Current Report Filing (8-k)

02 November 2019 - 1:30AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The

Securities Exchange Act of 1934

|

|

|

|

|

|

Date

of Report (Date of earliest event reported):

|

October 29, 2019

|

|

|

|

Video River Networks, Inc.

(Exact name of registrant

as specified in its charter)

|

Nevada

|

File Number: 0-30786

|

87-0627349

|

|

(State of incorporation)

|

(Commission File Number)

|

(IRS

Employer Identification No.)

|

|

370 Amapola Ave., Suite 200A,

Torrance, CA 90501

|

|

(Address of principal executive

offices) (Zip Code)

|

|

(310) 895-1839

|

|

(Registrant’s telephone number,

including area code)

|

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following

provisions:

Written communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange

Act (17 CFR 240.14d-2(b))

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange

Act (17 CFR 240.13e-4(c))

|

|

|

|

Item

3.02

|

Unregistered Sales of Equity Securities

|

On

October

29, 2019, the company sold one (1) Special 2019 series A preferred share (one

preferred share is convertible 150,000,000 share of common stocks) of the

company for an agreed upon purchase price to Community Economic Development

Capital LLC, a California limited liability company. The Special preferred

share controls 60% of the company’s total voting rights. The issuance of the

preferred share to Community Economic Development Capital LLC gave to Community

Economic Development Capital LLC, the controlling vote to control and dominate

the affairs of the company going forward.

The issuance of shares to Community

Economic Development Capital LLC was completed in reliance on Rule 506 of

Regulation D of the Securities Act of 1933, recognizing that these parties were

all accredited investors, as defined under Rule 501 of Regulation D of the

Securities Act of 1933. All securities issued were issued as restricted

securities and were endorsed with a restrictive legend confirming that the

securities could not be resold without registration under the Securities Act of

1933 or an applicable exemption from the registration requirements of the

Securities Act of 1933. No general solicitation or general advertising was

conducted in connection with the sales of the shares.

The subscription agreement executed

between us and Community

Economic Development Capital LLC included statements that the securities

had not been registered pursuant to the Securities Act of 1933 and

that the securities may not be offered or sold in the United States unless the

securities are registered under the Securities Act of 1933 or

pursuant to an exemption from the Securities Act of 1933. Community

Economic Development Capital LLC agreed by execution of the subscription

agreement for the shares: (i) to resell the securities purchased only in

accordance with the provisions of Regulation S, pursuant to registration under

the Securities Act of 1933 or pursuant to an exemption from

registration under the Securities Act of 1933; (ii) that we are required

to refuse to register any sale of the securities purchased unless the transfer

is in accordance with the provisions of Regulation S, pursuant to registration

under the Securities Act of 1933 or pursuant to an exemption from registration

under the Securities Act of 1933; and (iii) not to engage in hedging

transactions with regards to the securities purchased unless in compliance with

the Securities Act of 1933. All securities issued were endorsed with a

restrictive legend confirming that the securities had been issued pursuant to

Regulation S of the Securities Act of 1933 and could not be resold

without registration under the Securities Act of 1933 or an

applicable exemption from the registration requirements of the Securities

Act of 1933.

|

|

|

|

Item

5.01

|

Departure

of Directors or Certain Officers; Election of Directors; Appointment of

Certain Officers; Compensatory Arrangements of Certain Officers.

|

On October 29, 2019,

the company sold one (1) Special 2019 series A preferred share (one preferred

share is convertible 150,000,000 share of common stocks) of the company for an

agreed upon purchase price to Community Economic Development Capital LLC, a

California limited liability company.

The issuance of the preferred shares to Community

Economic Development Capital LLC.; therefore, give to Community Economic

Development Capital LLC, the controlling vote to control and dominate the

affairs of the company going forward.

As a

result of the Securities Sales Agreement, all the former officers of company

resigned their appointments. The Company has appointed Mr. Frank I Igwealor as

the Company's Chief Executive Officer, Chief Financial Officer and Chairman of

the Board of Directors effective October 29, 2019.

Mr.

Igwealor and Ms. Patience C Ogbozor have also been elected as new directors of

the Company. The changes to the board of directors of the Company will not be

effective until at least ten days after an Information Statement is mailed or

delivered to all of the Company's shareholders in compliance with Section 14(f)

of the Securities Exchange Act of 1934, as amended, and Rule 14f-1 thereunder.

The

parties were arms-length at the time of entering into the transaction. There

was no relationship between the Company and Community Economic

Development Capital LLC or any affiliate, director,

officer, or associate of the Company.

|

Item 5.02

|

Departure of Directors or Certain Officers;

Election of Directors; Appointment of Certain Officers; Compensatory

Arrangements of Certain Officers.

|

On October 29, 2019, the company

announced certain officer changes that will be effective immediately. Mr. Frank

I Igwealor, JD, CPA, CMA, CFM was elected the President and Chief Executive

Officer, Chief Financial Officer, and Company Secretary of the company.

There are no arrangements or

understandings between Mr. Igwealor and any other persons pursuant to which he

was selected to serve in his new position. There are no transactions in which

Mr. Igwealor has an interest requiring disclosure pursuant to Item 404(a) of

Regulation S-K.

Mr. Igwealor will become a party to

employment agreements with the company, which will provide for a base salary,

subject to adjustment, and participation in our cash incentive plan and other

employee benefit plans. The agreements would prohibit the executives from

competing with the company for a period of 12 months after termination of

employment. The agreements may be terminated without cause by either party on

12 months’ notice, during which period the executives are entitled to full

compensation under the agreements, including payment of base salary, target

cash incentive, and continuation of benefits.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has

duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

Video River

Networks, Inc.

|

Dated:

|

October

31, 2019 By:

|

/s/

Frank I Igwealor

|

|

|

|

Frank

I Igwealor, CPA, JD, CMA, CFM

|

|

|

|

President

and CEO

|

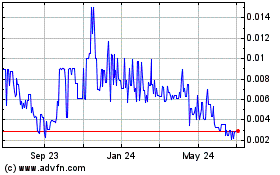

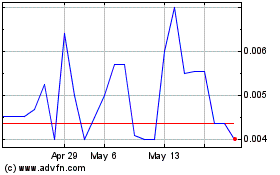

Video River Networks (PK) (USOTC:NIHK)

Historical Stock Chart

From Jan 2025 to Feb 2025

Video River Networks (PK) (USOTC:NIHK)

Historical Stock Chart

From Feb 2024 to Feb 2025