Partners Value Investments LP Announces US$250 Million Issuer Bid

04 June 2019 - 11:25PM

Partners Value Investments LP (the “Partnership”, TSXV: PVF.UN

TSXV: PVF.PR.U) announced today its wholly owned, indirect

subsidiary, PVII Subco Inc. (“SubCo”) is undertaking a substantial

issuer bid (the "Offer'') to purchase up to 9,915,637 Class A

Preferred Limited Partnership Units, Series 1 (the “Preferred

Units”) of the Partnership at a price per Preferred Unit of

US$25.2127 (the “Purchase Price”).

The Offer will expire at 5:00 p.m. (Toronto

time) on July 9, 2019 (the “Expiration Date”) unless the Offer is

extended, varied or withdrawn by SubCo.

The Offer by SubCo represents an effective use

of the financial resources of the Partnership and its subsidiaries

and provides more flexibility to raise capital in the future. The

Purchase Price in the Offer is the same amount per Preferred Unit

that would be received by the holders of Preferred Units

(“Unitholders”), if instead the Partnership had exercised its right

to redeem the Preferred Units pursuant to the terms and conditions

of the Partnership’s limited partnership agreement with the

redemption date being the Expiration Date. Proceeding by way of a

substantial issuer bid, provides Unitholders with the flexibility

to determine if and how many Preferred Units they wish to tender

which Unitholders would not have had if the Partnership had

exercised its right to redeem the Preferred Units instead.

Unitholders will receive the Purchase Price,

payable in cash, for Preferred Units tendered, subject to any

applicable withholding taxes. If the aggregate number of Preferred

Units properly deposited exceeds 9,915,637, such units will be

purchased on a pro rata basis, subject to the terms of the Offer.

The Offer will be offered to all Unitholders. The formal offer

documents being mailed to Unitholders will contain the full terms

and conditions of the Offer and instructions for tendering

Preferred Units.

Unitholders whose Preferred Units are taken up

in the Offer in accordance with the terms of the Offer will not be

entitled to receive the distribution payable by the

Partnership on July 31, 2019. The record date for the payment of

such distribution will be fixed by the Partnership to be the

date after the date on which Preferred Units are taken up in the

Offer.

For further information, contact Investor

Relations at ir@pvii.ca or 416-956-5142.

This news release includes forward-looking

information within the meaning of Canadian provincial securities

laws. Forward-looking statements in this news release include

statements with respect to the Offer and declaration of

distributions. Although the company believes that such statements

are based upon reasonable assumptions and expectations, the reader

should not place undue reliance on forward-looking statements and

information because they involve known and unknown risks,

uncertainties and other factors. Reference is made to the most

recent Annual Report for a description of the major risk factors.

When relying on our forward-looking statements to make decisions

with respect to the company, investors and others should carefully

consider such factors and other uncertainties and potential events.

Except as required by law, the company undertakes no obligation to

publicly update or revise any forward-looking statements or

information. whether written or oral, that may be as a result of

new information. figure events or otherwise.

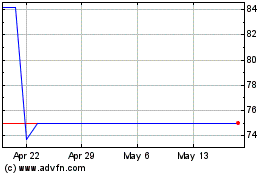

Partners Value Investments (TSXV:PVF.UN)

Historical Stock Chart

From Jan 2025 to Feb 2025

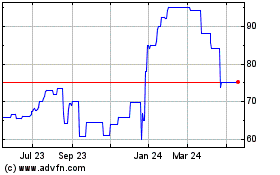

Partners Value Investments (TSXV:PVF.UN)

Historical Stock Chart

From Feb 2024 to Feb 2025