Alphinat Announces its Results for the Quarter Ended February 28,

2014

MONTREAL, QUEBEC--(Marketwired - Apr 17, 2014) - Alphinat Inc.

("Alphinat") (TSX-VENTURE:NPA), a leader in innovative Software for

the Smart Enterprise™, announces its results for the quarter ended

February 28, 2014.

During the quarter

under review, Alphinat has focused its efforts on nurturing and

expanding its distribution channels and on diversifying its

geographic and industry sector presence.

Alphinat has

continued to make strong headway into partnerships for enterprise

license sales, OEM agreements as well as for launching SaaS

services. We have seen significant uptake in sales with partners,

with a growing number of installed clients in various geographies

and industry sectors. Furthermore, during the period under review,

Alphinat has been involved in the implementation of SmartGuide with

clients in various vertical markets.

During the quarter

under review, Alphinat has seen OEM sales by partner CSDC continue

to progress with the addition of clients in the USA and in Canada.

During the same period, a large municipality in France ordered

additional SmartGuide licenses. SaaS sales by partner Vicrea have

also continued to increase at a steady pace.

During the period

under review, Alphinat received an order for delivery of a

SaaS-based solution from a private sector enterprise.

The Workplace Safety

and Insurance Board of Ontario (WSIB) and a client in Saskatchewan

have confirmed the renewal of their respective annual software

maintenance contracts.

In January 2014, the

Company finalized a contract renewal with an agency of the

government of France that allows France's SGMAP organization

(Secrétariat Général de Modernisation de l'Appareil Public), the

leading agency of the government of France for State Modernisation,

to continue to leverage SmartGuide and SmartGuide PaaS Edition to

deliver citizen-centric e-government services. The contract has

been renewed for three years with an option for a fourth year. This

new contract puts Alphinat in a direct relationship with the SGMAP

and allows the client to acquire additional software licenses,

annual maintenance and associated professional services.

Profit before

financing expenses and amortization amount to $14,160 for the

quarter ended February 28, 2014. The loss for the 3-month period

ended February 28, 2014 is $27,782 or $0.001 per outstanding common

share compared to a profit of $144,945 or $0.003 per outstanding

common share for the corresponding period in 2013.

Alphinat's financial

statements and Management's Discussion and Analysis for the quarter

ending February 28, 2014 can be found on SEDAR, at

www.sedar.com.

Additionally,

Alphinat announces the issuance of 198,989 Bonus Shares as set

forth in the Management Proxy Circular dated January 29, 2014. On

August 7, 2013, as announced in its press releases, the Corporation

closed the first tranche of a private placement consisting of Class

A Units, each comprising a Class A Debenture accompanied by one

Bonus Common Share per dollar of Class A Debenture subscribed and

Class B Units, each comprising a Class B Debenture accompanied by

one Bonus Common Share per dollar of Class B Debenture

subscribed.

The Class A

Debentures bear interest at 10% annually with interest payable

quarterly and mature on September 30, 2017. They are redeemable by

the Corporation on or after September 30, 2015. They were offered

at their face value. The Class A and Class B Debenture holders have

the right to convert the debentures at the principal amount plus

any unpaid accrued interest into the next equity issue of the

Corporation. In the event that the issue was offered at a discount

to market the Class B Debenture holders are not be entitled to any

discount. Conversion of debentures will be conditional to prior TSX

Venture Exchange's approval and the conversion price will be based

on market price at the time of conversion.

The Class B Units,

including a Class B Debenture substantially identical to the Class

A Debenture, were offered exclusively to Alphinat secured lenders

(the "Secured Lenders") who advanced $500,000 (the "Secured

Indebtedness") to the Corporation in October 2011. The Units were

offered in the context of a Debt Settlement whereby in

consideration of the cancellation of the Secured Indebtedness which

bore interest at a substantially higher rate than the Class B

Debenture, and the removal of the security for the Secured

Indebtedness, the Corporation issued Class B Debentures having a

value of 120% of the Secured Indebtedness being settled. The

premium was offered in view of the importance of foregoing

described benefits to the Corporation. In addition, the Secured

Lenders were entitled to receive one Bonus Common Share per dollar

of Class B Debenture subscribed, of which 154,761 Bonus Common

Shares have been issued at closing and the remaining 198,989 Bonus

Common Shares, will be issued only upon approval by the

shareholders at a special meeting of the shareholders. In addition,

the Secured Lenders were entitled to receive one Bonus Common Share

per dollar of Class B Debenture subscribed, of which 154,761 Bonus

Common Shares have been issued at closing and the remaining 198,989

Bonus Common Shares were to be issued only upon approval by the

shareholders at a special meeting of the shareholders. The annual

and special meeting of shareholders was held on February 26,

2014.

About Alphinat

Software for the

Smart Enterprise™ providing agility to leverage existing IT assets

and lower costs.

Alphinat develops,

markets and supports software technology that enables non-technical

managers to configure and deploy form based Web and mobile

applications and utilities that helps organizations and governments

better serve clients whether they are looking to deploy on premise

or in the Cloud. This technology uses sophisticated data

organization and processing software to automate interactions

between systems, employees, clients, suppliers and partners. The

software seamlessly integrates into complex environments permitting

a high level of collaboration in delivering user-centric services

while leveraging existing IT assets. It provides efficient and

cost-effective solutions to clients at both the time of acquisition

and on an ongoing basis.

Alphinat technology

could also be used in the healthcare, banking, insurance,

telecommunications and other sectors, in modernising, automating

and rendering cost-effective a number of business processes at a

fraction of the cost associated with conventional customized

solutions. For more details about Alphinat or its software suite,

please visit www.alphinat.com.

Forward-looking

statements

Certain statements

in this document, including those which express management's

expectations or estimations with regard to the Company's future

performance, constitute "forward-looking statements" as understood

by applicable securities laws. Forward-looking statements are, of

necessity, based on a certain number of estimates and hypotheses;

while management considers these to be accurate at the time they

are expressed, they are inherently subject to significant

uncertainties and risks on the commercial, economic and competitive

levels. We advise readers that these forward-looking statements are

subject to risks, uncertainties, and other known and unknown

factors that may cause the actual results, performance or

achievements of the Company to be materially different from any

future results, performance or achievements expressed or implied in

these forward-looking statements. A number of factors could cause

significant differences between actual results and those described

in forward-looking statements. These include, but are not limited

to, the Company's and CCFL Capital's ability to find subscribers in

connection with the proposed private placement. This is only one of

the factors that could bear on any of our forward-looking

statements. Investors are advised to not rely unduly on the

forward-looking statements. This advisory applies to all

forward-looking statements, whether expressed orally or in writing,

attributed to Alphinat or to any individual expressing them in the

name of the Company. Unless required by law, the Company is under

no obligation to publicly update these forward-looking statements,

whether to reflect new information, future events, or other

circumstances. Risks and uncertainties that bear on the Company are

described in greater detail in the Company's Annual Report.

Neither TSX

Venture Exchange nor its Regulation Services Provider (as that term

is defined in the policies of the TSX Venture Exchange) accepts

responsibility for the adequacy or accuracy of this

release.

Mr. Philippe LecoqChief Executive OfficerAlphinat Inc.(514)

398-9799 ext 222

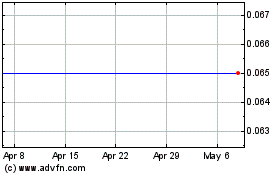

Alphinat (TSXV:NPA)

Historical Stock Chart

From Jan 2025 to Feb 2025

Alphinat (TSXV:NPA)

Historical Stock Chart

From Feb 2024 to Feb 2025