revolving Credit Facility of US$150 million from

March 3, 2028 to February 4, 2030.

REAFFIRMING 2023-2025 FINANCIAL

OBJECTIVES

The following is a summary of the Company’s

2023-2025 financial objectives:

|

(in millions of dollars, except percentages and ratios) |

2023-2025 Objectives |

|

Sales |

approx. $3,600 |

|

EBITDA margin |

> 17% |

|

Return to Shareholders: cumulative |

> $500 |

|

Net Debt-to-EBITDA |

2.0x-2.5x |

The Company assumed that the Canadian dollar

will trade, on average, at Can $1.36 per U.S. dollar for 2025.

QUARTERLY DIVIDEND INCREASED 11% TO

$0.31 PER SHARE

On February 26, 2025, the Board of

Directors declared a quarterly dividend of $0.31 per common share

payable on April 18, 2025 to shareholders of record at the

close of business on April 1, 2025. This dividend is

designated to be an eligible dividend.

CONFERENCE CALL

Stella-Jones will hold a conference call to

discuss these results on February 27, 2025, at 10:00 a.m.

Eastern Standard Time (“EST”). Interested parties can join the call

by dialing 1-800 206-4400. A live audio webcast of the conference

call will be available on the Company’s website, on the Investor

relations section’s home page or here:

https://meetings.lumiconnect.com/400-781-821-877. This recording

will be available on Thursday, February 27, 2025, as of 1:00 p.m.

EST until 11:59 p.m. EST on Thursday, March 6, 2025.

ABOUT STELLA-JONES

Stella-Jones Inc. (TSX: SJ) is a leading North

American manufacturer of products focused on supporting

infrastructure that are essential to the delivery of electrical

distribution and transmission, and the operation and maintenance of

railway transportation systems. It supplies the continent’s major

electrical utilities companies with treated wood utility poles and

North America’s Class 1, short line and commercial railroad

operators with treated wood railway ties and timbers. It also

supports infrastructure with industrial products, namely timbers

for railway bridges, crossings and construction, marine and

foundation pilings, and coal tar-based products. Additionally, the

Company manufactures and distributes premium treated residential

lumber and accessories to Canadian and American retailers for

outdoor applications, with a significant portion of the business

devoted to servicing Canadian customers through its national

manufacturing and distribution network.

CAUTION REGARDING FORWARD-LOOKING

INFORMATION

Except for historical information provided

herein, this press release may contain information and statements

of a forward-looking nature concerning the future performance of

the Company. These statements are based on suppositions and

uncertainties as well as on management's best possible evaluation

of future events. Such items include, among others: general

political, economic and business conditions, evolution in customer

demand for the Company's products and services, product selling

prices, availability and cost of raw materials, operational

disruption, climate change, failure to recruit and retain qualified

workforce, information security breaches or other cyber-security

threats, changes in foreign currency rates, the ability of the

Company to raise capital, regulatory and environmental compliance

and factors and assumptions referenced herein and in the Company’s

continuous disclosure filings. As a result, readers are advised

that actual results may differ from expected results. Unless

required to do so under applicable securities legislation, the

Company does not assume any obligation to update or revise

forward-looking statements to reflect new information, future

events or other changes after the date hereof.

Note to

readers: The audited consolidated financial

statements as well as the management’s discussion and analysis for

the year ended December 31, 2024 are available on Stella-Jones’

website at

www.stella-jones.com.

|

Head Office3100 de la Côte-Vertu Blvd., Suite

300Saint-Laurent, QuébecH4R 2J8 Tel.: (514) 934-8666Fax: (514)

934-5327 |

Exchange ListingsThe Toronto Stock ExchangeStock

Symbol: SJTransfer Agent and

RegistrarComputershare Investor Services Inc. |

Investor RelationsSilvana TravagliniSenior

Vice-President and Chief Financial OfficerTel.: (514) 934-8660Fax:

(514) 934-5327stravaglini@stella-jones.com |

|

Stella-Jones Inc.Consolidated Statements of

Income |

|

|

|

(in millions of Canadian dollars, except earnings per common

share) |

|

|

For thethree-month

periodsended December 31, |

|

|

For theyearsended

December 31, |

|

|

2024 |

2023 |

|

|

2024 |

2023 |

| |

|

|

|

|

|

|

Sales |

730 |

688 |

|

|

3,469 |

3,319 |

|

|

|

|

|

|

|

|

Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of sales (including

depreciation and amortization (3 months - $30 (2023 - $28) and 12

months - $115 (2023 - $94)) |

592 |

551 |

|

|

2,745 |

2,631 |

| Selling and administrative

(including depreciation and amortization (3 months - $4 (2023 - $3)

and 12 months - $15 (2023 - $15)) |

50 |

44 |

|

|

206 |

181 |

|

Other losses, net |

7 |

4 |

|

|

15 |

8 |

|

|

649 |

599 |

|

|

2,966 |

2,820 |

|

Operating income |

81 |

89 |

|

|

503 |

499 |

|

|

|

|

|

|

|

|

Financial expenses |

23 |

21 |

|

|

88 |

68 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before income taxes |

58 |

68 |

|

|

415 |

431 |

|

|

|

|

|

|

|

|

Income tax expense |

|

|

|

|

|

|

Current |

2 |

(12 |

) |

|

86 |

83 |

|

Deferred |

4 |

24 |

|

|

10 |

22 |

|

|

|

|

|

|

|

|

|

6 |

12 |

|

|

96 |

105 |

|

|

|

|

|

|

|

|

Net income |

52 |

56 |

|

|

319 |

326 |

|

|

|

|

|

|

|

|

Basic and diluted earnings per common share |

0.93 |

0.98 |

|

|

5.66 |

5.62 |

|

Stella-Jones Inc.Consolidated Statements of

Financial Position |

|

|

|

(in millions of Canadian dollars) |

|

|

2024 |

2023 |

|

Assets |

|

|

|

Current assets |

|

|

|

Cash and cash equivalents |

50 |

— |

|

Accounts receivable |

277 |

308 |

|

Inventories |

1,759 |

1,580 |

|

Income taxes receivable |

11 |

11 |

|

Other current assets |

42 |

48 |

|

|

2,139 |

1,947 |

|

Non-current assets |

|

|

|

Property, plant and equipment |

1,048 |

906 |

|

Right-of-use assets |

311 |

285 |

|

Intangible assets |

170 |

169 |

|

Goodwill |

406 |

375 |

|

Derivative financial instruments |

21 |

21 |

|

Other non-current assets |

8 |

5 |

|

|

4,103 |

3,708 |

|

Liabilities and Shareholders’ Equity |

|

|

|

Current liabilities |

|

|

|

Accounts payable and accrued liabilities |

180 |

204 |

|

Deferred revenue |

17 |

— |

|

Current portion of long-term debt |

1 |

100 |

|

Current portion of lease liabilities |

64 |

54 |

|

Current portion of provisions and other long-term liabilities |

24 |

26 |

|

|

286 |

384 |

|

Non-current liabilities |

|

|

|

Long-term debt |

1,379 |

1,216 |

|

Lease liabilities |

259 |

240 |

|

Deferred income taxes |

197 |

175 |

|

Provisions and other long-term liabilities |

37 |

31 |

|

Employee future benefits |

4 |

10 |

|

|

2,162 |

2,056 |

|

Shareholders’ equity |

|

|

|

Capital stock |

188 |

189 |

|

Retained earnings |

1,498 |

1,329 |

|

Accumulated other comprehensive income |

255 |

134 |

|

|

|

|

|

|

1,941 |

1,652 |

|

|

4,103 |

3,708 |

|

Stella-Jones Inc.Consolidated Statements of Cash

Flows |

|

|

|

(in millions of Canadian dollars) |

|

|

2024 |

|

2023 |

|

|

Cash flows from (used in) |

|

|

|

Operating activities |

|

|

|

Net income |

319 |

|

326 |

|

|

Adjustments for |

|

|

|

Depreciation of property, plant and equipment |

46 |

|

40 |

|

|

Depreciation of right-of-use assets |

66 |

|

53 |

|

|

Amortization of intangible assets |

18 |

|

16 |

|

|

Financial expenses |

88 |

|

68 |

|

|

Income tax expense |

96 |

|

105 |

|

|

Other |

4 |

|

11 |

|

| |

637 |

|

619 |

|

| |

|

|

|

Changes in non-cash working capital components |

|

|

|

Accounts receivable |

56 |

|

(7 |

) |

|

Inventories |

(82 |

) |

(353 |

) |

|

Income taxes receivable |

— |

|

(2 |

) |

|

Other current assets |

9 |

|

8 |

|

|

Accounts payable and accrued liabilities |

(40 |

) |

9 |

|

|

|

(57 |

) |

(345 |

) |

|

Interest paid |

(85 |

) |

(68 |

) |

|

Income taxes paid |

(87 |

) |

(99 |

) |

|

|

408 |

|

107 |

|

|

Financing activities |

|

|

|

Net change in revolving credit facilities |

(471 |

) |

362 |

|

|

Proceeds from long-term debt |

568 |

|

33 |

|

|

Repayment of long-term debt |

(103 |

) |

(1 |

) |

|

Repayment of lease liabilities |

(62 |

) |

(50 |

) |

|

Dividends on common shares |

(63 |

) |

(53 |

) |

|

Repurchase of common shares |

(90 |

) |

(142 |

) |

|

Other |

— |

|

2 |

|

|

|

(221 |

) |

151 |

|

|

Investing activities |

|

|

|

Business combinations |

(4 |

) |

(93 |

) |

|

Purchase of property, plant and equipment |

(132 |

) |

(155 |

) |

|

Property insurance proceeds |

10 |

|

— |

|

|

Additions of intangible assets |

(11 |

) |

(10 |

) |

|

|

(137 |

) |

(258 |

) |

|

Net change in cash and cash equivalents during the

year |

50 |

|

— |

|

|

Cash and cash equivalents – Beginning of year |

— |

|

— |

|

|

Cash and cash equivalents – End of year |

50 |

|

— |

|

NON-GAAP AND OTHER FINANCIAL

MEASURES

This section includes information required by

National Instrument 52-112 – Non-GAAP and Other Financial Measures

Disclosure in respect of “specified financial measures” (as defined

therein).

The below-described non-GAAP financial measures,

non-GAAP ratios and other financial measures have no standardized

meaning under GAAP and are not likely to be comparable to similar

measures presented by other issuers. The Company’s method of

calculating these measures may differ from the methods used by

others, and, accordingly, the definition of these measures may not

be comparable to similar measures presented by other issuers. In

addition, non-GAAP financial measures, non-GAAP ratios and other

financial measures should not be viewed as a substitute for the

related financial information prepared in accordance with GAAP.

Non-GAAP financial measures include:

- Organic sales

growth: Sales of a given period compared to sales of the

comparative period, excluding the effect of acquisitions and

foreign currency changes

- Gross profit:

Sales less cost of sales

- EBITDA: Operating

income before depreciation of property, plant and equipment,

depreciation of right-of-use assets and amortization of intangible

assets (also referred to as earnings before interest, taxes,

depreciation and amortization)

- Net debt: Sum of

long-term debt and lease liabilities (including the current

portion) less cash and cash equivalents

Non-GAAP ratios include:

- Organic sales growth percentage: Organic sales

growth divided by sales for the corresponding period

- Gross profit margin: Gross profit divided by

sales for the corresponding period

- EBITDA margin: EBITDA divided by sales for the

corresponding period

- Net debt-to-EBITDA: Net debt divided by

trailing 12-month (TTM) EBITDA

Other financial measures include:

- Operating income

margin: Operating income divided by sales for the

corresponding period

Management considers these non-GAAP and

specified financial measures to be useful information to assist

knowledgeable investors to understand the Company’s financial

position, operating results and cash flows as they provide a

supplemental measure of its performance. Management uses non-GAAP

and other financial measures in order to facilitate operating and

financial performance comparisons from period to period, to prepare

annual budgets, to assess the Company’s ability to meet future debt

service, capital expenditure and working capital requirements, and

to evaluate senior management’s performance. More specifically:

- Organic sales growth and

organic sales growth percentage: The Company uses these

measures to analyze the level of activity excluding the effect of

acquisitions and the impact of foreign exchange fluctuations, in

order to facilitate period-to-period comparisons. Management

believes these measures are used by investors and analysts to

evaluate the Company's performance.

- Gross profit and gross

profit margin: The Company uses these financial measures

to evaluate its ongoing operational performance.

- EBITDA and EBITDA

margin: The Company believes these measures provide

investors with useful information because they are common industry

measures used by investors and analysts to measure a company’s

ability to service debt and to meet other payment obligations, or

as a common valuation measurement. These measures are also key

metrics of the Company's operational and financial performance and

are used to evaluate senior management’s performance.

- Net debt and net

debt-to-EBITDA: The Company believes these measures are

indicators of the financial leverage of the Company.

The following tables present the reconciliations

of non-GAAP financial measures to their most comparable GAAP

measures.

|

Reconciliation of Operating Income to EBITDA(in

millions of dollars) |

Three-month periods ended December

31, |

Years ended December

31, |

|

|

2024 |

2023 |

2024 |

2023 |

|

Operating income |

81 |

89 |

503 |

499 |

|

Depreciation and amortization |

34 |

31 |

130 |

109 |

|

EBITDA |

115 |

120 |

633 |

608 |

|

Reconciliation of Long-Term Debt to Net Debt(in

millions of dollars) |

Years ended December

31, |

|

|

2024 |

2023 |

|

Long-term debt, including current portion |

1,380 |

1,316 |

|

Add: |

|

|

|

Lease liabilities, including current portion |

323 |

294 |

|

Less: |

|

|

|

Cash and cash equivalents |

50 |

— |

|

Net Debt |

1,653 |

1,610 |

|

EBITDA (TTM) |

633 |

608 |

|

Net Debt-to-EBITDA |

2.6x |

2.6x |

|

|

|

|

|

Source: |

Stella-Jones Inc. |

Stella-Jones Inc. |

| |

|

|

|

Contacts: |

Silvana Travaglini, CPA |

Stephanie Corrente |

| |

Senior Vice-President and Chief Financial Officer Stella-Jones |

Director, Corporate CommunicationsStella-Jones |

| |

Tel.: (514) 934-8660 |

|

| |

stravaglini@stella-jones.com |

communications@stella-jones.com |

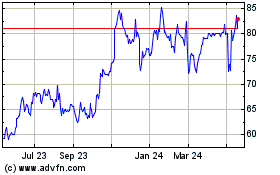

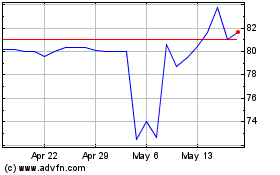

Stella Jones (TSX:SJ)

Historical Stock Chart

From Feb 2025 to Mar 2025

Stella Jones (TSX:SJ)

Historical Stock Chart

From Mar 2024 to Mar 2025