UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14C INFORMATION

Information

Statement Pursuant to Section 14(c) of the

Securities

Exchange Act of 1934

Check the

appropriate box:

| |

☒ |

Preliminary

Information Statement |

| |

☐ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14c-5(d)(2)) |

| |

☐ |

Definitive

Information Statement |

iL2M

INTERNATIONAL CORP.

(Name

of Registrant As Specified in Charter)

Payment

of Filing Fee (Check the appropriate box):

| |

☐ |

Fee

computed on table below per Exchange Act Rules 14c-5(g) and 0-11. |

| |

(1) |

Title

of each class of securities to which transaction applies: |

| |

(2) |

Aggregate

number of securities to which transaction applies: |

| |

(3) |

Per

unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which

the filing fee is calculated and state how it was determined): |

| |

(4) |

Proposed

maximum aggregate value of transaction: |

| |

(5) |

Total

fee paid: |

| |

☐ |

Fee

paid previously with preliminary materials |

| |

☐ |

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date

of its filing. |

| |

(1) |

Amount

Previously Paid: |

| |

(2) |

Form,

Schedule or Registration Statement No.: |

| |

(3) |

Filing

Party: |

| |

(4) |

Date

Filed: |

iL2M

INTERNATIONAL CORP.

3500

West Olive Avenue

Suite

810

Burbank,

California 91505

Dear Shareholders:

We

are writing to advise you that our Board of Directors and shareholders holding a majority of our outstanding voting capital stock

have approved an amendment to the articles of incorporation (the "Authorized Capital Amendment") to increase the total

authorized capital from 500,000,000 to 10,000,000,000 shares of common stock, par value $0.0001 (the "Increase in Authorized

Capital").

This

action was approved by written consent on January 23, 2015 by our Board of Directors and a majority of holders of our voting capital

stock, in accordance with Nevada Revised Statutes. Our directors and majority of the shareholders of our outstanding capital stock,

as of the record date of January 23, 2015, have approved the Authorized Capital Amendment as determined were in the best interests

of our Company and shareholders.

WE

ARE NOT ASKING YOU FOR A PROXY, AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

No

action is required by you. Pursuant to Rule 14(c)-2 under the Securities Exchange Act of 1934, as amended, the proposals will

not be adopted until a date at least ten (10) days after the date of this Information Statement has been filed and mailed to our

shareholders. This Information Statement will be mailed to you on or about February 3, 2015.

| |

For

the Board of Directors |

|

| |

|

|

|

| |

By: |

/s/

Sarkis Tsaoussian |

|

| |

|

Name:

Sarkis Tsaoussian

Title:

Chief Executive Officer |

|

iL2M

INTERNATIONAL CORP.

3500

West Olive Avenue

Suite

810

Burbank,

California 91505

INFORMATION

STATEMENT REGARDING

ACTION

TO BE TAKEN BY WRITTEN CONSENT OF

MAJORITY

SHAREHOLDERS

IN

LIEU OF A SPECIAL MEETING

PURSUANT

TO SECTION 14(C) OF THE

SECURITIES

EXCHANGE ACT OF 1934

WE

ARE NOT ASKING YOU FOR A PROXY,

AND

YOU ARE REQUESTED NOT TO SEND US A PROXY

GENERAL

This

Information Statement is being furnished to all holders of the common stock of il2m International Corp. (the "Company")

as of January 23, 2015 in connection with the action taken by written consent of holders of a majority of the outstanding voting

power of the Company to authorize the Authorized Capital Amendment.

"We,"

"us," "our," the “Registrant” and the "Company" refers to il2m International Corp.,

a Nevada corporation.

SUMMARY

OF CORPORATE ACTIONS

INFORMATION

STATEMENT

This

Information Statement is furnished to the stockholders of il2m International Corp., a Nevada corporation (the “Company”),

in connection with our prior receipt of approval by written consents, in lieu of a special meeting, of the holders of a majority

of our outstanding voting power authorizing the board of directors of the Company to amend the articles of incorporation to increase

the total authorized capital to 10,000,000,000 shares of common stock, par value $0.0001 (the "Authorized Capital Amendment").

On

January 23, 2015, the Company obtained the approval of the Authorized Capital Amendment by written consent of the stockholders

that are the record owners of 125,000,000 shares of common stock, which represents an aggregate of approximately 61.59% of the

voting power as of January 23, 2015. The name of the shareholder of record who holds in the aggregate a majority of our total

issued and outstanding common stock and who signed the written consent of stockholders is il2m Global Limited holding of record

125,000,000 shares of common stock (61.59%).

The

Authorized Capital Amendment will be effectuated ten (10) days after the filing and mailing of this Information Statement and

after the filing of the amended Articles of Incorporation with the Nevada Secretary of State with respect to the Increase in Authorized

Capital.

The

date on which this Information Statement will be sent to stockholders will be on or about February 3, 2015 and is being furnished

to all holders of the common stock of the Company on record as of January 23, 2015.

The

Board of Directors, and persons owning a majority of the outstanding voting securities of the Company have unanimously adopted,

ratified and approved the proposed actions by the Company's board of directors. No other votes are required or necessary.

The

Quarterly Report on Form 10-Q for the quarters ended November 30, 2014 (which will be filed shortly) and August 31, 2014, the

Annual Report on Form 10-K for fiscal year ended May 31, 2014 and the Quarterly Reports on Form 10-Q for the quarters ended February

28, 2014, November 30, 2013 and August 31, 2013 filed by the Company during the past two years with the Securities and Exchange

Commission may be viewed on the Securities and Exchange Commission’s web site at www.sec.gov in the Edgar Archives.

The Company is presently current in the filing of all reports required to be filed by it with the exception of its quarterly filing

on Form 10-Q for six month period ended November 30, 2014. Management anticipates the filing of the Quarterly Report on Form 10-Q

for the six month period ended November 30, 2014 within the week of January 26, 2015.

Only

one Information Statement is being delivered to multiple shareholders sharing an address, unless we have received contrary instructions

from one or more of the shareholders. We will undertake to deliver promptly upon written or oral request a separate copy of the

information statement to a stockholder at a shared address to which a single copy of the information statement was delivered.

You may make a written or oral request by sending a written notification to our principal executive offices stating your name,

your shared address, and the address to which we should direct the additional copy of the information statement or by calling

our principal executive offices at (702) 726-0381. If multiple shareholders sharing an address have received one

copy of this information statement and would prefer us to mail each stockholder a separate copy of future mailings, you may send

notification to or call our principal executive offices. Additionally, if current shareholders with a shared address received

multiple copies of this information statement and would prefer us to mail one copy of future mailings to shareholders at the shared

address, notification of that request may also be made by mail or telephone call to our principal executive offices.

VOTE

REQUIRED

Pursuant

to the Company's Bylaws and the Nevada Revised Statutes, a vote by the holders of at least a majority of the Company’s outstanding

votes is required to effect the Authorized Capital Amendment. The Company’s certificate of incorporation does not authorize

cumulative voting. As of the record date, the Company had 202,963,310 voting shares of common stock issued and outstanding. The

consenting stockholders of the shares of common stock are entitled to 125,000,000 votes, which represents approximately 61.59%

of the voting rights associated with the Company’s shares of common stock. The consenting stockholders voted in favor of

the Authorized Capital Amendment described herein by unanimous written consent dated January 23, 2015.

PROPOSAL

I

AMENDMENT

TO OUR ARTICLES OF INCORPORATION

TO

INCREASE THE AUTHORIZED CAPITAL OF THE CORPORATION

On

January 23, 2015, our Board of Directors and majority shareholders, believing it to be in the best interests of the Company and

its shareholders, approved the amendment the Company's Articles to increase the authorized share capital of the Company to 10,000,000,000

shares of common stock with the same par value of $0.0001 per share. The purpose of this proposed increase in authorized share

capital is to make available additional shares of common stock for issuance for general corporate purposes, including those contemplated

by various licensing agreement, the prospective business operations of the Company and subsequent financing activities, without

the requirement of further action by the shareholders of the Company. The Board of Directors has considered potential uses of

the additional authorized shares of common stock, which may include the seeking of additional equity financing through public

or private offerings, establishing additional employee or director equity compensation plans or arrangements or for other general

corporate purposes. Increasing the authorized number of shares of the common stock of the Company will provide the Company with

greater flexibility and allow the issuance of additional shares of common stock in most cases without the expense or delay of

seeking further approval from the shareholders. The Company is at all times investigating additional sources of financing which

the Board of Directors believes will be in the Company's best interests and in the best interests of the shareholders of the Company.

However, there are no definitive agreements in place regarding future issuances.

The

shares of common stock do not carry any pre-emptive rights. The adoption of the Amendment will not of itself cause any changes

in the Company's capital accounts.

The

increase in authorized share capital will not have any immediate effect on the rights of existing shareholders. However, the Board

of Directors will have the authority to issue authorized shares of common stock without requiring future approval from the shareholders

of such issuances, except as may be required by applicable law or exchange regulations. To the extent that additional authorized

shares of common stock are issued in the future, they will decrease the existing shareholders' percentage equity ownership interests

and, depending upon the price at which such shares of common stock are issued, could be dilutive to the existing shareholders.

Any such issuance of additional shares of common stock could have the effect of diluting the earnings per share and book value

per share of outstanding shares of common stock of the Company.

One

of the effects of the increase in authorized share capital, if adopted, however, may be to enable the Board of Directors to render

it more difficult to or discourage an attempt to obtain control of the Company by means of a merger, tender offer, proxy contest

or otherwise, and thereby protect the continuity of present management. The Board of Directors would, unless prohibited by applicable

law, have additional shares of common stock available to effect transactions (including private placements) in which the number

of the Company's outstanding shares would be increased and would thereby dilute the interest of any party attempting to gain control

of the Company. Such action, however, could discourage an acquisition of the Company which the shareholders of the Company might

view as desirable.

The

Company does not have any current definitive or executed agreements regarding further proposals and arrangements to issue additional

shares that will become authorized share capital of the Company pursuant to the Authorized Capital Amendment. Also, the Authorized

Capital Amendment will result in an increase in the number of authorized but unissued shares of the Company's common stock, it

may be construed as having an anti-takeover effect. Although the Authorized Capital Amendment is not being undertaken for this

purpose, in the future the board of directors could, subject to its fiduciary duties and applicable law, use the increased number

of authorized but unissued shares to frustrate persons seeking to take over or otherwise gain control of our company by, for example,

privately placing shares with purchasers who might side with the board of directors in opposing a hostile takeover bid. Such use

of the Company's common stock could render more difficult, or discourage, an attempt to acquire control of our company if such

transactions were opposed by the board of directors.

Effective

Time of the Authorized Capital Amendment

We

intend to file, as soon as practicable on or after the 10th day after this Information Statement is filed and sent to our shareholders,

an amendment to our Articles of Incorporation effectuating the creation of the Authorized Capital Amendment with the Secretary

of State of Nevada. The Authorized Capital Amendment to our Articles of Incorporation will become effective at the close of business

on the date the Certificate of Amendment to the Articles of Incorporation is accepted for filing by the Secretary of State of

Nevada. It is presently contemplated that such filing will be made approximately ten (10) days from the date that this Information

Statement is sent to our shareholders. The text of the Certificate of Amendment to the Articles of Incorporation is subject to

modification to include such changes as may be required by the Nevada Secretary of State to effectuate the Amendment.

No

Appraisal Rights for the Amendment

Under

Nevada law, the Company’s shareholders are not entitled to appraisal rights with respect to the Authorized Capital Amendment

and the Company will not independently provide shareholders with any such right.

BOARD

OF DIRECTORS’

AND

STOCKHOLDER APPROVAL

As

our directors and holders of approximately 61.59% of our voting power signed a written consent in favor of the Amendment to the

Articles of Incorporation and the Authorized Capital Amendment, we are authorized to file Articles of Amendment to the Articles

of Incorporation with the Nevada Secretary of State. The Authorized Capital Amendment will be effective upon the filing of the

Articles of Amendment with the Secretary of State of the State of Nevada, which is expected to occur as soon as reasonably practicable

on or after the 10th day following the filing and mailing of this Information Statement to stockholders.

The

information contained in this Information Statement constitutes the only notice we will be providing stockholders.

DESCRIPTION

OF SECURITIES

Description

of Common Stock

Number

of Authorized and Outstanding Shares

The

Company's Articles of Incorporation authorizes the issuance of 500,000,000 shares of common stock, par value $0.0001 per share,

of which 202,963,310 shares were outstanding on January 23, 2015. All of the outstanding shares of common stock are fully paid

and non-assessable. The Company's Articles of Incorporation further authorize the issuance of 10,000,000 shares of blank check

preferred stock, par value $0.0001, of which no preferred shares are issued.

Common

Stock

The

holders of the common stock are entitled to one vote for each share held of record on all matters submitted to a vote of stockholders.

Our certificate of incorporation and by-laws do not provide for cumulative voting rights in the election of directors. Accordingly,

holders of a majority of the shares of common stock entitled to vote in any election of directors may elect all of the directors

standing for election. Holders of common stock are entitled to receive ratably such dividends as may be declared by the Board

out of funds legally available therefore. In the event of our liquidation, dissolution or winding up, holders of common stock

are entitled to share ratably in the assets remaining after payment of liabilities. Holders of common stock have no preemptive,

conversion or redemption rights.

Preferred

Stock

Our

board of directors has the authority, within the limitations and restrictions in our articles of incorporation, to issue 10,000,000

shares of preferred stock in one or more series and to fix the rights, preferences, privileges and restrictions thereof, including

dividend rights, dividend rates, conversion rights, voting rights, terms of redemption, redemption prices, liquidation preferences

and the number of shares constituting any series or the designation of any series, without further vote or action by the stockholders.

The issuance of preferred stock may have the effect of delaying, deferring or preventing a change in our control without further

action by the stockholders. The issuance of preferred stock with voting and conversion rights may adversely affect the voting

power of the holders of our common Stock, including voting rights, of the holders of our common Stock. In some circumstances,

this issuance could have the effect of decreasing the market price of our common stock. We currently have no plans to issue any

shares of preferred stock.

Dividends

We

have not paid any cash dividends to shareholders. The declaration of any future cash dividends is at the discretion

of our board of directors and depends upon our earnings, if any, our capital requirements and financial position, our general

economic conditions, and other pertinent conditions. It is our present intention not to pay any cash dividends in the

foreseeable future, but rather to reinvest earnings, if any, in our business operations.

Warrants

There

are no outstanding warrants.

Options

There

are no outstanding options to purchase our securities.

Transfer

Agent

Shares

of common stock are registered at the transfer agent and are transferable at such office by the registered holder (or duly authorized

attorney) upon surrender of the common stock certificate, properly endorsed. No transfer shall be registered unless the Company

is satisfied that such transfer will not result in a violation of any applicable federal or state security laws. The Company’s

transfer agent for its common stock is VStock Transfer LLC, 77 Spruce Street, Suite 201, Cedarhurst, New York 11516.

VOTE

REQUIRED FOR APPROVAL

In

accordance with Section 78.315 and 78.320 of the Nevada Revised Statutes, the following actions were taken based upon the unanimous

recommendation and approval by the Company's Board of Directors and the written consent of the majority shareholders.

The

Board of Directors of the Company has adopted, ratified and approved the Authorized Capital Amendment. The securities that are

entitled to vote approval of the Authorized Capital Amendment consist of issued and outstanding shares of the Company's $0.0001

par value common voting stock outstanding on January 23, 2015, the record date for determining shareholders who are entitled to

notice of and to vote.

VOTING

SECURITIES AND PRINCIPAL HOLDERS THEREOF

The

Board of Directors fixed the close of business on January 23, 2015 as the record date for the determination of the common and

preferred shareholders entitled to notice of the action by written consent.

At

the record date, the Company had 500,000,000 shares of common stock authorized with a stated par value of $0.0001, of which 202,963,310

shares of common stock were issued and outstanding. The holders of shares of common stock are entitled to one vote per share on

matter to be voted upon by shareholders.

The

holders of shares of common stock are entitled to receive pro rata dividends, when and if declared by the Board of Directors in

its discretion, out of funds legally available therefore, but only if dividends on preferred stock have been paid in accordance

with the terms of the outstanding preferred stock and there exists no deficiency in the sinking fund for the preferred stock.

Dividends

on the common stock are declared by the Board of Directors. Payment of dividends on the common stock in the future, if any, will

be subordinate to the preferred stock, must comply with the provisions of the Nevada Revised Statutes and will be determined by

the Board of Directors. In addition, the payment of any such dividends will depend on the Company's financial condition, results

of operations, capital requirements and such other factors as the board of directors deems relevant.

Shareholders

and the holders of a controlling interest equaling approximately 61.59% of the voting power of the Company, as of the record date,

have consented to the proposed amendments to the Articles of Incorporation. The shareholders have consented to the action required

to adopt Proposal One through Four above. This consent was sufficient, without any further action, to provide the necessary stockholder

approval of the action.

IDENTIFICATION OF CURRENT DIRECTORS AND EXECUTIVE OFFICERS

All of the Company's directors hold office

until the next annual general meeting of the shareholders or until their successors are elected and qualified. The Company's officers

are appointed by its Board of Directors and hold office until their earlier death, retirement, resignation or removal.

The Company's current directors and executive

officers, their ages and positions held are as follows:

| NAME |

|

AGE |

|

POSITION |

|

DIRECTOR

SINCE |

|

| Sarkis A. Tsaoussian |

|

42 |

|

President/Chief Executive Officer, Secretary, Treasurer/Chief Financial Officer and Director |

|

2013 |

|

Biography. Sarkis Tsaoussian has been

our President/Chief Executive Officer, Secretary, Treasurer/Chief Financial Officer and sole member of the Board of Directors

since November 13, 2013. Mr. Tsaoussian is a dynamic, engaging and visionary leader with numerous achievements. He

is a seasoned senior executive and entrepreneur with over twenty years of senior level management experience in a variety of different

industries. In 1993, Mr. Tsaoussian joined Pizza Donini Inc. as a field supervisor and progressed through more responsible

positions serving as secretary treasurer and director of Pizza Donini.com Inc. From January 1994 until in May 1997, he was appointed

as president and chief operations officer. Pizza Donini Inc. was once a major player in the Montreal food industry having an average

of thirty stores at any given time and was one of the first restaurant chains to implement the one number system for pizza delivery. Mr. Tsaoussian

led the creation of Pizza Donini Inc.'s first bilingual website and was in complete charge of the chain’s call centre that

employed close to forty agents, including the IT department, human resources. He also managed all on-going programming related

to the call centre’s main frames and was a facilitator in franchisee/franchisor relations. In 2004, Mr. Tsaoussian

resigned from Pizza Donini Inc.

In late 2004, Mr. Tsaoussian incorporated a

holding company that would soon own and operate three reputable dry-cleaning locations mainly serving high profile businessmen

and women in the greater Montreal area. Within a six month period, Mr. Tsaoussian upgraded all equipment to state-of-the-art

technologically advanced computerized machinery capable of handling five times more volume. By improving the cleaning

and pressing, he increased all production within one year and also created a then non-existent wholesale division servicing many

independent counters. Mr. Tsaoussian also renovated all customer areas and computerized cash registers, further increasing profitability

by reducing cost. Over the next two to three years, he successfully sold all of the dry cleaning stores in order to return

to the restaurant industry.

In 2008, Mr. Tsaoussian was appointed president

of Pizza Nova Quebec Inc., reporting to the president of Pizza Nova Restaurants Limited, a pizza chain with over 120 franchised

locations in the greater Toronto area. Within a three to four month period, Mr. Tsaoussian successfully re-opened five Pizza Nova

restaurant locations in and around Montreal and built a complete functioning one-number call centre/central order processing department

from the ground-up that was capable of servicing eight restaurants and employing six customer service agents with the technological

foundation to grow tenfold effortlessly with minimal time and investment. Mr. Tsaoussian hired six field managers and roughly twelve

employees per location, set-up payroll through ADP, controlled store inventory and supplier purchases on a weekly basis via computer

software linked to a point of sale system, organized direct marketing campaigns and customer appreciation days at the store level

for kids; designed delivery menus, created pizza promotions tailored for the Quebec market, set-up flyer mailings with the post

office, handled all day to day operations hands-on by delegating multiple tasks to employees and reviewing them afterwards on a

daily/weekly basis. He also put together a franchising package and hired staff to start screening individuals interested in becoming

Quebec franchisees.

In 2009, Mr. Tsaoussian founded Montreal Pizza

Boys Restaurants Inc. He created and implemented the entire concept/franchise system within a two month period and successfully

converted six existing pizzerias in the greater Montreal area to the Montreal Pizza Boys banner in an additional six week

period. He further built a complete functioning one-number call centre/central order processing department from the ground-up within

a five day span that was capable of servicing ten restaurants and employing eight customer service agents with the technological

foundation to grow tenfold effortlessly with minimal time and investment and set-up all suppliers and created a reporting system

to control day to day operations.

From June 2010 to September 2012, Mr. Tsaoussian

owned, administered and operated his final restaurant venture known as Gourmet Pizzeria in the heart of old Montreal. It

catered to a variety of tourists, surrounding business’, private parties and gatherings of all occasions, operated with a

complete restaurant/bar license with an outdoor terrace and seating capacity of 120 guests, including two bars. At September

2012, Mr. Tsaoussian sold the business in order to dedicate all of his time to il2m Inc. and ilink2music.com.

This was an idea he had started working on during the months of February/March of 2010. Since then, he has been dedicating

himself exclusively on building the right infrastructure/team in order to make this venture into a great success.

Mr. Tsaoussian is also a musician/keyboardist

with extensive live stage and studio experience. He started playing the accordion at the age of five, and then moved on to

piano and organ. By the age of thirteen, Mr. Tsaoussian was sharing the stage with choirs and a multitude of accomplished classical

musicians, playing the pipe-organ. Music was a passion, whether it was Latin, Mediterranean, and American. He decided to part with

classical music a year later and started performing as a pop keyboardist. Over the next twenty years he organized, promoted,

participated and performed for numerous events and fund-raising functions at several community centers and venues, particularly

the ethnic and Mediterranean ones all over North America and even Europe. In addition, he took complete charge of all

music entertainment programs, sound systems and performed alongside a variety of musicians and vocalists from around the globe

giving him priceless international music experience while simultaneously teaching him the fundamental importance of relationships.

Family Relationships

There are no family relationships between any

of our directors or executive officers and any other directors or executive officers.

Board Committees and Independence

We are not required to have any independent

members of the Board of Directors. As we do not have any board committees, the board as a whole carries out the functions

of audit, nominating and compensation committees, and such “independent director” determination has been made pursuant

to the committee independence standards.

Involvement in Certain Legal Proceedings

Our directors and executive officers have not

been involved in any of the following events during the past ten years:

| |

1. |

any bankruptcy petition filed by or against such person or any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time; |

| |

2. |

any conviction in a criminal proceeding or being subject to a pending criminal proceeding (excluding traffic violations and other minor offenses); |

| |

3. |

being subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining him from or otherwise limiting his involvement in any type of business, securities or banking activities or to be associated with any person practicing in banking or securities activities; |

| |

4. |

being found by a court of competent jurisdiction in a civil action, the Securities and Exchange Commission or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended, or vacated; |

| |

5. |

being subject of, or a party to, any federal or state judicial or administrative order, judgment decree, or finding, not subsequently reversed, suspended or vacated, relating to an alleged violation of any federal or state securities or commodities law or regulation, any law or regulation respecting financial institutions or insurance companies, or any law or regulation prohibiting mail or wire fraud or fraud in connection with any business entity; or |

| |

6. |

being subject of or party to any sanction or order, not subsequently reversed, suspended, or vacated, of any self-regulatory organization, any registered entity or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member. |

Code of Ethics

We have not adopted a Code of Ethics but expect

to adopt a Code of Ethics and will require that each employee abide by the terms of such Code of Ethics.

Compliance With Section 16(A) of the Exchange Act

Section 16(a) of the Exchange Act requires

the Company's directors and officers, and the persons who beneficially own more than ten percent of our common stock, to file reports

of ownership and changes in ownership with the Securities and Exchange Commission. Copies of all filed reports are required to

be furnished to us pursuant to Rule 16a-3 promulgated under the Exchange Act. Based solely on the reports received by the Company

and on the representations of the reporting persons, the Company believes that these persons have complied with all applicable

filing requirements during the fiscal year ended May 31, 2014.

EXECUTIVE COMPENSATION

During fiscal year ended May 31, 2014, we did

not pay any executive compensation to our President/CEO Sarkis Tsaoussian. During fiscal year ended May 31, 2013, we paid $7,000

to our prior executive. There are no other stock option plans, retirement, pension or profit sharing plans for the benefits

of our officers and directors other than as described herein.

The following summary compensation table sets

forth all compensation awarded to, earned by, or paid to the named executive officers paid by us during the period ended May 31,

2014 and May 31, 2013.

Summary Compensation Table

| Name

and Principal Position | |

Year | | |

Salary

($) | | |

Bonus

($) | | |

Stock

Awards

($) | | |

Option

Awards

($) | | |

Non-Equity

Incentive Plan Compensation

($) | | |

Non-Qualified

Deferred Compensation Earnings

($) | | |

All

Other Compensation

($) | | |

Totals

($) | |

| Sarkis Tsaoussian, Current

President, Chief Executive Officer and Director | |

| 2014 | | |

$ | 0 | | |

$ | 0 | | |

$ | 0 | | |

$ | 0 | | |

$ | 0 | | |

$ | 0 | | |

$ | 0 | | |

$ | 0 | |

| Donna Cashwell, Prior President, Chief

Executive Officer and Director (1) | |

| 2013 | | |

$ | 0 | | |

$ | 0 | | |

$ | 0 | | |

$ | 0 | | |

$ | 0 | | |

$ | 0 | | |

$ | 0 | | |

$ | 0 | |

| Laura Gignac, Vice President and Director(1) | |

| 2013 | | |

$ | 0 | | |

$ | 0 | | |

$ | 0 | | |

$ | 0 | | |

$ | 0 | | |

$ | 0 | | |

$ | 0 | | |

$ | 0 | |

| Richard Wheeler, President, Chief Executive

Officer and Director(2) | |

| 2013 | | |

$ | 2,000 | | |

$ | 0 | | |

$ | 5,000 | | |

$ | 0 | | |

$ | 0 | | |

$ | 0 | | |

$ | 0 | | |

$ | 7,000 | |

| (1) |

On May 8, 2013, Donna Cashwell and Laura Gignac resigned from their positions as officers and directors of the Company. |

| (2) |

On May 8, 2013, Richard Wheeler was appointed as President, Chief Executive Officer and Director of the Company. On May 8, 2013, we issued 50,000 shares of common stock to Mr. Wheeler having a fair value of $5,000 ($0.10 per share) for his services. On November 15, 2013, Mr. Wheeler resigned all executive positions and as a member of the Board of Directors. |

Option Grants Table. There were

no individual grants of stock options to purchase our common stock made to the executive officers named in the above Summary Compensation

Table for the fiscal year ended May 31, 2014.

Aggregated Option Exercises and Fiscal Year-End

Option Value. There were no stock options exercised during the fiscal year ended May 31, 2014 by the executive

officers named in the Summary Compensation Table.

Long-Term Incentive Plan (“LTIP”)

Awards. There were no awards made to named executive officers in the last completed fiscal year under any LTIP.

Compensation of Directors

Directors are permitted to receive fixed fees

and other compensation for their services as directors. The Board of Directors has the authority to fix the compensation of directors.

No amounts have been paid to, or accrued to, directors in such capacity.

Our director did not receive any compensation

during the years ended May 31, 2014. During fiscal year ended May 31, 2013, one of our directors was compensated as follows:

| Name | |

Fees earned

or paid in cash ($) | | |

Stock

awards | | |

Bonus | | |

Option

Awards ($) | | |

All Other

Compensation | | |

Total ($) | |

| Sarkis Tsaoussian | |

| -0- | | |

| 2,500 | | |

| -0- | | |

| -0- | | |

| -0- | | |

| 2,500 | |

| Luke Quinn (1) | |

$ | -0- | | |

$ | 2,500 | (2) | |

$ | 0 | | |

$ | 0 | | |

$ | 0 | | |

$ | 4,500 | |

| (1) |

Luke Quinn was appointed as a director on June 11, 2013. On June 11, 2013, we entered into a consulting agreement with Mr. Quinn pursuant to we agreed to pay Mr. Quinn semi annually in advance at the rate of $2,000 per month. On November 15, 2013, Mr. Quinn resigned and the consulting agreement was terminated. |

| (2) |

For the period from October 17, 2013 to May 31, 2014, we issued 2,500 shares of common stock to our former director for services with a fair value of $2,500. |

Employment Agreements

As of the date of this Information Statement,

we do not have any employment agreements in place with any executive officers.

Indemnification of Directors and Officers

Our Articles of Incorporation, as amended and

restated, and our Bylaws provide for mandatory indemnification of our officers and directors, except where such person has been

adjudicated liable by reason of his negligence or willful misconduct toward the Company or such other corporation in the performance

of his duties as such officer or director. Our Bylaws also authorize the purchase of director and officer liability insurance to

insure them against any liability asserted against or incurred by such person in that capacity or arising from such person's status

as a director, officer, employee, fiduciary, or agent, whether or not the corporation would have the power to indemnify such person

under the applicable law.

SECURITY OWNERSHIP

OF EXECUTIVE OFFICERS, DIRECTORS

AND FIVE PERCENT STOCKHOLDERS

The following table sets forth certain information

concerning the ownership of the Company's common stock as of November 26, 2013 with respect to: (i) each person known to the Company

to be the beneficial owner of more than five percent of the Company's common stock; (ii) all directors; and (iii) directors and

executive officers of the Company as a group. The notes accompanying the information in the table below are necessary for a complete

understanding of the figures provided below. As of January 23, 2015, there were 202,963,310 shares of common stock issued and outstanding.

Security Ownership of Certain

Beneficial Owners

| Name and Address of Beneficial Owner(1) | |

Amount and Nature of Beneficial Ownership(1) | | |

Percentage of Beneficial Ownership | |

| Directors and Officers: | |

| | |

| |

| Sarkis Tsaoussian 3500 West Olive Avenue Suite 810 Burbank, California 91505 | |

| 465,000 | | |

| nil | % |

| | |

| | | |

| | |

| All executive officers and directors as a group (1 person) | |

| 465,000 | | |

| nil | % |

| | |

| | | |

| | |

| Beneficial Shareholders Greater than 10% | |

| | | |

| | |

| il2m Global Limited (2) Caye Financial Center, Corner Coconut Drive & Hurricane Way, 3rd Floor, San Pedro, Ambergris Caye, Belize, Central America | |

| 125,000,000 | | |

| 70.1 | % |

| * |

Less than one percent. |

| (1) |

Under Rule 13d-3, a beneficial owner of a security includes any person who, directly or indirectly, through any contract, arrangement, understanding, relationship, or otherwise has or shares: (i) voting power, which includes the power to vote, or to direct the voting of shares; and (ii) investment power, which includes the power to dispose or direct the disposition of shares. Certain shares may be deemed to be beneficially owned by more than one person (if, for example, persons share the power to vote or the power to dispose of the shares). In addition, shares are deemed to be beneficially owned by a person if the person has the right to acquire the shares (for example, upon exercise of an option) within 60 days of the date as of which the information is provided. In computing the percentage ownership of any person, the amount of shares outstanding is deemed to include the amount of shares beneficially owned by such person (and only such person) by reason of these acquisition rights. As a result, the percentage of outstanding shares of any person as shown in this table does not necessarily reflect the person’s actual ownership or voting power with respect to the number of shares of common stock actually outstanding as of the date of this Information Statement. |

| (2) |

Sarkis Tsaoussian is the sole officer and director of il2m Global Limited and, thus, has sole dispositive and voting power over the shares held of record by il2m Global Limited. |

INTEREST OF CERTAIN PERSONS IN MATTERS TO

BE ACTED UPON

No director, executive officer, nominee for

election as a director, associate of any director, executive officer or nominee or any other person has any substantial interest,

direct or indirect, by security holdings or otherwise, in the proposed increase in the number of authorized shares of the Company's

common stock or creation of preferred shares or in any action covered by the related resolutions adopted by the Board of Directors,

which is not shared by all other stockholders.

FORWARD-LOOKING STATEMENTS

This information statement may contain certain

“forward-looking” statements (as that term is defined in the Private Securities Litigation Reform Act of 1995 or by

the U.S. Securities and Exchange Commission in its rules, regulations and releases) representing our expectations or beliefs regarding

our company. These forward-looking statements include, but are not limited to, statements concerning our operations, economic performance,

financial condition, and prospects and opportunities. For this purpose, any statements contained herein that are not statements

of historical fact may be deemed to be forward-looking statements. Without limiting the generality of the foregoing, words such

as “may,” “will,” “expect,” “believe,” “anticipate,” “intend,”

“could,” “estimate,” “might,” or “continue” or the negative or other variations

thereof or comparable terminology are intended to identify forward-looking statements. These statements, by their nature, involve

substantial risks and uncertainties, certain of which are beyond our control, and actual results may differ materially depending

on a variety of important factors, including factors discussed in this and other of our filings with the U.S. Securities and Exchange

Commission.

WHERE YOU CAN FIND MORE INFORMATION

We are subject to the information and reporting

requirements of the Securities Exchange Act of 1934, as amended, and in accordance with the Securities Exchange Act, we file periodic

reports, documents, and other information with the Securities and Exchange Commission relating to our business, financial statements,

and other matters. These reports and other information may be inspected and are available for copying at the offices of the Securities

and Exchange Commission, 100 F Street, N.E., Washington, DC 20549. Our SEC filings are also available to the public on the SEC’s

website at http://www.sec.gov.

INCORPORATION OF FINANCIAL INFORMATION

We “incorporate by reference” into

this Information Statement the information in certain documents we file with the SEC, which means that we can disclose important

information to you by referring you to those documents. We incorporate by reference into this information statement the documents

we have previously filed with the SEC. You may request a copy of these filings at no cost, by writing or telephoning us at the

following address:

iL2M INTERNATIONAL CORP.

3500 West Olive Avenue

Suite 810

Burbank, California 91505

WE ARE NOT ASKING YOU FOR A PROXY AND YOU

ARE REQUESTED NOT TO SEND US A PROXY. This Information Statement is for informational purposes only. Please read this information

statement carefully.

Dated: January 23, 2015

By Order of the Board of Directors

| /s/ Sarkis Tsaoussian |

|

| Chief Executive Officer and Director |

|

15

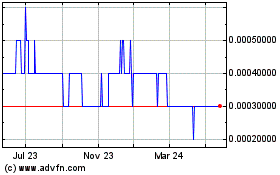

IL2M (PK) (USOTC:ILIM)

Historical Stock Chart

From Oct 2024 to Nov 2024

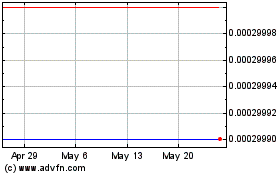

IL2M (PK) (USOTC:ILIM)

Historical Stock Chart

From Nov 2023 to Nov 2024