THIS DOCUMENT IS NOT INTENDED FOR DISSEMINATION OR DISTRIBUTION IN THE UNITED

STATES.

Questor Technology Inc. ("Questor" or the "Company") (TSX VENTURE:QST) announced

today it's financial and operating results for the year ended December 31, 2012.

The Company's audited annual financial statements have been prepared in

accordance with International Financial Reporting Standards ("IFRS").

The Company reported a profit of $1,040,356 ($0.042 per basic share) compared to

a profit of $1,190,404 ($0.048 per basic share) for the year ended December 31,

2011. The reduction in profit was primarily due to the impact of recording a

significant charge for allowance for doubtful accounts in 2012 and a one-time

Other revenue item recorded in 2011. Comparatively lower administration expenses

and net foreign exchange gains partially offset the impacts of those two items.

FINANCIAL HIGHLIGHTS SUMMARY

(Stated in Canadian dollars except per share amounts)

Increase

For the years ended December 31 2012 2011 (decrease)

----------------------------------------------------------------------------

Revenue 6,684,475 6,093,189 591,286

Gross profit(1) 3,078,180 2,883,387 194,793

EBITDA(1) 1,723,363 1,797,030 (73,667)

Profit and total comprehensive income 1,040,356 1,190,404 (150,048)

Cost of sales as a percent of

revenue(1) 53.9% 52.7% 1.2%

Cash generated from operations before

movements in non-cash working

capital(1) 1,826,443 1,793,638 32,805

Total assets 9,798,449 9,025,953 772,496

Non-current liabilities 272,976 156,034 116,942

Shares outstanding(2)

Basic 24,869,255 24,746,411 122,844

Diluted 25,144,794 24,796,499 348,295

Earnings per share Basic 0.042 0.048 (0.006)

Diluted 0.041 0.048 (0.007)

----------------------------------------------------------------------------

(1) Non-IFRS financial measure. Please see discussion in the Non-IFRS

Financial Measures section of Questor's Management's Discussion and

Analysis for the year ended December 31, 2012.

(2) Weighted average.

"Despite the challenging times and relative slowdown in industry activity, the

Questor team delivered a 10 percent increase in revenues in 2012 over 2011,

generating the second highest annual revenue in the Company's history and

increased gross profit by 7 percent to achieve earnings of $0.042 per share.

Revenues were up in all of the business segments for the year. We continued to

penetrate the U.S. market in both the sale of incinerators and use of

incineration equipment on a rental basis and saw sales of units in the Canadian

market jump by 51%. The anticipated fourth quarter delivery of a large capacity

unit to the U.S. market was deferred by our client to the first quarter of 2013"

said Audrey Mascarenhas, President and Chief Executive Officer. "In 2012 we

invested in our rental fleet and inventory using cash generated from operations

to continue to grow revenues into 2013."

"Questor's product quality and combustion expertise are becoming more recognized

on a daily basis globally" she continued. "Our incineration technology is unique

in its ability to allay public concerns regarding air quality and is capable of

meeting emissions standards across a wide range of applications. Recent

emissions legislation introduced in the United States and Europe are expected to

continue to increase interest in our incinerators as companies look for

solutions to flaring and emissions control."

To assist in this growth Questor announces that Mr. John Hankins has joined the

team in the role of Vice President of Business development. John brings a wealth

of experience to Questor in business development, most recently with Calgary

Economic Development.

Mr. Michael West has kindly agreed to have his name stand for election as

Director at Questor's Annual General Meeting on June 4, 2013. Mr. West will

bring considerable expertise to our Board guiding management through the

Company's anticipated growth. Michael's past roles include President and CEO of

CE Franklin Ltd and Vice President Sales and Operations for National Oilwell

Varco.

"We are well positioned to pursue growth opportunities in North America and

Europe in the coming year," concluded Ms. Mascarenhas.

2012 OPERATIONAL HIGHLIGHTS

Relative to the Company's strategic priorities, the following selected events

and achievements demonstrate Questor's progression in 2012:

-- Generated the highest annual revenue in the Company's history -

$6,684,475 - aside from 2007 where a one-time significant sale of

incinerators to China occurred.

-- Demonstrated the Company's technical expertise and competence in the

destruction of low heat content gases through the deployment of

incineration equipment and related technology to shale gas and oil sands

developments and to amine, dehydration and other crude oil and natural

gas processing applications. As a result, certain customers have

identified Questor's technology as best practice and specify the use of

the Company's solutions in their tenders to third parties for field

equipment.

-- Exploited the growing demand for non-permanent applications arising from

the industry's focus on shale gas opportunities investing $0.8 million

in 2012 in addition to $1.4 million in 2011 in rental incinerator fleet

additions and modifications including trailerization of one of the

Company's largest units.

-- Delivered in first quarter 2012 the first of the Company's incineration

equipment into Russia. The Russian market holds strong potential for

Questor as the country focuses on opportunities to reduce waste gas

flaring. An additional order for a unit is expected to be delivered in

second quarter 2013 and discussions are ongoing for future sales.

-- Advanced the development and commercialization of a process to recover

waste heat from incineration and convert the heat to power. The Company

experimented with a variety of designs at its test facility in Grande

Prairie, Alberta. The first such application was installed in third

quarter 2011 and has been the basis for the development of customized

designs for demonstration projects with potential customers throughout

2012.

-- Established a marketing arrangement with Global Industrial Dynamics B.V.

("GI Dynamics") to jointly market Questor's incineration equipment in

Europe, Russia, China and Australia. GI Dynamics is a technology and

service provider focused on industrial projects in natural gas

processing, waste handling and renewable technologies. The company is

headquartered in The Netherlands with offices in China and Australia.

The Managing Director of GI Dynamics made a presentation regarding

Questor's clean air technologies at the Gas Processors Association (GPA)

Europe Annual Conference 2012 in Berlin, Germany on May 24, 2012.

-- Built market awareness and recognition for Questor's expertise in

matters relating to air quality through presentations made by invitation

at several events worldwide including:

-- ACAMP (Alberta Centre for Advanced MNT Products) Cleantech

Technology Seminar 2012 in Calgary, Alberta on March 8, 2012 on the

topic of "Clearing the Air! Safely, Economically and Efficiently".

-- CERBA (Canada Eurasia Russian Business Association) International

Conference on Canada-Eurasia-Russia Cooperation on Energy Efficiency

and Sustainable Development of the Regions, in Vancouver, British

Columbia on March 14, 2012 on the topic of "Innovative Technologies

in Energy Efficiency and Environment Protection".

-- Country Special Canada Forum on the Far North: Economic

Opportunities, Environmental Challenges and Scientific Exploration

held in conjunction with the IFAT ENTSORGA Trade Show and Conference

in Munich, Germany on May 9, 2012 on the topic of "New Technological

and Regulatory Approaches to Addressing Environmental Challenges

around Northern Development in Alberta".

-- The 5th International Petroleum and Petrochemical Leadership and

Innovation Summit held in Dongying, Shandong Province, China from

September 17 - 19, 2012.

-- The Canadian Society for Unconventional Resources 14th Annual

Unconventional Resources Conference Frac to the Future, held October

3 - 4, 2012 in Calgary, Alberta.

-- The 19th International Petroleum Environmental Conference held

October 30, 31 and November 1, 2012 in Denver, Colorado, USA.

-- Unconventional Gas Aberdeen 2012 Conference in Aberdeen, Scotland on

November 28, 2012.

-- Copies of these presentations are available on the Company's website.

SUBSEQUENT TO DECEMBER 31, 2012

At December 31, 2012, the Company had confirmed incinerator sales orders of $1.2

million. Since the beginning of 2013, confirmed incinerator sales orders for an

additional $2.0 million have been received. Of the $3.2 million of associated

revenue to be recorded in relation to these orders, $1.2 million will be

recognized in first quarter 2013 and $2.0 million in second quarter 2013.

Ms. Mascarenhas conducted a webinar for the Society of Profession Engineers

connecting globally with their members on the topic of "a Sustainable Solution

to the Climate Change Dilemma - Eliminate the Flare".

Audrey will also make a presentation May 7th at the CSPG 2013 GeoConvention

entitled "It's Not Just About Rocks" and at the Western Energy Summit May 10th

discussing the key role that technology plays in Energy development.

The Company was selected for Alberta Venture's 2012 Fast Growth 50 list, an

annual ranking honouring fifty of the fastest growing companies in Alberta. This

was the fourth year in succession that Questor was selected.

On March 15, 2013 Questor was awarded the Alberta Export Award for Technology

and Media, an award sponsored jointly by the Canadian Manufacturers and

Exporters and Economic Development Canada and presented to companies who have

made an outstanding contribution to the economy in Alberta through the export of

products and services.

The Company announced that effective April 24, 2013, subject to regulatory

approval, the grant of share options to select officers and employees entitling

the purchase of up to 450,000 common shares at $0.53 per share, exercisable for

a period of five years and vesting in accordance with the provisions of

Questor's share option plan.

Shareholders are invited to attend the Company's Annual General Meeting to be

held on Tuesday, June 4, 2013 at 3:00 p.m. MDT in the Company's Corporate

Offices at 1121, 940 - 6th Avenue S.W, Calgary, Alberta. In addition to the

formal business items, management will be presenting an overview of Questor's

results for the financial year ended December 31, 2012 and first quarter ended

March 31, 2013 and discussing the Company's strategic initiatives for 2013.

Questor's audited financial statements and notes thereto and management's

discussion and analysis for the year ended December 31, 2012 will be available

shortly on the Company's website at www.questortech.com and through SEDAR at

www.sedar.com.

ABOUT QUESTOR TECHNOLOGY INC.

Questor is an international environmental oilfield service company founded in

late 1994 and headquartered in Calgary, Alberta, Canada with a field office

located in Grande Prairie, Alberta, Canada. The Company is focused on clean air

technologies with activities in Canada, the United States, Europe and Asia.

Questor designs and manufactures high efficiency waste gas incinerators for sale

or for use on a rental basis and also provides combustion-related oilfield

services. The Company's proprietary incinerator technology destroys noxious or

toxic hydrocarbon gases which ensures regulatory compliance, environmental

protection, public confidence and reduced operating costs for customers. Questor

is recognized for its particular expertise in the combustion of sour gas (H2S).

While the Company's current customer base is primarily in the crude oil and

natural gas industry, this technology is applicable to other industries such as

landfills, water and sewage treatment, tire recycling and agriculture.

Questor trades on the TSX Venture Exchange under the symbol "QST".

Certain information in this news release constitutes forward-looking statements.

When used in this news release, the words "may", "would", "could", "will",

"intend", "plan", "anticipate", "believe", "seek", "propose", "estimate",

"expect", and similar expressions, as they relate to the Company, are intended

to identify forward-looking statements. In particular, this news release

contains forward-looking statements with respect to, among other things,

business objectives, expected growth, results of operations, performance,

business projects and opportunities and financial results. These statements

involve known and unknown risks, uncertainties and other factors that may cause

actual results or events to differ materially from those anticipated in such

forward-looking statements. Such statements reflect the Company's current views

with respect to future events based on certain material factors and assumptions

and are subject to certain risks and uncertainties, including without

limitation, changes in market, competition, governmental or regulatory

developments, general economic conditions and other factors set out in the

Company's public disclosure documents. Many factors could cause the Company's

actual results, performance or achievements to vary from those described in this

news release, including without limitation those listed above. These factors

should not be construed as exhaustive. Should one or more of these risks or

uncertainties materialize, or should assumptions underlying forward-looking

statements prove incorrect, actual results may vary materially from those

described in this news release and such forward-looking statements included in,

or incorporated by reference in this news release, should not be unduly relied

upon. Such statements speak only as of the date of this news release. The

Company does not intend, and does not assume any obligation, to update these

forward-looking statements. The forward-looking statements contained in this

news release are expressly qualified by this cautionary statement.

----------------------------------------------------------------------------

QUESTOR TECHNOLOGY INC.

STATEMENTS OF FINANCIAL POSITION

Stated in Canadian dollars

December 31 December 31

As at Notes 2012 2011

----------------------------------------------------------------------------

ASSETS

Current assets

Cash and cash equivalents 4 $ 4,405,624 $ 2,166,301

Short-term investment 4 - 1,007,896

Trade and other receivables 5, 23 2,304,478 2,852,578

Inventories 6 670,959 766,028

Prepaid expenses and deposits 88,378 96,296

Current tax assets 25,158 73,341

----------------------------------------------------------------------------

Total current assets 7,494,597 6,962,440

----------------------------------------------------------------------------

Non-current assets

Property and equipment 7 2,295,529 2,053,972

Intangible assets 8 8,323 9,541

----------------------------------------------------------------------------

Total non-current assets 2,303,852 2,063,513

----------------------------------------------------------------------------

Total assets $ 9,798,449 $ 9,025,953

----------------------------------------------------------------------------

----------------------------------------------------------------------------

LIABILITIES AND EQUITY

Current liabilities

Trade payables, accrued liabilities

and provisions 9 $ 894,206 $ 1,070,989

Deferred revenue and deposits 2,205 280,042

Current tax liabilities 17 171,907 196,572

----------------------------------------------------------------------------

Total current liabilities 1,068,318 1,547,603

----------------------------------------------------------------------------

Non-current liabilities

Deferred tax liabilities 17 97,319 94,935

Lease inducement 24 152,746 61,099

----------------------------------------------------------------------------

Total non-current liabilities 250,065 156,034

----------------------------------------------------------------------------

Total liabilities 1,318,383 1,703,637

----------------------------------------------------------------------------

Capital and reserves

Issued capital 11 5,521,001 5,458,215

Reserves 12 676,834 622,226

Retained earnings 2,282,231 1,241,875

----------------------------------------------------------------------------

Total equity 8,480,066 7,322,316

----------------------------------------------------------------------------

Total liabilities and equity $ 9,798,449 $ 9,025,953

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Approved by the Board of Directors:

Gerald DeSorcy, Director Audrey Mascarenhas, Director

----------------------------------------------------------------------------

QUESTOR TECHNOLOGY INC.

STATEMENTS OF COMPREHENSIVE INCOME

Stated in Canadian dollars except per share data

For the years ended December 31 Notes 2012 2011

----------------------------------------------------------------------------

Revenue 13 $ 6,684,475 $ 6,093,189

Cost of sales 7, 15 (3,606,295) (3,209,802)

----------------------------------------------------------------------------

Gross profit 3,078,180 2,883,387

Administration expenses 15 (1,621,055) (1,548,813)

Write-off of property and equipment (27,865) (39,437)

Depreciation of property and

equipment 7 (41,316) (31,342)

Amortization of intangible assets 8 (1,218) (1,218)

Net foreign exchange gains/(losses) 10,603 (18,392)

Other income 13 23,997 324,593

----------------------------------------------------------------------------

Profit before tax 1,421,326 1,568,778

Income tax expense 17 (380,970) (378,374)

----------------------------------------------------------------------------

Profit and total comprehensive

income $ 1,040,356 $ 1,190,404

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Earnings per share 18

Basic $ 0.042 $ 0.048

Diluted $ 0.041 $ 0.048

----------------------------------------------------------------------------

----------------------------------------------------------------------------

QUESTOR TECHNOLOGY INC.

STATEMENTS OF CHANGES IN EQUITY

Stated in Canadian dollars

Issued Retained Total

capital Reserves earnings equity

----------------------------------------------------------------------------

Balance at January 1,

2011 $ 5,404,966 $ 593,944 $ 51,471 $ 6,050,381

Profit and total

comprehensive income - - 1,190,404 1,190,404

Recognition of share-

based payments - 54,531 - 54,531

Issue of ordinary

shares under employee

share option plan 53,249 (26,249) - 27,000

----------------------------------------------------------------------------

Balance at January 1,

2012 $ 5,458,215 $ 622,226 $ 1,241,875 $ 7,322,316

Profit and total

comprehensive income - - 1,040,356 1,040,356

Recognition of share-

based payments - 79,520 - 79,520

Issue of ordinary

shares under employee

share option plan 62,786 (24,912) - 37,874

----------------------------------------------------------------------------

Balance at December 31,

2012 $ 5,521,001 $ 676,834 $ 2,282,231 $ 8,480,066

----------------------------------------------------------------------------

----------------------------------------------------------------------------

----------------------------------------------------------------------------

QUESTOR TECHNOLOGY INC.

STATEMENTS OF CASH FLOWS

Stated in Canadian dollars

For the years ended December 31 Notes 2012 2011

----------------------------------------------------------------------------

Cash flows from (used in)

operating activities

Profit and total comprehensive

income for the year $ 1,040,356 $ 1,190,404

Adjustments for:

Income tax expense 17 380,970 378,374

Write-off of property and

equipment 7 27,865 39,437

Depreciation of property and

equipment 7 300,819 227,034

Amortization of intangible

assets 8 1,218 1,218

Net unrealized foreign

exchange gains (5,775) (102,361)

Expense recognized in respect

of equity-settled share-

based payments 11, 16 79,520 54,531

Write-downs of inventories to

net realizable value 6 1,470 5,001

----------------------------------------------------------------------------

1,826,443 1,793,638

Movements in non-cash working

capital 21 1,609,381 (2,076,211)

----------------------------------------------------------------------------

Cash generated from (used in)

operations 3,435,824 (282,573)

Income taxes paid (461,059) (278,710)

----------------------------------------------------------------------------

Net cash generated from (used in)

operating activities 2,974,765 (561,283)

----------------------------------------------------------------------------

Cash flows (used in) from

investing activities

Payments for property and

equipment (770,781) (1,411,014)

Proceeds from disposal of

property and equipment 7 - 3,200

Interest paid - -

----------------------------------------------------------------------------

Net cash used in investing

activities (770,781) (1,407,814)

----------------------------------------------------------------------------

Cash flows from financing

activities

Proceeds from issue of ordinary

shares under employee share

option plan 11,12,16 37,874 27,000

----------------------------------------------------------------------------

Net cash from financing

activities 37,874 27,000

----------------------------------------------------------------------------

Net increase (decrease) in cash 2,241,859 (1,942,097)

Cash at beginning of the year 2,166,301 3,995,669

Effects of exchange rate changes

on the balance of cash held in

foreign currencies (2,535) 112,729

----------------------------------------------------------------------------

Cash at end of the year $ 4,405,624 $ 2,166,301

----------------------------------------------------------------------------

----------------------------------------------------------------------------

FOR FURTHER INFORMATION PLEASE CONTACT:

Questor Technology Inc.

Audrey Mascarenhas

President and Chief Executive Officer

(403) 571-1530

(403) 571-1539 (FAX)

amascarenhas@questortech.com

www.questortech.com

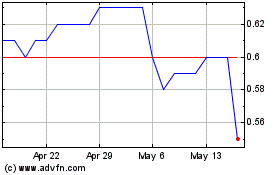

Questor Technology (TSXV:QST)

Historical Stock Chart

From Dec 2024 to Jan 2025

Questor Technology (TSXV:QST)

Historical Stock Chart

From Jan 2024 to Jan 2025