NowVertical Group Inc. (

TSX-V: NOW)

(

OTCQB: NOWVF) (“

NOW” or the

“

Company”), the Vertical Intelligence

(“

VI”) company, today announces its financial

results for the three and twelve months ended December 31, 2022.

All figures are in U.S. dollars unless otherwise stated.

“The fourth quarter results demonstrate our

ability to create value through a disciplined,

profitability-oriented growth strategy,” said Daren Trousdell,

Chief Executive Officer. “Carrying this momentum into fiscal 2023,

we are uniquely positioned – strategically, operationally, and

financially – to continue consolidating in markets around the

world, while realizing meaningful cost efficiencies and generating

increasing levels of organic growth.”

“NOW has ramped up our operations to build

significant scale and position us to compete with some of the

biggest and most well-known brands in the AI industry,” continued

Trousdell. “We have done this with a very strong and dedicated

corporate development team that has internally sourced, pursued,

and closed 12 acquisitions, that all-in generates approximately $60

million in revenue on a trailing 12-month (“TTM”)

basis.”1

Selected Financial

Highlights:

- TTM Proforma Revenue1 was

$33.7 million at December 31, 2022, an increase of

more than 300% from FY 2021.

- Current TTM Proforma Revenue1

at April 19, 2023, is approximately $60 million,

including TTM revenue from all 12 acquisitions completed.

- Adjusted Revenue1

Target for Q1 2023 is between

$11.5-$12.5 million.

- Adjusted Revenue1 – Adjusted

Revenue was $8.6 million1 in Q4 2022 and

$27.7 million1 for FY 2022, an increase of more

than 450% from Q4 2021 and more than 550% from FY 2021.

- Gross Profit1 was

$3.9 million in Q4 2022 and

$12.8 million in FY 2022,

representing significant increases from

$1.2 million in Q4 2021 and

$3.4 million in FY 2021.

- Adjusted EBITDA1 – Adjusted

EBITDA was $0.0 million in Q4 2022 and

($1.2) million

in FY 2022, representing significant improvements from

$(2.0) million in Q4 2021 and

($2.6) million in FY 2021.

- Net Loss – Net Loss was

$3.8 million in Q4 2022 and

$9.8 million in FY 2022,

improving from a net loss of $4.5

million in Q4 2021 and $13.9

million in FY 2021.

- Cash and Cash Equivalents – Unrestricted

Cash and cash equivalents were $3.8 million

as of December 31, 2022.

________________________1See NON-IFRS MEASURES at the end of

release

Financial Information:

| |

|

Three months ended |

|

(000)s |

|

December 31, 2022 |

|

December 31,

2021 |

|

|

Reported: |

|

NOWBusiness Units |

|

|

NOW Group Operations |

|

|

Total |

|

|

NOWBusiness Units |

|

|

NOW Group Operations |

|

|

Total |

|

|

Revenue |

$ |

8,392 |

|

$ |

- |

|

$ |

8,392 |

|

$ |

1,140 |

|

$ |

- |

|

$ |

1,140 |

|

| Loss

from operations |

$ |

(2,595 |

) |

$ |

(1,558 |

) |

$ |

(4,152 |

) |

$ |

(281 |

) |

$ |

(4,123 |

) |

$ |

(4,404 |

) |

|

Adjusted: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted Revenue |

$ |

8,575 |

|

$ |

- |

|

$ |

8,575 |

|

$ |

1,505 |

|

$ |

- |

|

$ |

1,505 |

|

| Cost of revenue |

$ |

(4,672 |

) |

$ |

- |

|

$ |

(4,672 |

) |

$ |

(272 |

) |

$ |

- |

|

$ |

(272 |

) |

| Gross Profit |

$ |

3,903 |

|

$ |

- |

|

$ |

3,903 |

|

$ |

1,233 |

|

$ |

- |

|

$ |

1,233 |

|

| Gross Profit margin |

|

46 |

% |

|

|

|

46 |

% |

|

82 |

% |

|

|

|

82 |

% |

| Administrative and other

expenses |

$ |

(2,501 |

) |

$ |

(1,423 |

) |

$ |

(3,925 |

) |

$ |

(818,447 |

) |

$ |

(2,410 |

) |

$ |

(3,229 |

) |

| Adjusted EBITDA |

$ |

1,402 |

|

$ |

(1,423 |

) |

$ |

(21 |

) |

$ |

414,434 |

|

$ |

(2,410 |

) |

$ |

(1,995 |

) |

| EBITDA

% |

|

16 |

% |

|

|

|

- |

|

|

28 |

% |

|

|

|

-133 |

% |

| |

|

12 Months Ended |

|

(000)s |

|

December 31, 2022 |

|

December 31,2021 |

|

As reported: |

|

NOWBusiness Units |

|

|

NOW Group Operations |

|

|

Total |

|

|

NOWBusiness Units |

|

|

NOW Group Operations |

|

|

Total |

|

|

Revenue |

$ |

27,009 |

|

$ |

– |

|

$ |

27,009 |

|

$ |

3,221 |

|

$ |

– |

|

$ |

3,221 |

|

| Loss

from operations |

$ |

(2,137 |

) |

$ |

(6,915 |

) |

$ |

(9,052 |

) |

$ |

895 |

|

$ |

(13,439 |

) |

$ |

(12,544 |

) |

|

Adjusted: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted Revenue |

$ |

27,746 |

|

$ |

– |

|

$ |

27,746 |

|

$ |

4,067 |

|

$ |

– |

|

$ |

4,067 |

|

| Cost of revenue |

$ |

(14,944 |

) |

$ |

– |

|

$ |

(14,944 |

) |

$ |

(569 |

) |

$ |

– |

|

$ |

(569 |

) |

| Gross Profit |

$ |

12,802 |

|

$ |

– |

|

$ |

12,802 |

|

$ |

3,498 |

|

$ |

– |

|

$ |

3,498 |

|

| Gross Profit margin |

|

46 |

% |

|

|

|

46 |

% |

|

86 |

% |

|

|

|

86 |

% |

| Administrative and other

expenses |

$ |

(7,842 |

) |

$ |

(6,201 |

) |

$ |

(14,044 |

) |

$ |

(1,379 |

) |

$ |

(4,748 |

) |

$ |

(6,127 |

) |

| Adjusted EBITDA |

$ |

4,960 |

|

$ |

(6,201 |

) |

$ |

(1,241 |

) |

$ |

2,119 |

|

$ |

(4,748 |

) |

$ |

(2,629 |

) |

| EBITDA

% |

|

18 |

% |

|

|

|

-4 |

% |

|

52 |

% |

|

|

|

-65 |

% |

Q4 2022 and Subsequent Business

Highlights

- In December 2022, NOW announced definitive agreements to

acquire 100% of the issued and outstanding securities of two

U.K.-based data analytics solution providers, Acrotrend Solutions

and Smartlytics Consultancy. Both acquisitions closed during Q1

2023, on January 12, 2023.

- In December 2022, NOW announced a definitive agreement to

acquire 100% of the issued and outstanding securities of Group

Analytics 10 and Inteligencia de Negocios and its affiliate

entities (collectively, the “A10 Group”) , one of

Latin America’s premier big data solution providers with an

experienced team of over 175 experts. The transaction closed during

Q1 2023 on February 2, 2023.

- On December 21, 2022, NOW entered into a partnership with

Export Development Canada (“EDC”) to support NOW’s

international growth and expansion efforts. As part of this

partnership, NOW and EDC have entered into a non-dilutive secured

$7.0 million credit facility agreement.

- On October 5, 2022, NOW completed a marketed public debenture

offering for total gross proceeds of C$5.1 million.

Subsequent to Q4:

- January 12, 2023, NOW announced a new credit agreement with The

Toronto-Dominion Bank (“TD Bank”) for CAD$7 million.

- On March 6, 2023, NOW announced its System Organization Control

Type II (“SOC 2”) certification.

- On February 21, 2023, Acrotrend, one of the newest additions to

NOW’s Vertical Intelligence offering, was awarded a gold rating in

the sixth annual listing of UK management firms most recommended by

their clients.

- On February 28, 2023, NOW completed a marketed public offering

of 9,631,500 units for aggregate gross proceeds of C$5.0

million.

Investor Call

NOW management will hold a quarterly broadcast to discuss 2022

results tomorrow morning at 9 am ET. Participants will include

Daren Trousdell, Chief Executive Officer; Alim Virani, Chief

Financial Officer; and Sasha Grujicic, President. A

question-and-answer session will follow.

Investor Conference Call

Registration

Register to watch the webinar here:

https://bit.ly/nowQ4webinar

For participants that would like to ask

questions on the call please register here for a dial in PIN:

https://bit.ly/NOWQ4registration

A recording of the webinar and supporting

materials will be made available following the call in the

investor’s section of the company’s website at

https://ir.nowvertical.com/news-and-media.

Release of Annual Audited Financial

Statements

The Company previously announced that its 2022

audited financial statements for the year ended December 31, 2022

(the “Financial Statements”) and accompanying

management’s discussion and analysis (the

“MD&A”) would be released following the close

of market on April 19, 2023. By way of update, the Company will be

releasing its Financial Statements and MD&A on or before the

filing deadline of April 30, 2023.

Corporate Update

Further to the Company’s news release dated

February 2, 2023 announcing the Company’s acquisition of the A10

Group, the Company would like to clarify that the earn-out

consideration payable under the purchase agreement with the A10

Group vendors which is to be paid over four fiscal years based on

certain Adjusted EBITDA targets is payable in part by way of an

issuance of subordinate voting shares in the capital of NOW

(“NOW Shares”) in the Company’s sole discretion

subject to a maximum of 1,500,000 NOW Shares (or an aggregate of

2,050,000 NOW Shares including the 550,000 NOW Shares issued on

closing at a deemed price of US$1.00 per NOW Share in settlement of

a US$550,000 payable on closing.

Further to the Company’s news release dated

March 28, 2022 announcing the Company’s acquisition of Exonar Ltd.

(“Exonar”), the Company would like to clarify that

the consideration payable under the purchase agreement to the

Exonar vendors is as follows: (i) a closing cash payment of

US$150,000 which was paid in March 2022 on closing; and (ii) a

deferred payment of US$500,000 payable one year from the closing

date (the “Deferred Payment”), in cash or NOW

Shares in the Company’s sole discretion at a deemed price per NOW

Share equal to the greater of (A) the Canadian dollar equivalent of

US$1.00 per share and (B) the Company's 20-day volume weighted

average trading price on the day prior to issuance, less the

maximum discount permitted under the rules of the TSX Venture

Exchange (the “TSXV”) and subject to the approval

of the TSXV. The Company has sought the approval of the TSXV to

issue 500,000 NOW Shares in settlement of the Deferred Payment and

such issuance remains subject to the approval of the TSXV.

Additionally, on April 18, 2023, the Company and

the former shareholders of Affinio, a company previously acquired

by NOW, agreed to amend the terms of a deferred payment of $1.5

million, by amending the amount payable to $1.74 million (the

“Remaining Amount”) and deferring the payment of

the Remaining Amount in cash installments between now and December

31, 2023.

Related links:

https://www.nowvertical.com

About NowVertical Group

Inc.

NowVertical Group is a Vertical Intelligence

(VI) software and services provider that delivers

vertically-specific data, technology, and artificial intelligence

(AI) applications into private and public verticals globally. NOW's

proprietary solutions sit at the foundation of the modern

enterprise by transforming AI investments into VI, enabling its

customers to minimize their risk, accelerate the time to value, and

reduce costs. NOW is rapidly growing organically and through

targeted acquisitions. For more information about NOW, visit

www.nowvertical.com.

Pre-Released Financial

Metrics

This news release contains certain pre-released

fourth quarter and full year financial metrics. The fourth quarter

and full year financial metrics contained in this news release are

preliminary and represent the most current information available to

the Company's management, as financial closing procedures for the

three months and year ended December 31, 2022 are not yet complete.

The Company's actual audited financial statements for such period

will be filed with the securities regulatory authorities in certain

provinces of Canada and available at www.sedar.com, on or before

the filing deadline of April 30, 2023, and may result in material

changes to the financial metrics summarized in this news release

(including by any one financial metric, or all of the financial

metrics, being below or above the figures indicated) as a result of

the completion of normal quarter and year end accounting procedures

and adjustments, and also what one might expect to be in the final

financial statements based on the financial metrics summarized in

this news release. Although the Company believes the expectations

reflected in this news release are based upon reasonable

assumptions, the Company can give no assurance that actual results

will not differ materially from these expectations.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

Follow us on Twitter and LinkedIn,

For further information, please contact:

Daren Trousdell, Chief Executive Officere:

daren@nowvertical.comt: (212) 302-0868

or

Glen Nelson, Investor Relationse: glen@nowvertical.comt: (403)

763-9797

NON-IFRS MEASURES

The non-IFRS financial measures referred to in this news release

are defined below. The management’s discussion and analysis for the

three and 12 months ended December 31, 2022, which will be

available on or before April 30, 2023 at www.nowvertical.com and on

the Company’s SEDAR profile, also contains supporting calculations

for Adjusted Revenue, EBITDA, Adjusted EBITDA, and Pro Forma TTM

Adjusted Revenue.

“Adjusted Revenue” adjusts

revenue to eliminate the effects of acquisition accounting on the

Company’s revenues.

“Q4 2022 Proforma Adjusted

Revenue” adjusts revenue to eliminate the effects of

acquisition accounting on the Company’s revenues and includes

revenues from all acquisitions completed as of the MD&A

issuance date.

“Adjusted EBITDA” adjusts

EBITDA for revenue adjustments in “Adjusted Revenue” and items such

as acquisition accounting adjustments, transaction expenses related

to acquisitions, transactional gains or losses on assets, asset

impairment charges, non-recurring expense items, non-cash stock

compensation costs, and the full-year impact of cost synergies

related to the reduction of employees.

“Pro Forma TTM Adjusted

Revenue” represents the trailing twelve months of Adjusted

Revenue of all acquisitions completed as of the end of the

respective period presented.

“Current Pro Forma TTM Adjusted

Revenue” adjusts Pro Forma TTM Adjusted Revenue to include

the Pro Forma TTM Adjusted Revenue of all acquisitions completed

through the date of the Q4 2022 MD&A. The prior year's

comparable amount reflects acquisitions completed through the date

of the prior period’s MD&A.

Forward‐Looking Statements

This news release may contain forward‐looking

statements (within the meaning of applicable securities laws) which

reflect the Company's current expectations regarding future events.

Forward-looking statements are identified by words such as

"believe", "anticipate", "project", "expect", "intend", "plan",

"will", "may", "estimate," and other similar expressions. These

statements are based on the Company's expectations, estimates,

forecasts and projections and include, without limitation,

statements regarding the future success of the Company's

business.

The forward-looking statements in this news

release are based on certain assumptions. The forward-looking

statements are not guarantees of future performance and involve

risks and uncertainties that are difficult to control or predict.

Several factors could cause actual results to differ materially

from the results discussed in the forward-looking statements.

Readers, therefore, should not place undue reliance on any such

forward-looking statements. Further, these forward-looking

statements are made as of the date of this news release. Except as

expressly required by applicable law, the Company assumes no

obligation to publicly update or revise any forward-looking

statement, whether as a result of new information, future events,

or otherwise.

Cautionary Note Regarding Non-IFRS

Measures

This news release refers to certain non-IFRS

measures. These measures are not recognized under IFRS, do not have

a standardized meaning prescribed by IFRS, and are, therefore,

unlikely to be comparable to similar measures presented by other

companies. Rather, these measures are provided as additional

information to complement those IFRS measures by providing further

understanding of the Company’s results of operations from

management’s perspective. The Company’s definitions of non-IFRS

measures used in this news release may not be the same as the

definitions for such measures used by other companies in their

reporting. Non-IFRS measures have limitations as analytical tools

and should not be considered in isolation nor as a substitute for

analysis of the Company’s financial information reported under

IFRS. The Company uses non-IFRS financial measures, including

“Adjusted Revenue”, “EBITDA”, “Adjusted EBITDA”, “Pro Forma TTM

Adjusted Revenue”, and “Current Pro Forma TTM Adjusted Revenue”.

These non-IFRS measures provide investors with supplemental

measures of our operating performance and eliminate items that have

less bearing on our operational performance or operating conditions

and thus highlight trends in our core business that may not

otherwise be apparent when relying solely on IFRS measures. The

Company believes that securities analysts, investors and other

interested parties frequently use non-IFRS financial measures in

the evaluation of issuers. The Company’s management also uses

non-IFRS financial measures in order to facilitate operating

performance comparisons from period to period and to prepare annual

budgets and forecasts.

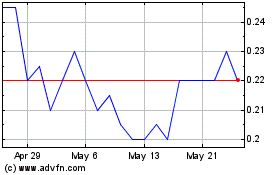

NowVertical (TSXV:NOW)

Historical Stock Chart

From Dec 2024 to Jan 2025

NowVertical (TSXV:NOW)

Historical Stock Chart

From Jan 2024 to Jan 2025