New Zealand Energy Announces Closing of Over-Allotment Option

02 September 2011 - 11:24PM

Marketwired Canada

NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE

UNITED STATES. ANY FAILURE TO COMPLY WITH THIS RESTRICTION MAY CONSTITUTE A

VIOLATION OF U.S. SECURITIES LAWS

New Zealand Energy Corp. (TSX VENTURE:NZ) ("NZEC" or the "Company"), an oil and

natural gas company with exploration and development prospects in New Zealand,

is pleased to announce that it has closed the over-allotment option related to

its recently completed initial public offering. Pursuant to the over-allotment

option, NZEC issued an additional 1,910,500 common shares at a price of $1.00

per common share, bringing the aggregate gross proceeds of the initial public

offering to $21,910,500.

In connection with the closing of the over-allotment option, the syndicate of

agents led by Canaccord Genuity Corp. and including GMP Securities L.P.,

Macquarie Capital Markets Canada Ltd., Haywood Securities Inc. and NCP Northland

Capital Partners Inc. (collectively, the "Agents"), received a 6% cash

commission on the proceeds from the sale of common shares. Warrants were also

issued totaling 3% of the common shares issued pursuant to the over-allotment

option, and are exercisable at $1.00 until February 3, 2013.

Net proceeds of the initial public offering and over-allotment option will be

used to explore and develop NZEC's oil and gas properties, for additional

geologic and technical studies and for general corporate purposes.

The common shares offered pursuant the over-allotment option were qualified for

distribution pursuant to the long form prospectus of the Company dated July 19,

2011 and filed in each of the provinces of Canada, other than Quebec. The long

form prospectus that details the current affairs on the Company, the

comprehensive work program and further information on the initial public

offering and over-allotment option, is available on SEDAR (www.sedar.com), on

the Company's website (www.newzealandenergy.com) or by contacting NZEC at

info@newzealandenergy.com.

ABOUT NEW ZEALAND ENERGY

NZEC is an oil and natural gas company engaged in the exploration, acquisition

and development of petroleum and natural gas assets in New Zealand. NZEC's

property portfolio collectively covers nearly two million acres in the Taranaki

Basin and East Coast Basin of New Zealand's North Island. NZEC holds two

petroleum exploration permits (Eltham Permit and Castlepoint Permit) and a 50%

interest in a petroleum exploration permit (Alton Permit, pending completion of

certain conditions), one pending petroleum exploration permit pursuant to an

assignment agreement (Ranui Permit), and one pending non-competitive petroleum

exploration permit application (East Cape Permit).

The Company's management team has extensive experience exploring and developing

oil and natural gas fields in New Zealand and Canada, and takes a

multi-disciplinary approach to value creation with a track record of successful

discoveries. NZEC plans to add shareholder value by executing a technically

disciplined exploration program focusing on the discovery of onshore and

offshore oil and natural gas resources in the politically and fiscally stable

country of New Zealand. The Company's strategy is to develop its existing

portfolio of assets and to pursue further exploration opportunities in other

areas with proven hydrocarbon systems. NZEC will continue to evaluate strategic

acquisitions from time to time where it views further exploration and

development opportunities exist, and may participate in future tenders offered

by the Government of New Zealand to acquire additional petroleum exploration

permits or petroleum mining permits.

On behalf of the Board of Directors

John Proust, Chief Executive Officer and Director

Forward-looking Statements

This news release contains certain forward-looking information and

forward-looking statements within the meaning of applicable securities

legislation (collectively "forward-looking statements"). The use of any of the

words "will be" and similar expressions are intended to identify forward-looking

statements. These statements involve known and unknown risks, uncertainties and

other factors that may cause actual results or events to differ materially from

those anticipated in such forward-looking statements, including without

limitation, the speculative nature of exploration, appraisal and development of

oil and natural gas properties; uncertainties associated with estimating oil and

natural gas resources; changes in the cost of operations, including cots of

extracting and delivering oil and natural gas to market, that affect potential

profitability of oil and natural gas exploration; operating hazards and risks

inherent in oil and natural gas operations; volatility in market prices for oil

and natural gas; market conditions that prevent the Company from raising the

funds necessary for exploration and development on acceptable terms or at all;

global financial market events that cause significant volatility in commodity

prices; unexpected costs or liabilities for environmental matters; competition

for, among other things, capital, acquisitions of resources, skilled personnel,

and access to equipment and services required for exploration, development and

production; changes in exchange rates, laws of New Zealand or laws of Canada

affecting foreign trade, taxation and investment; failure to realize the

anticipated benefits of acquisitions; and other factors discussed under "Risk

Factors" in NZEC's Prospectus dated July 19, 2011. NZEC believes the

expectations reflected in those forward-looking statements are reasonable, but

no assurance can be given that these expectations will prove to be correct. Such

forward-looking statements included in this news release should not be unduly

relied upon. These statements speak only as of the date of this news release and

NZEC does not undertake to update any forward-looking statements that are

contained in this news release, except in accordance with applicable securities

laws. In addition, this news release may contain forward-looking statements

attributed to third-party industry sources.

United States Advisory

This news release does not constitute an offer to sell or a solicitation of an

offer to buy, nor shall there be any sale of, any securities of NZEC in any

jurisdiction in which such offer, solicitation or sale would be unlawful. The

securities offered hereunder have not and will not be registered under the

United States Securities Act of 1933, as amended (the "U.S. Securities Act"), or

the securities laws of any state of the United States of America (the "United

States") and, subject to certain exceptions, may not be offered or sold within

the United States or its territories or possessions except in transactions

exempt from registration under the U.S. Securities Act and under the securities

laws of any applicable state. This news release does not constitute an offer to

sell or a solicitation of an offer to buy any of the securities offered hereby

within the United States, its territories or possessions.

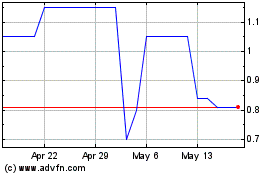

New Zealand Energy (TSXV:NZ)

Historical Stock Chart

From Jun 2024 to Jul 2024

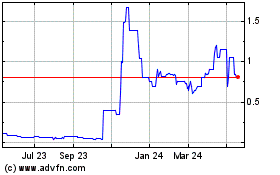

New Zealand Energy (TSXV:NZ)

Historical Stock Chart

From Jul 2023 to Jul 2024