Exco Technologies Limited (TSX-XTC, OTCQX-EXCOF)

today announced results for its fourth quarter and year ended

September 30, 2023. In addition, Exco announced a quarterly

dividend of $0.105 per common share which will be paid on December

29, 2023 to shareholders of record on December 15, 2023. The

dividend is an “eligible dividend” in accordance with the Income

Tax Act of Canada.

|

|

Three Months Ended September 30 |

Twelve Months EndedSeptember 30 |

| (in $

thousands except per share amounts) |

|

|

|

|

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| Sales |

$ |

160,152 |

|

$ |

140,411 |

|

$ |

619,303 |

|

$ |

489,943 |

|

| Net income for the period |

$ |

9,210 |

|

$ |

5,569 |

|

$ |

26,284 |

|

$ |

18,966 |

|

| Earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and Diluted –

Reported |

$ |

0.24 |

|

$ |

0.14 |

|

$ |

0.68 |

|

$ |

0.49 |

|

|

EBITDA |

$ |

22,901 |

|

$ |

16,538 |

|

$ |

74,490 |

|

$ |

53,017 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

“Exco’s F2023 results clearly demonstrate our

aggressive growth strategy is on the right track,” said Darren

Kirk, Exco’s President and CEO. “In addition to substantial

financial growth we pushed operational excellence throughout our

businesses again this year. It is truly inspiring to see the

numerous examples of innovation in both products and processes

happening across Exco which I’m confident will propel us towards

our lofty growth ambitions. I want to thank all Exco employees for

their continued dedication to innovation, efficiency and excellence

- the driving force behind our success.”

Consolidated sales for the fourth quarter ended

September 30, 2023 were $160.2 million compared to $140.4 million

in the same quarter last year – an increase of $19.7 million, or

14%. Foreign exchange rate movements increased sales by $4.8

million in the quarter.

The Automotive Solutions segment experienced a

33% increase in sales, or an increase of $21.6 million, to $87.6

million from $66.0 million in the fourth quarter of 2022. Excluding

the impact of foreign exchange, segment sales increased $19.2

million, or 30%. Sales increased at all four of the segment’s

operations. The sales increase was primarily driven by new program

launches and to a lesser extent higher vehicle production volumes.

North American vehicle production was up 9% compared to a year ago

and European vehicle production was up 6%. During the quarter,

there was virtually no impact of the UAW strike action which

started in mid September before being resolved by late October.

Exco expects a muted impact from these strikes in its first quarter

results in F2024. In the midterm, industry growth may be tempered

by rising interest rates and emerging indicators of a global

recession. Exco will nonetheless benefit from recent and future

program launches that are expected to provide ongoing growth in our

content per vehicle. Quoting activity remains encouraging and we

believe there is ample opportunity to achieve our targeted growth

objectives.

The Casting and Extrusion segment recorded sales

of $72.6 million in the fourth quarter compared to $74.4 million

last year – a decrease of $1.8 million or 2%. Excluding the impact

of foreign exchange movements, the segment’s sales were down 6% for

the quarter. Demand for our extrusion tooling was lower in the

fourth quarter as the impact of higher interest rates and potential

for a global recession reduced orders, mainly from the building and

construction markets. Demand for extrusion tooling for automotive

and sustainable energy markets remains strong and growing, but the

building and construction market is the largest driver of extrusion

tooling. Management remains focused on standardizing manufacturing

processes, enhancing engineering depth and centralizing critical

support functions across its various plants. These initiatives have

reduced lead times, enhanced product quality, expanded product

breadth and increased capacity, all of which position the extrusion

group favourably in the future. In the die-cast market, which

primarily serves the automotive industry, demand and order flow for

new moulds, associated consumable tooling (shot sleeves, rods,

rings, tips, etc.) and rebuild work continued to pick up as

industry vehicle production recovers and new electric vehicles and

more efficient internal combustion engine/transmission platforms

are launched. In addition, demand for Exco’s industry leading

additive (3D printed) tooling has continued to gain significant

traction as customers focus on greater efficiency with the size and

complexity of die-cast tooling continuing to increase. Sales in the

quarter were also aided by price increases, which were implemented

to protect margins from higher input costs. Also impacting revenue

during the quarter was the considerable period over period variance

to the recognition of revenue from some of the larger new-build

moulds, which have high price points relative to other products in

the segment. Quoting activity remains very robust and our backlogs

remain at record levels, which is expected to bode well for sales

into fiscal 2024.

The Company’s fourth quarter consolidated net

income increased to $9.2 million or earnings of $0.24 per share

compared to $5.6 million or earnings of $0.14 per share in the same

quarter last year. The effective income tax rate was 25% in the

current quarter compared 26% in the same quarter last year. The

change in income tax rate in the quarter was impacted by geographic

distribution and foreign tax rate differentials.

Fourth quarter pre-tax earnings in the

Automotive Solutions segment totalled $10.0 million, an increase of

$3.5 million or 54% over the same quarter last year. Although

production volumes continue to experience some challenges with

semiconductor and supply chain constraints, the impact of these

factors has reduced considerably. This has allowed all four

businesses to benefit from improved efficiencies and absorption of

fixed costs to offset the higher raw material and labour costs

experienced in recent years. In addition, the stabilized production

volumes mean improvements to scheduling and managing labour

downtime, fewer expedited shipping and overtime costs experienced

by this segment. Apart from UAW strike-related impacts, Management

is cautiously optimistic that its cost structures have improved to

relatively normal levels such that margins should improve with

strengthening and stabilizing volumes.

Fourth quarter pre-tax earnings in the Casting

and Extrusion segment totalled $5.3 million, an increase of $2.8

million or 108% over the same quarter last year. The pretax profit

improvement is due to improved efficiency in the Extrusion die

business, including improvements at Halex and the elimination of

fiscal 2022 one-time costs associated with outsourcing due to the

extrusion heat treatment implementation. As well, there was

improved absorption and efficiencies as Castool’s heat treatment

operation ramps up, stabilizing raw material and labour costs, and

lower Castool Morocco start up costs. Program pricing and mix has

also improved in the Large Mould group as demand has picked up in

recent quarters while efficiency initiatives continue to take hold.

Offsetting these reduced costs is a $0.5 million increase in

depreciation costs associated with the increased capital

expenditures and start-up losses at Castool’s new operations in

Mexico. Management remains focused on reducing its overall cost

structure and improving manufacturing efficiencies and expects such

activities together with its sales efforts should lead to improved

segment profitability over time.

The Corporate segment in the fourth quarter

recorded expenses of $0.8 million compared to $0.1 million last

year due to higher compensation expenses in the current quarter and

higher foreign exchange gains in fiscal 2022. As a result of the

foregoing, consolidated EBITDA in the quarter was $22.9 million

(14.3% of sales) compared to $16.5 million (11.8% of sales) last

year.

Operating cash flow before net changes in

working capital was $23.5 million in the quarter compared to $17.5

million in the prior year quarter. Higher fourth quarter net

income, depreciation, deferred taxes, and interest expense

contributed to the increased operating cash flow in the current

quarter. Net change in non-cash working capital was $5.9 million

cash used in fiscal 2023 compared to $21.5 million cash used last

year. Cash used for working capital was driven by higher accounts

receivable associated with higher fourth quarter sales and

increased inventory reflecting the strength of our backlog and

ramping up new facilities. Investment in fixed assets of $9.6

million compared to $16.4 million in the prior year quarter.

Included in the current year quarter is $5.2 million in growth

capital. The difference relates to timing of equipment purchases

and the completion of major projects from the prior year. Exco

ended the quarter with $94.2 million in net debt. The Company has

$43.0 million in available liquidity under its banking facilities

at year end.

Outlook

In late fiscal 2021, Exco announced it was

targeting a compounded average annual growth rate (excluding

acquisitions) of approximately 10% for revenues and slightly higher

levels for EBITDA and Net Income through fiscal 2026, which was

anticipated to produce approximately $750 million in annual

Revenue, $120 million in annual EBITDA and an annual EPS of roughly

$1.90 by the end of this timeframe. Exco has made significant

progress towards achieving these targets since they were announced

and continues to believe its Revenue and EBITDA targets remain

obtainable. However, Exco revised its EPS target lower – to

approximately $1.50 – to reflect the significant rise in interest

rates as well as elevated levels of depreciation due to higher than

planned capital expenditures associated with future growth

initiatives. These Revenue, EBITDA and revised EPS targets are

expected to be achieved through the launch of new programs, general

market growth, and also market share gains consistent with the

Company’s operating history.

Despite current macro-economic challenges,

including tightening monetary conditions and strike-related

production shut-downs in some North American OEM plants, the

overall outlook is very favorable across Exco’s segments into the

medium term. Consumer demand for automotive vehicles remains robust

in most markets, despite supply constraints by strike-related

activity in the US, a worldwide shortage of semiconductor chips

and, to a lesser extent, availability of other raw materials,

components and labour. Dealer inventory levels have been improving,

but remain below historical norms, while average transaction prices

for both new and used vehicles are near record highs and the

average age of the broader fleet has continued to increase to an

all-time high. This bodes well for higher levels of future vehicle

production and the sales opportunity of Exco’s various automotive

components and accessories as supply chains normalize. In addition,

OEMs are increasingly looking to the sale of higher margin

accessory products as a means to enhance their own levels of

profitability. Exco’s Automotive Solutions segment derives a

significant amount of activity from such products and is a leader

in the prototyping, development and marketing of the same.

Moreover, the rapid movement towards an electrified and hybrid

fleet for both passenger and commercial vehicles is enticing new

market entrants into the automotive market while causing

traditional OEM incumbents to further differentiate their product

offerings, all of which is driving above average opportunities for

Exco.

With respect to Exco’s Casting and Extrusion

segment, the intensifying global focus on environmental

sustainability has created significant growth drivers that are

expected to persist through at least the next decade. Automotive

OEMs are utilizing light-weight metals such as aluminum, in

particular, to reduce vehicle weight and reduce carbon dioxide

emissions. This trend is evident regardless of powertrain design -

whether internal combustion engines, electric vehicles or hybrids.

As well, a renewed focus on the efficiency of OEMs in their own

manufacturing process is creating higher demand for advanced

tooling that can enhance their profitability and sustainability

goals. Certain OEM manufacturers have begun utilizing much larger

die cast machines to cast entire vehicle sub-frames using

aluminum-based alloy rather than stamping, welding, and assembling

separate pieces of ferrous metal. Exco is in discussions with

several traditional OEMs and their tier providers who appear likely

to follow this trend. Exco is positioning its operations to

capitalize on these changes accordingly. Beyond the automotive

industry, Exco’s extrusion tooling supports diverse industrial end

markets which are also seeing increased demand for aluminum driven

by environmental trends, including energy efficient buildings,

solar panels, etc.

On the cost side, inflationary pressures have

intensified post COVID while prompt availability of various input

materials, components and labour has become more challenging,

though the intensity of these dynamics have generally moderated in

fiscal 2023. We are offsetting these dynamics through various

efficiency initiatives and taking pricing action where possible

although there is typically several quarters of lag before the

counter measures yield results.

The Russian invasion of Ukraine and the

Israeli/Palestine conflict have added additional uncertainty to the

global economy. And while Exco has essentially no direct exposure

to these countries, Ukraine does feed into the European automotive

market and Europe has traditionally depended on Russia for its

energy needs. Similarly, the conflict in the Middle East creates

the potential for a renewed rise in the price of oil and other

commodities and could weigh on consumer sentiment.

Exco itself is also looking inwards with respect

to ESG and sustainability trends to ensure its operations are

sustainable. We are investing significant capital to improve the

efficiency and capacity of our operations while lowering our carbon

footprint. Our 2023 Sustainability Report is available on our

corporate website at:

www.excocorp.com/leadership/sustainability/.

For further information and prior year

comparison please refer to the Company’s Fourth Quarter Financial

Statements in the Investor Relations section posted at

www.excocorp.com. Alternatively, please refer to

www.sedarplus.ca.

Non-IFRS Measures: In this News

Release, reference may be made to EBITDA, EBITDA Margin, Pretax

Profit, Free Cash Flow and Maintenance Fixed Asset Additions which

are not defined measures of financial performance under

International Financial Reporting Standards (“IFRS”). Exco

calculates EBITDA as earnings before interest, taxes, depreciation

and amortization and EBITDA Margin as EBITDA divided by sales. Exco

calculates Pretax Profit as segmented earnings before other

income/expense, interest and taxes. Free Cash Flow is

calculated as cash provided by operating activities less interest

paid and Maintenance Fixed Asset Additions. Maintenance Fixed Asset

Additions represents management’s estimate of the investment in

fixed assets that are required for the Company to continue

operating at current capacity levels. Given the Company’s elevated

planned capital spending on fixed assets for growth initiatives

(including additional Greenfield locations, energy efficient heat

treatment equipment and increased capacity) through the near term,

the Company has modified its calculation of Free Cash Flow to

include Maintenance Fixed Assets and not total fixed asset

purchases. This change is meant to enable investors to better gauge

the amount of generated cash flow that is available for these

investments as well as acquisitions and/or returns to shareholders

in the form of dividends or share buyback programs. EBITDA, EBITDA

Margin, Pretax Profit and Free Cash Flow are used by management,

from time to time, to facilitate period-to-period operating

comparisons and we believe some investors and analysts use these

measures as well when evaluating Exco’s financial performance.

These measures, as calculated by Exco, do not have any standardized

meaning prescribed by IFRS and are not necessarily comparable to

similar measures presented by other issuers.

Quarterly Conference Call –

November 30, 2023 at 10:00 a.m. (Toronto time):

To access the listen only live audio webcast,

please log on to www.excocorp.com, or

https://edge.media-server.com/mmc/p/3iaifenr a few minutes before

the event. Those interested in participating in the

question-and-answer conference call may register at

https://register.vevent.com/register/BI3c6447963f5b44e789a713655dc760cc

to receive the dial-in numbers and unique PIN to access the call.

It is recommended that you join 10 minutes prior to the event start

(although you may register and dial in at any time during the

call).

For those unable to participate on November 30, 2023, an

archived version will be available on the Exco website until

December 15, 2023.

|

Source: |

|

Exco Technologies Limited (TSX-XTC, OTCQX-EXCOF) |

|

Contact: |

|

Darren Kirk, President and CEO |

|

Telephone: |

|

(905) 477-3065 Ext. 7233 |

|

Website: |

|

http://www.excocorp.com |

About Exco Technologies Limited:

Exco Technologies Limited is a global supplier

of innovative technologies servicing the die-cast, extrusion and

automotive industries. Through our 21 strategic locations in

9 countries, we employ approximately 5,000 people and service a

diverse and broad customer base.

Notice To Reader: Forward Looking Statements

This press release contains forward-looking

information and forward-looking statements within the meaning of

applicable securities laws. We may use words such as "anticipate",

"may", "will", "should", "expect", "believe", "estimate", “5-year

target” and similar expressions to identify forward-looking

information and statements especially with respect to growth,

outlook and financial performance of the Company's business units,

contribution of our start-up business units, contribution of

awarded programs yet to be launched, margin performance, financial

performance of acquisitions, liquidity, operating efficiencies,

improvements in, expansion of and/or guidance or outlook as to

future revenue, sales, production sales, margin, earnings, earnings

per share, including the revised outlook for 2026, are

forward-looking statements. These forward-looking statements

include known and unknown risks, uncertainties, assumptions and

other factors which may cause actual results or achievements to be

materially different from those expressed or implied. These

forward-looking statements are based on our plans, intentions or

expectations which are based on, among other things, the current

improving global economic recovery from the COVID-19 pandemic and

containment of any future or similar outbreak of epidemic,

pandemic, or contagious diseases that may emerge in the human

population, which may have a material effect on how we and our

customers operate our businesses and the duration and extent to

which this will impact our future operating results, the impact of

the Russian invasion of Ukraine on the global financial, energy and

automotive markets, including increased supply chain risks,

assumptions about the demand for and number of automobiles produced

in North America and Europe, production mix between passenger cars

and trucks, the number of extrusion dies required in North America

and South America, the rate of economic growth in North America,

Europe and emerging market countries, investment by OEMs in

drivetrain architecture and other initiatives intended to reduce

fuel consumption and/or the weight of automobiles in response to

rising climate risks, raw material prices, supply disruptions,

economic conditions, inflation, currency fluctuations, trade

restrictions, energy rationing in Europe, our ability to integrate

acquisitions, our ability to continue increasing market share, or

launch of new programs and the rate at which our current and future

greenfield operations in Mexico and Morocco achieve sustained

profitability. Readers are cautioned not to place undue reliance on

forward-looking statements throughout this document and are also

cautioned that the foregoing list of important factors is not

exhaustive. The Company will update its disclosure upon publication

of each fiscal quarter's financial results and otherwise disclaims

any obligations to update publicly or otherwise revise any such

factors or any of the forward-looking information or statements

contained herein to reflect subsequent information, events or

developments, changes in risk factors or otherwise. For a more

extensive discussion of Exco's risks and uncertainties see the

'Risks and Uncertainties' section in our latest Annual Report,

Annual Information Form ("AIF") and other reports and securities

filings made by the Company. This information is available

at www.sedarplus.ca or www.excocorp.com.

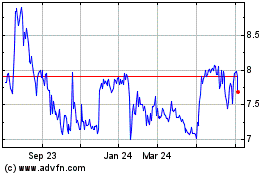

Exco Technologies (TSX:XTC)

Historical Stock Chart

From Dec 2024 to Jan 2025

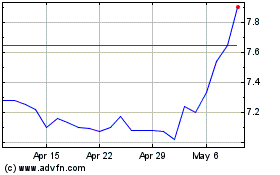

Exco Technologies (TSX:XTC)

Historical Stock Chart

From Jan 2024 to Jan 2025