Current Report Filing (8-k)

06 October 2022 - 7:23AM

Edgar (US Regulatory)

false0001580490KRNONE00015804902022-09-282022-09-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): September 28, 2022

I-ON DIGITAL CORP.

(Exact Name of Registrant as Specified in its Charter)

|

Delaware

|

000-54995

|

46-3031328

|

|

(State of Organization)

|

(Commission File Number)

|

(I.R.S. Employer Identification No.)

|

15, Tehran-ro 10-gil, Gangam-gu, Seoul, 06234 Korea

(Address of principal executive offices)

Registrant’s telephone number, including area code: +82-2-3430

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions:

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12)

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b))

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading

Symbol(s)

|

Name of each exchange on which

registered

|

|

Common Stock, $0.0001 par value per share

|

IONI

|

OTC Markets

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised

financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

Securities Purchase Agreement

On September 28, 2022, I-On Digital Corp. (the “Company,” “we,” “us” or “our”) entered into a Series A Preferred Stock Purchase Agreement (the “Purchase Agreement”)

with I-ON Acquisition Corp., a Florida corporation (“IAC”). Pursuant to the terms of the Purchase Agreement, IAC acquired 3,000 shares of a newly created Series A Convertible Preferred Stock, par value $0.0001 per share (the “Series A

Preferred”) for proceeds in the amount of $250,000 (the “Subscription Amount”) in the form of a promissory note (the “Note”) which is secured by the pledge of the Series A Shares, the Series B Shares (as defined herein) and other assets of IAC in

a Stock Pledge and Escrow Agreement (the “Pledge Agreement”). Each Series A Preferred Share is convertible into Ten Thousand (10,000) shares of the Company’s common stock, par value $0.0001 per share (the “Common Stock” and is entitled to vote

on matters as to which holders of the Common Stock shall be entitled to vote at a rate of One Hundred (100) votes per share of Series A Preferred.

Also on September 28, 2022, the Company entered into a Contribution Agreement (the “Contribution Agreement”) with certain Purchasers (the “Purchasers”) pursuant to

which the Purchasers agreed to purchase 6,000 shares of a newly created Series B Convertible Preferred Stock, par value $0.0001 per share (the “Series B Preferred”), in exchange for the Purchasers’ rights and title to certain assets of the

Purchasers described in the Contribution Agreement. Each Series B Preferred Share is convertible into One Thousand (1,000) shares of Common Stock and entitled to vote on matters as to which holders of the Common stock shall be entitled to vote at

a rate of One Thousand (1,000) votes per Series B Preferred Share.

Following the consummation of the transactions set forth in the Purchase Agreement and the Contribution Agreement, and the spin-off of the Company’s operating

subsidiary, I-On Communications Co., Ltd. (“Communications”), as descried further herein, the Company adopted the operations of IAC of providing funding and complimentary services, including hashing power, to mine bitcoin.

The Company’s officers and directors will not resign, and IAC’s management will not be appointed until the Note is paid in full.

The forgoing descriptions of the terms and conditions of the Purchase Agreement, the Contribution Agreement, the Note and the Pledge Agreement are only a summary and

are qualified in their entirety by the full text of the Purchase Agreement, the Contribution Agreement, the Note and the Pledge Agreement, copies of which are filed as Exhibit 10.1, 10.2, 10.3 and 10.4 respectively, to this Current Report on Form

8-K and which are incorporated herein by reference.

Spin-Off of I-On Communications Co., Ltd.

On September 29, 2022, the Company effectuated an Equity Transfer Agreement (the “Spin-Off Agreement”) among the Company, Communications and JFJ Digital Corp., a

Delaware corporation (“JFJ”), whereby all of the outstanding equity of Communications was transferred to JFJ in exchange for the return of 15,306,119 shares of the Company’s Common Stock held by Jae Cheol Oh and HongRae Kim, the Company’s principal

executive officer and members of the Board of Directors (the “Spin-Off”) . Pursuant to the Spin-Off Agreement, in addition to acquiring all of the outstanding capital stock of Communications, JFJ will assume all responsibilities for any debts,

obligations and liabilities of Communications and acquire all rights to any assets of Communications, including, but not limited to, the Subscription Amount.

As a result of the Spin-Off, Communications ceased being a subsidiary of the Company.

The foregoing description of the Spin-Off Agreement does not purport to be complete. For an understanding of its terms and provisions, reference should be made to

the Spin-Off Agreement attached as Exhibit 10.5 to this Current Report on Form 8-K.

|

Item 3.02.

|

Unregistered Sales of Equity Securities.

|

The information required by this Item 3.02 is set forth under Item 1.01 above and is hereby incorporated by reference in response to this Item 3.02. The shares of

Series A Preferred Stock and Series B Preferred Stock issued to Purchasers pursuant to the Series A Agreement and Series B Agreement were issued without registration under the Securities Act of 1933, as amended (the “Securities Act”), based on the

exemption from registration afforded by Section 4(a)(2) of the Securities Act.

|

Item 5.01

|

Changes in Control of Registrant.

|

The disclosures set forth in Item 2.01 are hereby incorporated by reference into this Item 5.01.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

|

Exhibit No.

|

|

Description

|

| |

|

|

|

|

|

Series A Preferred Securities Purchase Agreement, dated as of September 28 2022

|

|

|

|

Series B Preferred Securities Contribution Agreement, dated as of September 28 2022

|

|

|

|

Promissory Note dated September 28, 2012

|

|

|

|

Stock Pledge and Escrow Agreement dated September 28, 2022

|

|

|

|

Equity Transfer Agreement among I-ON Digital Corp., I-On Communications Co., Ltd. and JFJ Digital Corp.

|

SIGNATURES

Pursuant to the requirements of the Securities and Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

Date: October 5, 2022

|

I-ON DIGITAL CORP.

|

|

|

|

|

By:

|

/s/ Jae Cheol Oh

|

|

|

Name:

|

Jae Cheol Oh

|

|

|

Title:

|

Chief Executive Officer

|

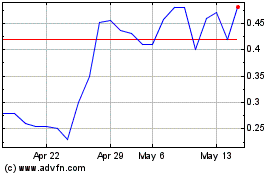

I ON Digital (PK) (USOTC:IONI)

Historical Stock Chart

From Oct 2024 to Nov 2024

I ON Digital (PK) (USOTC:IONI)

Historical Stock Chart

From Nov 2023 to Nov 2024