CROWFLIGHT MINERALS INC. (Crowflight, the Company) (TSX VENTURE:

CML) today announced its financial results for the third quarter of

2008. Complete unaudited interim financial statements and related

Management's Discussion and Analysis will be filed under the

Company's profile on www.sedar.com. All amounts are in Canadian

dollars unless otherwise indicated.

Q3 Highlights

- At September 30, 2008, cash and cash equivalents balances were

$13.0 million. At the end of the third quarter 2008, the loan

facility balance was $50.0 million.

- Net income for the quarter ended September 30, 2008 was $9.9

million ($0.04 per share) compared to a net loss of $2.2 million

(loss of $0.01 per share) for the quarter ended September 30, 2007.

This net income is attributed to a non-cash gain of $18.3 million

related to the change in value of the forward sale contracts

entered into in July 2008, as at September 30, 2008.

- Production of a nickel concentrate is scheduled to commence in

November 2008. Bucko Lake Nickel Mine capital and development

spending has totaled $25.1 million for the quarter and $57.7

million for the nine months ended September 30, 2008.

Unaudited Third Quarter 2008 Results

Cash used in Investing Activities during the quarter ended

September 30, 2008 was $18.0 million compared to $11.1 million used

in investing activities during the same period last year.

Cash spending on exploration and development of properties

primarily in the Thompson Nickel Belt, Manitoba as well as the

acquisition of capital assets related to exploration and

development for the current quarter was $25.1 million, net of

government assistance, compared to $12.1 million during the third

quarter of 2007. Specifically, the Company used $25.1 million in

cash in the development of the Bucko Lake Nickel Mine during the

quarter.

During the nine months ended September 30, 2008 and 2007, the

Company used $52.2 million compared to $20.1 million in investing

activities, respectively. Cash spending on exploration and

development properties primarily in the Thompson Nickel Belt,

Manitoba as well as the acquisition of capital assets related to

exploration and development for the nine months ended September 30,

2008 was $61.0 million, compared to $25.7 million during the same

period in 2007. Specifically, the Company used $57.7 million in

cash in the development of the Bucko Lake Nickel Mine during the

period. The expected cost to complete the Bucko Lake Nickel Mine is

$17 million. The Company has these funds available following the

restructuring of its debt facility announced October 28, 2008,

subsequent to the quarter's end. Additional capital compared to

previous estimates is required due to lower pre-production revenues

of $20 million due to lower projected nickel prices and lower

nickel pre-production and higher project capital costs of $4

million.

The Company recognized a net income for the quarter ended

September 30, 2008 of $9.8 million ($0.04 per share) compared to a

net loss of $2.2 million (loss of $0.01 per share) for the quarter

ended September 30, 2007. This net income is attributed to a

non-cash gain of $18.3 million related to the change in value of

the forward sale contracts entered into in July 2008, as at

September 30, 2008.

The net income for the nine months ended September 30, 2008 was

$5.5 million ($0.02 per share) compared to a net loss of $4.1

million (loss of $0.02 per share) for the nine months ended

September 30, 2007. The majority of this variance is attributable

to the non-cash gain of $18.3 million recognized on the change in

value of the forward sale nickel contracts entered into in

July.

At September 30, 2008, cash and cash equivalents balances were

$13.0 million, compared to $9.0 million as at December 31,

2007.

The loan facility balance was $50.0 million as at September 30,

2008, which was subsequently reduced to $7.6 million in October

following the restructuring of the debt facility, compared to nil

as at December 31, 2007.

Outlook

For the balance of 2008, Crowflight will continue to focus on

completion of the Bucko Lake Nickel Mine, expects to produce

concentrate for shipment and will work toward ramping up to full

production in early 2009.

CONSOLIDATED BALANCE SHEETS

As at

----------------------------------------------------------------------------

----------------------------------------------------------------------------

September 30, December 31,

2008 2007

ASSETS (unaudited) (audited)

Current

Cash and cash equivalents $ 13,039,999 $ 9,004,788

Amounts receivable 1,145,451 1,281,466

Prepaid expenses and deposits 144,566 276,164

Current portion of derivative asset 3,620,873 -

----------------------------------------------------------------------------

17,950,889 10,562,418

Deposits and advances 536,709 952,263

Equipment 75,627 102,769

Derivative assets 14,647,107 -

Exploration property, plant and equipment

and deferred exploration expenditures 137,615,537 76,596,884

----------------------------------------------------------------------------

$ 170,825,869 $ 88,214,334

----------------------------------------------------------------------------

----------------------------------------------------------------------------

LIABILITIES

Current

Accounts payable and accrued liabilities $ 15,775,537 $ 8,465,682

Current portion of long term debt 8,122,356 -

Equipment leases 121,200 188,856

----------------------------------------------------------------------------

24,019,093 8,654,538

Long term debt 39,548,701 -

Asset retirement obligations 352,000 331,000

Future income tax liability 10,983,000 2,490,000

----------------------------------------------------------------------------

74,902,794 11,475,538

----------------------------------------------------------------------------

SHAREHOLDERS' EQUITY

Common Shares 95,421,561 86,671,512

Warrants 3,964,310 2,025,712

Contributed surplus 13,167,976 10,193,512

Deficit (16,630,772) (22,151,940)

----------------------------------------------------------------------------

95,923,075 76,738,796

----------------------------------------------------------------------------

$ 170,825,869 $ 88,214,334

----------------------------------------------------------------------------

----------------------------------------------------------------------------

These financial statements should be read in conjunction with the notes and

management's discussion and analysis available online at www.sedar.com and

on the Company's website www.crowflight.com.

CONSOLIDATED STATEMENTS OF OPERATIONS AND DEFICIT

For the three and nine months ended September 30,

(UNAUDITED - prepared by management)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Three months ended Nine months ended

September 30, September 30,

2008 2007 2008 2007

----------------------------------------------------------------------------

Expenses

Professional,

consulting and

management fees $ 704,210 $ 2,393,567 $ 2,642,092 $ 4,163,486

Shareholder

communications and

investor relations 39,182 32,987 287,429 286,976

General and office 128,439 105,253 328,083 227,416

Travel 32,173 10,770 142,405 114,686

Amortization 1,437 882 5,560 3,329

Interest expenses

and bank charges 4,123 11,220 9,332 13,675

----------------------------------------------------------------------------

909,564 2,554,679 3,414,901 4,809,568

----------------------------------------------------------------------------

(Loss) before the

undernoted (909,564) (2,554,679) (3,414,901) (4,809,568)

Interest income 66,605 315,169 199,126 724,406

Interest on long

term debt (482,309) - (901,140) -

General exploration (106,921) - (106,921)

Debt facility

transaction costs (499,594) - (2,544,796) -

Accretion expense (299,695) - (789,180) -

Change in value

of derivative

instruments 18,267,980 18,267,980

----------------------------------------------------------------------------

Income/(loss) before

income taxes 16,036,502 (2,239,510) 10,710,168 (4,085,162)

Future income taxes (6,145,000) - (5,189,000) -

----------------------------------------------------------------------------

Income/(loss) for

the period 9,891,502 (2,239,510) 5,521,168 (4,085,162)

DEFICIT, beginning

of period (26,522,274) (19,532,323) (22,151,940) (17,686,671)

------------- ------------ ------------ ------------

DEFICIT, end of

period $(16,630,772) $(21,771,833) $(16,630,772) $(21,771,833)

------------- ------------- ------------- -------------

------------- ------------- ------------- -------------

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Earnings/(loss) per

share - basic $ 0.04 $ (0.01) $ 0.02 $ (0.02)

Earnings/(loss) per

share - diluted $ 0.04 $ (0.01) $ 0.02 $ (0.02)

Weighted average

number of shares -

basic 269,683,888 247,901,936 261,202,344 226,373,752

Weighted average

number of shares -

diluted 270,572,514 247,901,936 264,263,983 226,373,752

----------------------------------------------------------------------------

----------------------------------------------------------------------------

These financial statements should be read in conjunction with the notes and

management's discussion and analysis available online at www.sedar.com and

on the Company's website www.crowflight.com.

CONSOLIDATED STATEMENTS OF CASH FLOWS

For the three and nine months ended September 30,

(UNAUDITED - prepared by management)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Three months ended Nine months ended

September 30, September 30,

2008 2007 2008 2007

----------------------------------------------------------------------------

OPERATING ACTIVITIES:

Net income/(loss)

for the period $ 9,891,502 $ (2,239,510) $ 5,521,168 $ (4,085,162)

Charges not

affecting cash:

Amortization 1,437 882 5,560 3,329

Stock-based

compensation

expense 508,473 1,699,259 2,047,060 3,216,483

Debt facility costs 499,594 2,544,796 -

Capitalized interest 203,525 - 622,356 -

Accretion expense 299,695 - 789,180 -

Change in value

of derivative

instruments (18,267,980) - (18,267,980) -

Future income tax

expense 6,145,000 - 5,189,000 -

Net change in

non-cash working

capital 83,954 818,524 (1,036,472) (856,884)

----------------------------------------------------------------------------

(634,800) 279,155 (2,585,332) (1,722,234)

----------------------------------------------------------------------------

FINANCING ACTIVITIES:

Common shares issued

through private

placements - 364 10,184,706 21,411,350

Warrants issued

through private

placements - - - 1,359,375

Debt facility, net

of transaction costs 39,500,406 - 62,673,758 -

Retirement of debt

facility (15,000,000) - (15,000,000) -

Shares issued from

exercise of

warrants and

options 11,250 954,000 1,015,866 8,358,789

Payments on equipment

leases (20,312) - (67,656)

----------------------------------------------------------------------------

24,491,344 954,364 58,806,674 31,129,514

----------------------------------------------------------------------------

INVESTING ACTIVITIES:

Exploration property,

plant and equipment,

and deferred

exploration

expenditures (25,076,313) (12,094,968) (60,997,071) (25,684,841)

(Increase) decrease

in deposits and

prepaid exploration

expenditure - 62,915 318,554 408,882

(Decrease) increase

in accounts payable

attributable to

property exploration 6,888,246 953,660 8,492,386 4,495,369

Property, plant and

equipment - (12,503) - (65,723)

----------------------------------------------------------------------------

(18,188,067) (11,090,896) (52,186,131) (20,846,313)

----------------------------------------------------------------------------

CHANGE IN CASH AND

CASH EQUIVALENTS $ 5,668,477 $ (9,857,377) $ 4,035,211 $ 8,560,967

CASH AND CASH

EQUIVALENTS,

beginning of

period $ 7,371,522 $ 32,219,264 $ 9,004,788 $ 13,800,920

----------------------------------------------------------------------------

CASH AND CASH

EQUIVALENTS, end

of period $ 13,039,999 $ 22,361,887 $ 13,039,999 $ 22,361,887

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Cash and cash

equivalents

consists of:

Cash 5,488,999 914,971 5,488,999 914,971

Equivalents 7,551,000 21,446,916 7,551,000 21,446,916

----------------------------------------------------------------------------

$ 13,039,999 $ 22,361,887 $ 13,039,999 $ 22,361,887

----------------------------------------------------------------------------

These financial statements should be read in conjunction with the notes and

management's discussion and analysis available online at www.sedar.com and

on the Company's website www.crowflight.com.

Crowflight Minerals - Canada's Next Nickel Producer

Crowflight Minerals Inc. (TSX VENTURE: CML) is a Canadian junior

mining company that is bringing the Bucko Lake Nickel Mine near

Wabowden, Manitoba into production. Full commercial production is

expected to be achieved at Bucko in early 2009. The Company is also

focused on nickel, copper and Platinum Group Mineral (PGM) projects

in the Thompson Nickel Belt and Sudbury Basin.

Cautionary Note on Forward-Looking Information

Except for statements of historical fact contained herein, the

information in this press release constitutes "forward-looking

information" within the meaning of Canadian securities law. Such

forward-looking information may be identified by words such as

"plans", "proposes", "estimates", "intends", "expects", "believes",

"may", "will" and include without limitation, statements regarding

estimated capital and operating costs, expected production

timeline, benefits of updated development plans, foreign exchange

assumptions and regulatory approvals. There can be no assurance

that such statements will prove to be accurate; actual results and

future events could differ materially from such statements. Factors

that could cause actual results to differ materially include, among

others, metal prices, competition, risks inherent in the mining

industry, and regulatory risks. Most of these factors are outside

the control of the Company. Investors are cautioned not to put

undue reliance on forward-looking information. Except as otherwise

required by applicable securities statutes or regulation, the

Company expressly disclaims any intent or obligation to update

publicly forward-looking information, whether as a result of new

information, future events or otherwise.

TSX-V Trading Symbol: CML

Total Shares Outstanding: 269.7MM

Fully Diluted: 307.9MM

52-Week Trading Range: C$0.09 - $0.80

The TSX Venture Exchange does not accept responsibility for the

adequacy or accuracy of this release.

Contacts: Crowflight Minerals Inc. Mike Hoffman President and

CEO (416) 861-2964 Crowflight Minerals Inc. Heather Colpitts

Manager, Investor and Public Relations (416) 861-5803 Email:

info@crowflight.com Website: www.crowflight.com

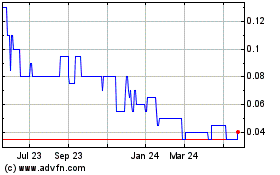

Canickel Mining (TSXV:CML)

Historical Stock Chart

From Feb 2025 to Mar 2025

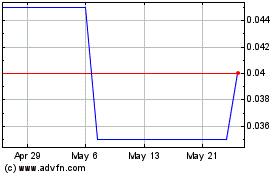

Canickel Mining (TSXV:CML)

Historical Stock Chart

From Mar 2024 to Mar 2025