Glencore Reports Record 2022 Marketing, Industrial Business Profit -- Commodity Comment

15 February 2023 - 7:49PM

Dow Jones News

Glencore PLC on Wednesday reported record profit for its

marketing and industrial businesses for 2022 and said demand for

many of its commodities is likely to remain healthy given the

re-opening of China following coronavirus-related lockdowns, while

supply constraints persist and inventories remain relatively low.

Here's what the Anglo-Swiss commodity mining and trading company

had to say:

On industrials:

"Industrial Assets adjusted Ebitda $27.3 billion, up 59%,

primarily reflecting a $13.0 billion increase from energy products,

in line with significantly higher coal prices, as well as the

Cerrejon partner buy-out contribution."

"Metals $9.3 billion, down $2.7 billion, reflecting higher costs

and lower volumes; Energy $18.6 billion, up $13.0 billion

(+232%)."

"Unit cost results: Cu 80c/lb (+13c/lb y/y); Zn 38c/lb (+42c/lb

y/y, whereby 2022 is net of 23c/lb of non-cash inventory

adjustments); Ni 631c/lb (+177c/lb y/y); coal $79/t ($166/t

margin)."

On marketing:

"Marketing adjusted EBIT $6.4 billion, up 73% y/y."

"Energy adjusted EBIT: $5.2 billion (+273%), as already tight

post-pandemic energy markets were jolted by significant

dislocation, generating extreme volatility in oil, refining

margins, freight, gas and coal, with prices (absolute and in

relation to quality and location differentials) reaching multi-year

highs or records in many cases."

"Metals adjusted EBIT: $1.6 billion (-34%), mainly reflecting

challenging conditions arising from China's prolonged Covid-19

lockdowns as well as higher overall inflation, triggering tighter

monetary conditions and demand uncertainty."

On copper:

"Own sourced copper production of 1,058,100 tonnes was 137,600

tonnes (12%) lower than 2021, due to the basis change arising from

the sale of Ernest Henry in January 2022 (44,800 tonnes), the

ongoing geotechnical constraints at Katanga (44,300 tonnes),

Collahuasi planned mining sequence changes (26,100 tonnes) and a

lower contribution from Mount Isa (21,000 tonnes)."

On zinc:

"Own sourced zinc production of 938,500 tonnes was 179,300

tonnes (16%) lower than 2021, reflecting the disposal/cessation of

South America operations (83,400 tonnes), closure of Matagami

(30,100 tonnes) and lower volumes from Mount Isa (39,600 tonnes),

as Lady Loretta approaches end of mine life."

On nickel:

"Own sourced nickel production of 107,500 tonnes was 5,200

tonnes (5%) higher than 2021, reflecting Murrin Murrin's scheduled

major maintenance shut in the prior year and Koniambo running two

production lines for the majority of 2022, partially offset by

lower production at INO due to strike action in Canada and

Norway."

On ferroalloys:

"Attributable ferrochrome production of 1,488,000 tonnes was in

line with 2021."

On coal:

"Coal production of 110.0 million tonnes was 6.7 million tonnes

(6%) higher than 2021, reflecting higher attributable production

from Cerrejon, following the acquisition in January 2022 of the

remaining two-thirds interest that Glencore did not already own,

less declines elsewhere in the portfolio."

"On a like for like basis, overall group production declined by

8.9 million tonnes (7%), primarily due to wet weather challenges

and an extended community blockade in Colombia."

On oil exploration and production:

"Entitlement interest oil production of 6.1 million barrels of

oil equivalent was 0.9 million barrels (16%) higher than 2021, due

to a full year of production from the Alen gas project in

Equatorial Guinea, following its commencement in March 2021."

Write to Ian Walker at ian.walker@wsj.com

(END) Dow Jones Newswires

February 15, 2023 03:34 ET (08:34 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

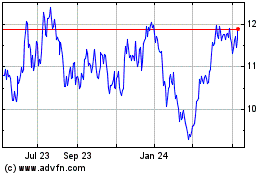

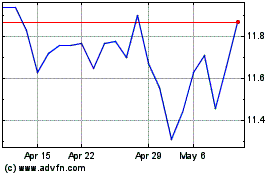

Glencore (PK) (USOTC:GLNCY)

Historical Stock Chart

From Jan 2025 to Feb 2025

Glencore (PK) (USOTC:GLNCY)

Historical Stock Chart

From Feb 2024 to Feb 2025