Gowest Provides Update on Previously Announced Investment by Greenwater Investment Hong Kong Limited

11 March 2022 - 8:50AM

Gowest Gold Ltd. (“

Gowest” or the

“

Corporation”) (TSX VENTURE: GWA) announced today

that it has completed the issuance and sale to Greenwater

Investment Hong Kong Limited (“

Greenwater”) of

promissory notes in an aggregate principal amount of $7,500,000

(the “

Promissory Notes”), for an aggregate

purchase price of $7,500,000.

The issuance and sale of the Promissory Notes

form part of a larger financing initiative of the Corporation

pursuant to which the Corporation may raise aggregate gross

proceeds of up to $19,000,000 (the “Offering”),

subject to the terms and conditions of the subscription agreement

between the Corporation and Greenwater related to the Offering. For

further details concerning the Promissory Notes and the Offering,

please see Gowest news release dated January 24, 2022.

Dan Gagnon, President and CEO of Gowest stated,

“The financing continues to demonstrate the support we have from

our existing shareholders as we proceed with the development of the

Bradshaw mine and surrounding properties.”

Subject to the receipt of requisite shareholder

approval, the Promissory Notes will automatically convert into

units of the Corporation (“Units”) at a conversion

price of $0.13 per Unit. Assuming conversion of the Promissory

Notes, an aggregate of 57,692,307 Units will be issued by the

Corporation. Each Unit will comprise one common share of the

Corporation and one common share purchase warrant (a

“Warrant”), with each Warrant being exercisable to

purchase one additional common share of the Corporation for a

period of two years following the receipt of shareholder approval,

at a price of $0.16 per Unit during the first 12-month period

following the receipt of shareholder approval and at a price of

$0.17 per Unit during the second 12-month period following the

receipt of shareholder approval.

The proceeds of the Offering will be principally

used by the Corporation for the continued development of

Bradshaw.

The securities offered have not been registered

under the United States Securities Act of 1933, as amended, and may

not be offered or sold in the United States or to, or for the

account or benefit of, U.S. persons absent registration or an

applicable exemption from registration requirements. This release

does not constitute an offer for the sale of securities in the

United States.

All of the securities issuable in connection

with the Offering will be subject to a hold period expiring four

months and one day after the date of issuance. The Offering remains

subject to the receipt of final approval from the TSX Venture

Exchange.

Update on Shareholder

Meeting

The Corporation has called a special meeting of

the shareholders of the Corporation (the

“Meeting”), scheduled to be held on March 31,

2022, for the purpose of obtaining shareholder approval of certain

aspects of the Offering, including the conversion of the Promissory

Notes into Units in accordance with their terms.

Further information regarding the Offering can

be found in the Management Information Circular of the Corporation

dated February 18, 2022 and prepared in connection with the

Meeting. The management information circular is available for

review under the Corporation’s SEDAR profile at www.sedar.com and

on the Corporation’s website at www.gowestgold.com. All

shareholders are urged to read the Management Information Circular

and vote at the Meeting.

About Gowest

Gowest is a Canadian gold exploration and

development company focused on the delineation and development of

its 100% owned Bradshaw Gold Deposit (Bradshaw) on the Frankfield

Property, part of the Corporation’s North Timmins Gold Project

(NTGP). Gowest is exploring additional gold targets on its

+100‐square‐kilometre NTGP land package and continues to evaluate

the area, which is part of the prolific Timmins, Ontario gold camp.

Currently, Bradshaw contains a National Instrument 43‐101 Indicated

Resource estimated at 2.1 million tonnes (“t”) grading 6.19 grams

per tonne gold (g/t Au) containing 422 thousand ounces (oz) Au and

an Inferred Resource of 3.6 million t grading 6.47 g/t Au

containing 755 thousand oz Au. Further, based on the

Pre‐Feasibility Study produced by Stantec Mining and announced on

June 9, 2015, Bradshaw contains Mineral Reserves (Mineral Resources

are inclusive of Mineral Reserves) in the probable category, using

a 3 g/t Au cut‐off and utilizing a gold price of US$1,200 / oz,

totaling 1.8 million t grading 4.82 g/t Au for 277 thousand oz

Au.

Forward-Looking Statements

Certain statements in this release constitute

forward-looking statements within the meaning of applicable

securities laws. Forward-looking statements in this press release

include, without limitation, statements relating to: the Offering;

the proposed use of proceeds of the Offering; and the special

meeting of the shareholders of the Corporation. Words such as

“may”, “would”, “could”, “should”, “will”, “anticipate”, “believe”,

“plan”, “expect”, “intend”, “potential” and similar expressions may

be used to identify these forward-looking statements although not

all forward-looking statements contain such words.

Forward-looking statements involve significant

risks, uncertainties and assumptions. Many factors could cause

actual results, performance or achievements to be materially

different from any future results, performance or achievements that

may be expressed or implied by such forward-looking statements,

including risks associated with the Offering and financing

transactions generally, such as the failure to satisfy the closing

conditions contained in the subscription agreement, the absence of

material adverse changes or other events which may give Greenwater

the basis on which to terminate the subscription agreement, and the

ability of the Corporation to complete and mail the information

circular in respect of the Meeting and hold the Meeting within the

time frames indicated. Additional risk factors are also set forth

in the Corporation’s management’s discussion and analysis and other

filings available via the System for Electronic Document Analysis

and Retrieval (SEDAR) under the Corporation’s profile at

www.sedar.com. Should one or more of these risks or uncertainties

materialize, or should assumptions underlying the forward-looking

statements prove incorrect, actual results, performance or

achievements may vary materially from those expressed or implied by

this press release. These factors should be considered carefully

and reader should not place undue reliance on the forward-looking

statements. These forward-looking statements are made as of the

date of this press release and, other than as required by law, the

Corporation does not intend to or assume any obligation to update

or revise these forward-looking statements, whether as a result of

new information, future events or otherwise.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS

REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE

POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR

THE ADEQUACY OR ACCURACY OF THIS RELEASE.

| For further information please

contact: |

| |

|

| Dan Gagnon |

Greg Taylor |

| President & CEO |

Investor Relations |

| Tel: (416) 363-1210 |

Tel: (416) 605-5120 |

| Email: info@gowestgold.com |

Email: gregt@gowestgold.com |

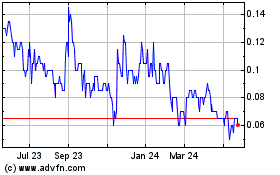

Gowest Gold (TSXV:GWA)

Historical Stock Chart

From Jan 2025 to Feb 2025

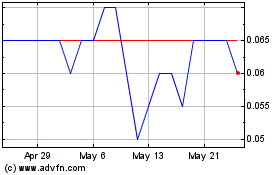

Gowest Gold (TSXV:GWA)

Historical Stock Chart

From Feb 2024 to Feb 2025