September 28, 2021 -- InvestorsHub NewsWire -- NetworkNewsWire

Editorial Coverage: As part of the reopening economy, investors

should be monitoring several trends in the healthcare space,

including several that fall in the “natural wellness” or “natural

alternatives” categories. The COVID-19 pandemic shone a

bright light on lifestyle and self-care as people were encouraged,

and often mandated, to stay at home. The trend further points to

the next phase of cannabis market maturation, dubbed cannabis 3.0,

against the backdrop of legislators discussing the Cannabis

Administration and Opportunity Act that would create a national

market for marijuana. Looking to address this

opportunity, BevCanna Enterprises Inc. (CSE: BEV)

(OTCQB: BVNNF) (FSE: 7BC) (Profile) has been expanding and

diversifying its business in 2021 from its core business as a

high-capacity cannabis beverage company into a diversified health

and wellness company through a number of accretive acquisitions.

BevCanna is emerging as a leader among a group of companies,

including the

Valens Company (TSX: VLNS) (OTCQX:

VLNCF), Neptune Wellness Solutions Inc. (NASDAQ:

NEPT), NewAge Inc. (NASDAQ:

NBEV) and AYR

Wellness Inc. (CSE: AYR.A) (OTCQX: AYRWF), that are

innovating and taking aggressive approaches to capitalize on the

growing cannabis consumer trend moving toward a more wholistic

wellness lifestyle business.

- Quince Market Insights estimates the 2021 market will reach

$19.89 billion and forecasts that the sector is now positioned to

see 27% CAGR.

- BevCanna has completed two significant acquisitions, giving it

two cannabis-related licenses and a global presence in natural

wellness markets.

- BevCanna operates a 40,000-square-foot, state-of-the-art

beverage production facility with annual capacity of 210 million

bottles.

- BevCanna’s acquisition of Embark Health adds revenue and IP as

well as a second production facility to increase its asset base to

more than $100 million.

Click here to view the custom infographic of

the BevCanna Enterprises Inc. editorial.

Cannabis 3.0 Has Arrived

Owing to increased use for medicinal purposes, Quince Market

Insights sees the global cannabis market ready to accelerate in a

big way. The firm

estimates the 2021 market will reach $19.89 billion and

forecasts that the sector is now positioned to see 27% compound

annual growth.

Cannabis 1.0 was the legalization of the plant, and 2.0 was the

introduction of derivatives into the market such as edibles and

other consumables. With cannabis 3.0 on the horizon, and U.S.

legalization looming, cannabis is becoming normalized, and

consumers are integrating it into their everyday lives, as an

ingredient in mainstream products in everything from drinks and

pharmaceuticals to personal hygiene and beauty products.

The upcoming widespread applications have underscored market

activity as companies position for the future. BevCanna

Enterprises Inc. (CSE: BEV) (OTCQB: BVNNF) (FSE:

7BC) has been a standout, diversifying already robust

operations and acquiring innovative wellness brands and companies

that expand its product offering and manufacturing capabilities to

new channels such as direct to consumer e-commerce, high-growth

adult-use cannabis products, hemp-derived CBD products, and

wellness-focused noncannabis products bridging the intersection of

two of the fastest-growing consumer categories: wellness and

cannabis.

BevCanna leadership has decades of experience creating,

branding, and manufacturing iconic brands, with CVs including

positions at the likes of Rogers, Best Buy, SC Johnson, Walmart,

Pepsi, Costco, Colgate, and more. The company owns in-house brands

Anarchist Mountain, Pure Therapy and the innovative TRACE water

& supplement brand, along with partner brands Keef Brands in

its portfolio. As the United States moves towards federal cannabis

legalization, the Keef partnership provides wide exposure to more

than 1,000 U.S. dispensaries. With the acquisitions of Naturo Group

and Pure Therapy complete, BevCanna just inked another

company-maker-type of deal.

Naturo Group: A Company Maker on Its Own

BevCanna planted its flag in the wellness space in November 2020

with an agreement to purchase Naturo Group, a company that had been

a close partner since 2017. The acquisition brought in about $38

million in assets, including a British Columbia-based,

40,000-square-foot, state-of-the-art, HACCP-certified beverage

manufacturing facility with capacity of 210 million bottles

annually in PET/RPET, aluminum and glass formats; a pristine onsite

alkaline spring water source; 315-acres of land for outdoor

cultivation purposes; and proprietary Health Canada-approved fulvic

and humic plant-based mineral formulation. The land and alkaline

spring water source alone are valued at more than $28

million, a true value proposition for a company with a market

capitalization around $56 million. In addition, BevCanna already

has government approval to expand its facility to

170,000-square-feet for CPG and cannabis purposes.

With the Naturo Group

acquisition, BevCanna brought the TRACE brand under its

umbrella, a leading mineralized water and supplement brand

that is sold in more than 3,000 Canadian retail locations, and is

actively expanding into the U.S. market with an initial focus on

California, Illinois and New York markets. While mostly supported

by anecdotal evidence, fulvic acid is heralded as a natural

supplement and immune system enhancer for warding off a variety

of diseases and

conditions, including allergies, eczema and even Alzheimer’s

disease. The products catalog contains a variety of alkaline and

natural spring waters, plant-based mineral concentrate, plant-based

mineralized shots and more.

Pure Therapy

The acquisition of Naturo Group came only a month after BevCanna

agreed to acquire Pure

Therapy, a natural health product company selling a range of

meticulously crafted goods, including nutraceutical and hemp-based

cannabidiol products, through its e-commerce platform across North

America and Western Europe. At the time of acquisition, Pure

Therapy had a base of approximately 23,000 customers, which

BevCanna has already grown by about 15%, with 3,270 new active

customers. The company also plans to accelerate growth by

leveraging the decades of marketing expertise that the Pure

Therapy’s team brings to the table.

BevCanna plans to launch its own nutraceuticals and CBD products

into the global health and wellness market, including the

burgeoning U.S. CBD space. The company has a jump start in the

lucrative U.S. markets through Pure Therapy and its partnership

with Keef Brands, a top U.S. cannabis-infused beverage company.

Embark Health, $100 Million in Assets

Last week, BevCanna made another significant acquisition,

entering a definitive agreement to buy Embark Health Inc. for C$21

million. The all-stock transaction valued BEV stock at C$0.45, a

33% premium to the average price of the stock for the five days

leading into the deal being disclosed.

Embark has extensive manufacturing and intellectual property

assets related to high-end solventless cannabis extracts such as

bubble hash, traditional pressed hash, rosin, dry sift and its

best-selling Hazel Hash Stick. Embark also boasts the capacity to

manufacture cannabis concentrates, liquids, powder beverage mixes,

topicals and edible products. The company generated C$790,000 in

revenue at ~65% gross margin in the last three months through its

four adult-use brands. The potential resonates in the deal’s

details, which include earn-out payments to Embark shareholders if

revenue reaches $92.18 million within three years.

The acquisition also gives BevCanna part of health and wellness

product company ProteinQuest, for which Embark is the majority

shareholder. Folding in Embark is beneficial to BevCanna in

multiple ways including the combined company totaling more than

$100 million in assets on the balance sheet.

In addition, the already impressive management team at BevCanna

is also gaining some new faces, namely Bruce Dawson-Scully (founder

and CEO of WeedMD); Marcus “Bubbleman” Richardson (best known for

being the founding pioneer of bubble hash); Michael West (global

extraction expert who has developed, designed and built more than a

dozen world-class extraction facilities for companies such

as Cresco Labs

(CSE: CL); and Curtis Leifso, an expert in enhanced

bioavailability drug-delivery technology.

Move Now or Pay Later

Savvy companies are seeing the trend shifts happening and making

moves to get in front of them to maximize market share. Some

companies are stepping into the cannabis space while others are

diversifying within the cannabis market, and some are expanding

from the cannabis space into the broader health and wellness

markets. Regardless of the strategy, the moves are making noise and

getting investors’ attention.

The

Valens Company (TSX: VLNS) (OTCQX: VLNCF), a leading

manufacturer of cannabis products, has been active with

acquisitions to grow its company. On Sept. 1, 2021, Valens completed the acquisition of Verse

Cannabis, a pioneer in the value segment that quickly emerged

following its launch in August 2020. That was only one day after

the company inked an agreement to acquire Citizen Stash Cannabis

Corp in an all-stock transaction valued at

approximately $54.3

million on an enterprise value basis. Valens expects the

acquisition of the licensed producer to be accretive in 2021 and

2022 before synergies.

Neptune Wellness Solutions Inc. (NASDAQ:

NEPT), a diversified health and wellness company, is

focused on building a portfolio of high-quality, affordable

consumer products in response to long-term secular trends and

market demand for natural, plant-based, sustainable, and

purpose-driven lifestyle brands. Quebec-based Neptune has 130 SKUS across eight brands spanning

cannabis, organic food and beverage, and personal care and beauty

that are sold at 20,000 retail locations. During Q1 fiscal 2022,

Neptune generated revenue of $12.4 million, exceeding guidance and

beating the year prior quarter by 83%.

NewAge Inc. (NASDAQ:

NBEV) commercializes a portfolio of organic and

healthy products worldwide primarily through a direct-to-consumer

distribution system. Colorado-based NewAge competes in three major category platforms

— health and wellness, healthy appearance, and nutritional

performance — and leads a network of more than 400,000 exclusive

independent distributors and brand partners around the world.

NewAge is looking to build on a record $124 million in revenue

during its second quarter, in part by partnering with

social-selling technology firm Kwikclick to launch an affiliate marketing

platform and collaborate on transforming the traditional influencer

and social selling influencer model.

AYR

Wellness Inc. (CSE: AYR.A) (OTCQX: AYRWF), a

vertically integrated cannabis multistate operator, has had a busy

September. In a matter of a few weeks, AYR has

opened Liberty Health Sciences West Pensacola, its 41st operating

dispensary in Florida; launched its Origyn Extracts premium

concentrates line in Pennsylvania and advanced more acquisition

deal flow. The company now has a binding letter of intent to

acquire PA Natural Medicine LLC, an operator of three licensed

retail dispensaries in Pennsylvania, and a definitive agreement to

acquire Cultivauna LLC, the owner of Levia-branded cannabis-infused

seltzers and water-soluble tinctures.

The cannabis market has been in a bit of a lull lately as many

investors wait for lawmakers on Capitol Hill to make their next

move. Companies, however, aren’t waiting. The market is quickly

approaching an inflection point in a post-COVID economy, and those

who hesitate just may get left behind — or at least pay dearly

to catch up.

For more information about BevCanna Enterprises Inc., please

visit BevCanna

Enterprises Inc. (CSE: BEV) (OTCQB: BVNNF) (FSE: 7BC).

About NetworkNewsWire

NetworkNewsWire (“NNW”) is a financial news and

content distribution company, one of 50+ brands within

the InvestorBrandNetwork (“IBN”), that

provides: (1) access to a network of wire

solutions via InvestorWire to reach all target markets,

industries and demographics in the most effective manner

possible; (2) article and editorial

syndication to 5,000+ news outlets; (3)

enhanced press release solutions to ensure maximum

impact; (4) social media distribution via IBN

millions of social media followers; and (5) a

full array of corporate communications solutions. As a multifaceted

organization with an extensive team of contributing journalists and

writers, NNW is uniquely positioned to best serve private and

public companies that desire to reach a wide audience comprising

investors, consumers, journalists and the general public. By

cutting through the overload of information in today’s market, NNW

brings its clients unparalleled visibility, recognition and brand

awareness. NNW is where news, content and information converge.

To receive SMS text alerts from NetworkNewsWire, text

“STOCKS” to 77948 (U.S. Mobile Phones Only)

For more information, please visit https://www.NetworkNewsWire.com

Please see full terms of use and disclaimers on the

NetworkNewsWire website applicable to all content provided by NNW,

wherever published or re-published: http://NNW.fm/Disclaimer

NetworkNewsWire (NNW)

New York, New York

www.NetworkNewsWire.com

212.418.1217 Office

Editor@NetworkNewsWire.com

NetworkNewsWire is part of the InvestorBrandNetwork

DISCLAIMER: NetworkNewsWire (NNW) is the source of the Article

and content set forth above. References to any issuer other than

the profiled issuer are intended solely to identify industry

participants and do not constitute an endorsement of any issuer and

do not constitute a comparison to the profiled issuer. The

commentary, views and opinions expressed in this release by NNW are

solely those of NNW. Readers of this Article and content agree that

they cannot and will not seek to hold liable NNW for any investment

decisions by their readers or subscribers. NNW is a news

dissemination and financial marketing solutions provider and are

NOT registered broker-dealers/analysts/investment advisers, hold no

investment licenses and may NOT sell, offer to sell or offer to buy

any security.

The Article and content related to the profiled company

represent the personal and subjective views of the Author, and are

subject to change at any time without notice. The information

provided in the Article and the content has been obtained from

sources which the Author believes to be reliable. However, the

Author has not independently verified or otherwise investigated all

such information. None of the Author, NNW, or any of their

respective affiliates, guarantee the accuracy or completeness of

any such information. This Article and content are not, and should

not be regarded as investment advice or as a recommendation

regarding any particular security or course of action; readers are

strongly urged to speak with their own investment advisor and

review all of the profiled issuer’s filings made with the

Securities and Exchange Commission before making any investment

decisions and should understand the risks associated with an

investment in the profiled issuer’s securities, including, but not

limited to, the complete loss of your investment.

NNW HOLDS NO SHARES OF ANY COMPANY NAMED IN THIS RELEASE.

This release contains “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E the Securities Exchange Act of 1934, as amended and

such forward-looking statements are made pursuant to the safe

harbor provisions of the Private Securities Litigation Reform Act

of 1995. “Forward-looking statements” describe future expectations,

plans, results, or strategies and are generally preceded by words

such as “may”, “future”, “plan” or “planned”, “will” or “should”,

“expected,” “anticipates”, “draft”, “eventually” or “projected”.

You are cautioned that such statements are subject to a multitude

of risks and uncertainties that could cause future circumstances,

events, or results to differ materially from those projected in the

forward-looking statements, including the risks that actual results

may differ materially from those projected in the forward-looking

statements as a result of various factors, and other risks

identified in a company’s annual report on Form 10-K or 10-KSB and

other filings made by such company with the Securities and Exchange

Commission. You should consider these factors in evaluating the

forward-looking statements included herein, and not place undue

reliance on such statements. The forward-looking statements in this

release are made as of the date hereof and NNW undertakes no

obligation to update such statements.

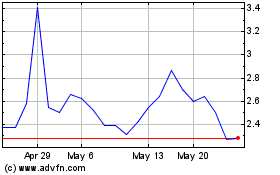

Ayr Wellness (QX) (USOTC:AYRWF)

Historical Stock Chart

From Nov 2024 to Dec 2024

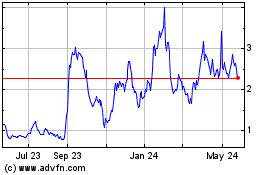

Ayr Wellness (QX) (USOTC:AYRWF)

Historical Stock Chart

From Dec 2023 to Dec 2024