By Orla McCaffrey

Hurricane Irma barreled through Gainesville, Fla., in 2017,

displacing some of the clients Faye Feazell worked with as a home

health aide. Ms. Feazell, unsure how she would make her monthly

mortgage payments, called her mortgage company for help.

She said the company, AmeriHome Mortgage Co., told her not to

worry: She could skip payments for 90 days. But three months later,

when she called to find out about resuming payments, she learned

she was being foreclosed on, she said. The AmeriHome employee she

spoke to didn't know anything about the relief plan Ms. Feazell

said she was offered.

"It was heartbreaking," Ms. Feazell said. "Because I have never

been behind on anything in my life."

Mortgage companies often offer help to borrowers after natural

disasters, but the programs can end up hurting them.

The scope of the problem is difficult to quantify. Hundreds of

homeowners have complained to the Consumer Financial Protection

Bureau about problems with so-called mortgage forbearance programs.

Consumer lawyers in regions hit hard by natural disasters say they

have seen more homeowners who are reported delinquent to

credit-reporting firms after accepting payment help.

"We're just one law firm in one disaster in one part of Florida

and we saw this come up a number of times," said Mike Ziegler, a

consumer lawyer in Clearwater.

How such programs operate, and their potential pitfalls, could

become even more important in light of the coronavirus epidemic. If

the disease spreads throughout the U.S. and puts some Americans out

of work, lenders would likely grapple with how and whether to offer

assistance to borrowers.

The problems with assistance programs often start with

administrative errors that lead to bigger issues down the road.

After storms, wildfires and other natural disasters, companies

sometimes offer help over the phone but don't record that they did

so, according to interviews with consumer lawyers and homeowners.

The companies might not make it clear when or if borrowers have to

make up the payments.

A company that tells borrowers they can miss payments might

report them as delinquent to credit-reporting firms when they do

so. That in turn can send their credit scores tumbling and make it

more difficult for them to buy a car, rent an apartment or tackle

other tasks after a storm. People with lower credit scores before a

natural disaster are more seriously affected by knocks to their

credit afterward, reinforcing their disadvantage, the Urban

Institute found.

Servicers say they do their best to help borrowers and have made

efforts to improve their disaster responses.

Credit-reporting firms Experian PLC, Equifax Inc. and TransUnion

didn't comment.

While such programs help many borrowers, reports of problems

highlight the need for consumer vigilance. A trade group that

represents the credit-reporting companies says consumers who skip

payments after a disaster with their mortgage company's permission

should check their credit reports to make sure they haven't

incorrectly been reported as delinquent.

Consumer lawyers say borrowers should accept payment relief only

if they have no other means to pay their mortgage and should call

their servicers regularly until a final repayment plan is ironed

out.

A law firm helped Ms. Feazell, 67, keep her home. But she still

has to pay more than $7,000 for the attorney AmeriHome hired to

process the planned foreclosure. She wishes she had never called

the company for help.

AmeriHome declined to comment.

Susan Tellem's home burned down when the Woolsey Fire tore

through her Malibu, Calif., neighborhood in November 2018. Her

mortgage servicer, Select Portfolio Servicing Inc., agreed to let

her skip payments for four months as she figured out how much her

insurance would pay to rebuild, she said.

Less than two months later, she got a letter from the company

saying she was in default for missing a payment. Ms. Tellem, a

senior partner at a public-relations firm, told the company she no

longer wanted the relief and started paying the mortgage again, she

said.

But her servicer reported her as delinquent, according to a copy

of her credit report. Ms. Tellem's credit score soon plunged. The

company eventually sent correct information to the credit bureaus,

she said, but her interactions were frustrating.

"It's like a revolving door," Ms. Tellem said. "You never talk

to the same person."

Select Portfolio Servicing didn't respond to requests for

comment.

For loans backed by Fannie Mae or Freddie Mac, mortgage

servicers are required to give borrowers the option to skip

payments for up to 12 months when a natural disaster hits, though

the policy kicks in only under certain conditions. For example, the

area has to be declared a major disaster by the president. The

Woolsey Fire fell into that category, as did Hurricane Dorian in

North Carolina and severe flooding in Nebraska and Iowa last

year.

Under the same rules, servicers aren't supposed to report

borrowers as delinquent to credit bureaus while they are on

disaster-relief plans. They are supposed to regularly check in with

homeowners and set up a plan to transition back to payment.

A similar policy applies to Federal Housing Administration

mortgages.

Some borrowers said their servicer told them they could skip

several months of payments and tack them on to the end of the loan

-- but then were told a few months later they had to repay the

money right away.

Cheryl and Garrett Bowles said that is what happened to them

with Mr. Cooper Group Inc., formerly known as Nationstar Mortgage,

after Hurricane Irma downed several trees on their property in

Citra, Fla.

The Bowleses couldn't afford to catch up with a lump-sum

payment, so a Mr. Cooper employee offered what they hoped was a way

out. Mrs. Bowles said she was told she could file paperwork

requesting that the skipped payments be added to the end of the

loan.

She said that she applied right away but a Mr. Cooper agent

later told her the company had lost the documents and she had to

reapply.

A spokesman for Mr. Cooper said Wednesday the company did offer

the Bowles family a loan modification but wouldn't specify terms or

when it was offered.

Mrs. Bowles applied again. Mr. Cooper told her in a December

letter it couldn't modify her loan because her family had

"insufficient disposable income."

The family moved out of their 1982 Catalina double-wide mobile

home in January. Mrs. Bowles found a buyer and expects the sale to

cover the $40,000 still owed to Mr. Cooper. For now, they have

moved in with Mrs. Bowles's sister.

Mr. Cooper settled with Florida's attorney general in 2018 over

accusations that it misled borrowers after Hurricane Irma. The

company didn't admit wrongdoing, but its chief executive said in a

press release its communication with some customers "was less than

perfect."

Write to Orla McCaffrey at orla.mccaffrey@wsj.com

(END) Dow Jones Newswires

February 29, 2020 05:44 ET (10:44 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

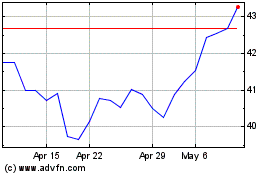

Experian (QX) (USOTC:EXPGY)

Historical Stock Chart

From Oct 2024 to Nov 2024

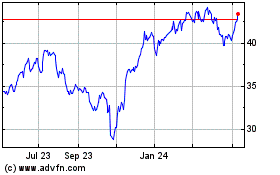

Experian (QX) (USOTC:EXPGY)

Historical Stock Chart

From Nov 2023 to Nov 2024