false

0001527702

0001527702

2025-01-21

2025-01-21

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________________

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): January

21, 2025

iQSTEL Inc.

(Exact name of registrant as specified in its charter)

| Nevada |

000-55984 |

45-2808620 |

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

| |

|

|

300 Aragon Avenue, Suite 375

Coral Gables, FL 33134 |

33134 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (954) 951-8191

|

________________________________________________

(Former name or former address, if changed since last

report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following provisions:

| |

[ ] |

Written communications pursuant to Rule 425 under the Securities Act (17CFR 230.425) |

| |

|

|

| |

[ ] |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

[ ] |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

[ ] |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: None.

Indicate by check mark whether the registrant is an emerging growth company

as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934

(§240.12b-2 of this chapter).

Emerging growth company [ ]

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. [ ]

SECTION 2 – Financial

Information

|

Item 2.02 | Results of Operations and Financial Condition.

|

|

We have issued a shareholder letter outlining the company’s strategic initiatives, financial performance, vision for the future and other matters.

The shareholder letter is furnished with this Current Report on Form 8-K

as Exhibits 99.1. The information furnished under this Item 2.02 and Item 9.01 of this Current Report on Form 8-K, including Exhibit 99.1,

shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise

subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any registration statement or other filing

under the Securities Act of 1933, as amended, regardless of any general incorporation by reference language in such filing, except as

shall be expressly set forth by specific reference in any such filing.

SECTION 9 – Financial Statements and Exhibits

| |

Item 9.01 | Financial Statements and Exhibits. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

iQSTEL Inc.

/s/ Leandro Iglesias

Leandro Iglesias

Chief Executive Officer

Date January 21, 2025

IQST - iQSTEL Releases 2025

Shareholder Letter Highlighting Strategic Growth, M&A 2025 Campaign, and Vision for a $1 Billion Corporation Future

New York, NY – January

21, 2025 – iQSTEL Inc. (OTCQX: IQST), a leading innovator in the technology and telecommunications sectors, is pleased to share

its 2025 Shareholder Letter, outlining the company’s strategic initiatives, financial performance, and bold vision for the future.

Below is the full letter from CEO Leandro Iglesias:

Letter to Shareholders

Dear Valued Shareholders,

As we embark on 2025 with great

enthusiasm and a bold vision for the future, I am thrilled to share iQSTEL’s strategic direction, remarkable achievements, and ambitious

goals. Your unwavering trust and confidence inspire us to push boundaries and achieve extraordinary milestones. Together, we are building

a company destined for greatness, driven by innovation, profitability, and an unrelenting focus on delivering exceptional shareholder

value.

Extraordinary Know-How in M&A

iQSTEL has established itself

as an expert in identifying, acquiring, and integrating high-value companies. Over the course of 11 successful venture and acquisitions,

we have refined a strategic approach that consistently drives growth and strengthens our position as a leader in the technology and telecommunications

industries.

Our most recent acquisition, QXTEL,

exemplifies this expertise. From April to December 2024, QXTEL generated $85 million in net revenue and $950,000 in EBITDA,

based on preliminary accounting. These results highlight iQSTEL’s ability to identify and unlock value, setting the stage for our

ambitious M&A campaign in 2025.

A Bold Step Forward: Our M&A 2025 Campaign

This year, iQSTEL is launching

an ambitious Mergers and Acquisitions (M&A) campaign designed to accelerate our growth trajectory. Our goal is to acquire a company

within the Telecom, Fintech, Cybersecurity, or AI services sectors, generating tens of millions of dollars in revenue and contributing

over $1 million EBITDA annually.

We intend to complete this acquisition

before reaching NASDAQ, where even greater opportunities await us. To support this campaign and advance our broader business objectives,

we have just filed an S-1 registration, reflecting our commitment to securing the resources necessary for transformative growth.

Enhancing Shareholder Value Through Strategic M&A

and Organic Growth

At iQSTEL, we place our shareholders

at the core of our strategic decisions. Our carefully planned M&A initiatives, combined with robust organic growth, have driven substantial

increases in Revenue Per Share (RPS) over recent years:

• 2020:

$0.380

• 2021:

$0.439

• 2022:

$0.577

• 2023:

$0.839

• 2024

(preliminary accounting): $1.364

This impressive RPS growth trajectory

reflects the success of our strategy to create sustainable shareholder value. By pursuing high-margin opportunities through both M&A

and organic initiatives, we anticipate maintaining this rapid growth pace.

Our strategy safeguards shareholder

value, ensuring that market perceptions align with the underlying strength demonstrated by our growing RPS and improving profitability.

This positions iQSTEL as a leader in its industry and strengthens our foundation for sustained success.

Building on Our Momentum in 2025

2024 was a pivotal year for iQSTEL.

We achieved critical mass, with our operating businesses generating positive net income quarter after quarter. This success underscores

the strength of our strategy and our ability to execute effectively. For 2025, we aim even higher:

• Revenue

Forecast: $340 million

• EBITDA

Forecast for our operating business: $3 million

These milestones are more than

just numbers—they are a testament to the dedication of our team, the support of our shareholders, and our relentless pursuit of

growth. They represent a critical step toward achieving our vision of becoming a $1 billion revenue company with eight-digit positive

EBITDA by 2027.

Even More, Continuous Progress and Innovation in

2025

Every day, iQSTEL takes bold steps to strengthen its

business and ensure a brighter future:

• Rebranding:

We are positioning iQSTEL as a technology leader, delivering high-margin, high-tech products to our customers. We have introduced our

new logo and plan to share more results from our rebranding collaboration with ONAR.

• Cost

Reduction and Efficiency: We are implementing strategies to streamline operations, accelerate EBITDA growth, and enhance shareholder

value. In the coming days, we will announce further cost-reduction initiatives to bolster profitability.

• Cybersecurity

Product Launch: Thanks to our strategic partnership with Cycurion, we are set to launch our cybersecurity

products this quarter and begin sales in the first half of 2025. This initiative expands our portfolio to address critical global needs.

• AI

Services Growth: Our AI platform, Airweb.ai, continues to gain customers and partners, underscoring its transformative potential.

New AI services will launch in the first half of 2025, reinforcing iQSTEL’s reputation as a powerhouse of innovation.

NASDAQ Uplisting: Building a Strong Foundation

Our journey toward a NASDAQ uplisting

is progressing steadily and strategically. While we are not rushing, we have been giving time for organic growth to enhance our stock

price, supported by the strength of our operating business, forecasted to generate $3 million in EBITDA in 2025.

If the management decided that

is the right time to jump into Nasdaq, and we have not achieved yet the organic price will be when the management will decide to expedite

the uplisting process through a reverse stock split, at that time we will ensure full transparency by filing an SEC notice. Any reverse

stock split, if executed, will be aligned with and in conjunction with the NASDAQ uplisting.

We are committed to building a

company that captures the attention of national investors and reflects the immense value we offer.

Management’s Commitment: Aligned with Shareholder

Interests

At iQSTEL, our leadership team

is not just steering the company toward its ambitious goals; we are also deeply invested in its success. As the largest shareholder group,

management holds the equivalent of 40.5 million common shares through a combination of common and preferred shares. This significant

ownership reflects our unwavering belief in iQSTEL’s potential and aligns our interests directly with those of our valued shareholders.

This commitment is a testament

to the confidence we have in iQSTEL’s vision of becoming a $1 billion revenue corporation by 2027. Our substantial stake

in the company ensures that management is fully aligned with long-term value creation. Every strategic decision we make—whether

it involves organic growth initiatives, high-margin product expansion, or strategic acquisitions—is driven by a shared goal: to

deliver sustainable growth and maximize shareholder value.

The road to achieving our $1 billion

revenue milestone is clear, and our investment in iQSTEL underscores our dedication to seeing it through. We are not merely stewards of

the company; we are also shareholders, invested in its future and committed to building a prosperous and sustainable enterprise for years

to come.

Confidence of Long-Term Investors: Extending Support

for a $1 Billion Vision

Our vision of achieving $1 billion

in revenue by 2027 is not just a statement—it is a well-defined plan that has garnered the trust and support of long-term investors.

Their confidence in our strategic direction is evidenced by their willingness to extend the maturity dates of convertible notes originally

used to acquire QXTel in 2024.

These notes, previously set to

mature in 2025, now have extended maturity dates through 2026, providing iQSTEL with additional financial flexibility to execute our growth

strategy. This extension underscores the belief that we are on a clear trajectory to achieve our ambitious goals and deliver exceptional

returns.

Our long-term investors recognize

the importance of supporting iQSTEL as we transition to a Nasdaq listing and continue to build momentum towards our revenue and profitability

targets. Their ongoing commitment reflects their trust in our ability to execute our plans and deliver on our promises.

A Brilliant Future Ahead

iQSTEL is more than a company—it’s

a testament to the power of vision, hard work, and innovation. Together, we are creating something extraordinary, a company that delivers

exceptional financial results while driving meaningful progress across industries.

This is an incredibly exciting

time for iQSTEL. The journey we are on is transformative, and the opportunities ahead are limitless. Thank you for being part of this

journey, for believing in our vision, and for sharing in our success. Together, we will achieve extraordinary milestones and secure a

bright and prosperous future for iQSTEL and its shareholders.

Warm regards,

Leandro Iglesias

President & CEO, iQSTEL Inc.

About iQSTEL:

iQSTEL Inc. (OTC-QX: IQST)

(www.iQSTEL.com) is a US-based multinational publicly listed company in the final stages of the path to becoming listed on NASDAQ. With

FY2024 revenues of $277 million based on preliminary accounting, iQSTEL is positioning itself for explosive growth. iQSTEL's mission

is to serve basic human needs in today's modern world by making essential tools accessible, regardless of race, ethnicity, religion,

socioeconomic status, or identity. The company recognizes that modern human needs such as physiological, safety, relationship, esteem,

and self-actualization are marginalized without access to ubiquitous communications, financial freedom, clean, affordable mobility, and

information.

iQSTEL has been building

a strong business platform with its customers, and by leveraging this trust, the company is now beginning to sell high-tech, high-margin

products across its divisions. iQSTEL is strategically positioned to achieve $1 billion in revenue by 2027 through organic growth, acquisitions,

and high-margin product expansion.

| · | Telecommunications Services Division (Communications):

Includes VoIP, SMS, International Fiber-Optic, Proprietary Internet of Things (IoT), and a Proprietary Mobile Portability Blockchain Platform. |

|

| · | Fintech Division (Financial Freedom):

Provides remittance services, top-up services, a MasterCard Debit Card, US bank accounts (no SSN required), and a Mobile App. |

|

| · | Electric Vehicles (EV) Division (Mobility):

Offers Electric Motorcycles and plans to launch a Mid-Speed Car. |

|

| · | Artificial Intelligence (AI) Services Division (Information

and Content):

Provides AI solutions for unified customer engagement across web and phone channels, along with a white-label platform offering seamless

access to services, entertainment, and support in a virtual 3D interface. |

|

| · | Cybersecurity Services:

Through a new partnership with Cycurion, iQSTEL will offer advanced cybersecurity solutions, including 24/7 monitoring, threat detection,

incident response, vulnerability assessments, and compliance management, providing essential protection to telecommunications clients

and beyond. |

|

| | | |

|

iQSTEL has completed 11

acquisitions since June 2018 and continues to develop an active pipeline of potential future acquisitions, further expanding its suite

of products and services both organically and through mergers and acquisitions.

Safe

Harbor Statement: Statements in this news release may be "forward-looking statements". Forward-looking statements include, but

are not limited to, statements that express our intentions, beliefs, expectations, strategies, predictions, or any other information relating

to our future activities or other future events or conditions. These statements are based on current expectations, estimates, and projections

about our business based partly on assumptions made by management. These statements are not guarantees of future performance and involve

risks, uncertainties, and assumptions that are difficult to predict. Therefore, actual outcomes and results may and are likely to differ

materially from what is expressed or forecasted in forward-looking statements due to numerous factors. Any forward-looking statements

speak only as of the date of this news release, and iQSTEL Inc. undertakes no obligation to update any forward-looking statement to reflect

events or circumstances after the date of this news release. This press release does not constitute a public offer of any securities for

sale. Any securities offered privately will not be or have not been registered under the Act and may not be offered or sold in the

United States absent registration or an applicable exemption from registration requirements.

iQSTEL

Inc.

IR US Phone: 646-740-0907

IR Email: investors@iqstel.com

Contact

Details

iQSTEL Inc.

+1 646-740-0907

investors@iqstel.com

Company

Website

www.iqstel.com

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

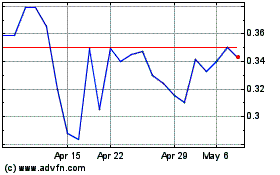

iQSTEL (QX) (USOTC:IQST)

Historical Stock Chart

From Dec 2024 to Jan 2025

iQSTEL (QX) (USOTC:IQST)

Historical Stock Chart

From Jan 2024 to Jan 2025