false

0001960262

0001960262

2024-09-16

2024-09-16

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C.

_____________________

FORM

8-K

_____________________

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): September 17, 2024 (September

16, 2024)

Ludwig

Enterprises, Inc.

(Exact

name of registrant as specified in its charter)

| |

333-271439 |

|

61-1133438 |

|

| |

(Commission

File Number) |

|

(IRS

Employer Identification Number) |

|

| |

1749

Victorian Avenue,

#C-350

Sparks,

Nevada |

|

89431 |

|

| |

(Address

of Principal Executive Offices) |

|

(Zip

Code) |

|

786-235-9026

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

☐

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12(b) under

the Exchange Act (17 CFR 240.14a-12(b))

☐

Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c))

Securities

registered pursuant to Section 12(b) of the Act:

| |

Title

of Each Class |

|

Trading

Symbol(s) |

|

Name

of Each Exchange on

Which

Registered |

|

| |

None |

|

N/A |

|

N/A |

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

1.01 Entry into a Material Definitive Agreement.

On

September 16, 2024, Ludwig Enterprises, Inc., a Nevada corporation (the “Company”), entered into an Intellectual

Property Conveyance Agreement, to be effective as of August 26, 2024 (the “IP Agreement”), with Marvin S. Hausman,

M.D., the Company’s Chief Science Officer and Director (“Hausman”), and Nova Mentis Life Science Corp.

(“Nova”). The basis for the IP Agreement is that certain mRNA Neuro Panel and Serotonin Assay, lodged by Nova

on or about April 26, 2024, as U.S. Patent Application 18/705375, International Publication Number WO 2023/077245, captioned as “Diagnosing,

Monitoring and Treating Neurological Disease with Psychoactive Tryptamine Derivatives and mRNA Measurements” (the “Patent”),

the invention of which was done by Hausman in collaboration with Nova.

The

stated purpose of the IP Agreement was to resolve all obligations owed to Hausman by Nova, including but not limited to $245,712.00 in

unpaid consulting consideration (the “Consulting Consideration”), by and through conveyance of all right, title

and interest Nova may have held in the Patent and associated intellectual property associated therewith to the Company (the “Conveyance”)

for further commercialization (the “Commercialization”).

In

addition to the Patent, the Conveyance related to the following: (1) those serotonin assay(s) being developed by Dr. Kiminobu Sugaya

at the University of Central Florida, including, but not limited to, preclinical and clinical data deriving therefrom or associated therewith;

(2) exosome development protocol currently active at the laboratory of Dr. Kiminobu Sugaya at the University of Central Florida, including

blood samples sent from the laboratory of Dr. Viviana Trezza and analysis data thereof obtained by Fabrizio Ascone; (3) work product

and output of the Autism Spectrum Disorder (ASD) and Fragile X Syndrome (FSX) Patient Observational Study commissioned by Nova and conducted

by Dr. Sugaya; and (4) work product and output of the Ambert/Molinaro Evaluation of 30 to 40 ASD patient mRNA cheek swab samples sent

to genetic lab of Irina Borodowsky and analyzed by Dr. Kyle Ambert PhD as to genetic biomarkers and indices in the ASD questionnaire

developed by John Molinaro.

In

consideration for the Conveyance, the Company, Hausman and Nova agreed to the following reciprocal terms:

| (a) |

|

As

to Hausman: Hausman shall accept the Conveyance, directed by Hausman to the Company for future potential Commercialization, as

a full and non-recourse waiver, release and satisfaction of any obligations now owed or owing to him by Nova, including, but not

limited to, payment of the Consulting Consideration. Other than as to a breach of the IP Agreement, Hausman expressly waived and

released Nova from any and all claims, known or unknown, he might assert against it, which waiver and release is willful, knowing,

intelligent, and voluntary. |

| (b) |

|

As

to the Company: As consideration for its receipt of the Patent from Nova, as directed thereto by Hausman, the Company agreed to: |

| |

(1) |

for

a term of 10 years (the “Royalty Term”), allocate a royalty (the “Nova Royalty”)

comprised of 5% of all revenue derived from the Commercialization, to be paid in equal amounts of 2.5% each to Nova and Hausman,

until such time as Hausman shall have received an amount equal to the Consulting Consideration, whereupon Nova shall, thereafter,

receive the full 5% for the balance of the Royalty Term; and |

| |

(2) |

issue

to Nova 750,000 shares of Company common stock (the “Consideration Shares”), which Consideration Shares

shall immediately vest upon the execution of the IP Agreement, though subject to the following “lock-up” restrictions,

to wit: |

| |

(A) |

the

Consideration Shares shall be subject to a one-year “lock-up,” during which the Consideration Shares may not be sold; |

| |

(B) |

at

the expiration of such one-year “lock-up,” Nova may sell up to 50,000 Consideration Shares during the next six-month

period; and |

| |

(C) |

at

the expiration of such six-month period, Nova may sell up to 100,000 Consideration Shares per quarter. |

| (c) |

|

As

to Nova: In consideration for the mutual promises and benefits in favor of Nova under the IP Agreement, Nova shall effect the

Conveyance and shall be entitled to no further payment or consideration, other than as expressly set forth herein. Other than as

to a breach of the IP Agreement, Nova expressly waived and released Hausman from any and all claims, known or unknown, it might assert

against him, which waiver and release is willful, knowing, intelligent, and voluntary. |

| |

|

|

|

|

The

foregoing description of the IP Agreement does not purport to be complete and is qualified in its entirety by reference to the full text

of the IP Agreement, a copy of which is filed as Exhibit 10.1 to this Current Report, which is incorporated herein in its entirety by

reference.

Item

7.01 Regulation FD Disclosure.

On

September 17, 2024, the Company issued a press release announcing the IP Agreement.

The

press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The

furnishing of the press release is not an admission as to the materiality of any information therein. The information contained in the

press release is summary information that is intended to be considered in the context of more complete information included in the Company’s

filings with the U.S. Securities and Exchange Commission (the “SEC”) and other public announcements that the Company has

made and may make from time to time by press release or otherwise. The Company undertakes no duty or obligation to update or revise the

information contained in this report, although it may do so from time to time as its management believes is appropriate. Any such updating

may be made through the filing of other reports or documents with the SEC, through press releases or through other public disclosures.

The

information in this Item 7.01 of this Current Report on Form 8-K and the press release shall not be deemed “filed” for purposes

of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section or Sections

11 and 12(a)(2) of the Securities Act of 1933, as amended. The information contained in this Item 7.01 and in the press release shall

not be incorporated by reference into any filing with the SEC made by the Company, whether made before or after the date hereof, regardless

of any general incorporation language in such filing.

Item

9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

Date:

September 17, 2024.

LUDWIG

ENTERPRISES, INC.

By:

/s/ Jose Antonio Reyes

Jose

Antonio Reyes

Chief

Executive Officer

Exhibit 10.1

Exhibit

99.1

Ludwig

Announces Acquisition of Intellectual Property and Patent

Sparks, NV, September 17, 2024, Ludwig

Enterprises, Inc., (OTCPINK: LUDG), a USA-based biotechnology company, is pleased to announce it has acquired all the intellectual property

and patent of the mRNA Neuro Panel and Serotonin Assay, along with all the data accumulated testing these Assays.

Significance of acquisition:

| - | Allows

use of mRNA genetic biomarkers to study inflammatory changes in the brain in such diseases

as autism, post-traumatic stress disorder (PTSD), Parkinson’s disease, Alzheimer’s

disease, multiple sclerosis, ALS, etc. |

| - | Acquisition

of breakthrough technology in measuring serotonin levels in salivary exosomes. Serotonin,

or 5-hydroxytryptamine (5-HT), is a neurotransmitter with an integral physiological

role in the human body; it regulates various activities, including behavior, mood, memory,

and gastrointestinal homeostasis. |

Serotonin

has a wide variety of functions in the human body. People sometimes call it the “happy” chemical because it contributes to

well-being and happiness. Serotonin appears to affect mood, emotions, appetite, and digestion. As the precursor for melatonin, it

helps regulate sleep-wake cycles and the body clock.

| - | Analysis

of autism questionnaire statements from ASD families or caregivers revealed an association

between mRNA inflammatory markers and ASD survey responses. These score results open the

door to the use of our mRNA neuroinflammatory markers in the diagnosis, evaluation, and treatment

responses of ASD individuals. Survey questions include eye contact, social interaction, anxiety,

etc. |

Ludwig acquired the following:

| - | U.S.

Patent Application 18/705375, International Publication Number WO 2023/077245, captioned

as “Diagnosing, Monitoring and Treating Neurological Disease with Psychoactive Tryptamine

Derivatives and mRNA Measurements. |

| - | Serotonin

assay(s) being developed by Dr. Kiminobu Sugaya at the University of Central Florida, including

preclinical and clinical data. |

| - | Work

product and output of the Autism Spectrum Disorder (ASD) and Fragile X Syndrome (FSX) Patient

Observational Study. |

“These patents

represent the culmination of over 10 years of work in the field of mRNA research.” said Marvin S. Hausman, MD, Chief Science Officer

of Ludwig Enterprises. “We think mRNA neurologic testing represents next-gen diagnostics that will bring affordable screening technology

to the masses. It's well known that the quicker we uncover a disease, the greater the chance we will successfully treat it. We intend

to start our screening business with breast cancer but hope to quickly expand to other disease indications like autism, PTSD, Alzheimer’s,

and Parkinson’s.”

About Ludwig Enterprises, Inc.

Ludwig Enterprises, Inc., a biotech

and healthcare holding company, is a global leader in mRNA genomics and machine learning AI technology. AI technology is used to extrapolate

inflammatory signals that are correlated to different types of cancer and chronic diseases. The company developed an early screening

cancer diagnostic kit Revealia™ utilizing a mail-order cheek swab that is sold directly to consumers. The proprietary test is patent-pending

and contains multi-cancer early detection screening technology in a painless convenient solution that is highly accurate compared to

alternative early screening test kits. The core research driving the diagnostic business opportunities comes from the ongoing identification

and monitoring of patients that present varying degrees of chronic inflammation which is the causative agent of illnesses such as cancer

and heart disease, which are responsible for more than 50% of deaths worldwide.

For more information please visit:

http://www.ludwigent.com. https://www.revealia.com

SAFE HARBOR

Forward-looking statements in this

release are made under the "safe harbor" provision of the Private Securities Litigation Reform Act of 1995. Ludwig Enterprises

Inc.'s forward-looking statements do not guarantee future performance. This news release includes forward-looking statements concerning

the future level of business for the parties. These statements are necessarily subject to risk and uncertainty. Actual results could

differ materially from those projected in these forward-looking statements due to certain risk factors that could cause results to differ

materially from estimated results. Management cautions that all statements as to future results of operations are necessarily subject

to risks, uncertainties, and events that may be beyond the control of Ludwig Enterprises, Inc., and no assurance can be given that such

results will be achieved. Potential risks and uncertainties include, but are not limited to, the ability to procure, appropriately price,

retain, and complete projects and changes in products and competition.

CONTACT:

Ludwig Enterprises, Inc.

Antonia Reyes, CEO

www.ludwigent.com

Investor Relations

Resources Unlimited NW LLC

Mike Sheikh, Investor Relations

mike@resourcesunlimtedllc.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

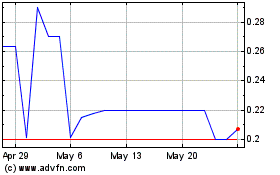

Ludwig Enterprises (PK) (USOTC:LUDG)

Historical Stock Chart

From Oct 2024 to Nov 2024

Ludwig Enterprises (PK) (USOTC:LUDG)

Historical Stock Chart

From Nov 2023 to Nov 2024