- On a 2023 year-to-date consolidated basis, excluding Cusi,

copper, silver, and gold production increased by 35%, 38%, and 92%,

respectively, when compared to 2022.

- Consolidated copper equivalent production, excluding Cusi,

was 27% higher in Q3 2023 when compared to Q3 2022.

- The Cusi Mine was placed in care and maintenance during the

quarter, with the process to sell the mine currently

underway.

(All metal prices reported in USD)

Sierra Metals Inc. (TSX: SMT; OTC: SMTSF) (“Sierra

Metals” or the “Company”) reports third quarter 2023

production results from its Yauricocha polymetallic mine in Peru

and the Bolivar copper mine in Mexico.

The Company’s Q3 2023 results will be released on Monday,

November 13, 2023 before the market open, with management hosting a

conference call and webcast the same day at 11:00 AM EST. Click

here to register.

Ernesto Balarezo, CEO of Sierra Metals, commented, “During the

quarter we continued to make tremendous strides in optimizing our

strong portfolio of assets. We have been able to maintain Bolivar

at desired levels of output and we are happy to see that our

efforts at Yauricocha are paying off. We are now well along the

process of divesting our Cusi silver mine, obtaining the permit to

mine below the 1120 level at Yauricocha and improving our balance

sheet. We remain steadfast in our focus to safely grow our business

and create long-term value.”

Consolidated Production Results

(Excluding Cusi)

Consolidated production results include the Yauricocha Mine and

Bolivar Mine and do not include results from the Cusi Mine, which

the Company deems to be a non-core asset.

Consolidated

Production

Nine Months Ended September

30,

Excluding Cusi

Q3 2023

Q2 2023

Q3 2022

2023

2022

Tonnes processed

622,622

650,302

496,726

1,791,086

1,572,991

Daily throughput

7,116

7,432

5,677

6,823

5,992

Silver production (000

oz)

458

523

327

1,370

991

Copper production (000

lb)

9,477

10,459

6,299

28,221

20,957

Lead production (000

lb)

4,084

3,930

3,579

10,792

10,467

Zinc production (000

lb)

11,176

12,228

10,815

33,983

31,733

Gold Production (oz)

3,651

4,311

2,010

11,753

6,121

Copper equivalent pounds

(000's)(1)

18,496

20,246

14,593

55,342

44,261

(1) Copper equivalent

pounds were calculated using the following realized prices:

Q3 2023 - $23.56/oz Ag, $3.78/lb Cu, $1.10/lb Zn, $0.98/lb Pb,

$1,927/oz Au. Q2 2023 - $24.17/oz Ag, $3.99/lb Cu, $1.16/lb

Zn, $0.96/lb Pb, $1,977/oz Au. Q3 2022 - $19.26/oz Ag,

$3.51/lb Cu, $1.49/lb Zn, $0.90/lb Pb, $1,730/oz Au. 9M 2023

- $23.44/oz Ag, $3.94/lb Cu, $1.23/lb Zn, $0.97/lb Pb, $1,932/oz

Au. 9M 2022 - $21.95/oz Ag, $4.12/lb Cu, $1.66/lb Zn,

$0.99/lb Pb, $1,826/oz Au.

Consolidated throughput in Q3 2023 was 4% lower than in Q2 2023

but 25% higher than in Q3 2022. Throughput from the Yauricocha Mine

during Q3 2023 of 259,732 tonnes, was 6% higher from the previous

quarter. The Bolivar Mine throughput in Q3 2023 increased by 59%

over Q2 2022 but declined 11% compared to Q2 2023, as

anticipated.

The Cusi Mine, which was considered a non-core asset in Q1 2023,

was placed in care and maintenance on September 20, 2023.

Yauricocha Mine, Peru

The Yauricocha Mine processed 259,732 tonnes during Q3 2023, an

increase of 6% over the previous quarter. Copper grades increased

by 23% when compared to Q2 2023 as well as silver and gold grades

by 7% and 3%, respectively.

Copper equivalent production for Q3 2023 of 10.4 million pounds

represented a 9% increase over the previous quarter. This increase

was attributed mainly to the 36% increase in copper production.

Lead and gold production increased 4% and 8%, respectively, while

zinc production declined 9% due to lower grades compared to Q2

2023.

When compared to Q3 2022, the 4% decrease in the copper

equivalent pounds produced resulted from the change in metal

prices, particularly zinc prices which declined by more than 26% as

compared to Q3 2022. The increase in metal production, except for

gold, did not offset the impact of the change in metal prices as

compared to Q3 2022.

A summary of the Yauricocha Mine production is provided

below:

Yauricocha Production

Nine Months Ended September

30,

Q3 2023

Q2 2023

Q3 2022

2023

2022

Tonnes processed

259,732

244,315

269,057

723,192

901,394

Daily throughput

2,968

2,792

3,075

2,755

3,434

Silver grade (g/t)

58.72

54.83

47.61

53.69

43.70

Copper grade

0.89%

0.72%

0.77%

0.80%

0.83%

Lead grade

0.86%

0.87%

0.72%

0.82%

0.65%

Zinc grade

2.36%

2.65%

2.16%

2.51%

1.95%

Gold Grade (g/t)

0.41

0.40

0.41

0.42

0.49

Silver recovery

63.16%

73.25%

62.27%

70.51%

61.61%

Copper recovery

74.81%

72.21%

77.30%

74.20%

77.55%

Lead recovery

83.09%

83.88%

83.60%

82.92%

79.73%

Zinc recovery

82.57%

85.54%

84.28%

84.67%

81.33%

Gold Recovery

19.95%

20.33%

20.79%

21.12%

20.83%

Silver production (000 oz)

310

316

256

875

779

Copper production (000 lb)

3,806

2,808

3,514

9,509

12,920

Lead production (000 lb)

4,084

3,930

3,579

10,792

10,467

Zinc production (000 lb)

11,176

12,228

10,815

33,983

31,733

Gold Production (oz)

686

633

743

2,073

2,979

Copper equivalent pounds

(000's)(1)

10,396

9,525

10,794

28,950

33,702

(1) Copper equivalent pounds were

calculated using the following realized prices: Q3 2023 -

$23.56/oz Ag, $3.78/lb Cu, $1.10/lb Zn, $0.98/lb Pb, $1,927/oz Au.

Q2 2023 - $24.17/oz Ag, $3.99/lb Cu, $1.16/lb Zn, $0.96/lb

Pb, $1,977/oz Au. Q3 2022 - $19.26/oz Ag, $3.51/lb Cu,

$1.49/lb Zn, $0.90/lb Pb, $1,730/oz Au. 9M 2023 - $23.44/oz

Ag, $3.94/lb Cu, $1.23/lb Zn, $0.97/lb Pb, $1,932/oz Au. 9M

2022 - $21.95/oz Ag, $4.12/lb Cu, $1.66/lb Zn, $0.99/lb Pb,

$1,826/oz Au.

Bolivar Mine, Mexico

The Bolivar Mine processed 362,890 tonnes in Q3 2023, which was

a 59% increase from Q3 2022. Bolivar also recorded higher grades

for all metals, namely 28%, 27% and 37% for copper, silver, and

gold, respectively, as compared to Q2 2022. As a result, copper

equivalent production of 8.1 million pounds in Q3 2023 was 113%

higher than in Q3 2022. When comparing Q3 2023 to Q2 2023, as

anticipated, Bolivar’s copper equivalent production was 24% lower;

driven by the lower output and lower grades. However, Bolivar’s

copper equivalent pounds produced during the nine-month period

ended September 2023 were 150% higher than the copper equivalent

pounds produced in the same period of 2022.

A summary of the Bolivar Mine production is provided below:

Bolivar Production

Nine Months Ended September

30,

Q3 2023 Q2 2023 Q3 2022

2023

2022

Tonnes processed

(t)

362,890

405,987

227,669

1,067,894

671,597

Daily throughput

4,147

4,640

2,602

4,068

2,558

Copper grade

0.77%

0.92%

0.60%

0.85%

0.61%

Silver grade (g/t)

15.44

19.65

12.14

17.59

11.90

Gold grade (g/t)

0.37

0.42

0.27

0.41

0.23

Copper recovery

92.10%

92.92%

92.05%

93.01%

89.60%

Silver recovery

81.95%

80.45%

79.95%

81.95%

82.72%

Gold recovery

69.58%

66.38%

64.67%

68.33%

64.98%

Copper production (000 lb)

5,671

7,651

2,785

18,712

8,037

Silver production (000 oz)

148

207

71

495

212

Gold production (oz)

2,965

3,678

1,267

9,680

3,142

Copper equivalent pounds

(000's)(1)

8,100

10,721

3,799

26,392

10,559

(1) Copper equivalent pounds were

calculated using the following realized prices: Q3 2023 -

$23.56/oz Ag, $3.78/lb Cu, $1.10/lb Zn, $0.98/lb Pb, $1,927/oz Au.

Q2 2023 - $24.17/oz Ag, $3.99/lb Cu, $1.16/lb Zn, $0.96/lb

Pb, $1,977/oz Au. Q3 2022 - $19.26/oz Ag, $3.51/lb Cu,

$1.49/lb Zn, $0.90/lb Pb, $1,730/oz Au. 9M 2023 - $23.44/oz

Ag, $3.94/lb Cu, $1.23/lb Zn, $0.97/lb Pb, $1,932/oz Au. 9M

2022 - $21.95/oz Ag, $4.12/lb Cu, $1.66/lb Zn, $0.99/lb Pb,

$1,826/oz Au.

Cusi Mine, Mexico

The Company is currently engaged in discussions with interested

parties for the sale of the Cusi Mine.

As a result of being placed in care and maintenance late in Q3

2023, the Cusi Mine only processed 29,050 tonnes of ore during Q3

2023, which was 44% and 55% lower than Q2 2023 and Q3 2022,

respectively. Silver equivalent production was also lower by 52%

and 69%, respectively, from both corresponding periods.

A summary of the Cusi Mine production, not included in the

consolidated production numbers, is provided below:

Cusi Production

Nine Months Ended September

30,

Q3 2023 Q2 2023 Q3 2022

2023

2022

Tonnes processed

(t)

29,050

51,750

65,180

139,922

219,826

Daily throughput

332

591

745

533

837

Silver grade (g/t)

126.86

160.18

187.44

145.50

169.57

Gold grade (g/t)

0.15

0.14

0.19

0.14

0.18

Lead grade

0.45%

0.33%

0.26%

0.32%

0.25%

Silver recovery

(flotation)

83.94%

81.67%

87.24%

84.10%

84.86%

Gold recovery (lixiviation)

58.50%

58.06%

48.28%

53.30%

47.46%

Lead recovery

87.83%

86.54%

80.70%

87.71%

78.59%

Silver production (000 oz)

99

217

342

549

1,020

Gold production (oz)

81

131

189

330

623

Lead production (000 lb)

251

326

299

859

960

Silver equivalent ounces

(000's)(1)

117

241

374

612

1,115

(1) Silver equivalent ounces were

calculated using the following realized prices: Q3 2023 -

$23.56/oz Ag, $3.78/lb Cu, $1.10/lb Zn, $0.98/lb Pb, $1,927/oz Au.

Q2 2023 - $24.17/oz Ag, $3.99/lb Cu, $1.16/lb Zn, $0.96/lb

Pb, $1,977/oz Au. Q3 2022 - $19.26/oz Ag, $3.51/lb Cu,

$1.49/lb Zn, $0.90/lb Pb, $1,730/oz Au. 9M 2023 - $23.44/oz

Ag, $3.94/lb Cu, $1.23/lb Zn, $0.97/lb Pb, $1,932/oz Au. 9M

2022 - $21.95/oz Ag, $4.12/lb Cu, $1.66/lb Zn, $0.99/lb Pb,

$1,826/oz Au.

Conference Call and

Webcast

Management will host a conference call and webcast to discuss Q3

2023 financial and operating results on November 13, 2023 at 11:00

am (Eastern). Details are as follows:

- Webcast:

https://services.choruscall.ca/links/sierrametalsq32023.html

- Dial-in: Canada/US toll free: 1-800-319-4610

- Other dial-in: +1-416-915-3239

Participants are asked to dial-in five to ten minutes before the

scheduled start time and ask to join the Sierra Metals Third

Quarter 2023 Consolidated Financial Results call.

About Sierra Metals

Sierra Metals is a Canadian mining company focused on copper

production with additional base and precious metals by-product

credits at its Yauricocha Mine in Peru and Bolivar Mine in Mexico.

The Company is intent on safely increasing production volume and

growing mineral resources. Sierra Metals has recently had several

new key discoveries and still has many more exciting brownfield

exploration opportunities in Peru and Mexico that are within close

proximity to the existing mines. Additionally, the Company has

large land packages at each of its mines with several prospective

regional targets providing longer-term exploration upside and

mineral resource growth potential.

Forward Looking

Statements

This news release contains forward-looking information within

the meaning of Canadian securities legislation. Forward-looking

information relates to future events or the anticipated performance

of Sierra Metals and reflects management's expectations or beliefs

regarding such future events and anticipated performance based on

an assumed set of economic conditions and courses of action

including the accuracy of the Company's current mineral resource

estimates, that the Company's activities will be conducted in

accordance with the Company's public statements and stated goals,

and that there will be no material adverse change affecting the

Company, its properties or its production estimates, the expected

trends in mineral prices, inflation and currency exchange rates,

that all required approvals will be obtained for the Company's

business operations on acceptable terms, and that there will be no

significant disruptions affecting the Company's operations. In

certain cases, statements that contain forward-looking information

can be identified by the use of words such as "plans", "expects",

"is expected", "budget", "scheduled", "estimates", "forecasts",

"intends", "anticipates", "believes" or variations of such words

and phrases or statements that certain actions, events or results

"may", "could", "would", "might", or "will be taken", "occur" or

"be achieved" or the negative of these words or comparable

terminology. Forward-looking statements include statements with

respect to the timing of the release of its Q3 2023 results and the

sale of Cusi. By its very nature forward-looking information

involves known and unknown risks, uncertainties and other factors

that may cause actual performance of Sierra Metals to be materially

different from any anticipated performance expressed or implied by

such forward-looking information.

Forward-looking information is subject to a variety of risks and

uncertainties, which could cause actual events or results to differ

from those reflected in the forward-looking information, including,

without limitation, the risks described under the heading "Risk

Factors" in the Company's annual information form dated March 28,

2023 for its fiscal year ended December 31, 2022 and other risks

identified in the Company's filings with Canadian securities

regulators, which filings are available at www.sedarplus.ca.

The risk factors referred to above are not an exhaustive list of

the factors that may affect any of the Company's forward-looking

information. Forward-looking information includes statements about

the future and is inherently uncertain, and the Company's actual

achievements or other future events or conditions may differ

materially from those reflected in the forward-looking information

due to a variety of risks, uncertainties and other factors. The

Company's statements containing forward-looking information are

based on the beliefs, expectations, and opinions of management on

the date the statements are made, and the Company does not assume

any obligation to update such forward-looking information if

circumstances or management's beliefs, expectations or opinions

should change, other than as required by applicable law. For the

reasons set forth above, one should not place undue reliance on

forward-looking information.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231019152017/en/

For further information regarding Sierra Metals, please visit

www.sierrametals.com or contact: Investor Relations Sierra

Metals Inc. Tel: +1 (416) 366-7777 Email: info@sierrametals.com

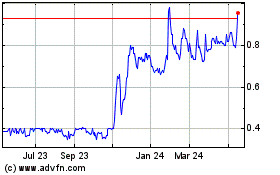

Sierra Metals (TSX:SMT)

Historical Stock Chart

From Nov 2024 to Dec 2024

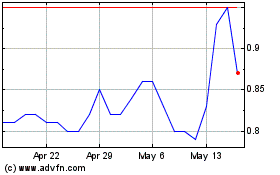

Sierra Metals (TSX:SMT)

Historical Stock Chart

From Dec 2023 to Dec 2024