WINDSOR, ONTARIO / ACCESSWIRE / June 9, 2015 / The

Wealthy Venture Capitalist, is an Investment Newsletter

focused on discovering and showcasing high-yield investment

opportunities in the mining sector, along with breaking news and

analysis geared at maximizing returns for ordinary investors.

Investors traditionally seek out opportunities in the gold

market by focusing their energies and research efforts on a narrow

band of regions. Africa and Australia continue to lead the

field. Asia continues to be a top draw with countries like China

and Kazakhstan enjoying a healthy dose of interest.

But tradition doesn't always equate to the best returns and in

the case of gold, investors completely miss out by ignoring the

emerging regions for gold exploration.

One of the hottest regions right now is South America and the

country of Colombia in particular is becoming a target for some of

the biggest gold exploration in the last 10 years. Billions are

being poured into the country as companies look to tap the gold

deposits that have come to encapsulate the "gold rush" that is

sweeping the nation.

QED Connect, Inc. (OTC: QEDN) is one of a

handful of companies that offer both early-stage upside opportunity

and strong growth potential for investors savvy enough to break

away from tradition and mediocre returns. Continental Gold

Ltd (OTC: CGOOF), Rio Novo Gold Inc. (OTC: RIVVF) and

Red Eagle Mining Corp. (OTC: RDEMF) are also

interesting prospects.

Colombia Now Shines among South America's Gold

Boom

Colombia is not exactly a debutante in the world of gold

exploration. Investors familiar with the mythical city of El Dorado

will know all too well what the country symbolizes to the idea of

huge fortunes in the quest for gold.

In the last 5 years revenues from gold exploration in Colombia

have increased 10-fold. Colombia has one of the highest

dollar-value mining productions in the region, coming in at over $8

billion in 2011. The country also has one of the most dynamic and

extensive exploration programs in South America. Colombia has

enjoyed drilling activity as high as 650,000 meters and typical

drill programs have ranged from 5—20km. These numbers highlight the

very real investing opportunities that are tied to companies like

QED Connect, Inc. (QEDN).

Remedios and What It Means For

the QEDN Investment Opportunity

At the start of March 2015 QEDN announced a MOU

for the intended acquisition of Green M&A Solutions, a company

with mining interests in Colombia.

On March 25th QEDN completed the

acquisition and immediately announced plans to expand operations in

Remedios, Colombia.

Remedios is a significant boost for QEDN

because it is the seat of the "La Palmichala" mine which is part of

the mining title acquired with Green M&A Solutions.

The Remedios jurisdiction is also hotly sought after due to its

location among some of the richest formations in Colombia. The La

Palmichala formation which showed 40,000 ounces of indicated gold

resources and 274,000 ounces of inferred gold resources in

geological surveys.

QED Connect, Inc. (OTC: QEDN) has also moved

(via Green M&A Solutions) to acquire two concessions for the

mining rights located in the jurisdiction of Remedios, municipality

of Department of Antioquia.

The mining concessions currently fall under the purview of

Yurany with 100 hectares of mining rights and Hidalgos SA Mining

which has been responsible for 600 hectares of property with over

100 years of history.

The strong consolidation of mining properties represents a huge

push by QEDN to rapidly deliver value to

shareholders.

The multi-million dollar processing facility at the Yurany mine

is particularly important for the company's growth potential.

QED Connect, Inc. (OTC: QEDN) Joins Elite Set of Gold

Mining Companies In Colombia

The success of Colombia and in particular Remedios in the gold

market can also be seen in the mining operations of several key

players – a large majority of which are big-board traded

companies.

Canadian-based Gran Colombia is only 15 minutes away from

QEDN's operations. Gran Colombia is a clear

indicator of the sort of mileage possible in Colombian mining and

produces over 100,000 ounces of gold annually from both its Segovia

and Marmato operations.

Just 30 minutes away from QEDN's operations is

B2Gold that via management by AngloGold Ashanti Limited, operates

the Gramalote property. This is the very property formerly

managed by QEDN's newly appointed board member,

Mr. John Naisbitt.

AngloGold Ashanti also owns the La Colosa gold project which is

the largest gold deposit in South America. La Colosa is currently

believed to have a potential of producing between 800,000 to 1.2

million ounces (moz) of gold per year for 20 years.

Rounding out the elite set of gold explorers near to

QEDN is Barrick Gold which owns 31,983 hectares of

mining property located 30 minutes from La Palmichala.

The presence of the world's third largest gold producer

(AngloGold Ashanti) in Colombia is a strong benchmark of the

opportunities that exist in the country.

That QED Connect, Inc. (QEDN) is mere minutes

away with its operations shows that the investment upside is closer

than most investors realize.

The Big Investing Picture for Colombia, Remedios and

Gold

QED Connect, Inc. (OTC: QEDN) and its gold

exploration efforts in Colombia speak for themselves. These efforts

tell the lucrative tale already being written by the likes of Anglo

Gold Ashanti.

QEDN's "Green M&A Solutions" also has

an agriculture project working with farmers in Colombia to grow

Inca nuts called "Sach Inchi." These are the only nuts with 48%

Omega 3 and which currently export to the USA, Canada, Japan and

China. Inca nut will be the only nut that can compete in the

lucrative Omega 3 market, the nut market and the weight loss market

as a health snack to lose weight.

This secondary dimension to the company's operations provides

added investment potential but more than anything else, investors

have an opportunity to capitalize on very tangible investment

upside crystalized in QEDN's share price.

Ground-floor, first-through-the-gates,

untapped are all words which can best be used to describe

the growth potential of QEDN. The company has made

its move and the acquisition of one important mining interest among

large-scale players in Colombia shows both savvy and firm

strategic guidance.

Continental Gold Ltd (OTC: CGOOF) is also in

line to benefit from the emerging exploration boom in South

America. The company has one of the most promising projects in

Colombia and currently has nine drills on its Buriticá project in

Antioquia. Last year CNL was on track to complete its Phase V,

60,000-metre diamond drilling program.

Rio Novo Gold Inc. (OTC: RIVVF) is another good

prospect for investors. Colombia is home to RIVVF's Told Fria Gold

Project which was acquired in 2011. The company has measured and

indicated resources of 1,191,252 oz. and 1,464,831 inferred oz. of

gold spread across its South American mining properties.

Red Eagle Mining Corp. (OTC: RDEMF) is also on

the investing radar. The company recently completed a $65 million

constructing financing with Orion Mine Finance. Corantioquia

(Department of Antioquia Environmental Agency, Colombia) granted

the company a full environmental license on March 9, 2015. This

paves the way for the company's construction and mining ambitions

at its San Ramon gold mine which is part of its 100 km² historic

Santa Rosa Gold Project.

The Wealthy Venture Capitalist is

always researching new trade ideas which have the makings for large

market moves. Traders are urged to follow us on social media (see

below) to stay apprised. We are an anti-email media outlet, and as

such will only be releasing our reports/ updates/ news through

Twitter and Facebook as well as newswire.

GET BREAKING NEWS FROM US:

Follow us on Twitter: @Wealthy_VC

Like us on Facebook: www.facebook.com/WealthyVC

Email: Info@WealthyVentureCapitalist.com

This report/release/profile is a commercial

advertisement and is for general information purposes only. We are

engaged in the business of marketing and advertising companies

for monetary

compensation unless otherwise stated

below. The Wealthy Venture Capitalist and its

employees are not Registered Investment Advisors, Broker Dealers or

a member of any association for other research providers in any

jurisdiction whatsoever and we are not qualified to give financial

advice. The information contained herein is based on sources

which we believe to be reliable but is not guaranteed by us as

being accurate and does not purport to be a complete statement or

summary of the available data. The Wealthy Venture Capitalist

encourages readers and investors to supplement the information in

these reports with independent research and other professional

advice. All information on featured companies is provided by the

companies profiled through their website, news releases, and

corporate filings, or is available from public sources and The

Wealthy Venture Capitalist makes no representations, warranties or

guarantees as to the accuracy or completeness of the disclosure by

the profiled companies. The Private Securities Litigation Reform

Act of 1995 provides investors a 'safe harbor' in regard to

forward-looking statements. Any statements that express or

involve discussions with respect to predictions, expectations,

beliefs, plans, projections, objectives, goals, assumptions or

future events or performance are not statements of historical fact

may be "forward looking statements". Forward looking statements are

based on expectations, estimates, and projections at the time the

statements are made that involve a number of risks and

uncertainties which could cause actual results or events to differ

materially from those presently anticipated. Forward looking

statements in this action may be identified through use of words

such as "projects," "foresee," "expects," "will," "anticipates,"

"estimates," "believes," "understands," or that by statements

indicating certain actions "may," "could," or "might" occur.

Understand there is no guarantee past performance will be

indicative of future results. Past Performance is based on the

security's previous day closing price and the high of day price

during our promotional coverage. The Wealthy Venture Capitalist's

parent company is and will be compensated roughly $25,000 per month

by QED Connect, Inc.

Readers must visit our website at

www.wealthyventurecapitalist.com in order to view our entire

disclaimer which covers most of the risks, biases and liability

releases to have a full understanding after reading this

article.

SOURCE: The Wealthy Venture

Capitalist

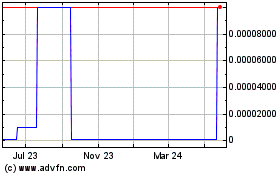

Red Eagle Mining (CE) (USOTC:RDEMF)

Historical Stock Chart

From Oct 2024 to Nov 2024

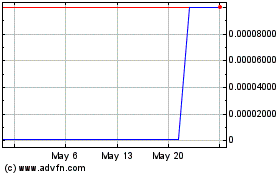

Red Eagle Mining (CE) (USOTC:RDEMF)

Historical Stock Chart

From Nov 2023 to Nov 2024