December 2023 Quarter

Highlights

During the quarter ending 31 December 2023

(December Quarter), Xanadu Mines Ltd (Xanadu or the

Company) continued to execute its three horizon strategy

making strong progress on the Kharmagtai Project (H1)

Pre-Feasibility Study (PFS) and associated

exploration activities (H2), funded at Kharmagtai by US$35 million

cash from the Joint Venture (JV or Khuiten

JV) with Zijin Mining Group Co., Ltd.

(Zijin). This progress included an important project

milestone with the successful delivery of an updated Mineral

Resource Estimate (MRE or

Resource) for Kharmagtai totalling 1.3Bt

including 3.4Mt of Cu, 8.5Moz of Au1,

representing an increase of approximately 15% contained copper and

9% contained gold metal and achieving targeted classification

upgrade of >90% Indicated within the currently defined open pit

volumes.

Deep discovery drilling continued to test for

significant mineralisation below the existing Resource targeted

using Xanadu’s Exploration Model which is based on geologic

analogues such as Hugo Dummett and Cadia East, with drill hole

KHDDH649 returning a broad intercept of low-grade mineralisation

totalling 1080m @ 0.21% CuEq from 491m below The White Hill

deposit. Shallow drilling also progressed testing known porphyry

clusters outside the Resource extending the system and informing

infrastructure planning.

The Company also completed the first tranche of

a $4.3M equity placement2 to further fund its Horizon 2 and Horizon

3 strategy, including exploration at the Red Mountain Copper-Gold

Project and new exploration project acquisition. Subsequent to the

quarter, the Company announced entry into a new magmatic

copper-nickel project Sant Tolgoi located in Western Mongolia.

Kharmagtai Resource3

- Significant

increase in Kharmagtai Resource to 1.3Bt containing 3.4Mt

Cu and 8.5Moz Au representing a 15% increase in contained

copper metal (Cu) and 9% increase in contained gold metal

(Au).

- Material 25%

increase in the higher-grade core from 100Mt @ 0.76%

CuEq4 to 125Mt @ 0.75%

CuEq, at a 0.55% CuEq cut off. This is an important driver

for early payback of Kharmagtai project capital.

- Since 2021

Resource update5, the Company has completed 162 diamond drill holes

for 58,259 metres.

- 63% of the

updated Resource is now classified in the higher confidence

“indicated” category, demonstrating the robust nature of the

deposit including >90% Indicated inside the pit shells defined

in the scoping study.

- Strong

exploration upside remains, with mineralisation open to the east,

west, south, and at depth.

Kharmagtai PFS

- Infill drill

program completed.

- Sulphide (main

orebody) metallurgical test-work advanced at ALS laboratories in

Perth and TruTRC laboratories in Ulaanbaatar; results expected in

Q1 CY2024.

- Oxide

metallurgical test-work in progress at MPS laboratories in Perth

and at Zijin Research Labs in Xiamen, China, for assessment of

leach technologies; results expected Q2 CY2024.

- Water Reserve

drilling and studies progressed with completion expected in Q2

CY2024.

- Power Supply,

Tailings Management, and Infrastructure studies progressing through

trade-off phase; majority of work to be completed by Q1

CY2024.

- Commenced

studies for System Optimisation (Whittle Consulting), Mine Design

(Mining Plus) and Process Engineering (DRA Global).

- New core

processing facility delivered and operational during the

Quarter.

- Kharmagtai PFS

including Maiden Ore Reserve on-track for Q3 CY2024.

Extensional

Drilling6

- After the

Quarter, extensional drilling at White Hill expands on recently

identified higher-grade zone, located below the previous Scoping

Study pit designs and outside the 2023 MRE, highlighting potential

to expand the 2023 MRE and both grow and deepen the 2022 Scoping

Study pit shells.

- KHDDH808 -

64.45m @ 0.74% CuEq (0.61% Cu & 0.74/t Au) from 516m, including

24.45m @ 1.41% CuEq (1.14% Cu & 0.53g/t Au) from 634m.

- KHDDH806 - 50m @

0.73% CuEq (0.94% Cu & 0.25g/t Au) from 545m, including 22m @

1.34% CuEq (2.10% Cu & 0.26g/t Au) from 549.

- After the

Quarter, step-out drilling at Golden Eagle returns grades higher

than the 2023 MRE and extends mineralisation.

- KHDDH801 - 83.4m

@ 0.8g/t AuEq (0.59g/t Au and 0.11% Cu) from 36.6m, including 29m @

1.42 g/t AuEq (1.14g/t Au and 0.14% Cu) from 57m, including 14m @

2.18g/t AuEq (1.9g/t Au and 0.14% Cu) from 60m.

Discovery

Exploration7,8

- New shallow

discovery drilling intersects mineralisation across three largely

unexplored porphyry clusters, including high-density stockwork,

breccia and gold only mineralisation.

- KHDDH590 - 8m @

1.59g/t Au from 289m, including 4m @ 3.04g.t Au from 291m at

Cluster Two (Figure 1).

- KHDDH622 - 15– @

1.26% Cu from 127m, including 6m @ 2.97% Cu from 132m at Cluster

Three (Figure 1).

- Deep diamond

drillholes targeting mineralisation below White Hill, the largest

deposit delineated to date at Kharmagtai, expands the mineralised

system by over 600m.

- KHDDH649 – 1080m

@ 0.21% CuEq from 491m.

- Subsequent to

the Quarter, deep drilling between Zaraa and Stockwork Hill

encounters two broad zones of porphyry and tourmaline breccia style

mineralisation between Stockwork Hill and Zaraa, potentially

indicating the edges of a very large-scale Cu-Au System.9

- Shallow drilling

at Cluster 2 extends mineralisation 800m along strike from the

current MRE limit. Given proximity to the high-grade Stockwork Hill

deposit, this extension could represent a mineralised porphyry

stockwork offset.

- KHDDH786 – 144m

@ 0.34% CuEq from 117m, including 12m @ 0.63% CuEq from 144m, and

including 12.3m @ 0.54% CuEq from 168m.

- Multiple new

broad zones of gold-rich tourmaline breccia mineralisation

delivered over a 2km strike, at Cluster 5.

- Extensive

discovery drilling continues with regular news flow to continue

throughout 2023, focussed on extensions to known deposits and new

porphyry copper gold systems.

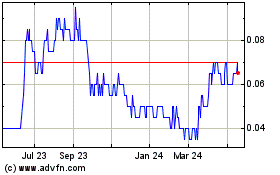

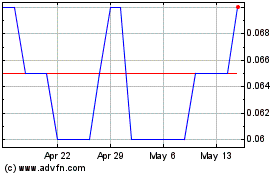

Corporate

- Completed first

tranche of a $4.3M equity placement.10

- First tranche

includes 62,996,490 Xanadu shares at $0.055 per share to

professional and sophisticated investors (A$3.46M before

costs).11

- Second tranche

of 15,185,328 Xanadu shares at $0.055 per share to Zijin (A$0.84M

before costs) subject to formal shareholder vote at Xanadu

Extraordinary Meeting (EGM) scheduled for 6

February 2024.12, 13

- After the

Quarter, agreed a binding term sheet for Sant Tolgoi, a

prospective, district-scale magmatic copper-nickel sulphide

project, aligned to its Horizon 3 Strategy to build a portfolio of

copper, gold & future facing mineral projects.14

- Kharmagtai PFS

and Discovery Exploration funded by US$35M from the Khuiten JV with

Zijin Mining Group15; with US$11.7 million in cash on 31 December

2023.

- Xanadu is

well-funded, with A$7.3 million in cash on 31 December 2023 and a

continued slow burn rate as operator fees are paid by the

Kharmagtai project.

Executive Chairman & Managing Director, Colin

Moorhead, said: “During the December Quarter, Xanadu

announced an updated Mineral Resource Estimate for our Kharmagtai

Copper-Gold Project, which represents a major step for the PFS. The

updated MRE meets our expectations by upgrading the resource

classification of the mineralisation within previously defined pit

shells to Indicated, and importantly it increased size of the

higher-grade zones by 25% to 125Mt, a key factor driving Kharmagtai

project economics. In parallel we effectively progressed other key

aspects of the Kharmagtai PFS including metallurgy, infrastructure,

tailings facility, water reserve and sterilisation drilling towards

our Q3 CY2024 delivery date.

Our Kharmagtai our Horizon Two exploration

program ran safely and effectively through the quarter, with

positive results from both the shallow and deep exploration

programs. The deep hole at White Hill demonstrates that system to

extend at depth and will help our exploration team to vector

towards higher grade mineralisation at depth. The shallow drilling

has also extended known mineralisation laterally and also helps

inform important infrastructure positioning for the PFS.

As a positive testament to our strategy and our

team, Xanadu was able to raise $4.3M in a very challenging equity

market. Pleasingly, this included proportional participation by

Zijin, our largest shareholder, (subject to Xanadu shareholder

approval at the upcoming Extraordinary General Meeting on 6

February). This will fund our Horizon 2 and Horizon 3 strategies,

focused on new discovery and the acquisition of new exploration

projects in Mongolia. The Company is planning to commence drilling

in the Spring at our Red Mountain project and to commence some

early work at Sant Tolgoi, an exciting new project recently

announced subsequent to the quarter.

I look forward to updating the market about our

Kharmagtai PFS and Discovery Exploration during the upcoming

quarters.”

Strategic Horizon 1 – Kharmagtai

Copper-Gold Project

During the December Quarter, the Company

continued to aggressively progress both the PFS and Discovery

Exploration at Kharmagtai Copper-Gold Project, which is funded by

US$35 million from the JV with Zijin. Xanadu is operator of the

joint venture during the PFS delivery period of 18 months, after

which Zijin will become operator for final engineering,

construction, and operations delivery.

Resource Update

An upgraded Resource was announced in December

2023, based on the infill drilling program completed in the

September quarter.16 The updated Resource increases both the

tonnes (+12%) and contained copper

equivalent (CuEq) metal (+13%). This includes a

+25% increase in the higher-grade component to

>125Mt, which is expected to enhance project cashflows

in the early years. Importantly for an infill program, it

successfully delivered an upgrade of material within the pit shells

to the higher confidence “Indicated” classification, demonstrating

the robust nature of the deposit.

Xanadu engaged independent consultants, Spiers

Geological Consultants (SGC), to prepare the updated Kharmagtai

Resource. The Resource, effective 8 December 2023, incorporates

drilling results from the past 24 months (including 162 holes for

58k metres of drilling) and is reported in accordance with the JORC

Code 2012. It is the first update to the Resource announced on 8

December 2021.17

Table 1: Comparison 2023 vs 2021

Resource

|

Resource |

Cutoff(% CuEq) |

Classification |

Tonnes (Mt) |

Grades |

Contained Metal |

|

CuEq (%) |

Cu (%) |

Au (g/t) |

CuEq (Mlbs) |

CuEq (kt) |

Cu (kt) |

Au (koz) |

|

2023 |

0.20 (OC)0.30 (UG) |

Indicated |

790 |

0.38 |

0.27 |

0.22 |

6,700 |

3,000 |

2,100 |

5,600 |

|

Inferred |

460 |

0.37 |

0.27 |

0.19 |

3,800 |

1,700 |

1,300 |

2,800 |

|

2021 |

0.20 (OC)0.30 (UG) |

Indicated |

450 |

0.40 |

0.28 |

0.25 |

4,100 |

1,900 |

1,300 |

3,700 |

|

Inferred |

660 |

0.35 |

0.25 |

0.19 |

5,100 |

2,300 |

1,700 |

4,100 |

Notes: Figures may not sum due to rounding and

significant figure do not imply an added level of precision.

The updated Resource block model will be used by

Xanadu for subsequent studies within the Kharmagtai PFS, including

system optimisation and economic trade-off studies in both mining

and plant design.

PFS Deliverables &

Schedule

The largest component of the Data Acquisition

stage of the Kharmagtai PFS is completed, following infill drill

program completion and recently announced new Resource. Remaining

data acquisition work includes:

- Final phases of

primary sulphide metallurgical test-work.

- Geometallurgical

modelling to support mine and plant optimisation.

- Oxide leach

testwork, converting waste from the PEA into ore.

- Water Reserve

studies and drilling, which will recommence after winter.

- Waste rock and

tailings geochemistry.

- Environmental

and socioeconomic baseline studies.

The Trade-Off Options studies stage of the

Kharmagtai PFS are now well underway to select a single go-forward

option for each key areas of the mine. These include:

- Tailings Storage

Facility.

- Power

Supply.

- Pit

Scheduling.

- Comminution

Circuit.

- Flotation

Circuit.

- Surface

Infrastructure.

During Q1 CY2023 the emphasis of the project

will shift towards studies including mine engineering and process

engineering. The project remains on track for delivery of a PFS and

Maiden Ore Reserve in Q3 CY2024.

Extensional Drilling

Subsequent to the quarter, assays were returned from extensional

drilling18 at both White Hill and Golden Eagle.

Three drill holes were collared at White Hill, aiming to extend

the recently discovered higher-grade core beneath the 2022 scoping

study open pits (Figure 1). These intercepted the

moderate grade halo (+0.3% CuEq) +350m shallower than expected and

encountered two zones of higher grade (+1% CuEq)

mineralisation.

Five drill holes have been collared at Golden Eagle designed to

extend the new higher-grade gold zone (+1g/t Au) at Golden Eagle.

These returned a broad zone of moderate grade gold with a

higher-grade zone at the expected interval. Importantly, the grades

encountered were higher than those in the new 2023 MRE19.

Figure 1: Kharmagtai copper-gold district

showing defined mineral deposits and completed infill drill holes,

deep exploration drill holes, and shallow exploration drill holes

since the last announcement of drilling results20.

Strategic Horizon 2 – World Class

Discovery

Shallow Discovery Exploration at

Kharmagtai

Shallow exploration drilling at Kharmagtai

targeted additional porphyry copper-gold deposits outside the

currently defined MRE. This programme also serves to inform future

infrastructure location decisions associated with the potential

development of the Kharmagtai Project into a large-scale mining

operation.

Through the December quarter, a total of 9,000m

diamond drilling in forty-one shallow (200m) diamond drill holes

was completed21 (Figure 2) since the last update

to the shallow drilling program.22 Important outcomes for which

follow-up drilling is being planned include:

- Identified a

broad zone of porphyry mineralisation above the Resource cut-off

grade, including a cohesive zone greater than 0.6% CuEq

mineralisation. This may represent a faulted offset to Stockwork

Hill.

- Encountered

mineralised structures at Cluster Three near surface containing up

to 1.3% Cu.

- Defined a 2km

long zone of gold-rich tourmaline breccia at Cluster Five.

- Encountered

broad zones of peripheral porphyry and tourmaline breccia

mineralisation approximately 1km along strike from the Stockwork

Hill Tourmaline Breccia.

- Encountered a

broad zone of shallow, low-grade porphyry mineralisation

approximately 1.5km southwest of Golden Eagle where there is little

drilling to date, suggesting the presence of a large-scale porphyry

in this area.

Figure 2: Kharmagtai copper-gold district

showing currently defined mineral deposits and planned and

completed shallow exploration drill holes. Grey outlines are 2021

scoping study open pit designs and white dashed outlines define

porphyry cluster target areas.

Deep Discovery Exploration at Kharmagtai

Existing geochemical, geological, and

geophysical datasets point to known mineralisation at Kharmagtai as

a shallow surface expression of a much larger porphyry system at

depth (Figure 3). Deep drill holes have been

designed to ensure that a potential high-grade, large-scale and

deeper “Oyu Tolgoi” style deposit is discovered early in the PFS

process, allowing optimal infrastructure decisions to be made,

without sterilising what could be the major value driver at

Kharmagtai (Figure 4).

Drilling in the December Quarter was designed to

test for a large-scale high-grade extension beneath White Hill.

KHDDH648 intercepted a very large (+1km) zone of porphyry

mineralisation, expanding the White Hill mineralised system more

than 600m down dip.23 This hole has provided the vectors required

to target higher-grade mineralisation at depth. 3D geological

modelling is underway to refine these vectors for further high

priority drilling.

Subsequent to the Quarter, assays were returned

for a single deep diamond drill hole was collared between Zaraa and

Stockwork Hill, designed to test for a large-scale porphyry

deposit. KHDDH779 encountered two broad zones of porphyry and

tourmaline breccia style mineralisation between Stockwork Hill and

Zaraa. This hole appears to have encountered the edges of a very

large-scale Cu-Au System.

Figure 3: Long Sections through the Oyu Tolgoi

Porphyry System and The Kharmagtai Porphyry System. Deep high-grade

exploration drill program geochemical zonation points to much

larger system beneath Kharmagtai.

Figure 4: Kharmagtai copper-gold district

showing currently defined mineral deposits and planned deep

exploration holes.

Red Mountain Exploration

No exploration activity was undertaken at

Xanadu’s Red Mountain copper-gold project during the December 20023

Quarter. A key purpose of the December 2023 equity placement24 was

to provide funds to re-commence this exploration in 2024. The 2024

Red Mountain exploration program will leverage significant

targeting information generated from drilling, trenching and

BoxScan in prior years and will be subject of a separate

announcement.

Strategic Horizon 3 – Portfolio

Growth

Subsequent to the Quarter, Xanadu announced a

binding term sheet with STSM LLC (STSM) granting

the right to earn up to 80% interest in two exploration licences

XV-17774 (Oyut) and XV-21887 (Sant

Tolgoi) located in the Zavkhan Province of Western

Mongolia (Figure 5)25. These two licenses make up

the Sant Tolgoi Project, which is considered highly prospective for

discovery of new magmatic intrusion-related Copper-Nickel sulphide

systems.

The Sant Tolgoi project hosts multiple shallow

copper-nickel targets over several kilometres of strike and is well

aligned to Xanadu’s Horizon 3 Strategy to build a portfolio future

facing metals projects. Detailed mapping, geochemistry and

geophysics is planned to start in March 2024.

Figure 5: Sant Tolgoi Cu-Ni

project is located in the Zavkhan Province approximately 1,100 km

west of Ulaanbaatar, Mongolia. Project to located close to

established infrastructure.

ASX Announcements

This December 2023 Quarterly Activities Report

contains information reported in accordance with the 2012 Edition

of the Australasian Code for Reporting of Exploration Results,

Mineral Resources and Ore Reserves (JORC Code,

2012) in the following announcements.

-

8 December 2021 – Kharmagtai Resource Grows to 1.1 Billion Tonnes,

containing 3Mt Cu and 8Mozu

-

28 February 2022 – Kharmagtai Technical Report

-

29 December 2022 – Investment Deal Signed with Zijin

-

5 July 2023 - Shallow Drilling Confirms Kharmagtai Discovery

Potential

-

4 October 2023 – High Grade Core Shaping Up at White Hill

-

26 October 2023 – New Gold Zone Discovered at Golden Eagle

-

16 November 2023 – Multiple New Breakthrough Achievements for

Kharmagtai Discovery Drilling

-

20 November 2023 - $4.3M Placement

-

28 November 2023 – Notice under Section 708A(5)(e) of the

Corporations Act

-

8 December 2023 – Kharmagtai Mineral Resource grows by 13% CuEq;

including >25% increase in higher grade ore

-

8 December 2023 – Second Tranche Placement to Zijin

-

15 December 2023 – Notice of Extraordinary General Meeting / Proxy

Form

-

22 January 2024 – Xanadu Enters Into New Magmatic Copper and Nickel

Sulphide Project

-

30 January 2024 - Kharmagtai Drilling Highlights Continued Growth

Potential

March 2024 Quarter Planned

Activities

Key activities planned during the quarter ending

31 March 2023 (March Quarter)

include:

-

Strategic Horizon 1 – Kharmagtai PFS

-

Follow-up drilling for Kharmagtai PFS primarily focused on

sterilisation and geotechnical.

-

Water reserve geophysics, modelling and drilling.

-

System Optimisation Trade-Off Studies for Process Plant, Mine

Design & Scheduling

-

Convergent Power Studies

-

Infrastructure and Tailings Storage Facility design work

-

Completion of sulphide metallurgical testing

-

Initial findings from oxide leach tests

-

Strategic Horizon 2 - Discovery

-

Kharmagtai Shallow and Deep Discovery Exploration drilling

programmes.

-

Commence a Red Mountain exploration plan.

-

Strategic Horizon 3 – Portfolio Expansion

-

Continue evaluating new battery metals project opportunities in

Mongolia.

Results of Operations

|

|

|

|

|

50% Ownership of Khuiten Metals Pte Ltd1 |

|

100% Ownership |

|

|

Quarter Ended |

|

|

31 Dec 2023$’000 |

|

30 Sep 2023$’000 |

|

30 Jun 2023$’000 |

|

31 Mar 2023$’000 |

|

31 Dec 2022$’000 |

| JV: Gross Exploration

Expenditurea |

|

|

|

|

|

|

|

|

|

|

Kharmagtai |

7,334 |

|

10,515 |

|

8,360 |

|

1,850 |

|

402 |

|

Drill metresb,c |

13,053 |

|

29,388 |

|

28,032 |

|

6,111 |

|

- |

| Gross Exploration

Expenditure |

|

|

|

|

|

|

|

|

|

|

Red Mountain |

54 |

|

90 |

|

32 |

|

29 |

|

261 |

|

Drill metresb,c |

- |

|

- |

|

- |

|

- |

|

- |

| Exploration expenditures

capitalised |

54d |

|

90d |

|

32d |

|

29d |

|

663 |

| Corporate general and

administration |

1,437 |

|

1,365 |

|

2,712e |

|

1,267 |

|

1,095 |

| Less JV Operator Overhead

recovery |

(891)f |

|

(970)f |

|

(1,001)f |

|

- |

|

|

| Net Corporate general and

administration |

546 |

|

395 |

|

1,712 |

|

1,267 |

|

|

| |

|

|

|

|

|

|

|

|

|

- The Company issued new shares in

its subsidiary Khuiten Metals Pte Ltd (Khuiten) on 10 March 2023 as

part of the Zijin Strategic Partnership for consideration of

US$35M. This transaction reduces the Company’s

shareholding from 100% to 50% in Khuiten, and in effect loss of

majority control. All quarterly results for 2023 above are

presented on the basis of the treatment of the investment of

Khuiten as a 50% JV under the equity accounting method (i.e., the

Khuiten operational results are not included on consolidation). The

prior period quarters have not been restated.

- Reflects invoiced metres paid

during the quarter under drilling contract. Physical metres drilled

during the quarter may vary due to invoice timing.

- Excludes horizontal trenching

metres.

- Excludes Kharmagtai JV Gross

exploration expenditure no longer consolidated in the Company’s

results.

- Includes success fee of AUD$753k

paid to Jefferies in April 2023 following completion of Khuiten JV

with Zijin.

- As operator of Khuiten JV, the

operator overheads are recoverable in accordance with the

Shareholders Joint Venture Agreement.

|

Financial

Capital Structure

On 31 December 2023, the Company had

1,700,820,681 fully paid ordinary shares and 121,860,000 options

over ordinary shares on issue, and approximately A$7.3 million in

cash. This total of ordinary shares excludes the Tranche 2

placement to Zijin which remains subject to shareholder approval at

the EGM scheduled on 6 February 2024 (see below). The Khuiten JV,

which controls the Kharmagtai project, had US$11.7 million in cash

available to progress the Kharmagtai PFS and exploration.

Equity Placement

Xanadu announced an A$4.3 million equity

placement (before costs) on 20 November 2023 to provide funding for

its strategic Horizons 2 and 3, as well as working capital.26 This

was well supported by both domestic and international institutions

and included proportionate participation by Zijin, Xanadu’s largest

shareholder. The placement was offered across two tranches to

eligible and sophisticated investors, comprising 78,181,818 fully

paid ordinary shares in Xanadu at an issue price of $0.055

each:

-

First tranche, being the issue of 62,996,490 New Shares to raise

A$3.36 million, is unconditional and was issued pursuant to the

Company’s existing placement capacity under ASX Listing Rule

7.1.

-

Second tranche, being the proposed subscription of 15,185,328 New

Shares by Xanadu’s major shareholder Zijin for A$0.84 million, is

subject to formal documentation and approval by Australia Foreign

Investment Review Board (FIRB) and Xanadu

shareholder approval.

Bell Potter Securities Limited acted as Lead

Manager and Ord Minnett acted as Co-Manager to the Placement.

An EGM is scheduled on 6 February 2024 to seek

the necessary Xanadu shareholder approvals.27

About Xanadu Mines

Xanadu is an ASX and TSX listed Exploration

company operating in Mongolia. We give investors exposure to

globally significant, large-scale copper-gold discoveries and

low-cost inventory growth. Xanadu maintains a portfolio of

exploration projects and remains one of the few junior explorers on

the ASX or TSX who jointly control a globally significant

copper-gold deposit in our flagship Kharmagtai project.

Figure 4: Location of Xanadu

Projects in the South Gobi region of Mongolia

For further information on Xanadu, please visit:

www.xanadumines.com or contact:

|

Colin MoorheadExecutive Chairman & Managing DirectorE:

colin.moorhead@xanadumines.com P: +61 2 8280 7497 |

Spencer ColeChief Financial & Development OfficerE:

spencer.cole@xanadumines.com P: +61 2 8280 7497 |

|

|

|

This Announcement was authorised for release by

Xanadu’s Board of Directors.

APPENDIX 1: TABLES

For original announcements please refer to the following:

- 4 October 2023 - High Grade Core Shaping Up at White Hill

- 26 October 2023 - New Gold Zone Discovered at Golden Eagle

- 16 November 2023 - Multiple New Breakthrough Achievements for

Kharmagtai Discovery Drilling

Table 1. Drill hole details from the quarter

(KH prefix = Kharmagtai, OU prefix = Red Mountain, excludes drill

holes completed in the prior quarter).

|

Hole ID |

Prospect |

East |

North |

RL |

Azimuth (°) |

Inc (°) |

Depth (m) |

|

KHDDH684 |

Golden Eagle |

595224 |

4876746 |

1270 |

359 |

-60 |

341.0 |

|

KHDDH685 |

Golden Eagle |

595226 |

4876847 |

1269 |

360 |

-60 |

325.0 |

|

KHDDH700 |

Golden Eagle |

595598 |

4876901 |

1269 |

0 |

-60 |

267.0 |

|

KHDDH701 |

Golden Eagle |

595597 |

4877002 |

1268 |

0 |

-60 |

220.0 |

|

KHDDH718 |

Zephyr |

595397 |

4877445 |

1267 |

0 |

-60 |

360.5 |

|

KHDDH721 |

Zephyr |

595523 |

4877497 |

1266 |

0 |

-60 |

405.5 |

|

KHDDH723 |

Zephyr |

595649 |

4877663 |

1266 |

0 |

-60 |

369.5 |

|

KHDDH736 |

Zephyr |

595524 |

4877596 |

1265 |

0 |

-60 |

314.0 |

|

KHDDH745 |

Zephyr |

595774 |

4877744 |

1270 |

0 |

-60 |

385.0 |

|

KHDDH779 |

Exploration |

593999 |

4876523 |

1285 |

0 |

-70 |

2132.7 |

|

KHDDH794 |

Exploration |

597193 |

4876330 |

1275 |

0 |

-60 |

200.0 |

|

KHDDH795 |

Exploration |

594260 |

4875729 |

1285 |

315 |

-60 |

498.4 |

|

KHDDH796 |

Exploration |

595818 |

4874725 |

1292 |

315 |

-60 |

93.0 |

|

KHDDH797 |

Exploration |

596531 |

4875896 |

1282 |

315 |

-60 |

200.0 |

|

KHDDH798 |

Exploration |

594900 |

4875664 |

1278 |

315 |

-60 |

200.0 |

|

KHDDH799 |

Exploration |

591077 |

4874898 |

1326 |

315 |

-60 |

200.0 |

|

KHDDH800 |

Exploration |

590011 |

4874691 |

1347 |

315 |

-60 |

201.0 |

|

KHDDH801 |

Golden Eagle |

595277 |

4876894 |

1269 |

0 |

-60 |

288.5 |

|

KHDDH802 |

Golden Eagle |

595332 |

4876839 |

1270 |

0 |

-60 |

285.5 |

|

KHDDH803 |

Golden Eagle |

595401 |

4876841 |

1269 |

0 |

-60 |

291.0 |

|

KHDDH804 |

Golden Eagle |

595328 |

4876942 |

1269 |

0 |

-60 |

279.5 |

|

KHDDH805 |

Golden Eagle |

595399 |

4876919 |

1269 |

0 |

-60 |

279.6 |

|

KHDDH806 |

White Hill |

592393 |

4877472 |

1293 |

180 |

-70 |

848.3 |

|

KHDDH807 |

White Hill |

591788 |

4876469 |

1317 |

0 |

-60 |

1212.7 |

|

KHDDH808 |

White Hill |

591959 |

4876661 |

1310 |

0 |

-60 |

1188.6 |

|

KHDDH809 |

Pechko |

597845 |

4877219 |

1265 |

0 |

-70 |

1200.0 |

|

KHDDH810 |

Altan Shand |

591291 |

4878056 |

1296 |

318 |

-60 |

444.6 |

|

KHDDH811 |

White Hill |

591099 |

4877967 |

1296 |

315 |

-60 |

450.8 |

|

KHDDH812 |

White Hill |

591328 |

4878186 |

1291 |

318 |

-60 |

230.0 |

Table 2. Significant drill results from the

quarter (KH prefix = Kharmagtai, OU prefix = Red

Mountain)

|

Hole ID |

Prospect |

From (m) |

To (m) |

Interval (m) |

Au (g/t) |

Cu (%) |

eCu (%) |

eAu (g/t) |

|

KHDDH684 |

Golden Eagle |

49 |

248 |

199 |

0.15 |

0.09 |

0.17 |

0.34 |

|

including |

|

186 |

220 |

34 |

0.33 |

0.17 |

0.34 |

0.67 |

|

and |

|

282.5 |

341 |

58.5 |

0.09 |

0.16 |

0.20 |

0.39 |

|

KHDDH685 |

Golden Eagle |

34 |

325 |

291 |

0.22 |

0.14 |

0.25 |

0.49 |

|

including |

|

70 |

74 |

4 |

1.26 |

0.14 |

0.78 |

1.53 |

|

including |

|

124 |

133.6 |

9.6 |

0.18 |

0.16 |

0.25 |

0.50 |

|

including |

|

144.95 |

240 |

95.05 |

0.35 |

0.16 |

0.34 |

0.66 |

|

KHDDH686 |

Golden Eagle |

38 |

267.6 |

229.6 |

0.25 |

0.13 |

0.25 |

0.50 |

|

including |

|

50 |

66 |

16 |

0.60 |

0.11 |

0.42 |

0.82 |

|

including |

|

94 |

102 |

8 |

0.41 |

0.15 |

0.36 |

0.71 |

|

including |

|

122 |

148 |

26 |

0.33 |

0.17 |

0.34 |

0.66 |

|

including |

|

176 |

202 |

26 |

0.40 |

0.14 |

0.35 |

0.69 |

|

KHDDH687 |

Golden Eagle |

37 |

73 |

36 |

0.12 |

0.11 |

0.17 |

0.33 |

|

KHDDH688 |

Golden Eagle |

36 |

144 |

108 |

0.33 |

0.11 |

0.28 |

0.54 |

|

including |

|

100 |

142 |

42 |

0.53 |

0.15 |

0.42 |

0.82 |

|

including |

|

122 |

132.9 |

10.9 |

0.72 |

0.25 |

0.61 |

1.20 |

|

and |

|

156 |

216 |

60 |

0.16 |

0.05 |

0.14 |

0.27 |

|

KHDDH689 |

Golden Eagle |

35.26 |

300 |

264.74 |

0.20 |

0.13 |

0.23 |

0.45 |

|

including |

|

55 |

65 |

10 |

0.38 |

0.12 |

0.32 |

0.62 |

|

including |

|

131 |

139 |

8 |

0.39 |

0.17 |

0.37 |

0.73 |

|

including |

|

181 |

185 |

4 |

0.36 |

0.18 |

0.36 |

0.71 |

|

including |

|

234 |

252 |

18 |

0.34 |

0.19 |

0.37 |

0.72 |

|

KHDDH690 |

Golden Eagle |

43 |

200 |

157 |

0.28 |

0.12 |

0.27 |

0.52 |

|

including |

|

53 |

93 |

40 |

0.31 |

0.14 |

0.30 |

0.58 |

|

including |

|

103 |

136 |

33 |

0.38 |

0.16 |

0.35 |

0.69 |

|

KHDDH691 |

Golden Eagle |

37.7 |

243 |

205.3 |

0.44 |

0.14 |

0.36 |

0.71 |

|

including |

|

48.3 |

80 |

31.7 |

0.49 |

0.12 |

0.37 |

0.73 |

|

including |

|

96 |

127 |

31 |

1.21 |

0.24 |

0.86 |

1.68 |

|

including |

|

96 |

175 |

79 |

0.71 |

0.20 |

0.56 |

1.09 |

|

including |

|

100 |

104 |

4 |

2.58 |

0.52 |

1.84 |

3.60 |

|

including |

|

119 |

125 |

6 |

2.58 |

0.49 |

1.81 |

3.55 |

|

including |

|

185 |

189 |

4 |

0.32 |

0.14 |

0.31 |

0.60 |

|

including |

|

221 |

231 |

10 |

0.34 |

0.12 |

0.30 |

0.58 |

|

and |

|

277 |

289 |

12 |

0.05 |

0.06 |

0.08 |

0.16 |

|

KHDDH692 |

Golden Eagle |

36 |

121 |

85 |

0.21 |

0.10 |

0.21 |

0.41 |

|

including |

|

80 |

107.1 |

27.1 |

0.35 |

0.15 |

0.32 |

0.63 |

|

KHDDH693 |

Golden Eagle |

36 |

175 |

139 |

0.20 |

0.11 |

0.21 |

0.41 |

|

including |

|

161 |

173 |

12 |

0.24 |

0.17 |

0.30 |

0.58 |

|

KHDDH694 |

Golden Eagle |

45 |

68 |

23 |

0.09 |

0.06 |

0.10 |

0.20 |

|

and |

|

86 |

124 |

38 |

0.12 |

0.05 |

0.11 |

0.21 |

|

KHDDH695 |

Golden Eagle |

39 |

228.6 |

189.6 |

0.30 |

0.12 |

0.28 |

0.54 |

|

including |

|

43 |

63 |

20 |

0.49 |

0.11 |

0.36 |

0.71 |

|

including |

|

125 |

153 |

28 |

0.34 |

0.15 |

0.32 |

0.62 |

|

including |

|

163 |

215 |

52 |

0.37 |

0.15 |

0.34 |

0.67 |

|

KHDDH696 |

Golden Eagle |

41.9 |

192.5 |

150.6 |

0.23 |

0.10 |

0.21 |

0.42 |

|

including |

|

48 |

76 |

28 |

0.49 |

0.15 |

0.39 |

0.77 |

|

including |

|

86 |

90 |

4 |

0.37 |

0.13 |

0.32 |

0.62 |

|

including |

|

144 |

148 |

4 |

0.50 |

0.17 |

0.43 |

0.84 |

|

including |

|

174 |

178 |

4 |

0.52 |

0.13 |

0.40 |

0.78 |

|

KHDDH697 |

Golden Eagle |

38.7 |

116 |

77.3 |

0.18 |

0.09 |

0.18 |

0.36 |

|

including |

|

40 |

70 |

30 |

0.30 |

0.13 |

0.29 |

0.56 |

|

KHDDH698 |

Golden Eagle |

31 |

243 |

212 |

0.32 |

0.13 |

0.29 |

0.57 |

|

including |

|

35 |

43 |

8 |

0.53 |

0.08 |

0.35 |

0.68 |

|

including |

|

67 |

90.75 |

23.75 |

0.44 |

0.18 |

0.40 |

0.79 |

|

including |

|

117 |

154 |

37 |

0.48 |

0.17 |

0.42 |

0.82 |

|

including |

|

176 |

188 |

12 |

0.32 |

0.19 |

0.35 |

0.68 |

|

including |

|

198 |

222 |

24 |

0.32 |

0.17 |

0.34 |

0.66 |

|

and |

|

253 |

275 |

22 |

0.14 |

0.14 |

0.21 |

0.41 |

|

KHDDH699 |

Golden Eagle |

36 |

50 |

14 |

0.21 |

0.04 |

0.14 |

0.28 |

|

KHDDH700 |

Golden Eagle |

43.5 |

196 |

152.5 |

0.22 |

0.09 |

0.20 |

0.39 |

|

including |

|

96 |

106 |

10 |

0.35 |

0.14 |

0.32 |

0.63 |

|

including |

|

168 |

182 |

14 |

0.59 |

0.15 |

0.46 |

0.89 |

|

including |

|

172 |

176 |

4 |

1.10 |

0.24 |

0.80 |

1.56 |

|

KHDDH701 |

Golden Eagle |

40.25 |

123 |

82.75 |

0.16 |

0.09 |

0.18 |

0.34 |

|

including |

|

42 |

46 |

4 |

0.46 |

0.16 |

0.39 |

0.76 |

|

KHDDH702 |

Golden Eagle |

41.2 |

201 |

159.8 |

0.25 |

0.12 |

0.25 |

0.48 |

|

including |

|

45 |

69 |

24 |

0.47 |

0.13 |

0.37 |

0.73 |

|

including |

|

129 |

145 |

16 |

0.30 |

0.14 |

0.29 |

0.58 |

|

and |

|

213 |

219 |

6 |

0.10 |

0.02 |

0.07 |

0.14 |

|

KHDDH703 |

Zephyr |

14.75 |

18.8 |

4.05 |

0.33 |

0.00 |

0.17 |

0.34 |

|

KHDDH704 |

Zephyr |

No significant intercepts |

|

KHDDH705 |

Zephyr |

14 |

42 |

28 |

0.28 |

0.03 |

0.18 |

0.35 |

|

and |

|

58 |

64 |

6 |

0.40 |

0.05 |

0.25 |

0.50 |

|

and |

|

78 |

86 |

8 |

0.11 |

0.02 |

0.08 |

0.15 |

|

KHDDH706 |

Zephyr |

No significant intercepts |

|

KHDDH707 |

Zephyr |

23.9 |

74 |

50.1 |

0.19 |

0.04 |

0.14 |

0.27 |

|

including |

|

48 |

64 |

16 |

0.47 |

0.04 |

0.28 |

0.55 |

|

KHDDH708 |

Zephyr |

40.3 |

157 |

116.7 |

0.18 |

0.09 |

0.18 |

0.35 |

|

including |

|

52 |

58 |

6 |

0.49 |

0.09 |

0.34 |

0.66 |

|

and |

|

171 |

187.1 |

16.1 |

0.26 |

0.04 |

0.17 |

0.33 |

|

and |

|

223 |

227.2 |

4.2 |

0.50 |

0.03 |

0.29 |

0.56 |

|

KHDDH709 |

Zephyr |

16 |

20 |

4 |

0.22 |

0.00 |

0.12 |

0.23 |

|

and |

|

51 |

58 |

7 |

0.20 |

0.03 |

0.14 |

0.27 |

|

KHDDH710 |

Zephyr |

No significant intercepts |

|

KHDDH711 |

Zephyr |

32 |

100 |

68 |

0.09 |

0.10 |

0.15 |

0.29 |

|

KHDDH712 |

Zephyr |

19 |

28 |

9 |

0.14 |

0.02 |

0.09 |

0.17 |

|

and |

|

41.9 |

57.6 |

15.7 |

0.42 |

0.02 |

0.24 |

0.46 |

|

and |

|

121 |

132 |

11 |

0.05 |

0.05 |

0.07 |

0.14 |

|

KHDDH713 |

Zephyr |

18.5 |

56 |

37.5 |

0.25 |

0.08 |

0.20 |

0.40 |

|

including |

|

40 |

48 |

8 |

0.74 |

0.16 |

0.54 |

1.06 |

|

and |

|

76 |

107.2 |

31.2 |

0.14 |

0.06 |

0.13 |

0.26 |

|

and |

|

129 |

140.7 |

11.7 |

0.14 |

0.06 |

0.13 |

0.26 |

|

and |

|

152 |

189.4 |

37.4 |

0.17 |

0.07 |

0.15 |

0.30 |

|

KHDDH714 |

Zephyr |

30 |

38 |

8 |

0.19 |

0.02 |

0.12 |

0.23 |

|

and |

|

48 |

52 |

4 |

0.31 |

0.03 |

0.18 |

0.35 |

|

and |

|

113 |

121 |

8 |

0.27 |

0.01 |

0.15 |

0.29 |

|

and |

|

135 |

142 |

7 |

0.22 |

0.01 |

0.12 |

0.24 |

|

KHDDH715 |

Zephyr |

No significant intercepts |

|

KHDDH716 |

Zephyr |

15.9 |

75 |

59.1 |

0.09 |

0.10 |

0.14 |

0.28 |

|

KHDDH717 |

Zephyr |

16.2 |

235 |

218.8 |

0.20 |

0.13 |

0.23 |

0.45 |

|

including |

|

47 |

73 |

26 |

0.46 |

0.24 |

0.47 |

0.93 |

|

including |

|

138 |

144 |

6 |

0.27 |

0.17 |

0.31 |

0.60 |

|

including |

|

205 |

223 |

18 |

0.21 |

0.22 |

0.33 |

0.64 |

|

KHDDH718 |

Zephyr |

49 |

67 |

18 |

0.25 |

0.04 |

0.16 |

0.32 |

|

and |

|

149 |

153 |

4 |

0.19 |

0.05 |

0.14 |

0.28 |

|

and |

|

171 |

356 |

185 |

0.21 |

0.12 |

0.22 |

0.44 |

|

including |

|

211 |

215 |

4 |

0.42 |

0.17 |

0.38 |

0.75 |

|

including |

|

265 |

276 |

11 |

0.86 |

0.16 |

0.60 |

1.17 |

|

including |

|

269.5 |

276 |

6.5 |

1.29 |

0.15 |

0.81 |

1.59 |

|

including |

|

304 |

338 |

34 |

0.33 |

0.20 |

0.37 |

0.72 |

|

KHDDH719 |

Zephyr |

45 |

49 |

4 |

0.19 |

0.04 |

0.14 |

0.27 |

|

and |

|

91 |

160 |

69 |

0.13 |

0.07 |

0.13 |

0.26 |

|

KHDDH720 |

Zephyr |

38 |

62 |

24 |

0.16 |

0.09 |

0.17 |

0.33 |

|

KHDDH721 |

Zephyr |

104 |

120 |

16 |

0.16 |

0.05 |

0.13 |

0.25 |

|

and |

|

139.5 |

336.9 |

197.4 |

0.13 |

0.16 |

0.23 |

0.45 |

|

including |

|

166 |

172 |

6 |

0.10 |

0.30 |

0.35 |

0.68 |

|

including |

|

193 |

221 |

28 |

0.15 |

0.26 |

0.34 |

0.66 |

|

including |

|

273 |

311 |

38 |

0.19 |

0.21 |

0.31 |

0.60 |

|

including |

|

327 |

336 |

9 |

0.24 |

0.17 |

0.29 |

0.57 |

|

and |

|

347 |

395 |

48 |

0.11 |

0.14 |

0.19 |

0.38 |

|

including |

|

369 |

389 |

20 |

0.11 |

0.21 |

0.27 |

0.52 |

|

KHDDH722 |

Zephyr |

23.2 |

144 |

120.8 |

0.26 |

0.18 |

0.32 |

0.62 |

|

including |

|

23.2 |

87 |

63.8 |

0.44 |

0.25 |

0.47 |

0.93 |

|

including |

|

25 |

45 |

20 |

0.89 |

0.25 |

0.70 |

1.37 |

|

including |

|

65 |

76.8 |

11.8 |

0.36 |

0.42 |

0.60 |

1.18 |

|

KHDDH723 |

Zephyr |

43 |

246 |

203 |

0.18 |

0.16 |

0.25 |

0.50 |

|

including |

|

83 |

103 |

20 |

0.13 |

0.33 |

0.39 |

0.77 |

|

including |

|

121 |

129 |

8 |

0.14 |

0.22 |

0.29 |

0.57 |

|

including |

|

141 |

149 |

8 |

0.31 |

0.30 |

0.45 |

0.89 |

|

including |

|

163 |

189 |

26 |

0.23 |

0.18 |

0.30 |

0.59 |

|

including |

|

199 |

219 |

20 |

0.55 |

0.16 |

0.44 |

0.85 |

|

including |

|

201 |

211 |

10 |

0.89 |

0.16 |

0.62 |

1.21 |

|

including |

|

232.7 |

242.3 |

9.6 |

0.23 |

0.09 |

0.20 |

0.40 |

|

and |

|

268 |

272 |

4 |

0.10 |

0.07 |

0.12 |

0.24 |

|

and |

|

312 |

316 |

4 |

0.16 |

0.05 |

0.13 |

0.25 |

|

KHDDH724 |

Zephyr |

13.6 |

118.5 |

104.9 |

0.21 |

0.16 |

0.27 |

0.52 |

|

including |

|

13.6 |

66 |

52.4 |

0.35 |

0.19 |

0.36 |

0.71 |

|

including |

|

26 |

38 |

12 |

0.31 |

0.34 |

0.50 |

0.97 |

|

and |

|

165 |

188 |

23 |

0.22 |

0.05 |

0.16 |

0.32 |

|

KHDDH725 |

Zephyr |

No significant intercepts |

|

KHDDH731 |

Zephyr |

59 |

65 |

6 |

0.22 |

0.03 |

0.14 |

0.28 |

|

and |

|

89 |

101 |

12 |

0.22 |

0.03 |

0.14 |

0.27 |

|

KHDDH732 |

Zephyr |

21.6 |

62 |

40.4 |

0.10 |

0.12 |

0.17 |

0.34 |

|

and |

|

74 |

200 |

126 |

0.13 |

0.22 |

0.29 |

0.57 |

|

including |

|

74 |

88 |

14 |

0.23 |

0.20 |

0.32 |

0.63 |

|

including |

|

98 |

108.2 |

10.2 |

0.23 |

0.25 |

0.37 |

0.72 |

|

including |

|

119.4 |

171 |

51.6 |

0.12 |

0.29 |

0.35 |

0.69 |

|

KHDDH736 |

Zephyr |

48 |

54 |

6 |

0.07 |

0.08 |

0.12 |

0.23 |

|

and |

|

68 |

264 |

196 |

0.25 |

0.12 |

0.25 |

0.48 |

|

including |

|

128 |

163.8 |

35.8 |

0.33 |

0.17 |

0.34 |

0.67 |

|

including |

|

184.2 |

211 |

26.8 |

1.00 |

0.16 |

0.68 |

1.32 |

|

including |

|

184.2 |

188.9 |

4.7 |

1.23 |

0.37 |

1.00 |

1.96 |

|

including |

|

200 |

209 |

9 |

1.77 |

0.17 |

1.07 |

2.10 |

|

KHDDH740 |

Zephyr |

31.2 |

59 |

27.8 |

0.04 |

0.10 |

0.12 |

0.23 |

|

KHDDH745 |

Zephyr |

38.8 |

104.9 |

66.1 |

0.10 |

0.21 |

0.26 |

0.51 |

|

including |

|

60 |

80 |

20 |

0.13 |

0.27 |

0.33 |

0.65 |

|

and |

|

171 |

179.2 |

8.2 |

0.16 |

0.06 |

0.15 |

0.29 |

|

and |

|

242 |

256 |

14 |

0.25 |

0.03 |

0.16 |

0.31 |

|

including |

|

242 |

252 |

10 |

0.32 |

0.03 |

0.20 |

0.38 |

|

and |

|

270 |

351 |

81 |

0.14 |

0.09 |

0.17 |

0.33 |

|

including |

|

270 |

277.3 |

7.3 |

0.53 |

0.07 |

0.34 |

0.66 |

|

including |

|

293 |

299 |

6 |

0.22 |

0.21 |

0.32 |

0.62 |

|

KHDDH752 |

Zephyr |

27.5 |

40 |

12.5 |

0.08 |

0.03 |

0.07 |

0.15 |

|

and |

|

111.1 |

118 |

6.9 |

0.07 |

0.07 |

0.10 |

0.20 |

|

and |

|

142 |

210 |

68 |

0.08 |

0.19 |

0.23 |

0.45 |

|

including |

|

156 |

160 |

4 |

0.29 |

0.24 |

0.39 |

0.76 |

|

including |

|

202 |

208 |

6 |

0.08 |

0.28 |

0.32 |

0.62 |

|

KHDDH761 |

Exploration |

39.5 |

141 |

101.5 |

0.19 |

0.06 |

0.16 |

0.30 |

|

including |

|

80 |

88 |

8 |

0.32 |

0.08 |

0.24 |

0.47 |

|

including |

|

98 |

106 |

8 |

0.61 |

0.07 |

0.38 |

0.74 |

|

and |

|

151 |

161 |

10 |

0.12 |

0.06 |

0.12 |

0.24 |

|

and |

|

175 |

225 |

50 |

0.11 |

0.09 |

0.14 |

0.28 |

|

and |

|

235 |

239 |

4 |

0.17 |

0.20 |

0.29 |

0.56 |

|

and |

|

261 |

267.5 |

6.5 |

0.37 |

0.16 |

0.35 |

0.69 |

|

and |

|

277 |

293.85 |

16.85 |

0.23 |

0.10 |

0.22 |

0.43 |

|

and |

|

316 |

337.5 |

21.5 |

0.22 |

0.07 |

0.18 |

0.35 |

|

including |

|

324 |

334 |

10 |

0.28 |

0.09 |

0.24 |

0.46 |

|

KHDDH762 |

Exploration |

43 |

96.3 |

53.3 |

0.21 |

0.07 |

0.17 |

0.34 |

|

and |

|

113.1 |

178.2 |

65.1 |

0.28 |

0.06 |

0.20 |

0.39 |

|

including |

|

129 |

145 |

16 |

0.44 |

0.07 |

0.30 |

0.58 |

|

KHDDH763 |

Exploration |

173 |

179 |

6 |

0.21 |

0.01 |

0.12 |

0.23 |

|

KHDDH764 |

Exploration |

56.9 |

67 |

10.1 |

0.27 |

0.11 |

0.25 |

0.48 |

|

including |

|

56.9 |

63 |

6.1 |

0.35 |

0.14 |

0.32 |

0.63 |

|

and |

|

129 |

139 |

10 |

0.50 |

0.06 |

0.31 |

0.61 |

|

including |

|

135 |

139 |

4 |

0.80 |

0.07 |

0.48 |

0.93 |

|

and |

|

149.25 |

194 |

44.75 |

0.21 |

0.09 |

0.20 |

0.39 |

|

including |

|

169 |

177 |

8 |

0.53 |

0.21 |

0.48 |

0.94 |

|

KHDDH765 |

Exploration |

144 |

150.5 |

6.5 |

0.29 |

0.12 |

0.27 |

0.52 |

|

KHDDH766 |

Exploration |

No significant intercepts |

|

KHDDH767 |

Exploration |

No significant intercepts |

|

KHDDH768 |

Exploration |

No significant intercepts |

|

KHDDH769 |

Exploration |

No significant intercepts |

|

KHDDH770 |

Exploration |

42 |

48 |

6 |

0.31 |

0.03 |

0.19 |

0.38 |

|

and |

|

70 |

84 |

14 |

0.03 |

0.12 |

0.14 |

0.27 |

|

and |

|

94 |

148 |

54 |

0.06 |

0.10 |

0.13 |

0.25 |

|

and |

|

181 |

194 |

13 |

0.07 |

0.05 |

0.08 |

0.16 |

|

KHDDH771 |

Exploration |

39 |

65.5 |

26.5 |

0.30 |

0.04 |

0.19 |

0.38 |

|

and |

|

76 |

86.9 |

10.9 |

0.18 |

0.06 |

0.15 |

0.29 |

|

and |

|

108 |

123.4 |

15.4 |

0.13 |

0.12 |

0.18 |

0.35 |

|

KHDDH772 |

Exploration |

41.3 |

51 |

9.7 |

0.19 |

0.05 |

0.15 |

0.29 |

|

KHDDH773 |

Exploration |

No significant intercepts |

|

KHDDH774 |

Exploration |

92.2 |

107 |

14.8 |

0.44 |

0.01 |

0.23 |

0.46 |

|

KHDDH775 |

Exploration |

No significant intercepts |

|

KHDDH776 |

Exploration |

No significant intercepts |

|

KHDDH777 |

Exploration |

No significant intercepts |

|

KHDDH778 |

Exploration |

No significant intercepts |

|

KHDDH779 |

Exploration |

66 |

78 |

12 |

0.13 |

0.08 |

0.14 |

0.28 |

|

and |

|

320 |

326 |

6 |

0.35 |

0.13 |

0.31 |

0.60 |

|

and |

|

499 |

505 |

6 |

0.01 |

0.11 |

0.11 |

0.22 |

|

and |

|

557 |

577 |

20 |

0.09 |

0.12 |

0.16 |

0.32 |

|

and |

|

587 |

595 |

8 |

0.02 |

0.11 |

0.12 |

0.23 |

|

and |

|

611 |

621 |

10 |

0.02 |

0.08 |

0.09 |

0.18 |

|

and |

|

661 |

673 |

12 |

0.04 |

0.08 |

0.11 |

0.21 |

|

and |

|

782 |

788 |

6 |

0.06 |

0.07 |

0.10 |

0.19 |

|

and |

|

810 |

820 |

10 |

0.05 |

0.07 |

0.10 |

0.19 |

|

and |

|

874 |

1118 |

244 |

0.03 |

0.13 |

0.15 |

0.29 |

|

including |

|

980 |

984 |

4 |

0.09 |

0.28 |

0.33 |

0.64 |

|

including |

|

1087 |

1098 |

11 |

0.05 |

0.19 |

0.22 |

0.42 |

|

and |

|

1132 |

1430 |

298 |

0.07 |

0.13 |

0.17 |

0.33 |

|

including |

|

1253.65 |

1263 |

9.35 |

0.06 |

0.23 |

0.26 |

0.51 |

|

including |

|

1362 |

1367 |

5 |

1.11 |

0.32 |

0.89 |

1.73 |

|

and |

|

1442 |

1486 |

44 |

0.06 |

0.08 |

0.11 |

0.22 |

|

and |

|

1496 |

1517 |

21 |

0.01 |

0.09 |

0.10 |

0.19 |

|

and |

|

1577 |

1585 |

8 |

0.16 |

0.15 |

0.23 |

0.44 |

|

and |

|

1649 |

1658 |

9 |

0.02 |

0.04 |

0.05 |

0.10 |

|

and |

|

1724 |

1730 |

6 |

0.03 |

0.15 |

0.17 |

0.33 |

|

and |

|

1756 |

1831 |

75 |

0.07 |

0.08 |

0.11 |

0.22 |

|

and |

|

1885 |

1930.8 |

45.8 |

0.05 |

0.10 |

0.13 |

0.25 |

|

including |

|

1925 |

1930.8 |

5.8 |

0.08 |

0.24 |

0.28 |

0.55 |

|

and |

|

1940 |

2050 |

110 |

0.08 |

0.18 |

0.22 |

0.44 |

|

including |

|

1996 |

2014.4 |

18.4 |

0.13 |

0.37 |

0.44 |

0.85 |

|

including |

|

2036 |

2050 |

14 |

0.16 |

0.22 |

0.30 |

0.59 |

|

and |

|

2068 |

2078.1 |

10.1 |

0.04 |

0.09 |

0.11 |

0.22 |

|

KHDDH780 |

Exploration |

No significant intercepts |

|

KHDDH781 |

Exploration |

No significant intercepts |

|

KHDDH782 |

Exploration |

No significant intercepts |

|

KHDDH783 |

Exploration |

29 |

68 |

39 |

0.06 |

0.08 |

0.11 |

0.22 |

|

and |

|

88 |

144 |

56 |

0.08 |

0.15 |

0.19 |

0.37 |

|

including |

|

106 |

110 |

4 |

0.20 |

0.44 |

0.54 |

1.05 |

|

and |

|

194 |

211 |

17 |

0.06 |

0.08 |

0.11 |

0.22 |

|

KHDDH784 |

Exploration |

224 |

228 |

4 |

0.19 |

0.09 |

0.18 |

0.36 |

|

and |

|

274 |

279.6 |

5.6 |

0.12 |

0.08 |

0.14 |

0.27 |

|

KHDDH785 |

Exploration |

No significant intercepts |

|

KHDDH786 |

Exploration |

41 |

45 |

4 |

0.64 |

0.01 |

0.34 |

0.66 |

|

and |

|

79 |

87 |

8 |

0.24 |

0.00 |

0.13 |

0.25 |

|

and |

|

117 |

261 |

144 |

0.18 |

0.25 |

0.34 |

0.67 |

|

including |

|

127 |

225 |

98 |

0.22 |

0.30 |

0.41 |

0.81 |

|

including |

|

144 |

156 |

12 |

0.31 |

0.47 |

0.63 |

1.23 |

|

including |

|

168 |

180.3 |

12.3 |

0.28 |

0.40 |

0.54 |

1.05 |

|

KHDDH787 |

Exploration |

22 |

38 |

16 |

0.14 |

0.12 |

0.19 |

0.37 |

|

including |

|

32 |

38 |

6 |

0.27 |

0.26 |

0.40 |

0.78 |

|

and |

|

56 |

70 |

14 |

0.10 |

0.13 |

0.18 |

0.35 |

|

and |

|

86 |

95 |

9 |

0.05 |

0.12 |

0.14 |

0.28 |

|

and |

|

128 |

138 |

10 |

0.12 |

0.06 |

0.13 |

0.25 |

|

and |

|

188 |

199 |

11 |

0.07 |

0.07 |

0.11 |

0.21 |

|

KHDDH788 |

Exploration |

141 |

145 |

4 |

0.18 |

0.03 |

0.12 |

0.23 |

|

KHDDH789 |

Exploration |

80 |

85 |

5 |

0.18 |

0.05 |

0.14 |

0.27 |

|

and |

|

271 |

275 |

4 |

0.18 |

0.05 |

0.14 |

0.27 |

|

KHDDH790 |

Exploration |

112 |

134 |

22 |

0.06 |

0.04 |

0.07 |

0.13 |

|

KHDDH791 |

Exploration |

132 |

136 |

4 |

0.03 |

0.11 |

0.13 |

0.25 |

|

and |

|

146 |

152 |

6 |

0.12 |

0.09 |

0.15 |

0.29 |

|

KHDDH792 |

Exploration |

24 |

30 |

6 |

0.03 |

0.14 |

0.15 |

0.30 |

|

and |

|

123 |

130.9 |

7.9 |

0.04 |

0.07 |

0.09 |

0.18 |

|

and |

|

172 |

184 |

12 |

0.05 |

0.07 |

0.10 |

0.19 |

|

and |

|

204 |

214 |

10 |

0.07 |

0.07 |

0.11 |

0.22 |

|

KHDDH793 |

Exploration |

51 |

63 |

12 |

0.05 |

0.07 |

0.10 |

0.19 |

|

and |

|

106 |

126 |

20 |

0.15 |

0.25 |

0.33 |

0.64 |

|

including |

|

110 |

124 |

14 |

0.13 |

0.32 |

0.39 |

0.76 |

|

and |

|

138 |

158 |

20 |

0.10 |

0.08 |

0.13 |

0.26 |

|

KHDDH794 |

Exploration |

No significant intercepts |

|

KHDDH795 |

Exploration |

68 |

94 |

26 |

0.03 |

0.07 |

0.09 |

0.17 |

|

and |

|

141 |

151 |

10 |

0.11 |

0.11 |

0.17 |

0.33 |

|

and |

|

194.1 |

294 |

99.9 |

0.22 |

0.08 |

0.19 |

0.37 |

|

including |

|

262 |

279.5 |

17.5 |

0.32 |

0.11 |

0.27 |

0.54 |

|

and |

|

308 |

330 |

22 |

0.13 |

0.06 |

0.13 |

0.25 |

|

and |

|

340 |

435 |

95 |

0.17 |

0.07 |

0.16 |

0.31 |

|

including |

|

382 |

388 |

6 |

0.35 |

0.17 |

0.35 |

0.68 |

|

including |

|

404.5 |

410.8 |

6.3 |

0.14 |

0.10 |

0.18 |

0.34 |

|

and |

|

491 |

495 |

4 |

0.17 |

0.06 |

0.15 |

0.30 |

|

KHDDH796 |

Exploration |

No significant intercepts |

|

KHDDH797 |

Exploration |

161 |

165 |

4 |

0.48 |

0.02 |

0.26 |

0.51 |

|

KHDDH798 |

Exploration |

14 |

28 |

14 |

0.09 |

0.09 |

0.13 |

0.26 |

|

and |

|

134 |

154 |

20 |

0.04 |

0.13 |

0.15 |

0.29 |

|

KHDDH799 |

Exploration |

No significant intercepts |

|

KHDDH800 |

Exploration |

No significant intercepts |

|

KHDDH801 |

Golden Eagle |

36.6 |

120 |

83.4 |

0.59 |

0.11 |

0.41 |

0.80 |

|

including |

|

57 |

86 |

29 |

1.14 |

0.14 |

0.73 |

1.42 |

|

including |

|

60 |

74 |

14 |

1.90 |

0.14 |

1.11 |

2.18 |

|

including |

|

106 |

114.2 |

8.2 |

0.46 |

0.12 |

0.35 |

0.69 |

|

and |

|

140 |

288.5 |

148.5 |

0.29 |

0.12 |

0.26 |

0.51 |

|

including |

|

201 |

209 |

8 |

0.33 |

0.15 |

0.32 |

0.62 |

|

including |

|

244 |

264 |

20 |

0.72 |

0.18 |

0.55 |

1.07 |

|

KHDDH802 |

Golden Eagle |

35.5 |

285.5 |

250 |

0.37 |

0.12 |

0.31 |

0.60 |

|

including |

|

84 |

180 |

96 |

0.55 |

0.14 |

0.41 |

0.81 |

|

including |

|

206 |

212 |

6 |

0.41 |

0.11 |

0.32 |

0.63 |

|

including |

|

232 |

252 |

20 |

0.39 |

0.15 |

0.35 |

0.68 |

|

KHDDH803 |

Golden Eagle |

36.8 |

244 |

207.2 |

0.20 |

0.11 |

0.21 |

0.42 |

|

including |

|

88 |

98 |

10 |

0.29 |

0.16 |

0.30 |

0.59 |

|

including |

|

170 |

200 |

30 |

0.34 |

0.12 |

0.30 |

0.58 |

|

and |

|

254 |

270.2 |

16.2 |

0.07 |

0.06 |

0.10 |

0.19 |

|

KHDDH804 |

Golden Eagle |

38.1 |

88 |

49.9 |

0.40 |

0.10 |

0.30 |

0.59 |

|

including |

|

38.9 |

58.8 |

19.9 |

0.61 |

0.16 |

0.47 |

0.92 |

|

and |

|

99.25 |

277 |

177.75 |

0.23 |

0.11 |

0.23 |

0.44 |

|

including |

|

113.8 |

178 |

64.2 |

0.42 |

0.14 |

0.35 |

0.69 |

|

including |

|

236 |

244.6 |

8.6 |

0.25 |

0.15 |

0.27 |

0.54 |

|

KHDDH805 |

Golden Eagle |

41.6 |

195 |

153.4 |

0.43 |

0.13 |

0.35 |

0.68 |

|

including |

|

44 |

111 |

67 |

0.67 |

0.15 |

0.50 |

0.97 |

|

including |

|

54 |

62 |

8 |

1.34 |

0.18 |

0.87 |

1.70 |

|

including |

|

54 |

60 |

6 |

1.43 |

0.18 |

0.91 |

1.78 |

|

including |

|

77 |

91 |

14 |

0.81 |

0.21 |

0.62 |

1.22 |

|

including |

|

127 |

133 |

6 |

0.37 |

0.15 |

0.34 |

0.66 |

|

and |

|

267 |

278 |

11 |

0.06 |

0.05 |

0.08 |

0.15 |

|

KHDDH806 |

White Hill |

2 |

146 |

144 |

0.06 |

0.13 |

0.16 |

0.32 |

|

and |

|

156 |

443.4 |

287.4 |

0.07 |

0.18 |

0.21 |

0.41 |

|

including |

|

386 |

443.4 |

57.4 |

0.15 |

0.29 |

0.36 |

0.71 |

|

and |

|

545 |

595 |

50 |

0.94 |

0.25 |

0.73 |

1.42 |

|

including |

|

549 |

571 |

22 |

2.10 |

0.26 |

1.34 |

2.62 |

|

and |

|

779 |

821 |

42 |

0.03 |

0.22 |

0.24 |

0.46 |

|

including |

|

781 |

790 |

9 |

0.05 |

0.53 |

0.56 |

1.09 |

|

KHDDH807 |

White Hill |

295 |

353 |

58 |

0.04 |

0.09 |

0.11 |

0.22 |

|

and |

|

367 |

425 |

58 |

0.04 |

0.12 |

0.14 |

0.27 |

|

including |

|

381 |

385 |

4 |

0.09 |

0.36 |

0.40 |

0.79 |

|

and |

|

435 |

994.7 |

559.7 |

0.07 |

0.23 |

0.27 |

0.53 |

|

including |

|

457 |

477 |

20 |

0.09 |

0.19 |

0.23 |

0.46 |

|

including |

|

487 |

499 |

12 |

0.11 |

0.31 |

0.36 |

0.71 |

|

including |

|

512 |

524 |

12 |

0.10 |

0.26 |

0.31 |

0.61 |

|

including |

|

546 |

555.4 |

9.4 |

0.13 |

0.26 |

0.33 |

0.65 |

|

including |

|

685 |

712 |

27 |

0.05 |

0.26 |

0.28 |

0.55 |

|

including |

|

734 |

747 |

13 |

0.08 |

0.33 |

0.37 |

0.72 |

|

including |

|

761 |

983 |

222 |

0.10 |

0.31 |

0.36 |

0.70 |

|

including |

|

834 |

838 |

4 |

0.22 |

0.55 |

0.66 |

1.28 |

|

and |

|

1004 |

1198 |

194 |

0.06 |

0.19 |

0.22 |

0.42 |

|

including |

|

1034 |

1090 |

56 |

0.10 |

0.25 |

0.30 |

0.59 |

|

including |

|

1180 |

1184 |

4 |

0.08 |

0.43 |

0.46 |

0.91 |

|

KHDDH808 |

White Hill |

238 |

242 |

4 |

0.05 |

0.18 |

0.20 |

0.39 |

|

and |

|

282.5 |

319 |

36.5 |

0.07 |

0.15 |

0.18 |

0.36 |

|

including |

|

305 |

311 |

6 |

0.09 |

0.32 |

0.36 |

0.70 |

|

and |

|

333 |

580.45 |

247.45 |

0.11 |

0.29 |

0.35 |

0.68 |

|

including |

|

341 |

346 |

5 |

0.07 |

0.24 |

0.27 |

0.53 |

|

including |

|

465 |

500 |

35 |

0.09 |

0.31 |

0.36 |

0.70 |

|

including |

|

516 |

580.45 |

64.45 |

0.26 |

0.61 |

0.74 |

1.44 |

|

including |

|

556 |

580.45 |

24.45 |

0.53 |

1.14 |

1.41 |

2.75 |

|

including |

|

558 |

571.8 |

13.8 |

0.70 |

1.64 |

1.99 |

3.90 |

|

and |

|

608 |

626 |

18 |

0.19 |

0.05 |

0.14 |

0.28 |

|

including |

|

620 |

624 |

4 |

0.50 |

0.05 |

0.31 |

0.60 |

|

and |

|

644 |

652 |

8 |

0.19 |

0.03 |

0.12 |

0.24 |

|

and |

|

664 |

672 |

8 |

0.10 |

0.15 |

0.20 |

0.39 |

|

and |

|

750 |

1085 |

335 |

0.08 |

0.25 |

0.30 |

0.58 |

|

including |

|

751.7 |

891 |

139.3 |

0.12 |

0.38 |

0.44 |

0.86 |

|

including |

|

786 |

796 |

10 |

0.13 |

0.54 |

0.61 |

1.19 |

|

including |

|

812 |

818 |

6 |

0.27 |

0.85 |

0.99 |

1.94 |

|

including |

|

918 |

926 |

8 |

0.08 |

0.26 |

0.30 |

0.59 |

|

including |

|

958 |

962 |

4 |

0.08 |

0.29 |

0.33 |

0.65 |

|

including |

|

980 |

989 |

9 |

0.22 |

0.22 |

0.33 |

0.64 |

|

including |

|

1028.8 |

1035 |

6.2 |

0.12 |

0.50 |

0.56 |

1.10 |

|

and |

|

1115 |

1127 |

12 |

0.03 |

0.12 |

0.14 |

0.27 |

|

and |

|

1142 |

1172 |

30 |

0.02 |

0.11 |

0.12 |

0.24 |

|

and |

|

1182 |

1186 |

4 |

0.02 |

0.13 |

0.14 |

0.27 |

|

KHDDH809 |

Assays pending |

|

|

|

|

|

|

|

|

KHDDH810 |

Assays pending |