Partners Value Investments LP (TSXV: PVF.UN, TSXV: PVF.PR.U) (the

“

Partnership”) and Partners Value Investments Inc.

(TSXV: PVF.WT) (“

PVII”) today announced that they

have obtained a final order (the “

Final Order”)

from the Ontario Superior Court of Justice (Commercial List)

approving the previously announced transaction with Partners

Limited to be implemented by way of a court approved plan of

arrangement (the “

Arrangement”).

The effect of the Arrangement is to, among other

things, amalgamate Partners Limited with PVII and other related

entities, with the resulting entity continuing to be named Partners

Value Investments Inc. (“Amalco”), under a newly

formed limited partnership named Partners Value Investments L.P.

(“New PVI LP”). New PVI LP will have substantially

the same capital structure and unit terms as the Partnership.

Receipt of the Final Order follows the approval

of the Arrangement by holders (“Equity

Unitholders”) of equity limited partnership units

(“Equity Units”) of the Partnership, holders

(“Preferred Unitholders”) of class A preferred

limited partnership units, Series 1, Series 2, Series 3 and Series

4 (“Preferred Units”) of the Partnership and

holders (“Warrantholders”) of share purchase

warrants of PVII (“PVII Warrants”) at the joint

special meeting of the Partnership and PVII on November 9, 2023.

The special resolution approving the Arrangement required the

approval of at least two-thirds of the votes cast by Equity

Unitholders, at least two-thirds of the votes cast by Preferred

Unitholders, voting as a single class, and a simple majority of the

votes cast by Equity Unitholders, excluding votes attached to

certain Equity Units under the requirements of Multilateral

Instrument 61-101 – Protection of Minority Security Holders in

Special Transactions.

The Partnership and PVII have now received

board, securityholder and court approval, all material regulatory

approvals have been obtained, and the shareholders of Partners

Limited have approved the Arrangement. Subject to the satisfaction

or waiver of the remaining conditions to the Arrangement, it is

expected the Arrangement will become effective following the close

of business on November 24, 2023.

The TSXV is expected to establish special

trading rules for the three trading days preceding the effective

date of the Arrangement to facilitate settlement prior to the

effective date of trades occurring on the TSXV during the three day

period. The Equity Units and series 1 of the Preferred Units

(“Preferred Units, Series 1”) are expected to be

delisted from the TSXV at the close of business on November 24,

2023, while the PVII Warrants are expected to be delisted on

November 27, 2023. The equity limited partnership units

(“New Equity Units”) and Class A preferred limited

partnership units, Series 1 (“New Preferred Units, Series

1”) of New PVI LP will commence trading on the TSXV under

the symbols “PVF.UN” and “PVF.PR.U”, respectively, following the

close of markets on November 24, 2023, the Class A preferred

shares, Series 1 (“Amalco Preferred Shares”) of

Amalco are expected to commence trading on the TSXV under the

symbol “PVF.PR.V” on November 27, 2023, and the share purchase

warrants (“Amalco Warrants”) of Amalco are

expected to be listed on November 27, 2023 and commence trading on

the TSXV under the symbol “PVF.WT” on November 29, 2023.

Completion of Transaction and Other

Information

Securityholders should expect to receive their

new securities, including the Brookfield Reinsurance Ltd. shares

they are entitled to receive pursuant to the Arrangement, during

the week of November 27, 2023.

For further details concerning the Arrangement

please consult the joint management information circular of the

Partnership and PVII that has been filed on the Partnership’s and

PVII’s profiles on SEDAR+ at www.sedarplus.ca.

This news release does not constitute an

offer to sell or a solicitation of an offer to buy any securities

of the Partnership, New PVI LP, PVII or Amalco or any other

securities, and shall not constitute an offer, solicitation or sale

in any state or jurisdiction in which such an offer, solicitation

or sale would be unlawful. No securities have been or will be

registered under the United States Securities Act of 1933, as

amended (the “U.S. Securities Act”), or the securities laws of any

state of the United States, and any securities issued in connection

with the Arrangement are anticipated to be issued in reliance upon

the exemption from the registration requirements of the U.S.

Securities Act provided for by Section 3(a)(10) thereof and in

accordance with applicable state securities

laws.

For additional information, please contact

Investor Relations at ir@pvii.ca or 416-643-7621.

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Forward-Looking Statements

Note: This news release contains

“forward-looking information” within the meaning of Canadian

provincial securities laws and “forward-looking statements” within

the meaning of applicable Canadian securities regulations.

Forward-looking statements include statements that are predictive

in nature, depend upon or refer to future events or conditions, or

include words such as “expects”, “anticipates”, “plans”,

“believes”, “estimates”, “intends”, “targets”, “projects”,

“forecasts”, “seeks”, “likely” or negative versions thereof and

other similar expressions, or future or conditional verbs such as

“may”, “will”, “should”, “would” and “could”. Forward-looking

statements in this news release include statements relating to and

regarding the anticipated completion of the Arrangement, the

anticipated timing of completion of the Arrangement, the benefits

to be received by securityholders, that all necessary TSXV

approvals will be obtained on the timelines and in the manner

currently anticipated, forward-looking statements concerning PVII,

the Partnership, New PVI LP, Amalco and other statements that are

not historical facts. Forward-looking statements are provided for

the purpose of presenting information about current expectations

and plans of management of PVII and the Partnership relating to the

future, and readers are cautioned that such statements may not be

appropriate for other purposes. Although management believes that

these forward-looking statements and information are based upon

reasonable assumptions and expectations, the reader should not

place undue reliance on forward-looking statements and information

because they involve known and unknown risks, uncertainties and

other factors, many of which are beyond the control of PVII and the

Partnership, which may cause the actual results, performance or

achievement of PVII and the Partnership to differ materially from

anticipated future results, performance or achievement expressed or

implied by such forward-looking statements and information.

Factors that could cause actual results to

differ materially from those contemplated or implied by

forward-looking statements and information include, but are not

limited to: TSXV approvals may not be obtained in the timelines or

on the terms currently anticipated or at all; the Arrangement is

subject to a number of closing conditions and no assurance can be

given that all such conditions will be met or will be met in the

timelines required by the Arrangement Agreement; the business,

operational and/or financial performance or achievements of PVII

and the Partnership may be materially different from that currently

anticipated and in particular, the benefits in respect of the

Arrangement are based on the current business, operational and

financial position of each of the parties to the Arrangement, which

are subject to a number of risks and uncertainties; the impact or

unanticipated impact of general economic, political and market

factors; the behavior of financial markets, including fluctuations

in interest and foreign exchanges rates; operational and

reputational risks; changes in government regulation and

legislation; changes in tax laws, catastrophic events, such as, but

not limited to, earthquakes and hurricanes; the possible impact of

international conflicts and other developments including terrorist

acts and the outbreak of disease including epidemics and pandemics;

and other risks and factors detailed from time to time in the

PVII’s and the Partnership’s documents filed with the securities

regulators in Canada.

Each of the Partnership and PVII cautions that

the foregoing list of important factors that may affect future

results is not exhaustive. When relying on the Partnership’s and

PVII’s forward-looking statements and information, investors and

others should carefully consider the foregoing factors and other

uncertainties and potential events. Except as required by law,

neither the Partnership nor PVII undertakes any obligation to

publicly update or revise any forward-looking statements and

information, whether written or oral, that may be as a result of

new information, future events or otherwise.

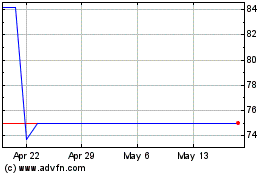

Partners Value Investments (TSXV:PVF.UN)

Historical Stock Chart

From Nov 2024 to Dec 2024

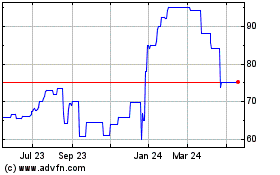

Partners Value Investments (TSXV:PVF.UN)

Historical Stock Chart

From Dec 2023 to Dec 2024