Athabasca Minerals Inc. Montney In-Basin Project Frac Sand Test Results

11 January 2019 - 11:01PM

Athabasca Minerals Inc. (“AMI” or the “Corporation”) (TSX Venture:

ABM) announces initial test results for the Montney In-Basin frac

sand project (“MIB Project”).

A photo accompanying this announcement is available at

http://www.globenewswire.com/NewsRoom/AttachmentNg/aca31608-2bcb-45c8-a201-b1d1452ebeca

STIM-LAB Inc. and Loring Laboratories Ltd.

completed testing on a 70/170 fraction size domestic sand, which

had sphericity of 0.7, roundness of 0.6, acid solubility of 2.3%,

Silicon Dioxide (SiO2) content of 98.5%, and a crush value of 8K.

These preliminary results indicate that the MIB Project sand aligns

with API Standard 19C, which provides the specifications for sands

used in hydraulic fracturing. The Montney basin represents over 50%

of the entire frac sand demand in Canada.

Robert Beekhuizen, CEO of Athabasca Minerals,

and President of AMI Silica Inc stated, “AMI continues to make

progress toward its strategic goal of becoming the leading in-basin

supplier of premium domestic frac sand for the Canadian energy

market. With the growing trend in the United States of in-basin

frac sand displacing Wisconsin sand, we believe an equivalent trend

is on the fore-front in Canada. In due course, a shift in our

current dependence on 70% American frac sand supplying Canadian

operations is possible. AMI aims to be the pace-setter in Western

Canada in providing in-basin premium domestic frac sand with

efficient logistical delivery solutions that bring both value and

reliability to the development and production programs of energy

companies, specifically operating in the Montney and Duvernay

regions.

Upcoming resource delineation for the MIB

Project will include an initial 6-hole confirmation drilling

program, followed by a 20-hole drilling program. Drilling will

focus on previously identified highly prospective zones, and on

lands with logistical advantages. A National Instrument 43-101

resource estimate is planned for completion in Q2-2019 to be

followed by a Preliminary Economic Assessment (“PEA”) in

Q3-2019.

Al Turner, MSc. P.Geol. of Stantec Inc., in

accordance with National Instrument 43-101, is the Qualified Person

responsible for the technical content of this release and has

reviewed and approved it accordingly. Mr. Turner is an independent

consultant contracted by the Corporation.

The Corporation also announces the granting of

275,000 stock options (“Options”) with an exercise price of $0.28

to officers and employees. The Options will have a five-year term

and are subject to a vesting schedule in accordance with the

Corporation’s Stock Option Plan. This option grant is subject to

TSX Venture Exchange approval.

About Athabasca Minerals

The Corporation is an integrated aggregates

company involved in resource development, aggregates marketing and

midstream supply-logistics solutions. Business activities include

aggregate production, pit management services, sales from

corporate-owned and third-party pits, acquisitions of sand and

gravel operations, and new venture development. Athabasca Minerals

is also the parent company of Aggregates Marketing Inc. – a

midstream business providing integrated supply and transportation

solutions for industrial and construction markets; AMI Silica Inc –

an in-basin supplier of premium domestic frac sand for Alberta and

NE British Columbia; and joint venture owner of the Montney

In-Basin Frac Sand Project. The Corporation also has industrial

mineral land exploration licenses that are strategically positioned

for future development in industrial regions of high potential

demand.

For further Information on Athabasca, please

contact:

Dean StuartT: 403-617-7609E: dean@boardmarker.net

Robert BeekhuizenT: 780-465-5696

Neither the TSX Venture Exchange

nor its Regulation Services Provider (as that term is defined in

the policies of the TSX Venture Exchange) accepts responsibility

for the adequacy or accuracy of this release.

This news release contains certain

forward-looking statements and forward-looking information

(collectively referred to in this news release as “forward-looking

information”) within the meaning of applicable Canadian securities

laws. All statements other than statements of present or historical

fact is forward-looking information. In particular, but without

limiting the foregoing, this news release contains forward-looking

information pertaining to the following: Athabasca Minerals Inc.

(“AMI”), Demand and Supply of Frac Sand & Projections, AMI

Silica Inc. and the Montney Frac Sand Project.

In addition to the assumptions contained

within the body of this news release, the forward-looking

information in this news release is based on certain key

expectations and assumptions of AMI including: growth for frac-sand

markets, ability to successfully integrate initiatives with

material contracts, and no material adverse changes to the business

of AMI. Although management of AMI consider these assumptions to be

reasonable based on information currently available to them, these

assumptions may prove to be incorrect.

Forward looking information is subject

to known and unknown risks, uncertainties and other factors that

may cause the actual results, level of activity, performance or

achievements of AMI to be materially different from those expressed

or implied by such forward-looking information. Such risks and

other factors may include, but are not limited to: general

business, economic, competitive, political and social

uncertainties; general capital market conditions and market prices

for securities; commodity pricing risk including pricing for silica

sand and other aggregates; resources may not have the quality of

quantity that management anticipates; changes in reclamation

obligations estimates; delay or failure to receive board or

regulatory approvals; the actual results of future development or

operations; competition; changes in project parameters as plans

continue to be refined; accidents and other risks inherent in the

aggregates and construction industries; lack of insurance; changes

in legislation, including environmental legislation, affecting AMI;

the timing and availability of external financing on acceptable

terms; and the lack of qualified, skilled labour or loss of key

individuals. A description of additional assumptions used to

develop such forward-looking information and a description of

additional risk factors that may cause actual results to differ

materially from forward-looking information can be found in AMI’s

disclosure documents on the SEDAR website at www.sedar.com.

Although AMI has attempted to identify important factors that could

cause actual results to differ materially from those contained in

forward-looking information, there may be other factors that cause

results not to be as anticipated, estimated or intended. Readers

are cautioned that the foregoing list of factors is not exhaustive.

As such, readers are further cautioned not to place undue reliance

on forward-looking information as there can be no assurance that

the plans, intentions or expectations upon which they are placed

will occur.

Forward-looking information contained in

this news release is expressly qualified by this cautionary

statement. The forward-looking information contained in this news

release represents the expectations of AMI as of the date of this

news release and, accordingly, is subject to change after such

date. However, AMI expressly disclaims any intention of obligation

to update or revise any forward-looking information, whether as a

result of new information, future events or otherwise, except as

expressly required by applicable securities law.

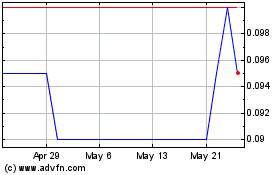

Aben Minerals (TSXV:ABM)

Historical Stock Chart

From Jan 2025 to Feb 2025

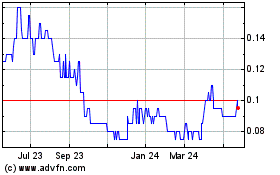

Aben Minerals (TSXV:ABM)

Historical Stock Chart

From Feb 2024 to Feb 2025