Current Report Filing (8-k)

05 August 2021 - 6:06AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 29, 2021

|

THC Therapeutics, Inc.

|

|

(Exact name of registrant as specified in its charter)

|

|

Nevada

|

|

000-55994

|

|

26-0164981

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification Number)

|

|

11700 W Charleston Blvd. #73

Las Vegas, Nevada

|

|

89135

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(833)-420-8428

(Registrant's telephone number, including area code)

Not applicable

(former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Precommencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Precommencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into Material Definitive Agreement.

Effective July 30, 2021, THC Therapeutics, Inc. (the "Company") entered into a Securities Purchase Agreement (the "Purchase Agreement") with GHS Investments, LLC, a Nevada limited liability company (the "Investor"), pursuant to which the Company designated 300 shares of the Company's authorized preferred stock as Series C Preferred Stock, and the Investor purchased 300 shares of the Series C Preferred Stock (the "Preferred Stock") for $300,000, less $5,000 for the Investor's due diligence and legal fees. The net purchase price of $295,000 was funded to the Company on July 30, 2021.

Each share of Preferred Stock has a face value of $1,200 and is generally convertible into shares of the Company's common stock at the Investor's election at a conversion price equal to 80% of the lowest volume-weighted average price of the Company's common stock during the 20 trading days immediately preceding the conversion date; provided, however, that the Investor may not convert shares of Preferred Stock into common stock to the extent that such conversion would cause the Investor's beneficial ownership of the Company's common stock to be in excess of 4.99% of the Company's outstanding shares of common stock. The Company is obligated to pay dividends on the Preferred Stock at the rate of 10% per annum, and the Company can elect to pay those dividends in cash or by issuing additional shares of Preferred Stock to the Investor. The Company has the right to redeem the Preferred Stock from the Investor by paying a redemption amount per share equal to the $1,200 stated value of each share, plus any accrued but unpaid dividends, and any other amounts owing to the Investor, multiplied by a redemption premium based on the date of redemption as follows: 100% if all of the Preferred Stock is redeemed within 90 days of the issuance date, 105% if all of the Preferred Stock is redeemed within 91-120 days of the issuance date, and 110% if all of the Preferred Stock is redeemed within 121-180 days of the issuance date. The Company is required to have redeemed all of the Preferred Stock from the Investor by the date that is one year following the issuance date of July 30, 2021.

The foregoing description of the Purchase Agreement is qualified in its entirety by the full text of the Purchase Agreement, which is filed as Exhibit 10.1 to, and incorporated by reference in, this report.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information in Item 1.01 above is incorporated by reference into this Item 2.03.

Item 3.02 Unregistered Sales of Equity Securities.

The information in Item 1.01 above is incorporated by reference into this Item 3.02. On July 30, 2021, the Company sold the Preferred Stock to the Investor. These shares were sold in reliance on the exemption from registration provided by Section 4(a)(2) of the Securities Act of 1933, as amended, and Rule 506(b) promulgated thereunder, as there was no general solicitation, the Investor was an accredited investor, and the transaction did not involve a public offering.

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

The information in Item 1.01 above is incorporated by reference into this Item 5.03. On July 29, 2021, the Company filed with the State of Nevada a Certificate of Designation, designating 300 shares of the Company's authorized preferred stock as Series C Preferred Stock.

The foregoing description of the Certificate of Designation is qualified in its entirety by the full text of the Certificate of Designation, which is filed as Exhibit 3.1 to, and incorporated by reference in, this report.

Item 9.01 Financial Statements and Exhibits.

The exhibits listed in the following Exhibit Index are filed as part of this Current Report on Form 8-K.

___________

* Certain schedules and exhibits have been omitted pursuant to Item 601(b)(2) of Regulation S-K. A copy of any omitted schedule or exhibit will be furnished supplementally to the Securities and Exchange Commission upon request; provided, however that the Company may request confidential treatment pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended, for any schedule or Exhibit so furnished.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

THC Therapeutics, Inc.

|

|

|

|

|

|

|

|

Dated: August 4, 2021

|

By:

|

/s/ Brandon Romanek

|

|

|

|

|

Brandon Romanek

|

|

|

|

|

Chief Executive Officer

|

|

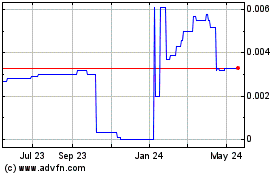

THC Therapeutics (CE) (USOTC:THCT)

Historical Stock Chart

From Oct 2024 to Nov 2024

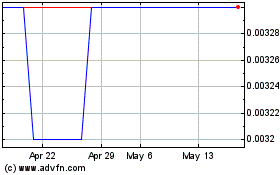

THC Therapeutics (CE) (USOTC:THCT)

Historical Stock Chart

From Nov 2023 to Nov 2024