UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

|

[X]

|

QUARTERLY REPORT UNDER TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE QUARTERLY PERIOD ENDED SEPTEMBER 30, 2009

|

|

|

|

|

OR

|

|

|

|

|

|

[ ]

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

Commission file number 000-53665

MEDICAL CARE TECHNOLOGIES, INC.

(Formerly AM Oil Resources & Technology Inc.)

(Exact name of registrant as specified in its charter)

NEVADA

(State or other jurisdiction of incorporation or organization)

22 Notting Hill Gate, Suite 127

London, UK, X0 W11 3JE

(Address of principal executive offices, including zip code.)

+44 207 526 2128

(Registrant’s telephone number, including area code)

Check whether the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the last 90 days.

YES

[X] NO [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer, “accelerated filer,” “non-accelerated filer,” and “smaller reporting company” in Rule

12b-2 of the Exchange Act.

|

|

Large Accelerated Filer

|

[ ]

|

Accelerated Filer

|

[ ]

|

|

|

Non-accelerated Filer

|

[ ]

|

Smaller Reporting Company

|

[X]

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

YES [X] NO [ ]

State the number of shares outstanding of each of the issuer’s classes of common equity, as of the latest practicable date: 98,900,000 as of November 20, 2009.

PART I – FINANCIAL INFORMATION

|

ITEM 1.

|

FINANCIAL STATEMENTS

|

Medical Care Technologies Inc.

(Formerly AM Oil Resources & Technology Inc.)

(A Development Stage Company)

September 30, 2009

Index

Consolidated Balance Sheets (unaudited) .....................................................................................................F-1

Consolidated Statements of Expenses (unaudited) ......................................................................................F-2

Consolidated Statements of Cash Flows (unaudited) ..................................................................................F-3

Notes to the Consolidated Financial Statements (unaudited) .....................................................................F-4

Medical Care Technologies Inc.

(Formerly AM Oil Resources & Technology Inc.)

(A Development Stage Company)

Consolidated Balance Sheets

(unaudited)

|

|

|

September 30,

|

|

|

December 31,

|

|

|

|

|

2009

|

|

|

2008

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$

|

75

|

|

|

$

|

9,791

|

|

|

Prepaid expenses

|

|

|

2,000

|

|

|

|

–

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Assets

|

|

$

|

2,075

|

|

|

$

|

9,791

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ DEFICIT

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Liabilities

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

|

76,585

|

|

|

|

24,256

|

|

|

Accounts payable – related party

|

|

|

25,439

|

|

|

|

23,445

|

|

|

Accrued liabilities

|

|

|

525

|

|

|

|

3,875

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Current Liabilities

|

|

|

102,549

|

|

|

|

51,576

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders’ Deficit

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred Stock, 100,000,000 shares authorized, $0.00001 par value,

No shares issued and outstanding

|

|

|

–

|

|

|

|

–

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock, 150,000,000 shares authorized, $0.00001 par value,

98,900,000 shares issued and outstanding

|

|

|

989

|

|

|

|

989

|

|

|

|

|

|

|

|

|

|

|

|

|

Additional Paid-in Capital

|

|

|

50,511

|

|

|

|

50,511

|

|

|

|

|

|

|

|

|

|

|

|

|

Deficit Accumulated During the Development Stage

|

|

|

(151,974

|

)

|

|

|

(93,285

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Total Stockholders’ Deficit

|

|

|

(100,474

|

)

|

|

|

(41,785

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Total Liabilities and Stockholders’ Deficit

|

|

$

|

2,075

|

|

|

$

|

9,791

|

|

|

|

|

|

|

|

|

|

|

|

(The accompanying notes are an integral part of these consolidated unaudited financial statements)

F-1

Medical Care Technologies Inc.

(Formerly AM Oil Resources & Technology Inc.)

(A Development Stage Company)

Consolidated Statements of Expenses

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine months ended

September 30,

|

|

|

Period from

|

|

|

|

|

Three months ended

September 30,

|

|

|

February 27, 2007

|

|

|

|

|

(Inception)

|

|

|

|

|

To September 30,

|

|

|

|

|

2009

|

|

|

2008

|

|

|

2009

|

|

|

2008

|

|

|

2009

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other General and administrative

|

|

$

|

13,330

|

|

|

$

|

–

|

|

|

$

|

44,332

|

|

|

$

|

–

|

|

|

$

|

50,307

|

|

|

Management fees

|

|

|

4,700

|

|

|

|

–

|

|

|

|

13,700

|

|

|

|

–

|

|

|

|

13,700

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total expenses

|

|

|

(18,030

|

)

|

|

|

–

|

|

|

|

(58,032

|

)

|

|

|

–

|

|

|

|

(64,007

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency exchange loss

|

|

|

(729

|

)

|

|

|

–

|

|

|

|

(657

|

)

|

|

|

–

|

|

|

|

(657

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (Loss) Before Discontinued Operations

|

|

|

(18,759

|

)

|

|

|

–

|

|

|

|

(58,689

|

)

|

|

|

–

|

|

|

|

(64,664

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from discontinued operations:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Discontinued operations

|

|

|

–

|

|

|

|

(7,154

|

)

|

|

|

–

|

|

|

|

(36,148

|

)

|

|

|

(87,310

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income (Loss)

|

|

$

|

(18,759

|

)

|

|

$

|

(7,154

|

)

|

|

$

|

(58,689

|

)

|

|

$

|

(36,148

|

)

|

|

$

|

(151,974

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income (Loss) Per Share – Basic and Diluted:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Discontinued Operations

|

|

|

N/A

|

|

|

$

|

0.00

|

|

|

|

N/A

|

|

|

$

|

0.00

|

|

|

|

N/A

|

|

|

Net Income (Loss)

|

|

$

|

0.00

|

|

|

$

|

0.00

|

|

|

$

|

0.00

|

|

|

$

|

0.00

|

|

|

|

N/A

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted Average Shares Outstanding–Basic and Diluted

|

|

|

73,193,000

|

|

|

|

98,900,000

|

|

|

|

77,343,000

|

|

|

|

98,900,000

|

|

|

|

N/A

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(The accompanying notes are an integral part of these consolidated unaudited financial statements)

F-2

Medical Care Technologies Inc.

(Formerly AM Oil Resources & Technology Inc.)

(A Development Stage Company)

Consolidated Statements of Cash Flows

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Period from

|

|

|

|

|

Nine months ended

September 30,

|

|

|

February 27, 2007

|

|

|

|

|

(Date of Inception)

|

|

|

|

|

To September 30,

|

|

|

|

|

2009

|

|

|

2008

|

|

|

2009

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Activities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

$

|

(58,689

|

)

|

|

$

|

(36,148

|

)

|

|

$

|

(151,974

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjustment to reconcile net loss to cash used in operating activities:

|

|

|

Donated services and expenses

|

|

|

–

|

|

|

|

4,500

|

|

|

|

10,500

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Changes in operating assets and liabilities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Prepaid expenses

|

|

|

(2,000

|

)

|

|

|

(1,195

|

)

|

|

|

(2,000

|

)

|

|

Account payable

|

|

|

52,329

|

|

|

|

1,467

|

|

|

|

77,220

|

|

|

Accrued liabilities

|

|

|

(3,350

|

)

|

|

|

–

|

|

|

|

525

|

|

|

Net Cash Used in Operating Activities

|

|

|

(11,710

|

)

|

|

|

(31,376

|

)

|

|

|

(65,729

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financing Activities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Issuance of common stock

|

|

|

–

|

|

|

|

–

|

|

|

|

41,000

|

|

|

Due to related party

|

|

|

1,994

|

|

|

|

715

|

|

|

|

24,804

|

|

|

Net Cash Provided by Financing Activities

|

|

|

1,994

|

|

|

|

715

|

|

|

|

65,804

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Increase (Decrease) in Cash

|

|

|

(9,716

|

)

|

|

|

(30,661

|

)

|

|

|

75

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash – Beginning of Period

|

|

|

9,791

|

|

|

|

30,841

|

|

|

|

–

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash – End of Period

|

|

$

|

75

|

|

|

$

|

180

|

|

|

$

|

75

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental Disclosures

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest paid

|

|

|

–

|

|

|

|

–

|

|

|

|

–

|

|

|

Income taxes paid

|

|

|

–

|

|

|

|

–

|

|

|

|

–

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-Cash Disclosures

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reclass of related party debt to accounts payable

|

|

$

|

–

|

|

|

$

|

–

|

|

|

$

|

22,810

|

|

|

Reclass of accounts payable to related party debt

|

|

$

|

23,445

|

|

|

$

|

–

|

|

|

$

|

23,445

|

|

(The accompanying notes are an integral part of these consolidated unaudited financial statements)

F-3

Medical Care Technologies Inc.

(Formerly AM Oil Resources & Technology Inc.)

(A Development Stage Company)

Notes to the Consolidated Unaudited Financial Statements

|

1.

|

Development Stage Company and Going Concern

|

Aventerra Explorations Inc. was incorporated in the State of Nevada on February 27, 2007 and changed its name to AM Oil Resources & Technology Inc. (the “Company”) on December 3, 2008. On September 28, 2009, the Company incorporated Medical Care Technologies Inc. for the sole purpose of effecting a name change. On October

13, 2009, the Company effected a merger with the wholly owned subsidiary and assumed the subsidiary’s name (Note 9). The Company is in the development stage as defined by Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 915,

Development Stage Entities

.

These consolidated financial statements have been prepared on a going concern basis, which implies the Company will continue to realize its assets and discharge its liabilities in the normal course of business. The Company has not generated revenues since inception and has never paid any dividends and is unlikely to pay dividends or generate

earnings in the immediate or foreseeable future. The continuation of the Company as a going concern is dependent upon the continued financial support from its shareholders, the ability of the Company to obtain necessary equity financing to continue operations and to determine the existence, discovery and successful exploitation of economically recoverable reserves in its resource properties, confirmation of the Company’s interests in the underlying properties, and the attainment of profitable operations.

At September 30, 2009, the Company has a working capital deficit and a deficit accumulated during the development stage. . These consolidated financial statements do not include any adjustments to the recoverability and classification of recorded asset amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern. These factors raise substantial doubt regarding the Company’s ability to continue as a going concern.

|

2.

|

Significant Accounting Policies

|

|

a)

|

Basis of Presentation and Consolidation

|

The accompanying unaudited interim financial statements of the Company have been prepared in accordance with accounting principles generally accepted in the United States of America and the rules of the Securities and Exchange Commission (“SEC”), and should be read in conjunction with the audited financial statements and notes

thereto contained in the Company’s December 31, 2008 Annual Report filed with the SEC on Form 10-K. In the opinion of management, all adjustments, consisting of normal recurring adjustments, necessary for a fair presentation of financial position and the results of operations for the interim periods presented have been reflected herein. The results of operations for interim periods are not necessarily indicative of the results to be expected for the full year. Notes to the financial statements which would

substantially duplicate the disclosure contained in the audited financial statements for the most recent fiscal year end December 31, 2008 as reported on Form 10-K, have been omitted.

Certain prior year amounts have been reclassified to conform with the current year presentation.

|

c)

|

Recently Adopted Accounting Pronouncements

|

In May 2009, FASB issued ASC 855,

Subsequent Events

, which establishes general standards of for the evaluation, recognition and disclosure of events and transactions that occur after the balance sheet date. Although there is new terminology, the standard is based on the same principles

as those that currently exist in the auditing standards. The standard, which includes a new required disclosure of the date through which an entity has evaluated subsequent events, is effective for interim or annual periods ending after June 15, 2009. The adoption of ASC 855 did not have a material effect on the Company’s financial statements. Refer to Note 9.

In June 2009, the FASB issued guidance now codified as ASC 105,

Generally Accepted Accounting Principles

as the single source of authoritative accounting principles recognized by the FASB to be applied by nongovernmental entities in the preparation of financial statements in conformity

with U.S. GAAP, aside from those issued by the SEC. ASC 105 does not change current U.S. GAAP, but is intended to simplify user access to all authoritative U.S. GAAP by providing all authoritative literature related to a particular topic in one place. The adoption of ASC 105 did not have a material impact on the Company’s financial statements, but did eliminate all references to pre-codification standards

The Company has implemented all new accounting pronouncements that are in effect and that may impact its financial statements and does not believe that there are any other new accounting pronouncements that have been issued that might have a material impact on its financial position or results of operations.

F-4

Medical Care Technologies Inc.

(Formerly AM Oil Resources & Technology Inc.)

(A Development Stage Company)

Notes to the Consolidated Unaudited Financial Statements

On November 25, 2008, we entered into a preliminary Asset Purchase Agreement (the “Agreement”) with AM Oil Resources & Technology Inc., (the “Vendor”), an unrelated company prior to the purchase of the patents, to acquire two patents for technologies that maximize oil production from existing oil wells. This

Agreement was finalized on March 11, 2009. Pursuant to the Agreement, we recognized the acquisition of the two patents in exchange for $500,000, in the form of a payable, and 30,000,000 shares of common stock. The patents covered certain oil and gas recovery enhancement techniques and were to expire in 2020.

Because our stock is not actively traded, the patents were valued using a discounted future cash flow model, which was based on management’s projections of future cash flows generated from the sale, license or other arrangement involving these patents. Based on the model, the patents were valued at $5,100,000 and were being amortized

using the straight-line method over the life of the patents. The present value of the non-interest bearing $500,000 payable was recorded and the difference between the discounted rate and the face value was being accreted into interest expense over the life of the liability. Consequently we recorded a discount of $76,795 relating to the payable.

During the quarter ended September 30, 2009, we discovered that the patents expired prior to the Agreement because certain maintenance fees were not kept current by the Vendor. As a result, the Vendor did not have clear title to convey ownership of the patents. Consequently, we never received title to these patents and due to the breach

by the Vendor, we were never obligated to pay the $500,000 or issue the 30,000,000 shares pursuant to the Agreement. The shares and the debt were cancelled by the company and no payments were made pursuant to the Agreement.

Based on our findings, we never owned the patents and recording this transaction in the first quarter was in error. As a result, we are restating the March 31, 2009 and June 30, 2009 financial statements filed on Form 10-Q to correct this error in those prior periods. The effect of the restatement is to derecognize the patent asset and

related liability, as well as cancel the 30,000,000 shares issued under the Agreement.

The following tables illustrate the effects of the restatement on the March 31, 2009 and June 30, 2009 financial statements:

|

Statement of Expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended March 31, 2009

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As Reported

|

|

|

Adjustments

|

|

|

As Restated

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Costs and Expenses

|

|

|

|

|

|

|

|

|

|

|

Amortization

|

|

$

|

21,250

|

|

|

$

|

(21,250

|

)

|

|

$

|

–

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expense):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense

|

|

|

1,702

|

|

|

|

(1,702

|

)

|

|

|

–

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

$

|

(37,695

|

)

|

|

$

|

(22,952

|

)

|

|

$

|

(14,743

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Loss per Share – Basic and Diluted

|

|

$

|

0.00

|

|

|

$

|

0.00

|

|

|

$

|

0.00

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted

|

|

|

87,594,000

|

|

|

|

(12,333,000

|

)

|

|

|

75,000,000

|

|

|

Statement of Cash Flows

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended March 31, 2009

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As Reported

|

|

|

Adjustments

|

|

|

As Restated

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Activities

|

|

|

|

|

|

|

|

|

|

|

Net Loss

|

|

$

|

(37,695

|

)

|

|

$

|

22,952

|

|

|

$

|

(14,743

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accretion of discount on debt

|

|

|

1,702

|

|

|

|

(1,702

|

)

|

|

|

–

|

|

|

Amortization

|

|

|

21,250

|

|

|

|

(21,250

|

)

|

|

|

–

|

|

|

Net Cash Used in Operating Activities

|

|

$

|

(11,797

|

)

|

|

$

|

–

|

|

|

$

|

(11,797

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

F-5

Medical Care Technologies Inc.

(Formerly AM Oil Resources & Technology Inc.)

(A Development Stage Company)

Notes to the Consolidated Unaudited Financial Statements

|

Balance Sheet

|

|

|

|

|

|

March 31, 2009

|

|

|

|

As Reported

|

|

|

Current Year

Adjustments

|

|

As Restated

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

|

|

Intangible assets

|

|

$

|

5,078,750

|

|

|

$

|

(5,078,750)

|

|

$

|

–

|

|

Total assets

|

|

$

|

5,078,750

|

|

|

$

|

(5,078,750)

|

|

$

|

–

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

|

|

|

|

Debt

|

|

$

|

424,907

|

|

|

$

|

(424,907)

|

|

$

|

–

|

|

Total liabilities

|

|

|

496,435

|

|

|

|

(424,907)

|

|

|

71,528

|

|

Stockholders’ deficit

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock

|

|

|

714

|

|

|

|

(300)

|

|

|

414

|

|

Additional Paid-In Capital

|

|

|

4,712,581

|

|

|

|

(4,676,495)

|

|

|

36,086

|

|

Retained earnings (deficit)

|

|

|

(130,980)

|

|

|

|

22,952

|

|

|

(108,028)

|

|

Total stockholders’ deficit

|

|

|

4,582,315

|

|

|

|

(4,653,843)

|

|

|

(71,528)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities and stockholders’ deficit

|

|

$

|

5,078,750

|

|

|

$

|

(5,078,750)

|

|

$

|

–

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Statement of Expenses

|

|

|

|

|

|

Six months ended June 30, 2009

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As Reported

|

|

|

|

Adjustments

|

|

|

|

As Restated

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Costs and Expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amortization

|

|

$

|

148,750

|

|

|

$

|

(148,750)

|

|

|

$

|

–

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expense):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense

|

|

|

20,243

|

|

|

|

(20,243)

|

|

|

|

–

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

$

|

(208,923)

|

|

|

$

|

(168,993)

|

|

|

$

|

(39,930)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Loss per Share – Basic and Diluted

|

|

$

|

0.00

|

|

|

$

|

0.01

|

|

|

$

|

0.00

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted

|

|

|

79,452,000

|

|

|

|

(21,215,000)

|

|

|

|

58,237,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Statement of Expenses

|

|

|

|

|

|

Three months ended June 30, 2009

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As Reported

|

|

|

|

Adjustments

|

|

|

|

As Restated

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Costs and Expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amortization

|

|

$

|

127,500

|

|

|

$

|

(127,500)

|

|

|

$

|

–

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expense):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense

|

|

|

18,541

|

|

|

|

(18,541)

|

|

|

|

–

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

$

|

(171,228)

|

|

|

$

|

(146,041)

|

|

|

$

|

(25,187)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Loss per Share – Basic and Diluted

|

|

$

|

0.00

|

|

|

$

|

0.00

|

|

|

$

|

0.00

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted

|

|

|

71,400,000

|

|

|

|

(30,000,000)

|

|

|

|

41,400,000

|

|

F-6

Medical Care Technologies Inc.

(Formerly AM Oil Resources & Technology Inc.)

(A Development Stage Company)

Notes to the Consolidated Unaudited Financial Statements

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Statement of Cash Flows

|

|

|

|

|

|

Six months ended June 30, 2009

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As Reported

|

|

|

|

Adjustments

|

|

|

|

As Restated

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Activities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Loss

|

|

$

|

(208,923)

|

|

|

$

|

168,993

|

|

|

$

|

39,930

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accretion of discount on debt

|

|

|

20,243

|

|

|

|

(20,243)

|

|

|

|

–

|

|

|

Amortization

|

|

|

148,750

|

|

|

|

(148,750)

|

|

|

|

–

|

|

|

Net Cash Used in Operating Activities

|

|

$

|

(9,604)

|

|

|

$

|

–

|

|

|

$

|

(9,604)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance Sheet

|

|

|

|

|

|

June 30, 2009

|

|

|

|

As Reported

|

|

|

Current Year

Adjustments

|

|

|

As Restated

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

|

|

|

Intangible assets

|

|

$

|

4,951,250

|

|

|

$

|

(4,951,250)

|

|

|

$

|

–

|

|

Total assets

|

|

$

|

4,953,437

|

|

|

$

|

(4,951,250)

|

|

|

$

|

2,187

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

|

|

|

|

|

Debt

|

|

$

|

443,448

|

|

|

$

|

(443,448)

|

|

|

$

|

–

|

|

Total liabilities

|

|

|

542,350

|

|

|

|

(443,448)

|

|

|

|

98,902

|

|

Stockholders’ deficit

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock

|

|

|

714

|

|

|

|

(300)

|

|

|

|

414

|

|

Additional Paid-In Capital

|

|

|

4,712,581

|

|

|

|

(4,676,495)

|

|

|

|

36,086

|

|

Retained earnings (deficit)

|

|

|

(302,208)

|

|

|

|

168,993

|

|

|

|

(133,215)

|

|

Total stockholders’ deficit

|

|

|

4,411,087

|

|

|

|

(4,507,802)

|

|

|

|

96,715

|

|

Total liabilities and stockholders’ deficit

|

|

$

|

4,953,437

|

|

|

$

|

(4,951,250)

|

|

|

$

|

2,187

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4.

|

Related Party Transactions

|

|

a)

|

At September 30, 2009 and December 31, 2008, the Company is indebted to the President of the Company for $23,445 and $nil, respectively, representing expenditures paid on behalf of the Company.

|

|

b)

|

At September 30, 2009 and December 31, 2008, the Company is indebted to a director of the Company for $1,994 and $nil, respectively, representing expenditures paid on behalf of the Company.

|

|

c)

|

During the nine month period ended September 30, 2009 and 2008, the Company recognized $nil and $4,500, respectively, for management services at $500 per month provided by the President of the Company. These services were terminated in November 2008.

|

|

a)

|

The preferred stock may be divided into and issued in series by the Board of Directors. The Board is authorized to fix and determine the designations, rights, qualifications, preferences, limitations and terms, within legal limitations. As of June 30, 2009 and December 31, 2008, there was no preferred stock issued and outstanding.

|

|

b)

|

On February 18, 2009, the Company reduced the authorized shares of common stock from 1,150,000,000 shares of common stock with a par value of $0.00001 per share to 150,000,000 shares of common stock with a par value of $0.00001 per share. The authorized shares of preferred stock will remain unchanged.

|

F-7

Medical Care Technologies Inc.

(Formerly AM Oil Resources & Technology Inc.)

(A Development Stage Company)

Notes to the Consolidated Unaudited Financial Statements

|

c)

|

On February 22, 2009, 57,500,000 shares of common stock were cancelled and returned to treasury by the President of the Company in consideration for $15,000. As the Company did not pay the $15,000, on September 28, 2009, 57,500,000 shares of common stock were re-issued to the President of the Company.

|

|

d)

|

On February 22, 2009, 30,000,000 shares of common stock with a deemed fair value of $4,676,795 were issued pursuant to the Asset Purchase Agreement with AM Oil Resources & Technology Inc described in Note 3. Because the Company’s common stock is not actively traded, the fair value of the stock was determined as the residual value of the fair

value of the patent less the fair value of the debt issued in the transaction. On September 28 2009, the 30,000,000 shares of common stock were cancelled and returned to treasury pursuant to the cancellation of the Asset Purchase Agreement.

|

|

6.

|

Discontinued Operations

|

During 2008, the Company abandoned further activity related to its mineral exploration business. As a result, the financial information in prior periods related to the mineral exploration business has been presented as discontinued operations.

The results of discontinued operations are summarized as follows:

|

|

|

For the

|

|

|

For the

|

|

|

Period from

|

|

|

|

|

Three months

|

|

|

Nine Months

|

|

|

February 27, 2007

|

|

|

|

|

Ended

|

|

|

Ended

|

|

|

(Inception)

|

|

|

|

|

September 30,

|

|

|

September 30,

|

|

|

To September 30,

|

|

|

|

|

2008

|

|

|

2008

|

|

|

2009

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative

|

|

$

|

3,569

|

|

|

$

|

9,305

|

|

|

$

|

20,041

|

|

|

Mineral property costs

|

|

|

500

|

|

|

|

500

|

|

|

|

16,000

|

|

|

Professional fees

|

|

|

3,085

|

|

|

|

26,343

|

|

|

|

51,269

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Loss from Discontinued Operations

|

|

$

|

(7,154

|

)

|

|

$

|

(36,148

|

)

|

|

$

|

(87,310

|

)

|

On October 13, 2009, the Company received communication from the Vendor of the Asset Purchase Agreement (Note 3) which detailed the Vendor’s intention to pursue the amounts outstanding under the debt. While the outcome of this matter is uncertain and there can be no assurance that the matter will be resolved in the Company’s

favor, the Company believes that the outcome of an adverse decision in the proceeding related to this matter or any amount which it may be required to pay thereof having a material adverse impact on its financial position, results of operations or liquidity is unlikely. In determining that the patents expired prior to the signing of the Asset Purchase Agreement, the Company strongly feels that the Vendor did not have good and marketable rights or ownerships to the patents and the Company believes the

claim is without merit and will defend its position.

Pursuant to FASB ASC 855, we have evaluated all events or transactions that occurred from September 30, 2009 through November 20, 2009, the date of issuance of the unaudited consolidated financial statements. During this period we did not have any material recognizable subsequent events, except as disclosed below:

F-8

Medical Care Technologies Inc.

(Formerly AM Oil Resources & Technology Inc.)

(A Development Stage Company)

Notes to the Consolidated Unaudited Financial Statements

|

a)

|

On November 17, 2009, It was determined that the patents had expired for failure to pay maintenance fees by the holder of the patents, thus leaving the patents open to the public domain. It was determined that US Patent No. 5979549 expired for failure to pay a maintenance fee on November 11, 2007 and US Patent No. 6129148 expired for failure

to pay a maintenance fee on October 10, 2008. The Company did not have good and marketable title to the Assets. The Vendor did not own and failed to assign the Assets to the Company, being US Patent No. 5979549 and US Patent No. 6129148. It was for this reason that the Agreement was terminated and the 30,000,000 shares issued to the Vendor were canceled.

|

|

b)

|

The Company has been informed that the name change has been processed by FINRA and has taken effect at the opening of business on November 20, 2009. In conjunction with the name change the Company has also been granted a new trading symbol. The Company’s new trading symbol is: MDCE.

|

F-9

ITEM 2. MANAGEMENT'S DISCUSSION AND ANALYSIS OR PLAN OF OPERATION.

This section of the report includes a number of forward-looking statements that reflect our current views with respect to future events and financial performance. Forward-looking statements are often identified by words like: believe, expect, estimate, anticipate, intend, project and similar

expressions, or words which, by their nature, refer to future events. You should not place undue certainty on these forward-looking statements, which apply only as of the date of this report. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from historical results or our predictions.

We are a start-up, development stage corporation and have not yet generated or realized any revenues from our business activities.

These financials have been prepared on a going concern basis. This means that there is substantial doubt that we can continue as an on-going business for the next twelve months unless we generate revenues. We currently do not have sufficient capital to maintain operations for the next twelve

months.

Significant Events

At September 10, 2008, the Company effected a 11.5:1 forward stock split of the authorized, and outstanding common stock. As a result, the authorized shares of common stock increased from 100,000,000 shares of common stock with a par value of $0.00001 per share to 1,150,000,000 shares of common

stock with a par value of $0.00001 per share. The issued and outstanding shares of common stock increased from 8,600,000 shares to 98,900,000 shares. The information contained in this report reflects the stock split.

On November 25, 2008, the Company entered into a preliminary Asset Purchase Agreement (the “Agreement”) with AM Oil Resources & Technology Inc., (the “Vendor”), an unrelated company prior to the purchase of the patents, to acquire two patents for technologies that

maximize oil production from existing oil wells. This Agreement was finalized on March 11, 2009. Pursuant to the Agreement, the Company acquired the two patents in exchange for $500,000, in the form of a payable, and 30,000,000 shares of common stock. The patents cover certain oil and gas recovery enhancement techniques and expire in 2020.

On February 18, 2009, the Company reduced the authorized shares of common stock from 1,150,000,000 shares of common stock with a par value of $0.00001 per share to 150,000,000 shares of common stock with a par value of $0.00001 per share. The authorized shares of preferred stock will remain

unchanged.

On February 22, 2009, 57,500,000 shares of common stock were cancelled and returned to treasury by the President of the Company.

On November 25, 2008, we entered into a preliminary Asset Purchase Agreement (the “Agreement”) with AM Oil Resources & Technology Inc., (the “Vendor”), an unrelated company prior to the purchase of the patents, to acquire

two patents for technologies that maximize oil production from existing oil wells. This Agreement was finalized on March 11, 2009. Pursuant to the Agreement, we recognized the acquisition of the two patents in exchange for $500,000, in the form of a payable, and 30,000,000 shares of common stock. The patents covered certain oil and gas recovery enhancement techniques and were to expire in 2020.

Because our stock is not actively traded, the patents were valued using a discounted future cash flow model, which was based on management’s projections of future cash flows generated from the sale, license or other arrangement involving these patents. Based on the model, the patents were valued at $5,100,000 and were being amortized

using the straight-line method over the life of the patents. The present value of the non-interest bearing $500,000 payable was recorded and the difference between the discounted rate and the face value was being accreted into interest expense over the life of the liability. Consequently we recorded a discount of $76,795 relating to the payable.

During the quarter ended September 30, 2009, we discovered that the patents expired prior to the Agreement because certain maintenance fees were not kept current by the Vendor. As a result, the Vendor did not have clear title to convey ownership of the patents. Consequently, we never received title to these patents and due to the breach by

the Vendor, we were never obligated to pay the $500,000 or issue the 30,000,000 shares pursuant to the Agreement. The shares and the debt were cancelled by the company and no payments were made pursuant to the Agreement.

Based on our findings, we never owned the patents and recording this transaction in the first quarter was in error. As a result, we are restating the March 31, 2009 and June 30, 2009 financial statements filed on Form 10-Q to correct this error in those prior periods. The effect of the restatement is to derecognize the patent asset and related

liability, as well as cancel the 30,000,000 shares issued under the Agreement.

On September 28, 2009, the previously cancelled 57,500,000 shares of common stock were re-issued to Patricia Traczykowski, our President, as a result of our failure to pay Ms. Traczykowski for her shares of common stock.

In light of these findings the Company is considering legal action against the Vendor.

The Company will be amending its March 31, 2009 and June 30, 2009 financial statements to reflect the foregoing matters.

On October 13, 2009 Medical Care Technologies Inc., formerly known as AM Oil Resources & Technology Inc. (the “Company”), filed Articles of Merger with the Nevada Secretary of State to effect a merger with its wholly owned subsidiary, Medical Care Technologies Inc. and assume

the subsidiary’s name. The subsidiary was incorporated entirely for the purpose of effecting this name change and the merger did not affect the Company’s Articles of Incorporation or corporate structure in any other way.

The Company has been informed that the name change has been processed by FINRA and has taken effect at the opening of business on November 20, 2009. In conjunction with the name change the Company has also been granted a new trading symbol. The Company’s new trading

symbol is: MDCE.

Liquidity and Capital Resources

We issued 57,500,000 shares of common stock through a private placement pursuant to Regulation S of the Securities Act of 1933 to Patricia Traczykowski, one of our two officers and directors at that time, in consideration of $5,000. Ms. Traczykowski was a non-US person and the transaction took

place outside the United States of America. This was accounted for as a purchase of shares of common stock. These shares were cancelled and subsequently reissued to Patricia Traczykowski.

In December 28, 2007, we completed a private placement of 41,400,000 restricted shares of common stock pursuant to Reg. S of the Securities Act of 1933 and raised $36,000. All of the shares were sold to non-US persons and all transactions closed outside the United States of America. This was

accounted for as a purchase of shares of common stock.

As of September 30, 2009, our total assets were $2,075 and our total liabilities were $102,549. Total assets decreased from December 31, 2008 by $7,716 and total liabilities increased from by $50,973. This is mainly due to the impairment of the patents. Because

the Company’s stock is not actively traded, the patents were valued using a discounted future cash flow model, which was based on management’s projections of future cash flows generated from the sale, license or other arrangement involving these patents. Based on the model, the patents were independently valued at $5,100,000 and are being amortized using the straight-line method over the life of the patents. Amortization expense totaled $148,750 for the six months ended June 30, 2009. There was no

amortization expense recognized during the three months ended September 30, 2009, as the Company decided not to pursue the purchase of the patents due to a breach of the Agreement.

Results of Operations

We have no revenues in the periods ended September, 2009 and 2008. In the nine month periods ended September, 2009 and 2008, we incurred net losses of $58,688 and $36,148. From February 27, 2007 (inception date) to September 30, 2009 we incurred a net loss of $151,974. Overall,

operating expenses increased due to discontinuation of operations, impairment of the patents, increased interest expense, and an increase in professional fees related to legal and accounting fees.

Limited Capital

We intend to use our limited cash to pay for our minimal operations and legal, accounting and professional services required to prepare and file our reports with the SEC. Our remaining cash, however, will only be sufficient to sustain us for the short-term. If we are unable to locate

additional financing within the short-term, we will be forced to suspend all public reporting with the SEC and possibly liquidate. Furthermore, our ability to execute on these business objectives may be subject to material doubt as our management team will likely be limited to one part-time individual who will have minimal cash resources to support operations for more than the short-term.

Business

Our former business was to use, sell and produce patent and patent pending technologies, providing an environmentally safe and cost-effective method that maximizes oil production from existing oil wells. The strategy was to market this technology strategically and to allow us to benefit

from worldwide demand for oil, resulting in significant growth in both revenues and profits for the company. Our goal was to provide solutions to help minimize U.S. dependence on foreign oil; thus providing innovative solutions to the world that will recover dormant lying crude oil in reserves all around the world.

As discussed above, we terminated the Asset Purchase Agreement (“Agreement”) and amendment thereto which we entered into with Anthony Miller (“Miller”) and AM Oil Resources & Technology, Inc., a California corporation (“AOR”). We terminated

the agreement unilaterally as a result of a breach of several provisions of the Asset Purchase Agreement and amendment thereto.

We concluded that the Agreement and amendment are in breach as follows:

1)

They do not have good title to the patents as represented in section 3.8;

2)

They have not provided the required insurance as required by section 3.10; and

3)

They have not transferred the patents to the Company as required by Section 6.2 of the Agreement.

Further, we cancelled all of shares of common stock that were issued in connection with the Asset Purchase Agreement and amendment.

We do not own any patents nor did we ever own, have assignment of, or clear title to any patents.

We previously terminated our mining operations and as a result of the termination of the Agreement, we are no longer pursuing the technologies to improve the recovery of oil and gas from existing oil and gas wells.

On October 6, 2009, the Company entered into a letter of intent to acquire 100% of medical care technologies and software held by Great Union Corporation (“Great Union”), a Hong Kong corporation, by way of a reverse merger. In accordance with the letter of intent, Great Union must

complete a foreign ownership structure in which the medical care technologies and software will be held by a company incorporated in the State of Nevada (the “Nevada Company”). The Company must exchange 38,400,000 shares of common stock for all of the outstanding common shares of the Nevada Company. In addition, the Company must cancel 57,300,000 shares of common stock held by the President of the Company.

Off-Balance Sheet Arrangements

We have no off-balance sheet arrangements.

ITEM 3. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

ITEM 4. CONTROLS AND PROCEDURES.

Under the supervision and with the participation of our management, including the Principal Executive Officer and Principal Financial Officer, we have evaluated the effectiveness of our disclosure controls and procedures as required by Exchange Act Rule 13a-15(b) as of the end of the period

covered by this report. Based on that evaluation, the Principal Executive Officer and Principal Financial Officer have concluded that these disclosure controls and procedures are not effective because we lack adequate personnel to manage our SEC compliance program.

There were no changes in our internal control over financial reporting during the quarter ended September 30, 2009 that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

PART II. OTHER INFORMATION

ITEM 1A. RISK FACTORS

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

ITEM 6. EXHIBITS.

The following documents are included herein:

|

Exhibit No.

|

Document Description

|

|

|

|

|

31.1

|

Certification of Principal Executive Officer and Principal Financial Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002.

|

|

|

|

32.1

|

Certification of Chief Executive Officer and Chief Financial Officer pursuant to section 906 of the Sarbanes-Oxley Act of 2002.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following person on behalf of the Registrant and in the capacities on this 23

rd

day of November, 2009.

|

|

MEDICAL CARE TECHNOLOGIES, INC.

|

|

|

|

|

|

|

BY:

|

PATRICIA TRACZYKOWSKI

|

|

|

|

Patricia Traczykowski, President, Principal Executive Officer, Treasurer, Principal Financial Officer, Principal Accounting Officer and a member of the Board of Directors.

|

EXHIBIT INDEX

|

Exhibit No.

|

Document Description

|

|

|

|

|

31.1

|

Certification of Principal Executive Officer and Principal Financial Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002.

|

|

|

|

32.1

|

Certification of Chief Executive Officer and Chief Financial Officer pursuant to section 906 of the Sarbanes-Oxley Act of 2002.

|

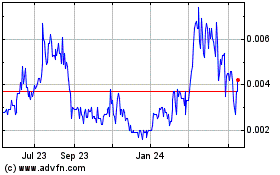

Medical Care Technologies (PK) (USOTC:MDCE)

Historical Stock Chart

From Jun 2024 to Jul 2024

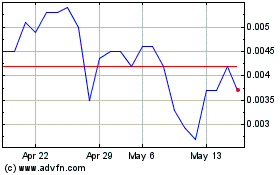

Medical Care Technologies (PK) (USOTC:MDCE)

Historical Stock Chart

From Jul 2023 to Jul 2024