Solar Alliance announced $1,000,000 non-brokered private placement and shares for debt exchange

15 May 2024 - 8:44AM

Solar Alliance Energy Inc. (‘Solar Alliance’ or the

‘Company’) (TSX-V: SOLR), a leading solar energy solutions

provider focused on the commercial and industrial solar sector, is

pleased to announced its intention to complete a non-brokered

private placement of up to 20,000,000 units of the Company (the

“Units”) at a price of C$0.05 per Unit for gross proceeds of up to

C$1,000,000 (the “Offering”). Each Unit will be comprised of one

(1) common share of the Company (a “Common Share”) and one (1)

Common Share purchase warrant (a “Warrant”). Each Warrant will

entitle the holder thereof to acquire one (1) Common Share (a

“Warrant Share”) at an exercise price of C$0.07 per Warrant Share

at any time for a period of thirty-six (36) months following the

closing of the Offering. Closing of the Offering is expected to be

on or about June 20, 2024 or such other date or dates that that the

Company may determine.

The Units will be offered by way of the “listed

issuer” financing exemption (the “Listed Issuer

Exemption”) under National Instrument 45-106 – Prospectus

Exemptions (“NI 45-106”) in all the provinces of

Canada with the exception of Quebec, and such other jurisdictions

as the Company may determine (the “Selling

Jurisdictions”). Since the Offering is being completed

pursuant to the Listed Issuer Exemption, the securities issued

under the Offering will not be subject to a hold period under

applicable Canadian securities laws.

The Company intends to use the net proceeds from

the Offering for general corporate and working capital purposes.

Completion of the Offering is subject to certain conditions

including, but not limited to, the receipt of all necessary

approvals, including the approval of the TSX Venture Exchange (the

“TSXV”) and applicable securities regulatory authorities.

In addition, the Company has agreed to settle

CAD$115,000 of debt owed to an Insider of the Company, in

consideration for the issuance of 2,300,000 Common Shares at a

deemed price of CAD$0.05 per Common Share (the “Debt

Settlement”). The debt is payable in respect of loans owed

to the Insider by the Company. The closing of the Debt Settlement

is subject to the approval from TSXV. The Corporation expects that

the proposed Debt Settlement will assist the Company in preserving

its cash for working capital and the board of directors of the

Corporation believes the Debt Settlement is in the best interests

of the Corporation. The securities to be issued pursuant to the

Debt Settlement will be subject to a four month and one day

statutory hold period from the date of issuance.

Certain directors, officers and Insiders of the

Company are expected to acquire Units under the Offering and to

participate in the Debt Settlement. Such participation will be

considered to be a “related party transaction” as defined under the

policies of the TSXV and Multilateral Instrument 61-101 –

Protection of Minority Security Holders in Special Transactions

(“MI 61-101”). The Company anticipates relying on exemptions from

the minority shareholder approval and formal valuation requirements

applicable to the related-party transactions under sections 5.5(a)

and 5.7(1)(a), respectively, of MI 61-101, as neither the fair

market value of the Units to be acquired or the participation in

the Debt Settlement by the participating directors, officers and

Insiders nor the consideration to be paid by such directors,

officers and Insiders is anticipated to exceed 25 percent of the

Company's market capitalization. Units issued to directors,

officers and Insiders of the Company will be subject to a hold

period of four months in accordance with the policies of the

TSXV.

There is an offering document related to the

Offering that can be accessed under the Company’s profile at

www.sedarplus.ca and on the Company’s website at

www.solaralliance.com. Prospective investors should read this

offering document before making an investment decision.

This press release does not constitute an offer

to sell or a solicitation of an offer to buy any of the securities

in the United States. The securities have not been and will not be

registered under the United States Securities Act of 1933, as

amended, or any state securities laws and may not be offered or

sold within the United States or to or for the account or benefit

of a U.S. person (as defined in Regulation S under the United

States Securities Act) unless registered under the U.S. Securities

Act and applicable state securities laws or an exemption from such

registration is available.

Myke Clark, CEO

|

For more information: |

|

Investor RelationsMyke Clark,

CEO416-848-7744mclark@solaralliance.com |

About Solar Alliance Energy Inc.

(www.solaralliance.com)

Solar Alliance is an energy solutions provider

focused on the commercial, utility and community solar sectors. Our

experienced team of solar professionals reduces or eliminates

customers' vulnerability to rising energy costs, offers an

environmentally friendly source of electricity generation, and

provides affordable, turnkey clean energy solutions. Solar

Alliance’s strategy is to build, own and operate our own solar

assets while also generating stable revenue through the sale and

installation of solar projects to commercial and utility customers.

The Company currently owns two operating solar projects in New York

and actively pursuing opportunities to grow its ownership pipeline.

The technical and operational synergies from this combined business

model supports sustained growth across the solar project value

chain from design, engineering, installation, ownership and

operations/maintenance.

Statements in this news release, other than

purely historical information, including statements relating to the

Company's future plans and objectives or expected results,

constitute Forward-looking statements. The words “would”, “will”,

“expected” and “estimated” or other similar words and phrases are

intended to identify forward-looking information. Forward-looking

information is subject to known and unknown risks, uncertainties

and other factors that may cause the Company’s actual results,

level of activity, performance or achievements to be materially

different than those expressed or implied by such forward-looking

information. Such factors include but are not limited to:

statements, projections and estimates with respect to the Offering

and Debt Settlement, including the terms, timing and completion

thereof, the use of proceeds of the Offering, the resale

restrictions of the securities issued pursuant to the Offering, the

issuance of the Units pursuant to the Listed Issuer Exemption

uncertainties related to the ability to raise sufficient capital;

changes in economic conditions or financial markets; litigation,

legislative or other judicial, regulatory, legislative and

political competitive developments; technological or operational

difficulties; the ability to maintain revenue growth; the ability

to execute on the Company’s strategies; the ability to complete the

Company’s current and backlog of solar projects; the ability to

grow the Company’s market share; the high growth US solar industry;

the ability to convert the backlog of projects into revenue; the

expected timing of the construction and completion of the 565-kW

and 872 KW Tennessee solar project; the ability to predict and

counteract the effects of COVID-19 on the business of the Company,

including but not limited to the effects of COVID-19 on the

construction sector, capital market conditions, restriction on

labour and international travel and supply chains; potential

corporate growth opportunities and the ability to execute on the

key objectives in 2024. Consequently, actual results may vary

materially from those described in the forward-looking

statements.

“Neither TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release."

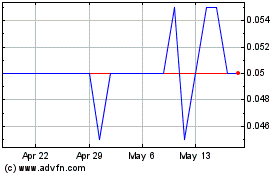

Solar Alliance Energy (TSXV:SOLR)

Historical Stock Chart

From Oct 2024 to Nov 2024

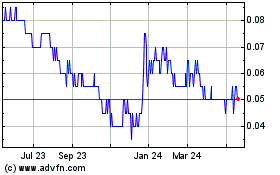

Solar Alliance Energy (TSXV:SOLR)

Historical Stock Chart

From Nov 2023 to Nov 2024