Pender Growth Fund Inc. (the “Company”) today announced its

financial and operational results for the three months and nine

months ended September 30, 2023.

Financial Highlights

(Unaudited)

- Net loss was

$97,003 for the three months ended September 30, 2023 (September

30, 2022 – Net loss $8,520,121) primarily the result of negative

investment performance in the quarter

- Net loss per

Class C common share (“Share”) for the three months ended September

30, 2023 was $0.01 (September 30, 2022 – Net loss per share

$1.12).

- The Company’s

total shareholders’ equity decreased by $253,874 for the three

months ended September 30, 2023, primarily due to share repurchases

of $156,871 under the Company’s Normal Course Issuer Bid (“NCIB”)

and a net loss of $97,003, primarily the result of negative

investment performance during the quarter.

- Shareholders’

equity per Share was $8.85 as at September 30, 2023 (December 31,

2022 – $9.28).

- The Company’s

total shareholders’ equity was $66.6 million as at September 30,

2023, a decrease from December 31, 2022 ($70.2 million) resulting

primarily from negative investment performance for the nine months

ended September 30, 2023.

- Shares

outstanding were 7,524,629 as at September 30, 2023, a decrease

from December 31, 2022 (7,569,929) as a result of share repurchases

under the NCIB, which was renewed on February 14, 2023.

- At September 30,

2023, 85.9% of the investment portfolio was made up of private

companies and 14.1% of public companies. However, taken together

with the Company’s indirect exposure to public companies through

its investment in Pender Private Investments Inc. (“PPI”) and

Pender Technology Inflection Fund II Limited Partnership (“PTIF

II”) , public companies make up 68.8% of the Company’s

holdings.

- Management

Expense Ratio (“MER”) before performance fees was 2.45% for the

quarter ended September 30, 2023, up 0.10% compared to 2.35% in the

third quarter of 2022.

|

PERFORMANCE (Based on Shareholders’

Equity) |

3 Month |

1 Year |

3 Year |

5 Year |

Since Inception |

|

Class C |

0.1% |

-15.4 |

20.7% |

15.9% |

17.5% |

The Company’s portfolio is materially

concentrated in the shares of one publicly listed Portfolio

Company, Copperleaf Technologies Inc. (“Copperleaf”). At September

30, 2023, considering both its direct investment and its indirect

investment through its holding of shares of PPI, the Company held

6,889,883 shares of Copperleaf with a value of $38.9 million, which

was 58.5% of the Company’s total shareholders’ equity of $66.6

million (December 31, 2022 – 6,762,065 Shares with a value of $38.8

million which was 55.3% of the Company’s total shareholders’ equity

of $70.2 million). As at September 30, 2023, Copperleaf’s trading

price was at $5.65 per share, down $0.09 per share from its

December 31, 2022 closing price of $5.74 per share. There can be no

assurance that the Company will be able to realize the value of

this investment.

Portfolio Highlights

During the third quarter, overall market

sentiment was more challenging, with equities and risk assets

broadly lower over the period. With the peak in inflation nearing

or behind us and central banks slowing and, in some cases, pausing,

their interest rate raising campaigns, the focus has turned to

apprehension about future economic growth and the lag effect of

tighter financial monetary conditions brought about by higher

interest rates. We think this will remain in focus with concern

from investors that tighter financial conditions will impact

spending habits and that a recession is on the horizon.

We believe that the Company continues to be

well-positioned today to pursue its investment objectives despite

current market volatility and valuations in micro and small cap

stocks in North America.

Investment results may be affected by future

developments and new information that may emerge about inflation

and the impact of central bank measures and geopolitical and other

global events, factors that are beyond the Company’s control.

While macro events have driven investor

sentiment, we have remained focused on our bottom-up fundamental

research to identify companies that can thrive in a wide range of

economic scenarios. We believe that this environment provides

compelling opportunities for long term focused investors and that

the Company is well-positioned to continue to pursue its investment

objectives.

As always, this quarter we worked closely with

our private portfolio companies and certain of our public portfolio

companies.

Significant Equity Investments & Recent

Developments

Pender Private Investments Inc.

At September 30, 2023, the Company held 100% of

the Legacy Shares of PPI, formerly the Working Opportunity Fund

(EVCC) Ltd. (“WOF”). These shares were acquired in May 2021 from

shareholders of WOF (“Exiting Shareholders”) under the previously

announced transaction (the “WOF Transaction”) and in transactions

subsequent to May 2021.

During the period, after receiving approval from

the PPI shareholders, a satisfactory Fairness Opinion and court

approval, the Company acquired the remaining 2% of PPI’s Legacy

Shares at a purchase price $6.94 per Share for a total cash

purchase price of $855,490, effective August 17, 2023.

Copperleaf Technologies Inc.

At September 30, 2023, the Company held 9.4% of

Copperleaf’s issued and outstanding shares, both directly and

through its investment in PPI. The value of the Company’s direct

and indirect holdings of Copperleaf was $38.9 million at September

30, 2023, which was 58.5% of the Company’s total shareholders’

equity.

Other Highlights

We continued to acquire shares of the Company in

the market under our NCIB because we believe the shares are trading

at a discount to their intrinsic value. On February 14, 2023, the

Company launched a new NCIB, under which the Company may purchase a

maximum of 663,045 shares, or 10% of the Company’s public float on

launch date, during the one-year period ending February 13,

2024.

We encourage you to refer to the Company’s

MD&A and quarterly unaudited financial statements for September

30, 2023, the annual audited financial statements for the

year-ended December 31, 2022, and other disclosures available under

the Company’s profile at www.sedarplus.ca for additional

information.

About the

Company

Pender Growth Fund Inc is an investment firm.

Its investment objective is to achieve long-term capital growth.

The Company utilizes its small capital base and long-term horizon

to invest in unique situations, primarily small cap, special

situations, and illiquid public and private companies. The firm

invests in public and private companies based primarily in Canada

and the U.S., principally in the technology sector. It trades on

the TSX Venture Exchange under the symbol “PTF” and posts its NAV

on its website, generally within five business days of each month

end.

Please visit www.pendergrowthfund.com.

For further information, please contact:

Tony Rautava

Corporate Secretary Pender Growth Fund Inc. (604) 653-9625Toll

Free: (866) 377-4743Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

Forward-Looking Information

This news release may contain forward-looking

statements (within the meaning of applicable securities laws)

relating to the business of the Company and the environment in

which it operates. Forward-looking statements are identified by

words such as “believe”, “anticipate”, “project”, “expect”,

“intend”, “plan”, “will”, “may”, “estimate” and other similar

expressions. These statements are based on the Company's

expectations, estimates, forecasts and projections and include,

without limitation, statements regarding the Company’s decreased

portfolio risk and future investment opportunities. The

forward-looking statements in this news release are based on

certain assumptions; they are not guarantees of future performance

and involve risks and uncertainties that are difficult to control

or predict. A number of factors could cause actual results to

differ materially from the results discussed in the forward-looking

statements, including, but not limited to, the factors discussed

under the heading “Risk Factors” in the Company's annual

information form available at www.sedarplus.ca. There can be no

assurance that forward-looking statements will prove to be accurate

as actual outcomes and results may differ materially from those

expressed in these forward-looking statements. Readers, therefore,

should not place undue reliance on any such forward-looking

statements. Further, these forward-looking statements are made as

of the date of this news release and, except as expressly required

by applicable law, the Company assumes no obligation to publicly

update or revise any forward-looking statement, whether as a result

of new information, future events or otherwise.

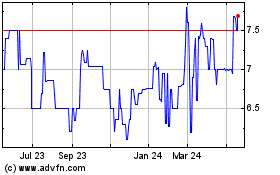

Pender Growth (TSXV:PTF)

Historical Stock Chart

From Dec 2024 to Jan 2025

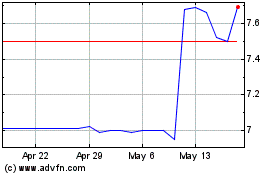

Pender Growth (TSXV:PTF)

Historical Stock Chart

From Jan 2024 to Jan 2025