Standard Uranium Ltd. (“Standard Uranium”, “Standard” or the

“Company”)

(TSX-V:STND) (OTCQB: STTDF) (Frankfurt: FWB:9SU)

is pleased to announce the Company’s wholly-owned subsidiary,

Standard Uranium (Saskatchewan) Ltd., has entered into a mineral

property purchase and sale agreement (the

“Purchase Agreement”), dated effective August 24,

2023, with Eagle Plains Resources Ltd. (“Eagle Plains”), pursuant

to which the Company will acquire eight additional mineral claims

totalling 4,278 hectares contiguous with the recently staked Corvo

Project, in the Eastern Athabasca Basin region (the “Acquisition”).

Upon completion of the Acquisition, the Corvo Project will comprise

7,989 hectares within ten claims and contain 14.5 km of prospective

exploration corridors across two trends. Standard Uranium continues

to implement their project generator growth strategy, further

adding to the already considerable land package in the Athabasca

basin through expansion and acquisition opportunities.

Summary of Purchase

Agreement

Pursuant the terms of the Definitive Agreement,

the aggregate purchase price payable by Standard Uranium to the

Eagle Plains consists of (a) 1,250,000 common shares of the

Company, (the “Consideration Shares”) and (b) the granting of a net

smelter returns royalty of 2.5% (the “NSR Royalty”) to Eagle Plains

on all Corvo claims effective as of the commencement of commercial

production. The NSR Royalty is subject to a buydown right in favour

of Standard Uranium pursuant to which Standard Uranium may purchase

1% of the NSR Royalty in exchange for payment of $1,000,000,

thereby reducing the NSR Royalty to 1.5%. The Consideration Shares

will be subject to a four month hold period as prescribed by

applicable securities laws.

“Completing this deal with Eagle Plains will add

significant value to the Corvo Project, delivering more than 5

kilometres of additional prospective exploration corridors in

addition to several more historical uranium showings,” said Sean

Hillacre, President and VP Exploration for the Company. “The fact

that the project is road-accessible year-round compliments the

strong geoscience attributes of the project, drawing on the analogy

of the near-by Gemini Mineralized Zone. With this addition to the

claims staked by our team, Corvo is now a highly optionable project

with size and strong geological characteristics prospective for

uranium mineralization.”

With the expansion of the Corvo Project, the

Company will have ownership interests in seven projects, totalling

over 187,542 acres across the uranium-rich Athabasca Basin.

Standard Uranium continues to expand its set of high-potential

assets across the Athabasca Basin to drive value and minimize

dilution to shareholders through focused exploration and

transactional success. The Company is seeking strategic partners to

advance all projects through earn-in agreements that provide upside

to shareholders through ongoing exploration and future

discovery.

Tim Termuende, President and CEO of Eagle Plains

commented, “We are pleased to have concluded a mutually beneficial

deal with Standard on their Corvo Project. Standard brings to the

table a solid management team while Eagle Plains will maintain

significant upside exposure to the project through its sizeable

shareholdings in Standard and the retention of an NSR.”

Figure 1. Overview map of Standard Uranium’s

Corvo Project. The newly expanded Corvo Project is located 45 km

northeast of the 92Energy’s Gemini Mineralized Zone (“GMZ”) and 60

km due east of Cameco’s McArthur River mine.

Key Focus Points:

- Expansion of the

Corvo Project will add an additional 4,278 hectares and 5

kilometres of two strong NE-SW magnetic low trends coincident with

EM conductors and cross-cutting faults. Parallel magnetic low

trends to the north and south are also added.

- Uranium

mineralization is present along a strike length of 800

metres in drill holes TL-79-3 (0.57%

U3O8

over 3.5 m) to TL-79-5 (0.65%

U3O8

over 0.1 m) within the new east-central

claim.

- Historical

surveys highlight geochemical anomalies along conductive trends and

lithologic contacts observed in outcrop. The expanded claims add

multiple new data points of uranium anomalism to the project,

including surface sample JBWLR011, returning 1,420 ppm

U.

- Elevated

radioactivity measured in boulders, outcrop, and drilled rock

coupled with the geochemical anomalies present on the Corvo project

indicate high potential for discovery of additional uranium

mineralization.

The Corvo Project is situated 1.5 kilometres

outside the current margin of the Athabasca Basin, approximately 50

kilometres southwest of Rabbit Lake mill facilities and 45

kilometres northeast of the Gemini Mineralized Zone (Figure 1).

The expanded Corvo Project will cover

approximately 14.5 kilometres of two northeast trending magnetic

low/electromagnetic (EM) conductor corridors (Figure 2). The new

claims acquired contain numerous historical samples and drill

holes, providing an abundance of supplementary data to the project

compilation (Figure 2). Additional uranium anomalies in both

surface samples and drill holes will bolster the exploration

strategy on the project and provide the basis for advancing Corvo

to discovery. Data compilation by the Company is currently underway

to identify target areas for high-grade1 uranium mineralization

within metasedimentary and orthogneissic basement rocks (Figure 3).

The Project will benefit from additional surface sampling and

geophysical surveys to aid in drill target vectoring.

Figure 2. Plan map showing the magnetic low/EM

conductor trends on the Corvo project highlighting historical

samples and drill holes with anomalous uranium and/or

radioactivity, with first vertical derivative magnetics in the

background. Several additional uranium occurrences have been added

to the project through the expansion.

Figure 3. Plan map showing regional bedrock

geology of the expanded Corvo project area and highlighting EM

conductors coincident with geochemical anomalies and cross-cutting

faults.

The Company believes the Corvo Project is highly

prospective for the discovery of shallow, high-grade

basement-hosted uranium mineralization akin to that recently

discovered at the Gemini Mineralized Zone. The expansion of the

Corvo Project is part of the Company’s strategy to increase its

landholdings in the infrastructure-rich eastern Athabasca Basin of

Saskatchewan, Canada, providing strong opportunities for earn-in

transactions. The project is extremely well positioned

logistically, being road accessible via Highway 905 and proximal to

other key infrastructure such as the Rabbit Lake Mill.

Completion of the Acquisition remains subject to

the approval of the TSX Venture Exchange. The Company and Eagle

Plains are at arms-length, and no finders’ fees or commissions are

payable by the Company in connection with the Acquisition. Upon

issuance, the Consideration Shares will be subject to a four month

hold period as prescribed by applicable securities laws.

The scientific and technical information

contained in this news release, including the sampling, analytical

and test data underlying the technical information contained in

this news release, has been reviewed, verified, and approved by

Sean Hillacre, P.Geo., President & VP Exploration of the

Company and a “qualified person” as defined in NI 43-101.

About Eagle Plains Resources

Ltd.

Based in Cranbrook, B.C., Eagle Plains is a

well-funded, prolific project generator that continues to conduct

research, acquire and explore mineral projects throughout western

Canada. The Company was formed in 1992 and is the ninth-oldest

listed issuer on the TSX-V (and one of only three that has not seen

a roll-back or restructuring of its shares). Eagle Plains has

continued to deliver shareholder value over the years and through

numerous spin outs has transferred over $100,000,000 in value

directly to its shareholders, with Copper Canyon

Resources and Taiga Gold Corp. being

notable examples. Eagle Plains latest spinout, Eagle

Royalties Ltd. (CSE:”ER”) was listed on May 24, 2023, and

holds a diverse portfolio of royalty assets throughout western

Canada.

Eagle Plains’ core business is acquiring

grassroots critical- and precious-metal exploration properties. The

Company is committed to steadily enhancing shareholder value by

advancing our diverse portfolio of projects toward discovery

through collaborative partnerships and development of a highly

experienced technical team.

Expenditures from 2011-2022 on Eagle

Plains-related projects exceed $30M, the majority of which was

funded by third-party partners. This exploration work resulted in

approximately 45,000m of diamond-drilling and extensive

ground-based exploration work facilitating the advancement of

numerous projects at various stages of development.

Throughout the exploration process, our mission

is to help maintain prosperous communities by exploring for and

discovering resource opportunities while building lasting

relationships through honest and respectful business practices.

On behalf of the Board of Directors

“Tim J. Termuende”President and

CEO

For further information on EPL, please contact

Mike Labach at 1 866 HUNT ORE (486 8673)Email: mgl@eagleplains.com

or visit our website at https://www.eagleplains.com

About Standard Uranium (TSX-V:

STND)

We find the fuel to power a

clean energy future.

Standard Uranium is a uranium exploration

company and emerging project generator poised for discovery in the

world’s richest uranium district. The Company holds interest in

over 187,542 acres (75,895 hectares) in the world-class Athabasca

Basin in Saskatchewan, Canada. Since its establishment, Standard

Uranium has focused on the identification, acquisition, and

exploration of Athabasca-style uranium targets with a view to

discovery and future development.

Standard Uranium’s Atlantic, Canary, Ascent,

Corvo, and Rocas Projects, in the eastern Athabasca Basin, comprise

twenty-three mineral claims over 25,242 hectares. The eastern basin

projects are highly prospective for unconformity related and/or

basement hosted uranium deposits based on historical uranium

occurrences, recently identified geophysical anomalies, and

location along trend from several high-grade uranium

discoveries.

Standard Uranium's Sun Dog project, in the

northwest part of the Athabasca Basin, Saskatchewan,

is comprised of nine mineral claims over 19,603 hectares. The Sun

Dog project is highly prospective for basement and unconformity

hosted uranium deposits yet remains largely untested by sufficient

drilling despite its location proximal to uranium discoveries in

the area.

Standard Uranium’s Davidson River Project, in

the southwest part of the Athabasca Basin, Saskatchewan, comprises

ten mineral claims over 30,737 hectares. Davidson River is highly

prospective for basement-hosted uranium deposits due to its

location along trend from recent high-grade uranium discoveries.

However, owing to the large project size with multiple targets, it

remains broadly under-tested by drilling. Recent intersections of

wide, structurally deformed and strongly altered shear zones

provide significant confidence in the exploration model and future

success is expected.

For further information contact:

Jon Bey, Chief Executive Officer, and Chairman

1030 West Georgia Street, Suite 907

Vancouver, BC V6E 2Y3

Tel: 1 (306) 850-6699E-mail: ir@standarduranium.ca

Cautionary Statement Regarding Forward-Looking

Statements

This news release contains “forward-looking

statements” or “forward-looking information” (collectively,

“forward-looking statements”) within the meaning of applicable

securities legislation. All statements, other than statements of

historical fact, are forward-looking statements and are based on

expectations, estimates and projections as of the date of this news

release. Forward-looking statements include, but are not limited

to, statements regarding the Acquisition, and the Company's

business and plans, including with respect to completing the

Acquisition, carrying out exploration activities in respect of its

Corvo Project, prospective uranium mineralization, the Company

seeking additional partners to advance all its projects, geological

interpretations; timing of the Company’s exploration programs; and

estimates of market conditions.

Forward-looking statements are subject to a

variety of known and unknown risks, uncertainties and other factors

that could cause actual events or results to differ from those

expressed or implied by forward-looking statements contained

herein. There can be no assurance that such statements will prove

to be accurate, as actual results and future events could differ

materially from those anticipated in such statements. Certain

important factors that could cause actual results, performance or

achievements to differ materially from those in the forward-looking

statements are highlighted in the “Risks and Uncertainties” in the

Company’s management discussion and analysis for the fiscal year

ended April 30, 2022, dated August 26, 2022, and also include the

risks that the Acquisition does not complete as contemplated, or at

all; that the Company does not complete any further acquisitions;

that the Company does not carry out exploration activities in

respect of its mineral project as planned (or at all); and that the

Company may not be able to carry out its business plans as

expected.

Forward-looking statements are based upon a

number of estimates and assumptions that, while considered

reasonable by the Company at this time, are inherently subject to

significant business, economic and competitive uncertainties and

contingencies that may cause the Company’s actual financial

results, performance, or achievements to be materially different

from those expressed or implied herein. Some of the material

factors or assumptions used to develop forward-looking statements

include, without limitation: the future price of uranium;

anticipated costs and the Company’s ability to raise additional

capital if and when necessary; volatility in the market price of

the Company’s securities; future sales of the Company’s securities;

the Company’s ability to carry on exploration and development

activities; the success of exploration, development and operations

activities; the timing and results of drilling programs; the

discovery of mineral resources on the Company’s mineral properties;

the costs of operating and exploration expenditures; the presence

of laws and regulations that may impose restrictions on mining;

employee relations; relationships with and claims by local

communities and indigenous populations; availability of increasing

costs associated with mining inputs and labour; the speculative

nature of mineral exploration and development (including the risks

of obtaining necessary licenses, permits and approvals from

government authorities); uncertainties related to title to mineral

properties; assessments by taxation authorities; fluctuations in

general macroeconomic conditions.

The forward-looking statements contained in this

news release are expressly qualified by this cautionary statement.

Any forward-looking statements and the assumptions made with

respect thereto are made as of the date of this news release and,

accordingly, are subject to change after such date. The Company

disclaims any obligation to update any forward-looking statements,

whether as a result of new information, future events or otherwise,

except as may be required by applicable securities laws. There can

be no assurance that forward-looking statements will prove to be

accurate, as actual results and future events could differ

materially from those anticipated in such statements. Accordingly,

readers should not place undue reliance on forward-looking

statements.

Neither the TSX-V nor its Regulation Services

Provider (as that term is defined in the policies of the TSX-V)

accepts responsibility for the adequacy or accuracy of this

release.

Photos accompanying this announcement are available

at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/24ffcb3a-018a-4848-8023-a2e2d9b6dab0

https://www.globenewswire.com/NewsRoom/AttachmentNg/d3ac3bf1-0055-435f-9c81-ecf779156c82

https://www.globenewswire.com/NewsRoom/AttachmentNg/fc7178aa-5c56-4d0d-b6db-b0b761f8303f

______________________________________1 The Company considers

uranium mineralization with concentrations greater than 1.0 wt.%

U3O8 to be “high-grade”.

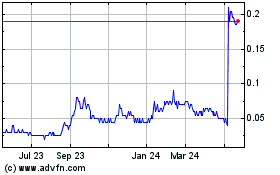

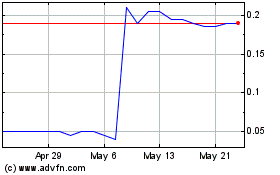

Standard Uranium (TSXV:STND)

Historical Stock Chart

From Jan 2025 to Feb 2025

Standard Uranium (TSXV:STND)

Historical Stock Chart

From Feb 2024 to Feb 2025