UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER PURSUANT TO RULE 13a-16 AND 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the Month of September 2023

File No. 000-55193

Silver North Resources Ltd.

(Formerly Alianza Minerals Ltd.)

(Name of Registrant)

410 – 325 Howe Street Vancouver, British Columbia, Canada V6C 1Z7

(Address of principal executive offices)

Indicate by check mark whether the Registrant files or will file annual reports under cover of Form 20-F or Form 40-F FORM 20-F x FORM 40-F ¨

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Form 6-K to be signed on its behalf by the undersigned, thereunto duly authorized.

Silver North Resources Ltd.

(Registrant)

Dated: September 6, 2023

| By: /s/ “Winnie Wong”

Winnie Wong,

Chief Financial Officer

|

Exhibits:

99.1Interim Financial Statements for the period ended June 30, 2023

99.2Management Discussion and Analysis

99.3CEO Certification

99.4CFO Certification

SILVER NORTH RESOURCES LTD.

(formerly known as Alianza Minerals Ltd.)

Condensed Consolidated Interim Financial Statements

For the nine months ended June 30, 2023 and 2022

325 Howe Street, Suite 410, Vancouver B.C. V6C 1Z7, Canada, TSXV: ANZ; Tel: 604-687-3520

CONTENTS

Page

Notice of No Auditor Review of Interim Financial Statements3

Condensed Consolidated Interim Financial Statements:

Statements of Financial Position4

Statements of Comprehensive Loss5

Statements of Changes in Shareholders’ Equity6

Statements of Cash Flows7

Notes to the Financial Statements8 - 29

NOTICE OF NO AUDITOR REVIEW OF

INTERIM FINANCIAL STATEMENTS

Under National Instrument 51-102, Part 4, subsection 4.3 (3) (a), if an auditor has not performed a review of the interim financial statements, they must be accompanied by a notice indicating that an auditor has not reviewed the financial statements.

The accompanying unaudited interim financial statements of the Company have been prepared by and are the responsibility of the Company’s management.

The Company’s independent auditor has not performed a review of these financial statements in accordance with standards established by the Chartered Professional Accountants of Canada for a review of interim financial statements by an entity’s auditor.

SILVER NORTH RESOURCES LTD.

(Formerly Alianza Minerals Ltd.)

CONDENSED CONSOLIDATED INTERIM STATEMENTS OF FINANCIAL POSITION

(Presented in Canadian Dollars)

|

| June 30,

| September 30,

|

| Note

| 2023

| 2022

|

|

|

|

|

|

|

Assets

|

|

|

|

|

|

Current assets

|

|

|

|

|

|

Cash

|

| $

| 5,673

| $

| 403,093

|

Restricted cash

| 5(c)

|

| 138,009

|

| 234,081

|

Deferred financing costs

| 9

|

| 8,000

|

| -

|

Marketable securities

| 4

|

| 8,250

|

| 161,799

|

Receivables

|

|

| 9,380

|

| 26,707

|

Prepaid expenses

|

|

| 26,361

|

| 107,030

|

|

|

| 195,673

|

| 932,710

|

Non-current assets

|

|

|

|

|

|

Exploration and evaluation assets

| 5

|

| 7,057,420

|

| 7,025,515

|

Deposits

| 6

|

| 79,729

|

| 94,720

|

VAT receivables

|

|

| 43,675

|

| 41,186

|

|

|

| 7,180,824

|

| 7,161,421

|

|

|

|

|

|

|

Total assets

|

| $

| 7,376,497

| $

| 8,094,131

|

|

|

|

|

|

|

Current liabilities

|

|

|

|

|

|

Accounts payable and accrued liabilities

|

| $

| 152,493

| $

| 480,299

|

Due to related parties

| 9

|

| 437,024

|

| 385,574

|

Funds held for optionee

| 5(c)

|

| 138,009

|

| 234,081

|

Flow-through share premium liability

| 7

|

| -

|

| 4,221

|

|

|

| 727,526

|

| 1,104,175

|

Shareholders' equity

|

|

|

|

|

|

Share capital

| 7

|

| 24,891,882

|

| 24,869,917

|

Reserves

| 7,8

|

| 3,745,186

|

| 3,745,186

|

Accumulated other comprehensive loss

|

|

| (45,872)

|

| (15,526)

|

Deficit

|

|

| (21,942,225)

|

| (21,609,621)

|

|

|

| 6,648,971

|

| 6,989,956

|

|

|

|

|

|

|

Total shareholders' equity and liabilities

|

| $

| 7,376,497

| $

| 8,094,131

|

Nature of operations and going concern (Note 1)

Event after the reporting period (Note 15)

These consolidated financial statements are authorized for issue by the Board of Directors on August 22, 2023.

On behalf of the Board of Directors:

Director “Jason Weber” Director “Mark T. Brown”

See accompanying notes to the condensed consolidated interim financial statements

SILVER NORTH RESOURCES LTD.

(Formerly Alianza Minerals Ltd.)

CONDENSED CONSOLIDATED INTERIM STATEMENTS OF COMPREHENSIVE LOSS

(Unaudited, presented in Canadian Dollars)

|

| Three months ended June 30,

| Nine months ended June 30,

|

| Note

| 2023

| 2022

| 2023

| 2022

|

|

|

|

|

|

|

|

|

|

|

Expenses

|

|

|

|

|

|

|

|

|

|

Accounting and legal fees

| 9

| $

| 17,728

| $

| 25,521

| $

| 88,971

| $

| 150,329

|

Investor relations and shareholder information

| 9

|

| 12,936

|

| 210,119

|

| 96,509

|

| 370,366

|

Office facilities and administrative services

| 9

|

| 4,500

|

| 4,500

|

| 13,500

|

| 13,502

|

Office expenses

|

|

| 6,022

|

| 2,110

|

| 19,792

|

| 11,309

|

Property investigation expenses

|

|

| 5,973

|

| 10,799

|

| 20,898

|

| 34,221

|

Share-based payments

| 9

|

| -

|

| -

|

| -

|

| 365,300

|

Transfer agent, listing and filing fees

|

|

| 7,081

|

| 7,334

|

| 31,099

|

| 31,204

|

Travel

|

|

| 1,254

|

| 4,488

|

| 7,663

|

| 17,597

|

Wages, benefits and consulting fees

| 9

|

| 57,656

|

| 40,992

|

| 136,077

|

| 133,706

|

|

|

| (113,150)

|

| (305,863)

|

| (414,509)

|

| (1,127,534)

|

|

|

|

|

|

|

|

|

|

|

Interest income and other income

|

|

| 450

|

| 420

|

| 2,139

|

| 441

|

Fair value gain (loss) on marketable securities

| 4

|

| (3,750)

|

| (45,000)

|

| 80,735

|

| (110,000)

|

Flow-through share premium recovery

|

|

| -

|

| 3,101

|

| 4,221

|

| 20,347

|

Foreign exchange gain (loss)

|

|

| (2,693)

|

| 455

|

| (2,138)

|

| 15,784

|

Loss on sale of marketable securities

|

|

| -

|

| -

|

| (30,052)

|

| -

|

Proceeds received in excess of exploration and

evaluation asset costs

| 5

|

| -

|

| 34,039

|

| -

|

| 298,961

|

Other income

| 5(d)(v)

|

| -

|

| -

|

| 27,000

|

| -

|

|

|

|

|

|

|

|

|

|

|

Write-down of exploration and evaluation assets

| 5

|

| -

|

| (441,347)

|

| -

|

| (441,347)

|

Net loss for the period

|

| $

| (119,143)

| $

| (754,195)

| $

| (332,604)

| $

| (1,343,348)

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive loss

|

|

|

|

|

|

|

|

|

|

Exchange difference arising on the translation of foreign subsidiary

|

|

| (11,538)

|

| 20,801

|

| (30,346)

|

| 6,987

|

Total comprehensive loss for the period

|

| $

| (130,681)

| $

| (733,394)

| $

| (362,950)

| $

| (1,336,361)

|

Basic and diluted loss per common share

|

| $

| (0.00)

| $

| (0.00)

| $

| (0.00)

| $

| (0.01)

|

Weighted average number of common shares outstanding – basic and diluted

|

|

| 159,389,955

|

| 153,566,040

|

| 159,122,835

|

| 150,489,117

|

See accompanying notes to the condensed consolidated interim financial statements

SILVER NORTH RESOURCES LTD.

(Formerly Alianza Minerals Ltd.)

CONDENSED CONSOLIDATED INTERIM STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY

(Unaudited, presented in Canadian Dollars)

|

|

| Share Capital

|

| Reserves

|

| Accumulated Other Comprehensive Income (Loss)

|

|

|

|

| Note

| Number of shares

| Amount

|

| Equity settled employee benefits

| Warrants

| Finders' warrants

|

| Foreign exchange reserve

| Deficit

| Total equity

|

Balance, September 30, 2021 (Audited)

|

| 148,950,655

| $ 24,290,287

|

| $ 2,132,792

| $ 641,848

| $ 455,246

|

| $ (44,933)

| $ (19.557,631)

| $ 7,917,609

|

Private placements

| 7(b)(i)

| 10,000,000

| 600,000

|

| -

| 150,000

| -

|

| -

| -

| 750,000

|

Share issue costs

| 7(b)(i)

| -

| (14,370)

|

| -

| -

| -

|

| -

| -

| (14,370)

|

Share-based payments

| 8(a)

| -

| -

|

| 365,300

| -

| -

|

| -

| -

| 365,300

|

Net loss

|

| -

| -

|

| -

| -

| -

|

| 6,987

| (1,343,348)

| (1,336,361)

|

Balance, June 30, 2022 (Unaudited)

|

| 158,950,655

| 24,875,917

|

| 2,498,092

| 791,848

| 455,246

|

| (37,946)

| (20,900,979)

| 7,682,178

|

Share issue costs

| 7(b)(i)

| -

| (6,000)

|

| -

| -

| -

|

| -

| -

| (6,000)

|

Net loss

|

| -

| -

|

| -

| -

| -

|

| 22,420

| (708,642)

| (686,222)

|

Balance, September 30, 2022 (Audited)

|

| 158,950,655

| 24,869,917

|

| 2,498,092

| 791,848

| 455,246

|

| (15,526)

| (21,609,621)

| 6,989,956

|

Exercise of warrants

| 7(b)(ii)

| 439,300

| 21,965

|

| -

| -

| -

|

| -

| -

| 21,965

|

Net loss

|

| -

| -

|

| -

| -

| -

|

| (30,346)

| (332,604)

| (362,950)

|

Balance, June 30, 2023 (Unaudited)

|

| 159,389,955

| $ 24,891,882

|

| $ 2,498,092

| $ 791,848

| $ 455,246

|

| $ (45,872)

| $ (21,942,225)

| $ 6,648,971

|

Subsequently, on August 14, 2023, the Company’s shares were consolidated on a 5 for 1 basis (Note 15)

See accompanying notes to the condensed consolidated interim financial statements

SILVER NORTH RESOURCES LTD.

(Formerly Alianza Minerals Ltd.)

CONDENSED CONSOLIDATED INTERIM STATEMENTS OF CASH FLOWS

FOR THE NINE MONTHS ENDED JUNE 30

(Unaudited, presented in Canadian Dollars)

|

| Nine months ended June 30,

|

|

| 2023

| 2022

|

Cash flows from (used in) operating activities

|

|

|

|

|

|

Net loss for the period

|

| $

| (332,604)

| $

| (1,343,348)

|

Items not affecting cash:

|

|

|

|

|

|

Fair value (gain) loss on marketable securities

|

|

| (80,735)

|

| 110,000

|

Flow-through share premium recovery

|

|

| (4,221)

|

| (20,347)

|

Loss on transfer of marketable securities

|

|

| 30,052

|

| -

|

Other income

|

|

| (27,000)

|

| -

|

Proceeds received in excess of exploration and evaluation asset costs

|

|

| -

|

| (298,961)

|

Share-based payments

|

|

| -

|

| 365,300

|

Write-down of exploration and evaluation assets

|

|

| -

|

| 441,347

|

|

|

|

|

|

|

Changes in non-cash working capital items:

|

|

|

|

|

|

Receivables

|

|

| 73,581

|

| (1,113)

|

Due from alliance partner

|

|

| -

|

| 126,047

|

Due from optionee

|

|

| -

|

| 6,888

|

VAT Receivables

|

|

| (197)

|

| (394)

|

Prepaid expenses

|

|

| 59,891

|

| (87,356)

|

Accounts payable and accrued liabilities

|

|

| 64,356

|

| (34,269)

|

Due to related parties

|

|

| 43,450

|

| 64,596

|

Funds held for optionee

|

|

| (96,072)

|

| 25,837

|

Net cash (used in) operating activities

|

|

| (269,499)

|

| (645,773)

|

|

|

|

|

|

|

Cash flows from (used in) investing activities

|

|

|

|

|

|

Proceeds from sale of marketable securities

|

|

| 216,232

|

| -

|

Deposits

|

|

| 12,219

|

| (54,982)

|

Exploration and evaluation assets, net of recoveries

|

|

| (459,969)

|

| (221,414)

|

Net cash (used in) investing activities

|

|

| (231,518)

|

| (276,396)

|

|

|

|

|

|

|

Cash flows from financing activities

|

|

|

|

|

|

Proceeds from issuance of common shares

|

|

| -

|

| 750,000

|

Proceeds from exercise of warrants

|

|

| 21,965

|

| -

|

Share issue costs

|

|

| -

|

| (14,370)

|

Net cash provided by financing activities

|

|

| 21,965

|

| 735,630

|

|

|

|

|

|

|

Effect of exchange rate changes on cash

|

|

| (14,440)

|

| (4,487)

|

Change in cash for the period

|

|

| (493,492)

|

| (191,026)

|

Cash, beginning of the period

|

|

| 637,174

|

| 412,676

|

Cash, end of the period

|

| $

| 143,682

| $

| 221,650

|

Cash comprised of:

|

|

|

|

|

|

Cash

|

| $

| 5,673

| $

| 195,813

|

Restricted Cash

|

|

| 138,009

|

| 25,837

|

|

| $

| 143,682

| $

| 221,650

|

Supplemental disclosure with respect to cash flows (Note 10)

Cash includes $nil (2022 - $144,451) held to pay for flow-through expenditures. Amounts of $nil (2022 - $1,926) included in accounts payable and accrued liabilities relate to flow-through expenditures.

See accompanying notes to the condensed consolidated interim financial statements

SILVER NORTH RESOURCES LTD.

(Formerly Alianza Minerals Ltd.)

NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

FOR THE NINE MONTHS ENDED JUNE 30, 2023 AND 2022

(Unaudited, presented in Canadian Dollars)

1.NATURE OF OPERATIONS AND GOING CONCERN

Silver North Resources Ltd. (formerly Alianza Minerals Ltd., “Alianza”) (the “Company” or “Silver North”) was incorporated in Alberta on October 21, 2005 under the Business Corporations Act of Alberta and its registered office is Suite 410, 325 Howe Street, Vancouver, BC, Canada, V6C 1Z7. On April 25, 2008 the Company filed for a certificate of continuance and is continuing as a BC Company under the Business Corporations Act (British Columbia). The Company changed its name and consolidated its shares (“Consolidation”) on August 14, 2023 (see Note 15) and began trading on the TSX Venture Exchange (the “Exchange”) under the symbol “SNAG”.

The Company is an exploration stage company and is engaged principally in the acquisition and exploration of mineral properties. The recovery of the Company’s investment in its exploration and evaluation assets is dependent upon the future discovery, development and sale of minerals, upon the ability to raise sufficient capital to finance these activities, and/or upon the sale of these properties.

These condensed consolidated interim financial statements have been prepared in accordance with International Financial Reporting Standards (“IFRS”) applicable to a going concern, which assumes that the Company will be able to realize its assets and discharge its liabilities in the normal course of business for the foreseeable future. The ability of the Company to continue as a going concern is dependent on obtaining additional financing through the issuance of common shares or obtaining joint venture or property sale agreements for one or more properties.

There can be no assurance that the Company will be able to continue to raise funds in which case the Company may be unable to meet its obligations. Should the Company be unable to realize on its assets and discharge its liabilities in the normal course of business, the net realizable value of its assets may be materially less than the amounts recorded on the condensed consolidated interim statement of financial position. The condensed consolidated interim financial statements do not include adjustments to amounts and classifications of assets and liabilities that might be necessary should the Company be unable to continue operations.

Adverse financial market conditions and volatility increase the uncertainty of the Company’s ability to continue as a going concern given the need to both manage expenditures and to raise additional funds. The Company is experiencing, and has experienced, negative operating cash flows. The Company will continue to search for new or alternate sources of financing but anticipates that the current market conditions may impact the ability to source such funds. Accordingly, these material uncertainties may cast significant doubt upon the Company’s ability to continue as a going concern.

As at June 30, 2023, the Company had working capital deficiency of $531,853 (September 30, 2022: $171,465) and shareholders’ equity of $6,648,971 (September 30, 2022: $6,989,956).

2.BASIS OF PREPARATION

Statement of Compliance

These condensed consolidated interim financial statements, including comparatives, have been prepared in accordance with International Accounting Standard 34 “Interim Financial Reporting” (“IAS 34”) using accounting policies consistent with IFRS issued by the International Accounting Standards Board (“IASB”) and interpretations of the International Financial Reporting Interpretations Committee (“IFRIC”).

SILVER NORTH RESOURCES LTD.

(Formerly Alianza Minerals Ltd.)

NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

FOR THE NINE MONTHS ENDED JUNE 30, 2023 AND 2022

(Unaudited, presented in Canadian Dollars)

2.BASIS OF PREPARATION - continued

Basis of preparation

These condensed consolidated interim financial statements have been prepared on a historical cost basis except for marketable securities classified as available-for-sale, which are stated at fair value through other comprehensive income (loss). In addition, these condensed consolidated interim financial statements have been prepared using the accrual basis of accounting, except for cash flow information.

The preparation of these condensed consolidated interim financial statements in conformity with IAS 34 requires management to make judgements, estimates and assumptions that affect the application of policies and reported amounts of assets and liabilities, income and expenses. Actual results may differ from these estimates. These condensed consolidated interim financial statements do not include all of the information required for full annual financial statements.

These condensed consolidated interim financial statements, including comparatives, have been prepared on the basis of IFRS standards that are published at the time of preparation.

New accounting standards and interpretations

Certain new accounting standards and interpretations have been published that are not mandatory for the June 30, 2023 reporting period. The Company has not early adopted the following new and revised standards, amendments and interpretations that have been issued but are not yet effective:

·Presentation of financial statements

An amendment to IAS 1 was issued in January 2020 and applies to annual reporting periods beginning on or after January 1, 2023. The amendment clarifies the criterion for classifying a liability as non-current relating to the right to defer settlement of a liability for at least 12 months after the reporting period.

The Company anticipates that the application of the above new and revised standards, amendments and interpretations will have no material impact on its results and financial position.

3.SIGNIFICANT ACCOUNTING POLICIES

These unaudited condensed consolidated interim financial statements have been prepared in accordance with IFRS as issued by the IASB on a basis consistent with those followed in the Company’s most recent annual financial statements for the year ended September 30, 2022.

These unaudited condensed consolidated interim financial statements do not include all note disclosures required by IFRS for annual financial statements, and therefore should be read in conjunction with the annual financial statements for the year ended September 30, 2022. In the opinion of management, all adjustments considered necessary for fair presentation of the Company’s financial position, results of operations and cash flows have been included. Operating results for the nine-month period ended June 30, 2023 are not necessarily indicative of the results that may be expected for the current fiscal year ending September 30, 2023.

SILVER NORTH RESOURCES LTD.

(Formerly Alianza Minerals Ltd.)

NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

FOR THE NINE MONTHS ENDED JUNE 30, 2023 AND 2022

(Unaudited, presented in Canadian Dollars)

4.MARKETABLE SECURTIES

On February 3, 2022, the Company received 1,000,000 shares of Volt Lithium Corp. (formerly known as Allied Copper Corp.) (“Volt” or “Allied”) valued at $225,000 pursuant to an option agreement entered into in 2021 for the Klondike property (Note 5(c)(ii)). On September 8, 2022, the Company received 250,000 Allied shares valued at $42,500 pursuant to an option agreement entered into in 2022 for the Stateline property (Note 5(c)(iii)).

On August 8, 2022, the Company paid the finders for the Klondike property by transferring 94,293 Allied shares at a value of $20,800 (US$16,000) with a loss on the transfer of Allied shares of $416 recognized.

On March 29, 2023, the Company received 75,000 shares of Highlander Silver Corp. (“Highlander”) valued at $12,000 pursuant to a data purchase agreement (Note 5(d)(v)).

The shares are measured and presented at fair value using the observable market share price as at the dates of the statements of financial position. The gain or loss as a result of the re-measurement is recorded in profit and loss.

| June 30, 2023

| Number of

Shares

| Cost

| Fair Value

|

| Highlander Silver Corp.

| 75,000

| $ 12,000

| $ 8,250

|

| September 30, 2022

| Number of

Shares

| Cost

| Fair Value

|

| Allied Copper Corp.

| 1,155,707

| $ 246,284

| $ 161,799

|

|

| June 30, 2023

| June 30, 2022

|

| Net changes in fair value of marketable securities

through profit and loss:

|

|

|

| Beginning of the period

| $

| 161,799

| $

| -

|

| Shares received

|

| 12,000

|

| 225,000

|

| Shares sold

|

| (246,284)

|

| -

|

| Change in unrealized gain (loss)

|

| 80,735

|

| (110,000)

|

| Value at June 30, 2023 and 2022

| $

| 8,250

| $

| 115,000

|

SILVER NORTH RESOURCES LTD.

(Formerly Alianza Minerals Ltd.)

NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

FOR THE NINE MONTHS ENDED JUNE 30, 2023 AND 2022

(Unaudited, presented in Canadian Dollars)

5.EXPLORATION AND EVALUATION ASSETS

The Company typically obtains its mineral exploration rights by way of direct acquisition from government regulatory authorities, outright purchases from third parties, or by entering into option agreements to acquire such rights subject to future consideration, often inclusive of requirements to complete exploration work on such properties. Such costs, when subsequently incurred by the Company, are also capitalized as non-current assets and included within the Exploration and Evaluation category. The Company will, and has, also subsequently entered into arrangements with other parties to vend certain of these interests utilizing similar mechanisms, based on management’s assessment of what is advantageous to the Company.

Although the Company has taken steps to verify title to its unproven mineral right interests, these procedures do not guarantee the Company's title. Such properties may be subject to prior agreements or transfers and title may be affected by undetected defects.

The Company’s major mineral property interests are its Haldane and Tim silver properties located in the Yukon Territory of Canada while it also has other mineral property interests in North and South America. Following are summary tables of exploration and evaluation assets and brief summary descriptions of each of the exploration and evaluation assets:

SILVER NORTH RESOURCES LTD.

(Formerly Alianza Minerals Ltd.)

NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

FOR THE NINE MONTHS ENDED JUNE 30, 2023 AND 2022

(Unaudited, presented in Canadian Dollars)

5.EXPLORATION AND EVALUATION ASSETS – continued

Exploration and Evaluation Assets for the period ended June 30, 2023

| Haldane

| Tim

| Others

| Total

|

|

|

|

|

|

|

|

|

|

Balance at September 30, 2022

| $

| 4,963,946

| $

| (49,949)

| $

| 2,111.518

| $

| 7,025,515

|

|

|

|

|

|

|

|

|

|

Additions during the period

|

|

|

|

|

|

|

|

|

Acquisition costs:

|

|

|

|

|

|

|

|

|

Claim staking

|

| -

|

| -

|

| 5,799

|

| 5,799

|

|

| -

|

| -

|

| 5,799

|

| 5,799

|

|

|

|

|

|

|

|

|

|

Exploration expenditures:

|

|

|

|

|

|

|

|

|

Camp, travel and meals

|

| 14,293

|

| -

|

| 13,860

|

| 28,153

|

Drilling

|

| -

|

| -

|

| 19,301

|

| 19,301

|

Field equipment rental

|

| -

|

| -

|

| 6,864

|

| 6,864

|

Field supplies and maps

|

| 297

|

| -

|

| 143

|

| 440

|

Geochemical

|

| 4,868

|

| -

|

| 11,538

|

| 16,406

|

Geological consulting

|

| 53,956

|

| 4,031

|

| 28,243

|

| 86,230

|

Legal and accounting

|

| -

|

| -

|

| 6,158

|

| 6,158

|

Licence and permits

|

| -

|

| -

|

| 7,889

|

| 7,889

|

Management fees

|

| -

|

| -

|

| 15,054

|

| 15,054

|

Permitting

|

| -

|

| 12,000

|

| 31,094

|

| 43,094

|

Reclamation

|

| -

|

| -

|

| 702

|

| 702

|

Reporting, drafting, sampling and analysis

|

| -

|

| -

|

| 298

|

| 298

|

|

| 73,414

|

| 16,031

|

| 141,144

|

| 230,589

|

Less:

|

|

|

|

|

|

|

|

|

Recovered exploration expenditures

|

| -

|

| (50,000)

|

| (133,617)

|

| (183,617)

|

|

|

|

|

|

|

|

|

|

Net additions

|

| 73,414

|

| (33,969)

|

| 13,326

|

| 52,771

|

|

|

|

|

|

|

|

|

|

Foreign currency translation

|

|

|

| -

|

| (20,866)

|

| (20,866)

|

|

|

|

|

|

|

|

|

|

Balance at June 30, 2023

| $

| 5,037,360

| $

| (83,918)

| $

| 2,103,978

| $

| 7,057,420

|

SILVER NORTH RESOURCES LTD.

(Formerly Alianza Minerals Ltd.)

NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

FOR THE NINE MONTHS ENDED JUNE 30, 2023 AND 2022

(Unaudited, presented in Canadian Dollars)

5.EXPLORATION AND EVALUATION ASSETS – continued

Exploration and Evaluation Assets for the year ended September 30, 2022

| Haldane

| Tim

| Others

| Dropped /

Disposed

| Total

|

|

|

|

|

|

|

|

|

|

|

|

Balance at September 30, 2021

| $

| 4,648,181

| $

| (9,949)

| $

| 2,048,745

| $

| 1,021,402

| $

| 7,708,379

|

|

|

|

|

|

|

|

|

|

|

|

Additions during the year

|

|

|

|

|

|

|

|

|

|

|

Acquisition costs:

|

|

|

|

|

|

|

|

|

|

|

Claim staking

|

| -

|

| -

|

| 880

|

| -

|

| 880

|

Property acquisition

|

| -

|

|

|

| 91.837

|

| -

|

| 91,837

|

|

| -

|

| -

|

| 92,717

|

| -

|

| 92,717

|

|

|

|

|

|

|

|

|

|

|

|

Exploration expenditures:

|

|

|

|

|

|

|

|

|

|

|

Aircraft charter

|

| 1,066

|

| -

|

| -

|

| -

|

| 1,066

|

Camp, travel and meals

|

| 30,005

|

| -

|

| 51,703

|

| -

|

| 81,708

|

Drilling

|

| 55,332

|

| -

|

| 591,169

|

| -

|

| 646,501

|

Field equipment rental

|

| 11,731

|

| -

|

| 27,769

|

| -

|

| 39,500

|

Field supplies and maps

|

| 786

|

| -

|

| 7,566

|

| -

|

| 8,352

|

Geochemical

|

| -

|

| -

|

| 1,942

|

| -

|

| 1,942

|

Geological consulting

|

| 179,177

|

| -

|

| 116,575

|

| 4,206

|

| 299,958

|

Legal and accounting

|

| -

|

| -

|

| 11,662

|

| -

|

| 11,662

|

Licence and permits

|

| -

|

| -

|

| 59,257

|

| -

|

| 59,257

|

Management fees

|

| -

|

| -

|

| 19,875

|

| -

|

| 19,875

|

Permitting

|

| 13,823

|

| -

|

| 122,796

|

| 2,500

|

| 139,119

|

Reclamation

|

| -

|

| -

|

| 10,525

|

| -

|

| 10,525

|

Reporting, drafting, sampling and analysis

|

| 23,845

|

| -

|

| 13,431

|

| -

|

| 37,276

|

Trenching

|

| -

|

|

|

| 87,008

|

| -

|

| 87,008

|

|

| 315,765

|

| -

|

| 1,121,278

|

| 6,706

|

| 1,443,749

|

Less:

|

|

|

|

|

|

|

|

|

|

|

Option payment received

|

| -

|

| -

|

| (412,500)

|

| -

|

| (412,500)

|

Proceeds received in excess of exploration and

evaluation asset costs – recognized as income

|

| -

|

| -

|

| 341,966

|

| -

|

| 341,966

|

Recovered exploration expenditures

|

| -

|

| (40,000)

|

| (1,117,966)

|

| -

|

| (1,157,966)

|

Write-down of properties

|

| -

|

| -

|

| -

|

| (1,038,046)

|

| (1,038,046)

|

|

|

|

|

|

|

|

|

|

|

|

Net additions

|

| 315,765

|

| (40,000)

|

| 25,495

|

| (1,031,340)

|

| (730,080)

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation

|

|

|

| -

|

| 37,278

|

| 9,938

|

| 47,216

|

|

|

|

|

|

|

|

|

|

|

|

Balance at September 30, 2022

| $

| 4,963,946

| $

| (49,949)

| $

| 2,111,518

| $

| -

| $

| 7,025,515

|

SILVER NORTH RESOURCES LTD.

(Formerly Alianza Minerals Ltd.)

NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

FOR THE NINE MONTHS ENDED JUNE 30, 2023 AND 2022

(Unaudited, presented in Canadian Dollars)

5.EXPLORATION AND EVALUATION ASSETS – continued

(a)Haldane

On March 2, 2018, the Haldane property was purchased from Equity Exploration Consultants Ltd. (“Equity”), and is located in Yukon Territory, Canada. Equity has a 2% NSR royalty on the Haldane property and is entitled to receiving bonus share payments from the Company:

oissue 50,000 post-Consolidation shares to Equity upon the public disclosure of a Measured Mineral Resource (as such term is defined in National Instrument 43-101- Standards of Disclosure for Mineral Projects) of 5 million oz silver-equivalent at 500g/t silver-equivalent; and

o100,000 post-Consolidation shares to be issued upon the decision to commence construction of a mine or processing plant.

On April 12, 2018, the Company purchased the Nur, Clarkston and Fara claims which are contiguous to and grouped with the Haldane property from the estate of Yukon prospector John Peter Ross (the “Estate”). The Estate is entitled to receiving bonus share payments from the Company:

oissue 50,000 post-Consolidation shares to the Estate upon the public disclosure of a Measured Mineral Resource (as such term is defined in National Instrument 43-101- Standards of Disclosure for Mineral Projects) of 5 million oz silver-equivalent at 500g/t silver-equivalent; and

o100,000 post-Consolidation shares to be issued upon the decision to commence construction of a mine or processing plant.

As of June 30, 2023, the Company had spent $5,037,360 (September 30, 2022 - $4,963,946) on advancing this property, including the acquisition costs.

(b)Tim

On January 24, 2020, the Company entered into an option agreement with a wholly owned subsidiary of Coeur Mining Inc. (“Coeur”) to explore the Tim property in southern Yukon.

Coeur can earn an initial 51% interest in the Tim property by (i) financing $3.55-million in exploration over five years and (ii) making scheduled cash payments totalling $275,000 over five years as follows.

Date/Period

| Expenditures

| Option Payment

|

On the Effective Date

| None

| $10,000 (received)

|

On or before 1st anniversary of the Class 1 Notification Date

| $50,000

| $15,000 (received)

|

On or before 2nd anniversary of the Class 1 Notification Date

| $500,000

| $25,000 (received)

|

On or before 3rd anniversary of the Class 1 Notification Date

| $500,000

| $50,000 (received)

|

On or before 4th anniversary of the Class 1 Notification Date

| $1,000,000

| $75,000

|

On or before 5th anniversary of the Class 1 Notification Date

| $1,500,000

| $100,000

|

(*) Class 1 Notification Date is December 16, 2020.

SILVER NORTH RESOURCES LTD.

(Formerly Alianza Minerals Ltd.)

NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

FOR THE NINE MONTHS ENDED JUNE 30, 2023 AND 2022

(Unaudited, presented in Canadian Dollars)

5.EXPLORATION AND EVALUATION ASSETS – continued

(b)Tim – continued

As of the 2nd Anniversary of the Class 1 Notification Date, Coeur had only made exploration expenditures totalling $377,702 of the $550,000 required under the agreement due to the delays in receiving a Class 3 exploration permit that would allow for a drill program at Tim. Silver North has deferred the requirement and rolled it into the 3rd Anniversary exploration requirements. Coeur will add the remaining $172,298 in expenditures to the $500,000 requirement for the current year, once the Class 3 exploration permit has been received.

After earning an initial 51% interest in the property, to increase its interest to 80%, Coeur must finance a feasibility study and notify the Company of its intention to develop a commercial mine on the property on or before the eighth anniversary from the date of notification of the Class 1 exploration permit, as well as pay an additional $300,000 to the Company as follows:

Date/Period

| Option Payment

|

On or before 6th anniversary of the Class 1 Notification Date

| $100,000

|

On or before 7th anniversary of the Class 1 Notification Date

| $100,000

|

On or before 8th anniversary of the Class 1 Notification Date

| $100,000

|

(c)Others

i.Twin Canyon (Colorado)

On June 17, 2020, the Company acquired a lease of the Twin Canyon gold property in southwest Colorado from Myron Goldstein and Jon Thorson (“Goldstein and Thorson”). Goldstein and Thorson are entitled to receiving further share payments from the Company:under the following terms:

·100,000 post-Consolidation shares on the date that is five business days following the date that the Company enters into a joint venture, option or similar agreement with a third party in respect of the property; and

·100,000 post-Consolidation shares on the date that is five business days following the date that the Company, directly or indirectly, commence a drill program in respect of the property.

The Company agreed to assume the terms of Goldstein and Thorson’s commitments under the lease, namely the annual lease payments of US$15,000 for ten years, with the right to extend the lease for two additional terms of ten years each. The original property owner has a 1.5% NSR on the property, two-thirds (1%) of which is purchasable at any time for US$1,000,000. If annual NSR payments exceed US$20,000 in a given year, the Company will not have to make the annual US$15,000 lease payment for that year.

As of June 30, 2023, the Company had spent $633,055 (September 30, 2022 - $651,660) on advancing this property, including the acquisition costs.

SILVER NORTH RESOURCES LTD.

(Formerly Alianza Minerals Ltd.)

NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

FOR THE NINE MONTHS ENDED JUNE 30, 2023 AND 2022

(Unaudited, presented in Canadian Dollars)

5.EXPLORATION AND EVALUATION ASSETS – continued

(c)Others – continued

ii.Klondike (Colorado)

The Company acquired the Klondike property by staking a 100% interest in this property in Colorado.

On June 7, 2021, the Company and Cloudbreak Discovery PLC (“Cloudbreak”) entered into an agreement whereby either company can introduce projects to a Strategic Alliance. Projects accepted into the Strategic Alliance will be held 50/50 as to beneficial ownership but funding of the initial acquisition and any preliminary work programs will be funded 40% by the introducing partner and 60% by the other party. The initial term of the Strategic Alliance is two years and may be extended for an additional two years. The Strategic Alliance is not a separate legal entity of any kind and represents a cost-sharing arrangement only.

The Company and Cloudbreak agreed to accept the Klondike property as part of the Strategic Alliance. During the nine months ended June 30, 2023, Cloudbreak was invoiced $nil (US$nil) (2022 - $12,168 [US$9,443]) for reimbursements related to the Klondike property pertaining to the Strategic Alliance.

On December 3, 2021, as amended February 1, 2022, the Company and Cloudbreak entered into an option agreement, pursuant to which it granted Volt an option to earn a 100% interest in the Klondike property. The Company and Cloudbreak are to each receive 50% of the option payments.

Volt could earn a 100% interest in the Klondike property by (i) incurring $4.75 million in exploration expenditures on the property over four years, with expenditure shortfalls able to be paid in cash to the Company and Cloudbreak, (ii) issuing 7 million common shares over two years, (iii) making cash payments totaling $400,000 over four years and (iv) issuing 3,000,000 warrants exercisable for a three-year term at a price equal to the greater of (i) $0.23 and (ii) the 10-day VWAP of Volt’s common shares at the time of the issuance, as follows:

Date/Period

| Expenditures

| Option Payment

|

Cash

| Shares

| Warrants

|

On the Effective Date

| None

| $50,000 (Company’s portion of $25,000 received)

| None

| None

|

On the Closing Date (February 3, 2022)

| None

| $150,000 (Company’s portion of $75,000 received)

| 2,000,000 (Company’s portion of 1,000,000 shares received)

| None

|

On or before 1st anniversary of the Closing Date

| $500,000

| None

| 2,000,000

| None

|

On or before 2nd anniversary of the Closing Date

| $750,000

| None

| 3,000,000

| None

|

On or before 3rd anniversary of the Closing Date

| $1,500,000

| $100,000

| None

| 3,000,000

|

On or before 4th anniversary of the Closing Date

| $2,000,000

| $100,000

| None

| None

|

SILVER NORTH RESOURCES LTD.

(Formerly Alianza Minerals Ltd.)

NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

FOR THE NINE MONTHS ENDED JUNE 30, 2023 AND 2022

(Unaudited, presented in Canadian Dollars)

5.EXPLORATION AND EVALUATION ASSETS – continued

(c)Others – continued

ii.Klondike (Colorado) – continued

On February 2, 2023, Volt terminated the option agreement and the Company and Cloudbreak now retain a 100% interest in this property.

As at June 30, 2023, Volt had forwarded a total of $1,239,280 (US$915,747) for reimbursements related to the Klondike property and the Company held $135,710 (US$102,500) (September 30, 2022 - $226,663 [US$165,364]) of restricted cash on behalf of Volt to be spent on the Klondike property for the purpose of reclamation and claim maintenance costs for 2 years as per the terms of the agreement, which is recorded as restricted cash.

iii.Stateline (Colorado and Utah)

The Company acquired the Stateline property by staking a 100% interest in this property in Colorado and Utah.

The Company and Cloudbreak agreed to accept the Stateline property as part of the Strategic Alliance. During the nine months ended June 30, 2023, Cloudbreak was invoiced $nil (US$nil) (2022 - $18,455 [US$14,796]) for reimbursements related to the Stateline property pertaining to the Strategic Alliance.

On February 9, 2022, the Company and Cloudbreak entered into an option agreement with Volt to explore the Stateline property with the following terms where the Company and Cloudbreak will each receive 50% of the option payments:

Volt could earn a 100% interest in the Stateline property by (i) incurring $3.75-million in exploration expenditures on the property over four years, with expenditure shortfalls able to be paid in cash to the Company and Cloudbreak, (ii) issuing 4.25 million common shares and (iii) making cash payments totaling $315,000 over three years, as follows.

Date/Period

| Expenditures

| Option Payment

|

Cash

| Shares

|

On the Effective Date

| None

| $40,000 (Company’s portion of $20,000 received)

| None

|

On the Closing Date (September 8, 2022)

| None

| $50,000 (Company’s portion of $25,000 received)

| 500,000 (Company’s portion of 250,000 shares received)

|

On or before 1st anniversary of the Closing Date

| $500,000

| $50,000

| 750,000

|

On or before 2nd anniversary of the Closing Date

| $750,000

| $75,000

| 1,500,000

|

On or before 3rd anniversary of the Closing Date

| $1,000,000

| $100,000

| 1,500,000

|

On or before 4th anniversary of the Closing Date

| $1,500,000

| None

| None

|

SILVER NORTH RESOURCES LTD.

(Formerly Alianza Minerals Ltd.)

NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

FOR THE NINE MONTHS ENDED JUNE 30, 2023 AND 2022

(Unaudited, presented in Canadian Dollars)

5.EXPLORATION AND EVALUATION ASSETS – continued

(c)Others – continued

iii.Stateline (Colorado and Utah) – continued

As of June 30, 2023, Volt had forwarded a total of $100,175 (US$74,023) for reimbursements related to the Stateline property. The Company held $2,299 (US$1,737) (September 30, 2022 - $7,418 [US$5,412]) of restricted cash on behalf of Volt to be spent on the Stateline property, which is recorded as restricted cash.

Subsequently, on August 11, 2023, Volt terminated the option agreement and the Company and Cloudbreak now retain a 100% interest in this property.

iv.Ashby (Nevada)

On January 27, 2015, the Company signed a binding agreement to acquire the Ashby gold property from Sandstorm Gold Ltd. (“Sandstorm”) and granted Sandstorm a right of first refusal on any future metal streaming agreements.

On August 2, 2017, the Company signed an exploration lease agreement to lease the Ashby property to Nevada Canyon Gold Corp. (“Nevada Canyon”). Under the terms of the agreement, Nevada Canyon made a US$1,000 payment on signing, will make annual payments of US$2,000 and will grant a 2% Net Smelter Royalty (“NSR”) on future production from the Lazy 1-3 claims comprising the Ashby property. Nevada Canyon will also be responsible for all claim fees and certain reclamation work to be undertaken on the property. The initial term of the lease is 10 years and can be extended for an additional 20 years.

A 2% NSR is payable to Nevada Eagle Resources LLC (“NER”) and a 1% NSR is payable to Sandstorm on production from the property.

During the year ended September 30, 2022, Nevada Canyon reimbursed the Company $3,304 which includes US$543 for the 2022 annual property claim fee and US$2,000 for the 2022 annual payment. Subsequent to June 30, 2023, the Nevada Canyon reimbursed the Company $3,391 which includes US$543 for the 2023 annual property claim fee and US$2,000 for the 2023 annual payment.

v.BP (Nevada)

On June 10, 2013, the Company purchased from Almaden Minerals Ltd. (“Almaden”) the BP property in Nevada, USA. A 2% NSR is payable to Almadex Minerals Limited (“Almadex”) on future production on the property after Almaden transferred the NSR right to Almadex.

In 2017, the Company acquired new ground by staking additional BLM Iode mining claims at the BP property.

vi.East Walker (Nevada)

On January 27, 2015, the Company signed a binding agreement to acquire the East Walker property from Sandstorm. The East Walker property is located in Lyon County, west of Hawthorne. A 2% NSR is payable to NER from production from some claims on the property and a 1% NSR is payable to Sandstorm from all the claims on the property.

SILVER NORTH RESOURCES LTD.

(Formerly Alianza Minerals Ltd.)

NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

FOR THE NINE MONTHS ENDED JUNE 30, 2023 AND 2022

(Unaudited, presented in Canadian Dollars)

5.EXPLORATION AND EVALUATION ASSETS – continued

(c)Others – continued

vii.White River, Goz Creek and MOR (Yukon)

In 2010, the Company acquired the White River property through staking. The White River property is located in the Yukon Territory, northwest of Whitehorse.

On July 23, 2007, the Company purchased from Almaden certain properties in the Yukon and Almaden assigned the 2% NSR royalty on future production from these mineral claims to Almadex:

·Goz Creek – located 180 kilometers north east of Mayo, Yukon.

·MOR – located 35 kilometers east of Teslin, Yukon and is 1.5 kilometers north of the paved Alaska Highway.

As of June 30, 2023, the Company had spent $1,045,224 (September 30, 2022 - 1,071,213) on advancing these properties, net of recoveries.

viii.Mexico

The Company holds a 1% Net Smelter Royalty on certain Mexican properties which is capped at $1,000,000.

ix.Peru

The Company holds a 1.08% Net Smelter Royalty on the Pucarana project in central Peru.

(d)Dropped / disposed properties

i.Horsethief (Nevada)

On January 27, 2015, the Company signed a binding agreement to acquire the Horsethief property from Sandstorm. During the year ended September 30, 2022, the Company dropped the Horsethief property and wrote off $146,089 of capitalized exploration and evaluation costs.

ii.Bellview (Nevada)

On January 27, 2015, the Company signed a binding agreement to acquire the Bellview property from Sandstorm. During the year ended September 30, 2022, the Company dropped the Bellview property and wrote off $110,687 of capitalized exploration and evaluation costs.

iii.KRL (British Columbia)

On September 1, 2018, the Company optioned the KRL property in British Columbia’s prolific Golden Triangle from prospector Bernie Kreft (“Kreft”) by making certain cash and share payments over four years as well as certain milestone payments. During the year ended September 30, 2022, the Company dropped the KRL property and wrote off $336,975 of capitalized exploration and evaluation costs.

SILVER NORTH RESOURCES LTD.

(Formerly Alianza Minerals Ltd.)

NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

FOR THE NINE MONTHS ENDED JUNE 30, 2023 AND 2022

(Unaudited, presented in Canadian Dollars)

5.EXPLORATION AND EVALUATION ASSETS – continued

(d)Dropped / disposed properties – continued

iv.Yanac (Peru)

On April 29, 2015, the Company acquired the Yanac property which is located in Chincha region of the Department of Ica, south-central Peru. During the year ended September 30, 2022, the Company dropped Yanac property and wrote off $444,295 of capitalized exploration and evaluation costs.

v.La Estrella (Peru)

On March 23, 2023, the Company sold its project data associated with the La Estrella project in Peru to Highlander in consideration for the payment of $15,000 (received) and the issuance of 75,000 common shares of Highlander (received and valued at $12,000) (Note 4).

6.DEPOSITS

As of June 30, 2023, the Company has a US$60,218 ($79,729) performance bond with the State of Colorado Board of Land Commissioners and Colorado Division of Reclamation, Mining and Safety for the Klondike property, Stateline property and Twin Canyon property (September 30, 2022 - US$58,218 ($79,799)) and a $nil reclamation bond with the Ministry of Energy, Mines and Low Carbon Innovation for the KRL property (September 30, 2022 - $14,921).

7.SHARE CAPITAL

a)Authorized:

As at June 30, 2023, the authorized share capital is comprised of an unlimited number of common shares without par value and an unlimited number of preferred shares issuable in series. All issued shares are fully paid. Effective August 14, 2023, the Company consolidated its common shares on a 5 for 1 basis (Note 15). All references to the number of shares and per-share amounts have not been restated yet to reflect this share consolidation.

b)Issued:

During the year ended September 30, 2022, the Company:

i)Completed a non-brokered private placement on May 19, 2022 by issuing 10,000,000 units (“Unit”) at a price of $0.075 per Unit for gross proceeds of $750,000. Each Unit consists of one common share and one-half common share purchase warrant. Each warrant entitles the holder to purchase one additional common share for a 36-month period at a price of $0.125. Under the residual value approach, $150,000 was assigned to the warrant component of the Units. The Company incurred share issue costs of $20,370 in connection with this financing.

During the nine months ended June 30, 2023, the Company:

ii)Issued common shares pursuant to the exercise of 439,300 warrants for cash proceeds of $21,965.

SILVER NORTH RESOURCES LTD.

(Formerly Alianza Minerals Ltd.)

NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

FOR THE NINE MONTHS ENDED JUNE 30, 2023 AND 2022

(Unaudited, presented in Canadian Dollars)

8.STOCK OPTIONS AND WARRANTS

a)Stock option compensation plan

The Company grants stock options to directors, officers, employees and consultants pursuant to the Company’s Stock Option Plan (the “Plan”). The number of options that may be issued pursuant to the Plan are limited to 10% of the Company’s issued and outstanding common shares and to other restrictions with respect to any single participant (not greater than 5% of the issued common shares) or any one consultant (not greater than 2% of the issued common shares).

Options granted to consultants performing investor relations activities will contain vesting provisions such that vesting occurs over at least 12 months with no more than one quarter of the options vesting in any 3-month period.

Vesting provisions may also be applied to other option grants, at the discretion of the directors. Options issued pursuant to the Plan will have an exercise price as determined by the directors, and permitted by the TSX-V, at the time of the grant. Options have a maximum expiry date of 5 years from the grant date.

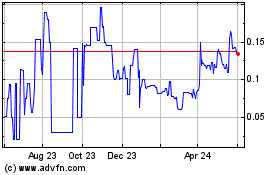

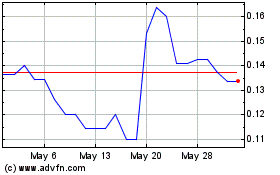

Stock option transactions and the number of stock options for the nine months ended June 30, 2023 are summarized as follows:

| Expiry date

| Exercise price

| September 30, 2022

| Granted

| Exercised

| Expired / cancelled

| June 30,

2023

|

| March 14, 2023

| $0.10

| 840,000

| -

| -

| (840,000)

| -

|

| July 30, 2024

| $0.10

| 1,725,000

| -

| -

| -

| 1,725,000

|

| October 15, 2025

| $0.14

| 2,005,000

| -

| -

| -

| 2,005,000

|

| January 18, 2027

| $0.10

| 5,800,000

| -

| -

| -

| 5,800,000

|

| March 17, 2027

| $0.10

| 500,000

| -

| -

| -

| 500,000

|

| Options outstanding

|

| 10,870,000

| -

| -

| (840,000)

| 10,030,000

|

| Options exercisable

|

| 10,870,000

| -

| -

| (840,000)

| 10,030,000

|

| Weighted average exercise price

|

| $0.11

| $Nil

| $Nil

| $0.10

| $0.11

|

SILVER NORTH RESOURCES LTD.

(Formerly Alianza Minerals Ltd.)

NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

FOR THE NINE MONTHS ENDED JUNE 30, 2023 AND 2022

(Unaudited, presented in Canadian Dollars)

8.STOCK OPTIONS AND WARRANTS – continued

a)Stock option compensation plan – continued

As at June 30, 2023, the weighted average contractual remaining life of options is 2.89 years (September 30, 2022 – 3.39 years). The weighted average fair value of stock options granted during the nine months ended June 30, 2023 was $nil (2022 - $0.06).

Subsequently, on August 14, 2023, the Company’s options were consolidated on a 5 for 1 basis and the exercise prices were reflected as such (Note 15). All references to the number of options and exercise prices have not been restated yet to reflect this share consolidation.

Stock option transactions and the number of stock options for the year ended September 30, 2022 are summarized as follows:

| Expiry date

| Exercise price

| September 30, 2021

| Granted

| Exercised

| Expired / cancelled

| September 30,

2022

|

| March 14, 2023

| $0.10

| 840,000

| -

| -

| -

| 840,000

|

| July 30, 2024

| $0.10

| 1,725,000

| -

| -

| -

| 1,725,000

|

| October 15, 2025

| $0.14

| 2,005,000

| -

| -

| -

| 2,005,000

|

| January 18, 2027

| $0.10

| -

| 5,800,000

| -

| -

| 5,800,000

|

| March 17, 2027

| $0.10

| -

| 500,000

| -

| -

| 500,000

|

| Options outstanding

|

| 4,570,000

| 6,300,000

| -

| -

| 10,870,000

|

| Options exercisable

|

| 4,570,000

| 6,300,000

| -

| -

| 10,870,000

|

| Weighted average exercise price

|

| $0.12

| $0.10

| $Nil

| $Nil

| $0.11

|

The weighted average assumptions used to estimate the fair value of options for the nine months ended June 30, 2023 and 2022 were as follows:

|

| June 30, 2023

| June 30, 2022

|

| Risk-free interest rate

| n/a

| 1.32% - 1.34%

|

| Expected life

| n/a

| 5 years

|

| Expected volatility

| n/a

| 104.30% - 104.41%

|

| Expected dividend yield

| n/a

| nil

|

b)Warrants

The continuity of warrants for the nine months ended June 30, 2023 is as follows:

| Expiry date

|

| Exercise price

| September 30, 2022

| Issued

| Exercised

| Expired

| June 30,

2023

|

| October 9, 2022

|

| $0.20

| 3,835,186

| -

| -

| (3,835,186)

| -

|

| March 15, 2023

| (a)

| $0.05

| 19,100,000

| -

| (439,300)

| (18,660,700)

| -

|

| May 19, 2025

|

| $0.125

| 5,000,000

| -

| -

| -

| 5,000,000

|

| March 15, 2025

| (b)

| $0.10

| -

| 439,300

| -

|

| 439,300

|

| Outstanding

|

|

| 27,935,186

| 439,300

| (439,300)

| (22,495,886)

| 5,439,300

|

| Weighted average exercise price

|

|

| $0.12

| $0.10

| $0.05

| $0.08

| $0.12

|

(a)On February 15, 2023, the exercise price of the 19,100,000 warrants was amended from $0.10 to $0.05 and the expiry date was extended to March 15, 2023.

(b)Pursuant to the warrant incentive program, 439,300 warrants were exercised for 439,300 common shares and 439,300 incentive warrants at a price of $0.10 expiring on March 15, 2025.

SILVER NORTH RESOURCES LTD.

(Formerly Alianza Minerals Ltd.)

NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

FOR THE NINE MONTHS ENDED JUNE 30, 2023 AND 2022

(Unaudited, presented in Canadian Dollars)

8.STOCK OPTIONS AND WARRANTS - continued

b)Warrants – continued

As at June 30, 2023, the weighted average contractual remaining life of warrants is 1.87 years (September 30, 2022 – 0.75 years).

Subsequently, on August 14, 2023, the Company’s warrants were consolidated on a 5 for 1 basis and the exercise prices were reflected as such (Note 15). All references to the number of warrants and exercise prices have not been restated yet to reflect this share consolidation.

The continuity of warrants for the year ended September 30, 2022 is as follows:

Warrants

| Expiry date

| Exercise price

| September 30, 2021

| Issued

| Exercised

| Expired

| September 30,

2022

|

| July 9, 2022

| $0.10

| 11,350,000

| -

| -

| (11,350,000)

| -

|

| October 9, 2022

| $0.20

| 3,835,186

| -

| -

| -

| 3,835,186

|

| February 25, 2023

| $0.10

| 19,100,000

| -

| -

| -

| 19,100,000

|

| May 19, 2025

| $0.125

| -

| 5,000,000

| -

| -

| 5,000,000

|

| Outstanding

|

| 34,285,186

| 5,000,000

| -

| (11,350,000)

| 27,935,186

|

c)Finder’s warrants

The continuity of finder’s warrants for the nine months ended June 30, 2023 is as follows:

|

Expiry date

| Exercise

price

| September 30,

2022

|

Issued

|

Exercised

|

Expired

| June 30,

2023

|

| October 9, 2022

| $0.135

| 1,339,036

| -

| -

| (1,339,036)

| -

|

| June 14, 2023

| $0.12

| 665,583

| -

| -

| (665,583)

| -

|

| Outstanding

|

| 2,004,619

| -

| -

| (2,004,619)

| -

|

| Weighted average

exercise price

|

|

$0.13

|

$Nil

|

$Nil

|

$0.13

|

$Nil

|

As at June 30, 2023, the weighted average contractual remaining life of finder’s warrants is nil years (September 30, 2022 – 0.25 years).

Subsequently, on August 14, 2023, the Company’s finder’s warrants were consolidated on a 5 for 1 basis and the exercise prices were reflected as such (Note 15). All references to the number of finder’s warrants and exercise prices have not been restated yet to reflect this share consolidation.

The continuity of finder’s warrants for the year ended September 30, 2022 is as follows:

Finder’s warrants

|

Expiry date

| Exercise

price

| September 30,

2021

|

Issued

|

Exercised

|

Expired

| September 30,

2022

|

| October 9, 2022

| $0.135

| 1,339,036

| -

| -

| -

| 1,339,036

|

| June 14, 2023

| $0.12

| 665,583

| -

| -

| -

| 665,583

|

| Outstanding

|

| 2,004,619

| -

| -

| -

| 2,004,619

|

SILVER NORTH RESOURCES LTD.

(Formerly Alianza Minerals Ltd.)

NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

FOR THE NINE MONTHS ENDED JUNE 30, 2023 AND 2022

(Unaudited, presented in Canadian Dollars)

8.STOCK OPTIONS AND WARRANTS - continued

c)Finder’s warrants – continued

The weighted average assumptions used to estimate the fair value of finder’s warrants for the nine months ended June 30, 2023 and 2022 were as follows:

|

| June 30, 2023

| June 30, 2022

|

| Risk-free interest rate

| n/a

| n/a

|

| Expected life

| n/a

| n/a

|

| Expected volatility

| n/a

| n/a

|

| Expected dividend yield

| n/a

| n/a

|

9. RELATED PARTY TRANSACTIONS

The aggregate value of transactions and outstanding balances relating to key management personnel and entities over which they have control or significant influence were as follows:

| For the nine months ended June 30, 2023

|

|

| Short-term

employee

benefits

| Post-

employment

benefits

|

Other long-

term benefits

|

Termination

benefits

|

Share-based

payments

|

Total

|

| Jason Weber

Chief Executive Officer,

Director

|

$ 121,500

|

$ Nil

|

$ Nil

|

$ Nil

|

$ Nil

|

$ 121,500

|

| Rob Duncan

VP of Exploration

|

$ 112,500

|

$ Nil

|

$ Nil

|

$ Nil

|

$ Nil

|

$ 112,500

|

For the nine months ended June 30, 2022

|

| Short-term

employee

benefits

| Post-

employment

benefits

|

Other long-

term benefits

|

Termination

benefits

|

Share-based

payments

|

Total

|

Jason Weber

Chief Executive Officer,

Director

|

$ 121,500

|

$ Nil

|

$ Nil

|

$ Nil

|

$ 59,000

|

$ 180,500

|

Rob Duncan

VP of Exploration

|

$ 112,500

|

$ Nil

|

$ Nil

|

$ Nil

|

$ 44,250

|

$ 156,750

|

Winnie Wong

Chief Financial Officer

| $ Nil

| $ Nil

| $ Nil

| $ Nil

| $ 29,500

| $ 29,500

|

Marc G. Blythe

Director

| $ Nil

| $ Nil

| $ Nil

| $ Nil

| $ 29,500

| $ 29,500

|

Mark T. Brown

Director (a)

| $ Nil

| $ Nil

| $ Nil

| $ Nil

| $ 44,250

| $ 44,250

|

Craig Lindsay

Director

| $ Nil

| $ Nil

| $ Nil

| $ Nil

| $ 29,500

| $ 29,500

|

John Wilson

Director

| $ Nil

| $ Nil

| $ Nil

| $ Nil

| $ 14,750

| $ 14,750

|

Sven Gollan

Director

| $ Nil

| $ Nil

| $ Nil

| $ Nil

| $ 23,100

| $ 23,100

|

SILVER NORTH RESOURCES LTD.

(Formerly Alianza Minerals Ltd.)

NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

FOR THE NINE MONTHS ENDED JUNE 30, 2023 AND 2022

(Unaudited, presented in Canadian Dollars)

9.RELATED PARTY TRANSACTIONS - continued

Related party transactions and balances

|

|

| Nine months ended

| Balance due

|

|

|

Services

|

June 30,

2023

|

June 30,

2022

| As at

June 30,

2023

| As at

September 30,

2022

|

| Amounts due to:

|

|

|

|

|

|

| Jason Weber

| Consulting fee and

share-based payment

| $ 121,500

| $ 180,500

| $ 14,761

| $ Nil

|

|

|

|

|

|

|

|

| Rob Duncan

| Consulting fee and

share-based payment

| $ 112,500

| $ 156,750

| $ 13,209

| $ Nil

|

|

|

|

|

|

|

|

| Pacific Opportunity

Capital Ltd. (a)

| Accounting, financing and shareholder communication

services

| $ 105,500

| $ 153,000

| $ 409,054 (b)

| $ 379,717 (b)

|

| Mark Brown

| Expenses

reimbursement

| $ Nil

| $ Nil

| $ Nil

| $ 5,857

|

| TOTAL:

|

| $ 339,500

| $ 490,250

| $ 437,024

| $ 385,574

|

(a)The president of Pacific Opportunity Capital Ltd., a private company, is a director of the Company.

(b)Includes a $63,465 advance (September 30, 2022 - $49,465) that is non-interest bearing without specific terms of repayment.

10.SUPPLEMENTAL DISCLOSURE WITH RESPECT TO CASH FLOWS

The significant non-cash investing and financing transactions during the nine months ended June 30, 2023 were as follows:

·$8,824 in exploration and evaluation asset costs was included in accounts payable and accrued liabilities; and

·$32,750 in share issue costs was included in due to related parties and $8,000 in deferred financing costs was included in due to related parties.

The significant non-cash investing and financing transactions during the nine months ended June 30, 2022 were as follows:

·As of June 30, 2022, a total of $42,412 in exploration and evaluation asset costs was included in accounts payable and accrued liabilities and $4,546 in exploration and evaluation asset costs was included in due to related parties;

·As of June 30, 2022, a total of $32,750 in share issue costs was included in due to related parties; and

·The Company recorded $225,000 in marketable securities related to the shares received for the Klondike property.

SILVER NORTH RESOURCES LTD.

(Formerly Alianza Minerals Ltd.)

NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

FOR THE NINE MONTHS ENDED JUNE 30, 2023 AND 2022

(Unaudited, presented in Canadian Dollars)

11.SEGMENTED INFORMATION

The Company has one reportable operating segment, that being the acquisition and exploration of mineral properties. Geographical information is as follows:

|

| June 30, 2023

| September 30, 2022

|

| Non-current assets

|

|

|

|

|

| USA

| $

| 1,054,565

| $

| 1,070,155

|

| Peru

|

| 43,675

|

| 41.186

|

| Canada

|

| 6,082,584

|

| 6,050,080

|

|

| $

| 7,180,824

| $

| 7,161,421

|

12.FINANCIAL INSTRUMENTS

The Company’s financial instruments are exposed to certain financial risks, including currency risk, credit risk, liquidity risk, market risk and commodity price risk.

(a)Currency risk

The Company’s property interests in Peru and USA make it subject to foreign currency fluctuations and inflationary pressures which may adversely affect the Company’s financial position, results of operations and cash flows. The Company is affected by changes in exchange rates between the Canadian Dollar and foreign functional currencies. The Company does not invest in foreign currency contracts to mitigate the risks. The Company’s exploration program, some of its general and administrative expenses and financial instruments denoted in a foreign currency are exposed to currency risk. A 10% change in the US dollar and the Peruvian nuevo sol over the Canadian dollar would not significantly affect the Company.

(b)Credit risk

Credit risk is the risk of an unexpected loss if a customer or third party to a financial instrument fails to meet its contractual obligations. The Company’s credit risk is primarily attributable to the liquidity of its cash. The Company limits exposure to credit risk by maintaining its cash with a large Canadian financial institution.

(c)Liquidity risk

Liquidity risk is the risk that the Company will not be able to meet its financial obligations as they fall due. The Company ensures there is sufficient capital in order to meet short-term business requirements, after taking into account cash flows from operations and the Company’s holdings of cash. The Company does not have sufficient cash to settle its current liabilities, and further funding will be required to meet the Company’s short-term and long-term operating needs. The Company manages liquidity risk through the management of its capital structure.

Accounts payable and accrued liabilities are due within the current operating period.

SILVER NORTH RESOURCES LTD.

(Formerly Alianza Minerals Ltd.)

NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

FOR THE NINE MONTHS ENDED JUNE 30, 2023 AND 2022

(Unaudited, presented in Canadian Dollars)

12.FINANCIAL INSTRUMENTS – continued

(d)Market risk

Market risks to which the Company is exposed include unfavorable movements in commodity prices, interest rates, and foreign exchange rates. As at June 30, 2023, the Company has no producing assets and holds the majority of its cash in secure, Canadian dollar-denominated deposits. Consequently, its exposure to these risks has been significantly reduced, but as the Company redeploys its cash, exposure to these risks may increase. The objective of the Company is to mitigate exposure to these risks while maximizing returns.