International Frontier Resources Corporation (“IFR”)

(TSX-V: IFR) is pleased to announce that it has entered

into a non-binding Letter of Intent (“

LOI”) dated

May 3, 2021 with respect to a potential reverse takeover of IFR

(the “

Proposed Transaction”) by a private oil and

gas company (“

PrivateCo”). The final structure and

terms of the Proposed Transaction have not yet been finalized and

further details will be announced at a later date. The Proposed

Transaction is an arm's length transaction. IFR also announced

today a US$750,000 10% per annum secured convertible debenture

(“

Convertible Debenture”) private placement (the

“

CD Offering”) from PrivateCo, and an up to

CDN$1,000,000 non-brokered common share private

placement offering (“

Common Share Offering”) at

$0.025 per IFR common share (“

Common

Share”).

Completion of the Proposed Transaction is

subject to a number of conditions and other contingencies as set

forth below in this news release and as set forth in the LOI,

including, but not limited to: the negotiation and execution of a

definitive agreement for the Proposed Transaction (the

“Definitive Agreement”); any required approvals

of relevant government authorities, determination of favourable tax

structuring for the Proposed Transaction; TSX Venture Exchange

(the “TSXV”) acceptance of the Proposed

Transaction; satisfactory due diligence; board of director

approval; shareholder consent; and other conditions typical for

transactions of a similar nature. Where applicable, the Proposed

Transaction cannot close until the required shareholder approval is

obtained. There can be no assurance that the parties will

execute the Definitive Agreement or that the Proposed Transaction

will be completed as proposed or at all. Investors are cautioned

that, except as disclosed in the management information circular or

filing statement to be prepared in connection with the Proposed

Transaction, any information released or received with respect to

the Proposed Transaction may not be accurate or complete and should

not be relied upon. Trading in the securities of IFR should be

considered highly speculative. The TSXV has in no way passed upon

the merits of the Proposed Transaction and has neither approved

nor disapproved the contents of this news release.

RTO With PrivateCo

The indicative terms of the LOI contemplate the

following terms and conditions as part of the Proposed

Transaction:

- That all of the common shares in

the capital of PrivateCo will be purchased or exchanged for Common

Shares of IFR at an exchange ratio determined for the Proposed

Transaction

- Prior to the closing of the

Proposed Transaction, IFR will complete a consolidation (the

“Consolidation”) of its outstanding share capital

at a rate yet to be determined

- That upon completion of the

Proposed Transaction, the directors and officers of IFR will be

replaced by nominees of PrivateCo

- Renaming of IFR and a change of the

Ticker Symbol

- Subject to TSXV acceptance, IFR

intends to complete a spin-out of IFR’s non-Mexican assets creating

a new spin-out company (“SpinCo”) holding such

assets

- IFR or its wholly owned subsidiary

Petro Frontera, S.A.P.I. de C.V. will have purchased all of the

outstanding shares in the joint venture company, Tonalli Energia

S.A.P.I. de C.V. (“Tonalli”) held by its joint

venture partner, Grupo IDESA S.A. de C.V.

- Funding of the $US750,000 CD

Offering will have been completed

- Completion of a concurrent

financing in relation to the Proposed Transaction in an expected

range of US$20,000,000 to US$60,000,000

- Management, insiders, control

persons, and such other persons entering into lock-ups to support

the Proposed Transaction in an amount no less 30% of the

outstanding IFR Common Shares

- The Definitive Agreement will

contemplate a break fee in the amount of $500,000 payable by IFR to

PrivateCo upon the occurrence of certain events

Further updates and particulars of the Proposed

Transaction will be provided upon IFR and PrivateCo entering into a

Definitive Agreement for the Proposed Transaction.

US$750,000 10% Secured Convertible

Debenture Offering

Pursuant to the LOI and prior to the execution

of a Definitive Agreement, subject to TSXV acceptance, IFR intends

to complete the 10% per annum secured CD Offering for US$750,000

from PrivateCo. The net proceeds of the CD Offering is intended as

bridge financing and will be used as follows: (a) drilling of a

potential Tecolutla 12 well; (b) regulatory costs and contract

license fees for Tecolutla; (c) IFR expenses related to the

Proposed Transaction; and (d) IFR expenses related to the other

transactions described in the LOI. The Convertible Debenture

Offering is expected to close within two weeks of the execution

of the LOI.

The Convertible Debenture will have a 3 year

term from the date of issuance (the “Maturity

Date”) and will bear an interest rate of 10% per annum,

calculated semi-annually, and payable on the Conversion Date (as

defined below) or Maturity Date. The Convertible Debenture will be

secured by a promissory note and a share pledge agreement, both in

respect of the shares of Tonalli held by IFR or its subsidiaries.

There will be no other security over the assets of IFR in relation

to the Convertible Debenture. The Convertible Debenture will be

convertible at PrivateCo’s option into post-Consolidation Common

Shares of IFR (“Resulting Issuer Shares”) at any

time prior to the Maturity Date at a conversion price equal to a

10% discount to the deemed price of the Resulting Issuer Shares on

completion of the Proposed Transaction (the “Conversion

Price”) provided that the minimum Conversion Price will

equal $0.025 multiplied by the Consolidation ratio (being the

number of pre-Consolidation Common Shares that will be exchanged

for one post-Consolidation Common Share). At IFR’s Option, IFR may

prepay without penalty the principal amount of the Convertible

Debenture in cash or in Common Shares at the Conversion Price in

whole or in part. If the Proposed Transaction does not close by

October 1, 2021, or the LOI is Terminated, IFR has the option to

satisfy all or a portion of the principal amount and accrued and

unpaid interest under the Convertible Debenture by converting the

same to services. Upon conversion of such principal and interest

into services, IFR will have satisfied its obligations under the

Convertible Debenture.

CDN$1,000,000 Common Share Offering at

$0.025 Per Common Share

IFR announced today a non-brokered Common Share

Offering for gross proceeds of up to $1,000,000

at a price of $0.025 per Common Share, subject to

TSXV acceptance. The net proceeds from the Common Share Offering

are expected to be used for: G&A Expenses including salaries

with the remainder for general working capital purposes. The

Common Share Offering will be completed pursuant to certain

exemptions from the prospectus requirements under applicable

securities laws. Subject to acceptance by IFR, in addition to other

available exemption for the Common Share Offering, the Common

Share Offering is open to all existing shareholders of IFR in

reliance upon the prospectus exemption described in Alberta

Securities Commission Rule 45-516 “Prospectus Exemptions For Retail

Investors And Existing Security Holders” and set forth in the

various corresponding blanket orders and rules in certain

jurisdictions of Canada (the “Existing Shareholder

Exemption”), subject to the terms and conditions therein.

The aggregate acquisition cost to a subscriber under the Existing

Shareholder Exemption cannot exceed $15,000 unless that subscriber

has obtained advice from a registered investment dealer regarding

the suitability of the investment. IFR has fixed May 6, 2021 as

the record date for the purpose of determining existing

shareholders of IFR who are entitled to participate in the Common

Share Offering pursuant to the Existing Shareholder Exemption.

Subscribers purchasing Common Shares under the Existing

Shareholder Exemption will need to represent in writing that they

meet certain requirements of the Existing Shareholder Exemption,

including that on or before the record date, they became a

shareholder of IFR and that they continue to be a shareholder of

IFR. In accordance with the requirements of the Existing

Shareholder Exemption and Investment Dealer Exemption, IFR

confirms there is no material fact or material change related to

IFR which has not been generally disclosed. The closing of the

Common Share Offering is expected to occur on or about June 4, 2021

and is subject to regulatory approval, including the approval of

the TSXV.

OTHER INFORMATION IN RESPECT OF THE CD

OFFERING AND THE COMMON SHARE OFFERING

The closings of the CD Offering and the Common

Share Offering (collectively, the “Offerings”) are

subject to a number of conditions, including receipt of all

necessary corporate and regulatory approvals, including TSXV

acceptance. As such, there is no assurance that IFR will

complete the Offerings as described above or at all. It is

anticipated that the Offerings will be completed pursuant to

certain exemptions from the prospectus requirement under applicable

securities laws. The Offerings may be closed in one or more

tranches. The Convertible Debenture and all of the Common Shares

issued pursuant to the Offerings, and any securities into which the

Convertible Debenture may be converted, are subject to resale

restrictions imposed by applicable law or regulation, including a

statutory hold period expiring four months and a day from the

closing dates of the Offerings. It is not anticipated that any new

insiders will be created, nor that any change of control will

occur, as a result of the Offerings. Any participation by insiders

of IFR in the Offerings will be on the same terms as arm’s length

investors. Depending on market conditions, the gross proceeds of

the Offerings could be increased or decreased. None of the

securities issued in connection with the Offerings will be

registered under the United States Securities Act of 1933, as

amended (the “1933 Act”), and none of them may be

offered or sold in the United States absent registration or an

applicable exemption from the registration requirements of the 1933

Act. This news release shall not constitute an offer to sell or a

solicitation of an offer to buy nor shall there be any sale of the

securities in any state where such offer, solicitation, or sale

would be unlawful.

Shares for Debt Settlement

In conjunction with the Common Share Offering,

IFR has agreed to settle outstanding debt of $392,900 with certain

officers and consultants of IFR by issuing 15,716,000 Common Shares

of IFR at a deemed price of $0.025 per Common Share. The issuance

of Common Shares in connection with the shares for debt settlement

is subject to the approval of the TSXV. The Common Shares issued

pursuant to the shares for debt settlement will be subject to a

four-month and one day hold period in accordance with applicable

securities legislation.

Trading Halt

Trading in IFR’s Common Shares on the TSXV is

halted and will remain halted until the documentation required by

the TSXV in relation to the Proposed Transaction has been reviewed

and accepted by the TSXV.

About International Frontier

ResourcesInternational Frontier Resources Corporation

(IFR) is a Canadian publicly traded company with a demonstrated

track record of advancing oil and gas projects. Through its Mexican

subsidiary, Petro Frontera S.A.P.I de CV (Frontera) and strategic

joint ventures, it is advancing the development of petroleum and

natural gas assets in Mexico. IFR also has projects in Canada and

the United States, including the Northwest Territories, Alberta and

Montana.

IFR’s shares are listed on the TSX Venture,

trading under the symbol IFR. For additional information please

visit www.internationalfrontier.com.

For further information

| Steve Hanson – President and CEO |

|

or |

|

Tony Kinnon –

Chairman |

| (403) 215-2780 |

|

|

|

(403) 215-2780 |

| shanson@internationalfrontier.com |

|

|

|

tkinnon@internationalfrontier.com |

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility or

accuracy of this release.

Forward Looking Statements

This press release contains forward‐looking

statements and forward‐looking information (collectively

"forward‐looking

information") within the meaning of applicable securities

laws. All statements, other than statements of historical fact,

included herein are forward-looking information. In addition, and

without limiting the generality of the foregoing, this news release

contains forward‐looking information regarding: the Proposed

Transaction, including the potential finalization and structuring

of the Proposed Transaction and the potential terms and conditions

in relation to the proposed transaction; the potential execution of

a Definitive Agreement in relation to the proposed transaction and

the terms and conditions of such Definitive Agreement; the required

approvals for the proposed transaction, including TSXV acceptance,

and regulatory, director and shareholder approvals of the Proposed

Transaction; the potential issuance of Common Shares in relation to

the Proposed transaction; the potential Consolidation, change of

management, name change, change of ticker symbol and the

US$20,000,000 to $US60,000,000 concurrent financing in relation to

the Proposed Transaction; the potential spin-out; the potential

purchase of Tonalli shares; the potential Offerings including, the

potential subscriber in the CD Offering, the use of proceeds of the

Offerings, the anticipated closing date of the CD Offering, the

approval required for the Offerings, including TSXV acceptance of

the CD Offering, and the size of the Common Share Offering, the

potential conversion of the Convertible Debenture into services;

and the potential shares for debt settlement.

There can be no assurance that such

forward-looking information will prove to be accurate. Actual

results and future events could differ materially from those

anticipated in such forward-looking information. This

forward-looking information reflects IFR’s current beliefs and is

based on information currently available to IFR and on assumptions

IFR believes are reasonable. These assumptions include, but are not

limited to: the execution of a Definitive Agreement, the

completion of satisfactory due diligence by IFR and PrivateCo in

relation to the Proposed Transaction; satisfactory tax structuring

of the Proposed Transaction; the satisfactory fulfilment of all of

the conditions precedent to the Proposed Transaction; the receipt

of all required approvals for the Proposed Transaction including

director and shareholder approvals of both IFR and PrivateCo, TSXV

acceptance and other regulatory approvals; the issuance of the

Common Shares in relation to the Proposed Transaction and the

purchase of the Tonalli shares; market acceptance of the Proposed

Transaction, the Consolidation, the spin-out and the concurrent

financing, and completion of the same; the value of PrivateCo in

relation to the Proposed Transaction; the underlying value of IFR

and its Common Shares; market acceptance of the Offerings; TSXV

acceptance of the Offerings; and expectations concerning prevailing

commodity prices, exchange rates, interest rates, applicable

royalty rates and tax laws.

Forward looking information is subject to known

and unknown risks, uncertainties and other factors that may cause

the actual results, level of activity, performance or achievements

of IFR, and the potential completion of the Proposed Transaction,

to be materially different from those expressed or implied by such

forward-looking information. Such risks and other factors may

include, but are not limited to: general business, economic,

competitive, political and social uncertainties; general capital

market conditions and market prices for securities; delay or

failure to receive board or regulatory approvals, including TSXV

acceptance; the actual results of future operations; general

economic, political, market and business conditions; risks inherent

in oil and natural gas operations; fluctuations in the price of oil

and natural gas, interest and exchange rates; the risks of the oil

and gas industry, such as operational risks and market demand;

governmental regulation of the oil and gas industry, including

environmental regulation; actions taken by governmental

authorities, including increases in taxes and changes in government

regulations and incentive programs; geological, technical, drilling

and processing problems; the uncertainty of reserves estimates and

reserves life; unanticipated operating events which could reduce

production or cause production to be shut-in or delayed; hazards

such as fire, explosion, blowouts, cratering, and spills, each of

which could result in substantial damage to wells, production

facilities, other property and the environment or in personal

injury; encountering unexpected formations or pressures, premature

decline of reservoirs and the invasion of water into producing

formations; failure to obtain industry partner and other third

party consents and approvals, as and when required; competition;

the timing and availability of external financing on acceptable

terms; and lack of qualified, skilled labour or loss of key

individuals. A description of additional risk factors that may

cause actual results to differ materially from forward-looking

information can be found in IFR’s disclosure documents on the SEDAR

website at www.sedar.com. Although IFR has attempted to identify

important factors that could cause actual results to differ

materially from those contained in forward-looking information,

there may be other factors that cause results not to be as

anticipated, estimated or intended. Readers are cautioned that the

foregoing list of factors is not exhaustive. Readers are further

cautioned not to place undue reliance on forward-looking

information as there can be no assurance that the plans, intentions

or expectations upon which they are placed will occur.

Forward-looking information contained in this

news release is expressly qualified by this cautionary statement.

The forward-looking information contained in this news release

represents the expectations of IFR as of the date of this news

release and, accordingly, is subject to change after such date.

However, IFR expressly disclaims any intention or obligation to

update or revise any forward-looking information, whether as a

result of new information, future events or otherwise, except as

expressly required by applicable securities law.

IFR seeks Safe Harbor.

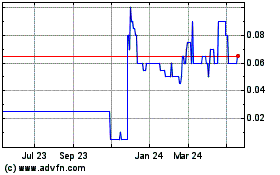

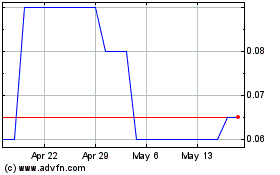

International Frontier R... (TSXV:IFR)

Historical Stock Chart

From Nov 2024 to Dec 2024

International Frontier R... (TSXV:IFR)

Historical Stock Chart

From Dec 2023 to Dec 2024