UPDATE: Michelin Launches EUR1.2 Billion Capital Hike To Fund Growth

28 September 2010 - 6:45PM

Dow Jones News

Tire maker Michelin (ML.FR) Tuesday launched a heavily

discounted EUR1.2 billion capital increase to finance its

expansion, particularly in fast-growing emerging markets.

The move took investors by surprise. At 0750 GMT, Michelin's

shares traded down EUR5.26, or 8.1%, at EUR60, making it the

biggest faller in the benchmark CAC-40 index, which traded down

1.2%.

The subscription price of the new shares was set at EUR45, a 27%

discount to the closing price Monday. Shareholders are entitled to

two new shares for every 11 shares currently held. The subscription

period runs from Sept. 30 to Oct. 13 and the new shares will begin

trading Oct. 25.

Michelin wants the cash to fund its ambitious medium-term growth

plans that include boosting sales by 25% between now and 2015 and

by 50% by 2020.

The company has been spending about EUR1.2 billion a year on

capital expenditure annually in recent years, but this will rise to

EUR1.6 billion from 2011, joint managing partner Jean-Dominique

Senard told reporters.

It intends to add 150,000 tons of production capacity annually

in its target markets of Brazil, China and India, equivalent to

more than one new factory every year. The tire maker is following

in the tracks of the world's major automakers, which are driving

full-speed into emerging markets in search of faster growth.

Investment will increase between 5% and 6% annually through

2015, said Michel Rollier, Senard's co-chief. Of the EUR1.6 billion

in annual investment, EUR1 billion will be devoted to emerging

markets.

Rollier said he doesn't exclude taking advantage of acquisition

opportunities, but Senard said there was no "hidden project" for a

purchase behind the rights issue.

Rollier said the capital hike wasn't designed to shore up

Michelin's finances, as the company "has the best balance sheet it

has had in 30 years."

Senard said Michelin expects to increase its global tire sales

by 50% through 2020, with sales in emerging countries likely to

double while those in mature markets will rise by 25%. The fast

ramp-up outside Europe and North America will mean that 45% of the

company's sales will be in emerging countries by 2020, compared to

33% at present, he said, and nearly half of total sales will be of

energy-efficient tires with low rolling resistance, compared to

only 10% now.

Rollier said the company intends to maintain a pricing policy

whereby any increases in raw materials prices are passed on to

customers. The company, which vies with Japanese competitor

Bridgestone Corp. (5108.TO) to be the world's leading tire maker,

enjoys strong pricing power thanks to its large market shares.

Michelin reaffirmed its earnings guidance for 2010, saying it

still expects to achieve an operating margin of around 9% of sales

on a increase of more than 10% in volume sales, together with a

positive cash flow. It said the planned capital boost will have no

impact on its 2010 cash flow.

Other medium-term goals include achieving an operation profit

excluding exceptional items of substantially more than EUR2

billion, a long-term return on capital employed of more than 9%, to

generate significantly positive cash flow through 2015, and a

dividend payout ratio of around 30% over that period.

-By David Pearson, Dow Jones Newswires; +33140171740;

david.pearson@dowjones.com

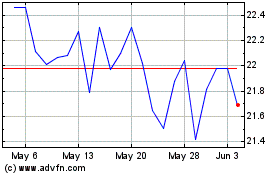

Bridgestone (PK) (USOTC:BRDCY)

Historical Stock Chart

From Jan 2025 to Feb 2025

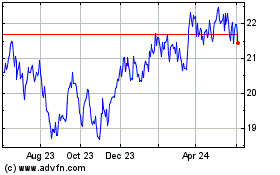

Bridgestone (PK) (USOTC:BRDCY)

Historical Stock Chart

From Feb 2024 to Feb 2025