Atico Reports Consolidated Financial Results for the First Quarter

of 2014

(All amounts expressed in US dollars, unless otherwise

stated)

VANCOUVER, BRITISH COLUMBIA--(Marketwired - May 29, 2014) -

Atico Mining Corporation (the "Company" or "Atico")

(TSX-VENTURE:ATY)(PINKSHEETS:ATCMF) today announced its financial

results for the three months ended March 31, 2014, posting income

from mining operations of $539,870 and a net loss of $779,972, due

to 2,516 tonnes of non-invoiced dry concentrate remaining in

inventory at quarter end. Production for the quarter at Atico's El

Roble mine totaled 1.4 million pounds of copper and 1,147 ounces of

gold in concentrates at a cash cost(1) of $1.33 per equivalent

payable pound of copper produced.

"During the first full quarter of operating the El Roble mine,

copper and gold production exceeded our expectations as the

operations team materially increased production from previous

quarters," said Fernando E. Ganoza, CEO. "We are looking forward to

a strong second quarter which will include revenue from our first

full-size concentrate shipment."

First Quarter Financial Highlights

- The Company produced 2,735 tonnes of dry concentrate during the

quarter with a metal content of 1.398 million pounds of copper and

1,147 ounces of gold.

- Revenues of $2.04 million generated during the quarter from the

shipping and provisional invoicing of 946.7 tonnes of dry

concentrate containing 465,941 pounds of payable copper and 694

ounces of payable gold respectively.

- At quarter end 2,515.7 tonnes of non-invoiced dry concentrate

remained at the company's warehouses.

- Income from mining operations of $539,870 for the quarter.

- Net loss of $779,972 for the quarter primarily due to the sale

and shipping of only a limited quantity of metals concentrate.

- Average production costs(1) (before depreciation and

amortization) for the quarter were $114.2 per tonne of processed

ore.

- Cash cost(1) per equivalent payable pound of copper produced

was $1.33.

First Quarter Operations Review

El Roble performed better than planned in the first quarter of

2014 with an increase in copper and gold production. The

performance was driven by a combination of higher than budgeted

throughput, head grade and metallurgical recovery.

(1) These are alternative performance measures; please refer to

"Non-GAAP Financial Measures" at the end of this release.

Cash cost(1) per tonne of processed ore was $114.2 and in line

with company expectations. Cash cost(1) per payable pound of copper

equivalent was $1.33. The company believes there is opportunity to

improve the cash cost as the throughput increases in the subsequent

quarters.

|

| First Quarter Operational Details |

|

|

|

Q1 Total |

| Production (Contained in Concentrates)* |

|

| Copper (000s pounds) |

1,398 |

| Gold (ounces) |

1,147 |

| Silver (ounces) |

3,461 |

| Mine |

|

| Tonnes of ore mined |

26,791 |

| Mill |

|

| Tonnes processed |

23,016 |

| Tonnes processed per day |

354.1 |

| Copper grade (%) |

3.01 |

| Gold grade (g/t) |

2.43 |

| Silver grade (g/t) |

10.65 |

| Recoveries |

|

| Copper (%) |

91.53 |

| Gold (%) |

63.73 |

| Silver (%) |

43.91 |

| Concentrates |

|

| Copper Concentrates (dmt) |

2,735 |

|

Copper (%) |

23.19 |

|

Gold (g/t) |

13.05 |

|

Silver (g/t) |

39.36 |

|

|

| Payable copper produced (000s lbs) |

1,332 |

| Cash cost per pound of payable copper(1) ($/lbs) |

1.33 |

|

| *Subject to adjustments due to final settlement |

|

The financial statements and MD&A are available on SEDAR and

have also been posted on the company's website at

http://www.aticomining.com/s/FinancialStatements.asp

El Roble Mine

El Roble is an operating underground copper and gold mine with a

nominal mineral processing capacity of 400 tonnes per day. Over the

past 22 years, the mine has processed 1.5 million tonnes of ore at

an average head grade of 2.5% copper and an estimated 2.5 g/t gold.

Copper and gold mineralization occurs within volcanogenic massive

sulfide ("VMS") lenses.

Since entering into an option agreement in January 2011 to

acquire 90% of El Roble, Atico has aggressively explored the mine

and surrounding claims. The Company has completed 11,740 meters of

diamond drilling and identified numerous prospective targets for

VMS deposits on the 6,679-hectare property. This exploration led to

the discovery of high-grade copper and gold mineralization below

the 2000 level, previously the lowest production level of the El

Roble mine. Atico has developed a new adit access from the 1880

elevation to develop these new resources.

National Instrument 43-101 compliant inferred mineral resource

are 1.58 million tonnes grading 4.45 % copper and 3.17 g/t gold, at

a cut-off grade of 0.72 % copper equivalent. Mineralization is open

at depth and along strike, the Company plans to further test the

limits of the resource.

On the larger land package, the Company has identified a

prospective stratigraphic contact between volcanic rocks and black

and grey cherts that has been traced by Atico geologists for ten

kilometers. This contact has been determined to be an important

control on VMS mineralization on which Atico has identified 15

prospective target areas for VMS type mineralization occurrence,

which is the focus of the surface drill program at El Roble.

Qualified Person

Mr. Thomas Kelly (SME Registered Member 1696580), Chief

Operating Officer of the Company and a qualified person under

National Instrument 43-101 standards, is responsible for ensuring

that the technical information contained in this news release is an

accurate summary of the original reports and data provided to or

developed by Atico.

About Atico Mining Corporation

Atico is a growth-oriented company, focused on exploring,

developing and mining copper and gold projects in Latin America.

The Company operates the El Roble mine and is pursuing additional

acquisition opportunities. For more information, please visit

www.aticomining.com.

ON BEHALF OF THE BOARD

Fernando E. Ganoza, CEO

Atico Mining Corporation

Trading symbols: TSX.V: ATY | OTC: ATCMF

Neither the TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

No securities regulatory authority has either approved or

disapproved of the contents of this news release. The securities

being offered have not been, and will not be, registered under the

United States Securities Act of 1933, as amended (the "U.S.

Securities Act"), or any state securities laws, and may not be

offered or sold in the United States, or to, or for the account or

benefit of, a "U.S. person" (as defined in Regulation S of the U.S.

Securities Act) unless pursuant to an exemption therefrom. This

press release is for information purposes only and does not

constitute an offer to sell or a solicitation of an offer to buy

any securities of the Company in any jurisdiction.

Cautionary Note Regarding Forward Looking

Statements

This announcement includes certain "forward-looking

statements" within the meaning of Canadian securities legislation.

All statements, other than statements of historical fact, included

herein, without limitation the use of net proceeds, are

forward-looking statements. Forward- looking statements involve

various risks and uncertainties and are based on certain factors

and assumptions. There can be no assurance that such statements

will prove to be accurate, and actual results and future events

could differ materially from those anticipated in such statements.

Important factors that could cause actual results to differ

materially from the Company's expectations include uncertainties

relating to interpretation of drill results and the geology,

continuity and grade of mineral deposits; uncertainty of estimates

of capital and operating costs; the need to obtain additional

financing to maintain its interest in and/or explore and develop

the Company's mineral projects; uncertainty of meeting anticipated

program milestones for the Company's mineral projects; and other

risks and uncertainties disclosed under the heading "Risk Factors"

in the prospectus of the Company dated March 2, 2012 filed with the

Canadian securities regulatory authorities on the SEDAR website

at www.sedar.com

Non-GAAP Financial Measures

The items marked with a "(1)" are

alternative performance measures and readers should refer to

Non-GAAP Financial Measures in the Company's Management's

Discussion and Analysis for the three months ended March 31, 2014

as filed on SEDAR and as available on the Company's website for

further details.

Atico Mining CorporationIgor DutinaInvestor

Relations+1.604.633.9022www.aticomining.com

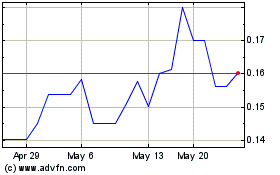

Atico Mining (QX) (USOTC:ATCMF)

Historical Stock Chart

From Feb 2025 to Mar 2025

Atico Mining (QX) (USOTC:ATCMF)

Historical Stock Chart

From Mar 2024 to Mar 2025