NowVertical Group Inc. (TSXV: NOW) ("

NOW" or

the

"Company"), the VI software and solutions

company, is pleased to announce that it has entered into a

definitive agreement with Group Analytics 10 and Inteligencia de

Negocios and its affiliate entities (collectively, “

A10

Group”) to acquire 100% of the issued and outstanding

securities of A10 Group (the “

Acquisition”), for

total upfront gross consideration of US$5.5 million, subject to

customary post-closing adjustments. The Acquisition is expected to

increase NOW’s annual revenues by approximately US$23.5

million and Adjusted EBITDA by approximately US$2.5 million

(unaudited), pre-synergies.

“The acquisition announced today represents a

significant expansion into the LATAM market with new operations in

Brazil, Chile and Mexico," said Daren Trousdell, Chairman & CEO

of NOW. “We had already established a significant presence in the

region with our CoreBI acquisition earlier this year. Today, with

our 12th acquisition, we are adding one of the region's premier big

data solution providers with a highly seasoned team of more than

175 individuals. We see an exceptional future and accelerated

growth ahead for NOW in one of the world’s most exciting big data

and analytics markets.”

About A10 Group:

Founded in 2004, A10 Group is one of Latin

America's most experienced big data, business intelligence, and

advanced analytics partners. It helps organizations make

intelligent, data-backed decisions by translating data into

understandable information that accelerates concrete

actions. A10 Group has helped serve more than 700 clients,

including some of LATAM's most prominent governmental and

commercial organizations. A10 Group provides exceptional client

support through a team of approximately 175 collaborators. With

state-of-the-art technologies and solid processes, it can respond

to specific needs and requirements to solve complex problems,

simplify implementation, and ensure effective results. With

operations in Brazil, Chile, and Mexico, A10 Group works with

globally renowned brands across multiple verticals, including

Nestle, Court of Federal Districts (Brazil), Biogen, AutoZone,

Thompson Reuters, Bayer and Walmart.

A10 Group also develops and implements visual

analytics, business intelligence, data discovery tools and

projects. The Group is an award-winning leader in the big data and

analytics market known for providing value-added solutions to

governmental and commercial clients across their entire data

estates.

“We’re excited to join forces with NOW to

accelerate our growth across the LATAM Big Data and Analytics

market,” said Cristóbal Urenda, Co-Founder and Board Member of A10

Group. “By joining forces with NOW, we’ll be able to deliver that

same experience on an increased scale with access to new regions

and clients. With their world-class capabilities, established LATAM

footprint and talent, and complementary client roster, NOW is our

ideal partner.”

Transaction Details:

Under the terms of the definitive purchase

agreement dated December 21, 2022, the Company has agreed to

complete the Acquisition for consideration payable as follows: (i)

a closing cash payment of US$4.95 million, subject to holdbacks,

(ii) $550,000 settled by way of an issuance of subordinate voting

shares in the capital of NOW (“NOW Shares” each a

“NOW Share”) at a deemed price equal to the

greater of NOW’s 20-day VWAP on closing and US$1.00 per NOW Share,

subject to customary lock-ups, and (iii) earn-out consideration

paid over four fiscal years based on certain Adjusted EBITDA

targets.

Closing of the Acquisition is subject to

customary closing conditions, including the receipt of necessary

third-party consents, regulatory approvals, and approval of the TSX

Venture Exchange. NOW anticipates the completion of the Acquisition

to occur during the first quarter of 2023. The Acquisition is

an arm’s length transaction and no finder’s fee is expected to be

paid by NOW in connection with the Acquisition.New Credit

Facility with Export Development Canada

NOW is also pleased to announce it has launched

a partnership with Export Development Canada

(“EDC”) to support NOW’s international growth and

expansion efforts. As part of this partnership, NOW and EDC have

entered into a non-dilutive secured USD$7 million credit

facility agreement effective December 21, 2022 (the

“EDC Facility”).

The EDC Facility enables requests by the Company

for periodic advances to be made for a period of six (6) months,

subject to the satisfaction of certain customary conditions, and

the EDC Facility matures on the date that is 72 months following

the date of the first advance (the “Maturity Date”). The EDC

Facility bears interest at a variable rate of US prime plus 3% on

drawn amounts and has no prepayment penalty or standby charge.

About NowVertical Group

Inc.

NOW is the VI software and solutions company

growing organically and through acquisition. NOW's VI solutions are

organized by industry vertical and are built upon a foundational

set of data technologies that fuse, secure, and mobilize data in a

transformative and compliant way. The NOW product suite enables the

creation of high-value VI solutions that are predictive in nature

and drive automation specific to each high-value industry vertical.

For more information about the Company, visit

www.nowvertical.com.

Neither the TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

For further information, please contact: Daren Trousdell, Chief

Executive Officere: daren@nowvertical.comt: (212) 302-0868 orGlen

Nelson, Investor Relationse: glen@nowvertical.comt: (403)

763-9797

Forward-Looking Statements

This news release may contain forward-looking

statements (within the meaning of applicable securities laws) which

reflect the Company's current expectations regarding future events.

Forward-looking statements are identified by words such as

"believe", "anticipate", "project", "expect", "intend", "plan",

"will", "may", "estimate" and other similar expressions. These

statements are based on the Company's expectations, estimates,

forecasts and projections and include, without limitation,

statements regarding the future success of the Company's business,

statements relating to NOW’s business plans and outlook, TSX

Venture Exchange approval of the Acquisition, the completion of the

EDC Facility and the use of proceeds from the EDC Facility.

The forward-looking statements in this news

release are based on certain assumptions. The forward-looking

statements are not guarantees of future performance and involve

risks and uncertainties that are difficult to control or predict. A

number of factors could cause actual results to differ materially

from the results discussed in the forward-looking statements.

Readers, therefore, should not place undue reliance on any such

forward-looking statements. Further, these forward-looking

statements are made as of the date of this news release and, except

as expressly required by applicable law, the Company assumes no

obligation to publicly update or revise any forward-looking

statement, whether as a result of new information, future events or

otherwise.

Cautionary Note Regarding Non-IFRS

Measures

This news release makes reference to certain

non-IFRS measures. These measures are not recognized measures under

IFRS, do not have a standardized meaning prescribed by IFRS, and

are therefore, unlikely to be comparable to similar measures

presented by other companies. Instead, these measures are provided

as additional information to complement those IFRS measures by

providing further understanding of the Company’s results of

operations from management’s perspective. The Company’s definitions

of non-IFRS measures used in this news release may not be the same

as the definitions for such measures used by other companies in

their reporting. Non-IFRS measures have limitations as analytical

tools and should not be considered in isolation nor as a substitute

for analysis of the Company’s financial information reported under

IFRS. The Company uses non-IFRS financial measures including

“Adjusted Revenues”, “EBITDA” and “Adjusted EBITDA”. These non-IFRS

measures are used to provide investors with supplemental measures

of our operating performance and to eliminate items that have less

bearing on our operating performance or operating conditions and

thus highlight trends in our core business that may not otherwise

be apparent when relying solely on IFRS measures. Specifically, the

Company believes that Adjusted EBITDA, when viewed with the

Company’s results under IFRS, provide useful information about the

Company’s business without regard to potential distortions. By

eliminating differences in results of operations between periods

caused by factors such as acquisition-related adjustments,

depreciation and amortization methods, impairment and other

charges, the Company believes that Adjusted EBITDA can provide a

useful basis for comparing the current performance of the

underlying operations being evaluated. The Company believes that

securities analysts, investors and other interested parties

frequently use non-IFRS financial measures in the evaluation of

issuers. The Company’s management also uses non-IFRS financial

measures in order to facilitate operating performance comparisons

from period to period and to prepare annual budgets and

forecasts.

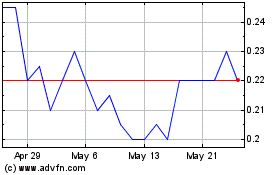

NowVertical (TSXV:NOW)

Historical Stock Chart

From Dec 2024 to Jan 2025

NowVertical (TSXV:NOW)

Historical Stock Chart

From Jan 2024 to Jan 2025