Solar Alliance Energy Inc. (‘Solar Alliance’ or the

‘Company’) (TSX-V: SOLR), a leading solar energy solutions

provider focused on the commercial and industrial solar sector,

announces that it has closed: (a) the debt transaction with certain

directors of the Company, as previously announced on March 1, 2024

(the “

First Debt Settlement”) and

(b) the debt transaction with Tom Anderson, an Insider of the

Company, as previously announced on May 15, 2024 (the

“

Second Debt Settlement”, and

together with the First Debt Settlement, the “

Debt

Settlements”)

Under the First Debt Settlement, the Company

settled aggregate debt of $160,000 accrued liabilities for

directors' fees owed to certain current directors of the Company

through the issuance of 2,909,090 common shares of the Company (the

“Director Shares”) at a deemed price of $0.055 per

Director Share. Under the Second Debt Settlement, the Company

settled aggregate debt of $115,000 owed to Mr. Anderson, with

respect to loans provided by Mr. Anderson to the Company through

the issuance of 2,300,000 common shares of the Company (the

“Insider Shares”, and together with the Director

Shares, the “Shares”) at a deemed price of $0.05

per Insider Share. The loan was for $100,000 (the

“Loan”) and was provided by Mr. Anderson to the

Company on February 27, 2204. The Loan was unsecured, bore interest

at 15% per annum and was due to mature on February 27, 2025 (the

“Maturity Date”). Repayment of the Loan prior to

the Maturity Date requires an early repayment fee equal to the

amount of interest payable per annum.

The Company issued the Shares to settle the

debts in order to preserve cash for general working capital

purposes. The Debt Settlements are subject to the final approval of

the TSX Venture Exhchange. The Shares issued pursuant to the Debt

Settlements are subject to a four month and one day hold period,

which will expire on October15, 2024.

Related Party Transaction and Early

Warning Report

The directors and Mr. Anderson that participated

in the Debt Settlements are insiders of the Company, and

accordingly, the Debt Settlements and the Loan are each considered

a “related party transaction” within the meaning of Multilateral

Instrument 61-101 – Protection of Minority Security Holders in

Special Transaction (“MI 61-101”). The Company

relied on the exemptions from the requirement for a formal

valuation and minority shareholder approval under MI 61-101 on the

basis of the exemptions contained in section 5.5(1)(a) and section

5.7(1)(a) of MI 61-101, as the fair market value of the Shares

issued to insiders in connection with the Debt Settlements and the

fair market value of the Loan did not exceed 25% of the Company’s

market capitalization.

As at the date of the filing of Mr. Anderson’s

last Form 62-103F1 relating to his holdings of common shares of the

Company (the “Common Shares”), being February 11,

2019 (the “Last Filing”), Mr. Anderson

beneficially owned and exercised control and direction over

98,843,082 Common Shares, representing approximately 50.4% of the

Common Shares on a non-diluted and partially diluted basis as at

the date of the Last Filing. Following the Second Debt Settlement,

Mr. Anderson owns and exercises control and direction over

100,216,369 Common Shares, representing approximately 35.77% of the

Common Shares on a non-diluted and partially diluted basis.

In satisfaction of the requirements of National

Instrument 62-104 – Take-Over Bids and Issuer Bids and National

Instrument 62-103 – The Early Warning System and Related Take-Over

Bid and Insider Reporting Issues, an early warning report

respecting the acquisition of securities by Mr. Anderson will be

filed under the Company’s SEDAR+ Profile at www.sedarplus.ca.

The Second Debt Settlement was completed to

settle outstanding indebtedness and Mr. Anderson intends to hold

the Insider Shares for investment purposes. Depending on market and

other conditions, Mr. Anderson may from time to time in the future

increase or decrease his ownership, control or direction over

securities of the Company, through market transactions, private

agreements, or otherwise.

The securities described herein have not been,

and will not be, registered under the United States Securities Act,

or any state securities laws, and accordingly may not be offered or

sold within the United States except in compliance with the

registration requirements of the U.S. Securities Act and applicable

state securities requirements or pursuant to exemptions therefrom.

This press release does not constitute an offer to sell or a

solicitation to buy any securities in any jurisdiction.

Myke Clark, CEO

|

For more information: |

|

Investor RelationsMyke Clark,

CEO416-848-7744mclark@solaralliance.com |

About Solar Alliance Energy Inc.

(www.solaralliance.com)

Solar Alliance is an energy solutions provider

focused on the commercial, utility and community solar sectors. Our

experienced team of solar professionals reduces or eliminates

customers' vulnerability to rising energy costs, offers an

environmentally friendly source of electricity generation, and

provides affordable, turnkey clean energy solutions. Solar

Alliance’s strategy is to build, own and operate our own solar

assets while also generating stable revenue through the sale and

installation of solar projects to commercial and utility customers.

The Company currently owns two operating solar projects in New York

and actively pursuing opportunities to grow its ownership pipeline.

The technical and operational synergies from this combined business

model supports sustained growth across the solar project value

chain from design, engineering, installation, ownership and

operations/maintenance.

Statements in this news release, other than

purely historical information, including statements relating to the

Company's future plans and objectives or expected results,

constitute Forward-looking statements. The words “would”, “will”,

“expected” and “estimated” or other similar words and phrases are

intended to identify forward-looking information. Forward-looking

information is subject to known and unknown risks, uncertainties

and other factors that may cause the Company’s actual results,

level of activity, performance or achievements to be materially

different than those expressed or implied by such forward-looking

information. Such factors include but are not limited to:

statements, projections and estimates with respect to uncertainties

related to the ability to raise sufficient capital; changes in

economic conditions or financial markets; litigation, legislative

or other judicial, regulatory, legislative and political

competitive developments; technological or operational

difficulties; the ability to maintain revenue growth; the ability

to execute on the Company’s strategies; the ability to complete the

Company’s current and backlog of solar projects; the ability to

grow the Company’s market share; the high growth US solar industry;

the ability to convert the backlog of projects into revenue; the

expected timing of the construction and completion of the Company’s

solar projects; the ability to predict and counteract the effects

of COVID-19 on the business of the Company, including but not

limited to the effects of COVID-19 on the construction sector,

capital market conditions, restriction on labour and international

travel and supply chains; potential corporate growth opportunities

and the ability to execute on the key objectives in 2024.

Consequently, actual results may vary materially from those

described in the forward-looking statements.

“Neither TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release."

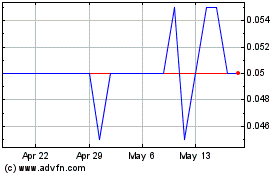

Solar Alliance Energy (TSXV:SOLR)

Historical Stock Chart

From Nov 2024 to Dec 2024

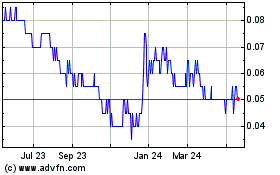

Solar Alliance Energy (TSXV:SOLR)

Historical Stock Chart

From Dec 2023 to Dec 2024