Solar Alliance reports profitable first half of 2024

30 August 2024 - 7:30AM

Solar Alliance Energy Inc. (‘Solar Alliance’ or the

‘Company’) (TSX-V: SOLR, OTC: SAENF), a leading solar

energy solutions provider focused on the commercial and utility

solar sectors, announces it has filed its unaudited financial

results for the for the three- and six-month period ended June 30,

2024. The Company’s Financial Statements and related Management’s

Discussion and Analysis are available under the Company’s profile

at www.sedarplus.ca and on the Solar Alliance website at

www.solaralliance.com.

“The Solar Alliance team experienced a busy

second quarter as we worked through the installation of several

larger projects in our pipeline. Our purposeful transition to

larger commercial and utility solar projects has resulted in a

profitable first half of 2024, the first ever in the Company’s

commercial solar history. Solar Alliance has been clear in our

signalling to the market that our key focus was targeting

profitability, and we are pleased to have achieved this milestone

in the first half of 2024. We remain committed to accelerating our

growth on a profitable basis for the full year 2024, based on

growing sales opportunities, diligent cost control and operational

efficiencies.”

Key financial highlights for H1 and Q2, 2024

- Revenue for the first six months of

2024 of $2,376,389 compared to $2,428,790 in the comparative period

in 2023.

- Net income for the first six months

of 2024 of $1,495 compared to a loss of $1,731,135 in the

comparative period in 2023.

- Gross profit for the first six

months of 2024 of $853,695 and gross margin of 36% compared to a

gross profit of $237,963 and gross margin of 10% in the comparative

period in 2023.

- Revenue for the three months ended

June 30, 2024, was $711,532 (Q2, 2023 - $1,454,213).

- Net loss for the three months ended

June 30, 2024 of $200,339 (Q2, 2023 – net loss of $240,522).

- Cost of sales for the three months

ended June 30, 2024 of $504,300 (Q2, 2023 - $951,052) resulting in

a gross profit of $207,232 and a gross margin of 29% (Q2, 2023:

gross profit of $503,161 and gross margin of 34%).

“A natural by-product of the shift to larger

projects is fluctuating revenue based on project milestones. For

the second quarter, the Solar Alliance team executed on several

larger projects that completed post-quarter end and that revenue is

expected to be recognized in future quarters. Our business

development efforts now include assessing specific regional

requests for proposals for solar projects in the multi-megawatt

range, where Solar Alliance believes it has a competitive advantage

as a result of our installation experience and regional brand

awareness. Solar Alliance provides a unique product offering that

fills a need in the commercial solar industry in the Southeast U.S.

and represents an attractive investment opportunity based on our

recent results and future opportunities,” concluded Clark.

Myke Clark, CEO

|

For more information: |

|

Investor RelationsMyke Clark,

CEO604-359-5178mclark@solaralliance.com |

About Solar Alliance Energy Inc.

(www.solaralliance.com)Solar

Alliance is an energy solutions provider focused on the commercial,

utility and community solar sectors. Our experienced team of solar

professionals reduces or eliminates customers' vulnerability to

rising energy costs, offers an environmentally friendly source of

electricity generation, and provides affordable, turnkey clean

energy solutions. Solar Alliance’s strategy is to build, own and

operate our own solar assets while also generating stable revenue

through the sale and installation of solar projects to commercial

and utility customers. The technical and operational synergies from

this combined business model supports sustained growth across the

solar project value chain from design, engineering, installation,

ownership and operations/maintenance.

Statements in this news release, other than

purely historical information, including statements relating to the

Company's future plans and objectives or expected results,

constitute Forward-looking statements. The words “would”, “will”,

“expected” and “estimated” or other similar words and phrases are

intended to identify forward-looking information. Forward-looking

information in this press release include, but is not limited to

focus on larger, higher margin commercial solar projects, the

assessment of acquisition opportunities and pursuit of corporate

opportunities, the ability to scale, increasing project margins,

targeting profitability, the expectation that the completion of

several larger projects post-quarter end will result in revenue to

be recognized in future quarters and the Company offering a unique

investment opportunity in the renewables sector space.

Forward-looking information is subject to known and unknown risks,

uncertainties and other factors that may cause the Company’s actual

results, level of activity, performance or achievements to be

materially different than those expressed or implied by such

forward-looking information. Such factors include but are not

limited to: uncertainties related to the ability to raise

sufficient capital, changes in economic conditions or financial

markets, litigation, legislative or other judicial, regulatory,

legislative and political competitive developments, technological

or operational difficulties, the ability to maintain revenue

growth, the ability to execute on the Company’s strategies, the

ability to complete the Company’s current and backlog of solar

projects, the ability to grow the Company’s market share, the high

growth US solar industry, the ability to convert the backlog of

projects into revenue, the expected timing of the construction and

completion of the Company’s solar projects, the targeting of larger

customers, potential corporate growth opportunities and the ability

to execute on the key objectives in 2024. Consequently, actual

results may vary materially from those described in the

forward-looking statements.

“Neither TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release."

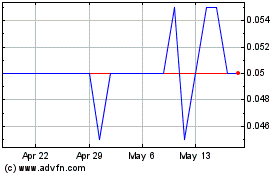

Solar Alliance Energy (TSXV:SOLR)

Historical Stock Chart

From Nov 2024 to Dec 2024

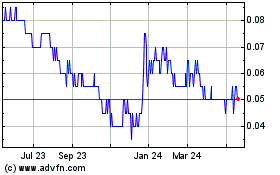

Solar Alliance Energy (TSXV:SOLR)

Historical Stock Chart

From Dec 2023 to Dec 2024