false

FY

0001410738

98-0184110

0001410738

2023-10-01

2024-09-30

0001410738

2023-03-31

0001410738

2024-12-23

0001410738

2024-09-30

0001410738

2023-09-30

0001410738

2022-10-01

2023-09-30

0001410738

2022-09-30

0001410738

us-gaap:CommonStockMember

2022-09-30

0001410738

us-gaap:PreferredStockMember

2022-09-30

0001410738

VPLM:SharesToBeIssuedValueMember

2022-09-30

0001410738

us-gaap:AdditionalPaidInCapitalMember

2022-09-30

0001410738

us-gaap:RetainedEarningsMember

2022-09-30

0001410738

us-gaap:CommonStockMember

2023-09-30

0001410738

us-gaap:PreferredStockMember

2023-09-30

0001410738

VPLM:SharesToBeIssuedValueMember

2023-09-30

0001410738

us-gaap:AdditionalPaidInCapitalMember

2023-09-30

0001410738

us-gaap:RetainedEarningsMember

2023-09-30

0001410738

us-gaap:CommonStockMember

2022-10-01

2023-09-30

0001410738

us-gaap:PreferredStockMember

2022-10-01

2023-09-30

0001410738

VPLM:SharesToBeIssuedValueMember

2022-10-01

2023-09-30

0001410738

us-gaap:AdditionalPaidInCapitalMember

2022-10-01

2023-09-30

0001410738

us-gaap:RetainedEarningsMember

2022-10-01

2023-09-30

0001410738

us-gaap:CommonStockMember

2023-10-01

2024-09-30

0001410738

us-gaap:PreferredStockMember

2023-10-01

2024-09-30

0001410738

VPLM:SharesToBeIssuedValueMember

2023-10-01

2024-09-30

0001410738

us-gaap:AdditionalPaidInCapitalMember

2023-10-01

2024-09-30

0001410738

us-gaap:RetainedEarningsMember

2023-10-01

2024-09-30

0001410738

us-gaap:CommonStockMember

2024-09-30

0001410738

us-gaap:PreferredStockMember

2024-09-30

0001410738

VPLM:SharesToBeIssuedValueMember

2024-09-30

0001410738

us-gaap:AdditionalPaidInCapitalMember

2024-09-30

0001410738

us-gaap:RetainedEarningsMember

2024-09-30

0001410738

VPLM:SharePurchaseAgreementMember

VPLM:DigifonicaMember

2013-12-31

0001410738

VPLM:SharePurchaseAgreementMember

VPLM:DigifonicaMember

2013-12-01

2013-12-31

0001410738

VPLM:DigifonicaMember

2013-12-31

0001410738

VPLM:SellerOfDigifonicaMember

2021-04-12

2021-04-12

0001410738

VPLM:SellerOfDigifonicaMember

2021-04-12

0001410738

us-gaap:PreferredStockMember

VPLM:DigifonicaMember

2023-04-23

0001410738

us-gaap:WarrantMember

2023-06-30

2023-06-30

0001410738

us-gaap:SeriesAPreferredStockMember

2023-06-30

2023-06-30

0001410738

us-gaap:WarrantMember

2023-10-01

2024-09-30

0001410738

us-gaap:SeriesAPreferredStockMember

2024-01-12

2024-01-12

0001410738

us-gaap:RestrictedStockMember

2022-01-01

2022-12-31

0001410738

us-gaap:RestrictedStockMember

2023-01-01

2023-12-31

0001410738

us-gaap:RestrictedStockMember

2022-12-31

0001410738

us-gaap:RestrictedStockMember

2023-12-31

0001410738

2022-12-31

0001410738

2023-12-31

0001410738

VPLM:PromissoryNoteAgreementMember

2024-03-20

2024-03-20

0001410738

VPLM:PromissoryNoteAgreementMember

2024-04-16

2024-04-16

0001410738

srt:ChiefExecutiveOfficerMember

2023-10-01

2024-09-30

0001410738

srt:ChiefExecutiveOfficerMember

2022-10-01

2023-09-30

0001410738

srt:ChiefFinancialOfficerMember

2023-10-01

2024-09-30

0001410738

srt:ChiefFinancialOfficerMember

2022-10-01

2023-09-30

0001410738

VPLM:FormerChiefFinancialOfficerMember

2023-10-01

2024-09-30

0001410738

VPLM:FormerChiefFinancialOfficerMember

2022-10-01

2023-09-30

0001410738

srt:DirectorMember

2023-10-01

2024-09-30

0001410738

srt:DirectorMember

2022-10-01

2023-09-30

0001410738

VPLM:StockBasedCompensationMember

2023-10-01

2024-09-30

0001410738

VPLM:StockBasedCompensationMember

2022-10-01

2023-09-30

0001410738

VPLM:OfficersandDirectorsMember

2024-09-30

0001410738

VPLM:OfficersandDirectorsMember

2023-09-30

0001410738

srt:DirectorMember

2024-09-30

0001410738

srt:DirectorMember

2023-09-30

0001410738

us-gaap:SeriesAPreferredStockMember

2024-09-30

0001410738

us-gaap:SeriesAPreferredStockMember

2023-09-30

0001410738

us-gaap:PrivatePlacementMember

2023-10-01

2024-09-30

0001410738

us-gaap:PrivatePlacementMember

2024-09-30

0001410738

VPLM:CommonStockOneMember

2023-10-01

2024-09-30

0001410738

us-gaap:SeriesAPreferredStockMember

2023-10-01

2024-09-30

0001410738

us-gaap:WarrantMember

2024-09-30

0001410738

us-gaap:PrivatePlacementMember

2022-10-01

2023-09-30

0001410738

us-gaap:PrivatePlacementMember

2023-09-30

0001410738

us-gaap:WarrantMember

2023-09-30

0001410738

us-gaap:SeriesAPreferredStockMember

2022-10-01

2023-09-30

0001410738

us-gaap:SubsequentEventMember

VPLM:LocksmithFinancialCorporationMember

2024-10-01

2024-10-01

0001410738

us-gaap:SubsequentEventMember

VPLM:LocksmithFinancialCorporationMember

2024-10-01

0001410738

us-gaap:CommonStockMember

us-gaap:SubsequentEventMember

2024-10-30

2024-10-30

0001410738

us-gaap:WarrantMember

us-gaap:SubsequentEventMember

2024-10-09

0001410738

us-gaap:SubsequentEventMember

us-gaap:CommonStockMember

2024-10-09

0001410738

us-gaap:WarrantMember

us-gaap:SubsequentEventMember

2024-10-29

0001410738

us-gaap:SubsequentEventMember

us-gaap:CommonStockMember

2024-10-29

0001410738

us-gaap:WarrantMember

us-gaap:SubsequentEventMember

2024-11-13

0001410738

us-gaap:SubsequentEventMember

us-gaap:CommonStockMember

2024-11-13

0001410738

us-gaap:WarrantMember

us-gaap:SubsequentEventMember

2024-12-02

0001410738

us-gaap:SubsequentEventMember

us-gaap:CommonStockMember

2024-12-02

0001410738

2024-01-12

2024-01-12

0001410738

2024-01-12

0001410738

2023-04-23

0001410738

2021-04-12

0001410738

2023-04-24

2023-04-24

0001410738

2022-05-30

0001410738

2023-04-24

0001410738

us-gaap:WarrantMember

2023-06-30

0001410738

2023-06-30

0001410738

us-gaap:WarrantMember

VPLM:ConsultantMember

2024-09-17

0001410738

us-gaap:WarrantMember

us-gaap:MeasurementInputRiskFreeInterestRateMember

2024-09-30

0001410738

us-gaap:WarrantMember

us-gaap:MeasurementInputExpectedTermMember

2024-09-30

0001410738

us-gaap:WarrantMember

us-gaap:MeasurementInputPriceVolatilityMember

2024-09-30

0001410738

us-gaap:WarrantMember

us-gaap:MeasurementInputExpectedDividendRateMember

2024-09-30

0001410738

us-gaap:WarrantMember

VPLM:DirectorsOfficersEmployeesAndConsultantsMember

2023-10-01

2024-09-30

0001410738

us-gaap:WarrantMember

2022-10-01

2023-09-30

0001410738

us-gaap:WarrantMember

VPLM:OfficersEmployeesAndConsultantsMember

2024-09-12

0001410738

VPLM:WarrantOneMember

us-gaap:MeasurementInputRiskFreeInterestRateMember

2024-09-30

0001410738

VPLM:WarrantOneMember

us-gaap:MeasurementInputExpectedTermMember

2024-09-30

0001410738

VPLM:WarrantOneMember

us-gaap:MeasurementInputPriceVolatilityMember

2024-09-30

0001410738

VPLM:WarrantOneMember

us-gaap:MeasurementInputExpectedDividendRateMember

2024-09-30

0001410738

VPLM:DirectorsOfficersEmployeesAndConsultantsMember

VPLM:WarrantOneMember

2023-10-01

2024-09-30

0001410738

VPLM:WarrantOneMember

2023-10-01

2024-09-30

0001410738

VPLM:WarrantOneMember

2022-10-01

2023-09-30

0001410738

VPLM:OfficersandDirectorsMember

VPLM:WarrantOneMember

2023-10-01

2024-09-30

0001410738

VPLM:ProfessionalFeesAndServicesMember

VPLM:WarrantOneMember

2023-10-01

2024-09-30

0001410738

us-gaap:WarrantMember

VPLM:ConsultantMember

2024-09-06

0001410738

VPLM:WarrantTwoMember

us-gaap:MeasurementInputRiskFreeInterestRateMember

2023-09-30

0001410738

VPLM:WarrantTwoMember

us-gaap:MeasurementInputExpectedTermMember

2024-09-30

0001410738

VPLM:WarrantTwoMember

us-gaap:MeasurementInputPriceVolatilityMember

2024-09-30

0001410738

VPLM:WarrantTwoMember

us-gaap:MeasurementInputExpectedDividendRateMember

2024-09-30

0001410738

VPLM:DirectorsOfficersEmployeesAndConsultantsMember

VPLM:WarrantTwoMember

2023-10-01

2024-09-30

0001410738

VPLM:WarrantTwoMember

2023-10-01

2024-09-30

0001410738

VPLM:WarrantTwoMember

2022-10-01

2023-09-30

0001410738

us-gaap:WarrantMember

VPLM:ChiefExecutiveOfficerAndChairmanMember

2024-08-18

0001410738

VPLM:WarrantThreeMember

us-gaap:MeasurementInputRiskFreeInterestRateMember

2023-09-30

0001410738

VPLM:WarrantThreeMember

us-gaap:MeasurementInputExpectedTermMember

2024-09-30

0001410738

VPLM:WarrantThreeMember

us-gaap:MeasurementInputPriceVolatilityMember

2024-09-30

0001410738

VPLM:WarrantThreeMember

us-gaap:MeasurementInputExpectedDividendRateMember

2024-09-30

0001410738

VPLM:DirectorsOfficersEmployeesAndConsultantsMember

VPLM:WarrantThreeMember

2023-10-01

2024-09-30

0001410738

VPLM:WarrantThreeMember

2023-10-01

2024-09-30

0001410738

VPLM:WarrantThreeMember

2022-10-01

2023-09-30

0001410738

us-gaap:WarrantMember

VPLM:DirectorsOfficersEmployeesAndConsultantsMember

2024-08-18

0001410738

us-gaap:WarrantMember

VPLM:ConsultantMember

2024-06-12

0001410738

us-gaap:WarrantMember

VPLM:DirectorsOfficersEmployeesAndConsultantsMember

2024-04-25

0001410738

VPLM:WarrantFourMember

us-gaap:MeasurementInputRiskFreeInterestRateMember

2024-09-30

0001410738

VPLM:WarrantFourMember

us-gaap:MeasurementInputExpectedTermMember

2024-09-30

0001410738

VPLM:WarrantFourMember

us-gaap:MeasurementInputPriceVolatilityMember

2024-09-30

0001410738

VPLM:WarrantFourMember

us-gaap:MeasurementInputExpectedDividendRateMember

2024-09-30

0001410738

VPLM:DirectorsOfficersEmployeesAndConsultantsMember

VPLM:WarrantFourMember

2023-10-01

2024-09-30

0001410738

VPLM:WarrantFourMember

2023-10-01

2024-09-30

0001410738

VPLM:WarrantFourMember

2022-10-01

2023-09-30

0001410738

VPLM:WarrantFourMember

VPLM:OfficersandDirectorsMember

2023-10-01

2024-09-30

0001410738

VPLM:WarrantFourMember

VPLM:ProfessionalFeesAndServicesMember

2023-10-01

2024-09-30

0001410738

us-gaap:WarrantMember

VPLM:DirectorsOfficersEmployeesAndConsultantsMember

2024-01-12

0001410738

VPLM:WarrantFiveMember

us-gaap:MeasurementInputRiskFreeInterestRateMember

2023-09-30

0001410738

VPLM:WarrantFiveMember

us-gaap:MeasurementInputExpectedTermMember

2024-09-30

0001410738

VPLM:WarrantFiveMember

us-gaap:MeasurementInputPriceVolatilityMember

2024-09-30

0001410738

VPLM:WarrantFiveMember

us-gaap:MeasurementInputExpectedDividendRateMember

2024-09-30

0001410738

VPLM:DirectorsOfficersEmployeesAndConsultantsMember

VPLM:WarrantFiveMember

2023-10-01

2024-09-30

0001410738

VPLM:WarrantFiveMember

2023-10-01

2024-09-30

0001410738

VPLM:WarrantFiveMember

2022-10-01

2023-09-30

0001410738

us-gaap:WarrantMember

VPLM:DirectorsOfficersEmployeesAndConsultantsMember

2023-06-30

0001410738

us-gaap:WarrantMember

us-gaap:MeasurementInputRiskFreeInterestRateMember

2023-09-30

0001410738

us-gaap:WarrantMember

us-gaap:MeasurementInputExpectedTermMember

2023-09-30

0001410738

us-gaap:WarrantMember

us-gaap:MeasurementInputPriceVolatilityMember

2023-09-30

0001410738

us-gaap:WarrantMember

us-gaap:MeasurementInputExpectedDividendRateMember

2023-09-30

0001410738

us-gaap:WarrantMember

VPLM:DirectorsOfficersEmployeesAndConsultantsMember

2022-10-01

2023-09-30

0001410738

us-gaap:WarrantMember

VPLM:DirectorsOfficersEmployeesAndConsultantsMember

2022-05-30

0001410738

us-gaap:WarrantMember

VPLM:DirectorsOfficersEmployeesAndConsultantsMember

2023-04-24

0001410738

us-gaap:WarrantMember

us-gaap:MeasurementInputRiskFreeInterestRateMember

2022-09-30

0001410738

us-gaap:WarrantMember

us-gaap:MeasurementInputExpectedTermMember

2022-09-30

0001410738

us-gaap:WarrantMember

us-gaap:MeasurementInputPriceVolatilityMember

2022-09-30

0001410738

us-gaap:WarrantMember

us-gaap:MeasurementInputExpectedDividendRateMember

2022-09-30

0001410738

us-gaap:WarrantMember

VPLM:DirectorsOfficersEmployeesAndConsultantsMember

2021-10-01

2022-09-30

0001410738

us-gaap:WarrantMember

2021-04-12

0001410738

us-gaap:WarrantMember

2023-04-23

0001410738

VPLM:WarrantOneMember

us-gaap:MeasurementInputRiskFreeInterestRateMember

2023-09-30

0001410738

VPLM:WarrantOneMember

us-gaap:MeasurementInputExpectedTermMember

2023-09-30

0001410738

VPLM:WarrantOneMember

us-gaap:MeasurementInputPriceVolatilityMember

2023-09-30

0001410738

VPLM:WarrantOneMember

us-gaap:MeasurementInputExpectedDividendRateMember

2023-09-30

0001410738

VPLM:IncentiveStockOptionPlanMember

2023-10-01

2024-09-30

0001410738

VPLM:ConsultantsAndAdvisorsMember

2024-01-12

2024-01-12

0001410738

us-gaap:CommonStockMember

VPLM:ConsultantsAndAdvisorsMember

2024-01-12

0001410738

VPLM:ConsultantsAndAdvisorsMember

2024-07-12

2024-07-12

0001410738

VPLM:OfficersandDirectorsMember

2023-10-01

2024-09-30

0001410738

VPLM:ProfessionalFeesAndServicesMember

2023-10-01

2024-09-30

0001410738

VPLM:DirectorsConsultantsAndAdvisorsMember

2023-05-30

2023-05-31

0001410738

us-gaap:CommonStockMember

VPLM:DirectorsConsultantsAndAdvisorsMember

2023-05-30

2023-05-31

0001410738

VPLM:ConsultantsAndAdvisorsMember

2023-05-30

2023-05-31

0001410738

us-gaap:CommonStockMember

VPLM:ConsultantsAndAdvisorsMember

2023-05-30

2023-05-31

0001410738

us-gaap:CommonStockMember

VPLM:ConsultantsAndAdvisorsMember

2023-05-31

0001410738

VPLM:ConsultantsAndAdvisorsMember

2024-05-30

2024-05-31

0001410738

VPLM:ConsultantsAndAdvisorsMember

srt:ScenarioForecastMember

2025-05-30

2025-05-31

0001410738

VPLM:StockOptionOneMember

2023-10-01

2024-09-30

0001410738

VPLM:StockOptionOneMember

2022-10-01

2023-09-30

0001410738

VPLM:ProfessionalFeesAndServicesMember

VPLM:StockOptionOneMember

2023-10-01

2024-09-30

0001410738

VPLM:ConsultantsAndAdvisorsMember

2022-05-29

2022-05-30

0001410738

us-gaap:CommonStockMember

VPLM:ConsultantsAndAdvisorsMember

2022-05-29

2022-05-30

0001410738

us-gaap:CommonStockMember

VPLM:ConsultantsAndAdvisorsMember

2022-05-30

0001410738

VPLM:ConsultantsAndAdvisorsMember

2022-05-30

0001410738

VPLM:ConsultantsAndAdvisorsMember

2023-04-24

0001410738

2021-10-01

2022-09-30

0001410738

VPLM:StockOptionTwoMember

2023-10-01

2024-09-30

0001410738

VPLM:StockOptionTwoMember

2021-10-01

2022-09-30

0001410738

VPLM:StockOptionTwoMember

2022-10-01

2023-09-30

0001410738

VPLM:DirectorsOfficersEmployeesConsultantsAndAdvisorsMember

2021-04-22

2021-04-23

0001410738

us-gaap:CommonStockMember

VPLM:DirectorsOfficersEmployeesConsultantsAndAdvisorsMember

2021-04-22

2021-04-23

0001410738

VPLM:DirectorsOfficersEmployeesConsultantsAndAdvisorsMember

us-gaap:CommonStockMember

2021-04-23

0001410738

VPLM:DirectorsOfficersEmployeesConsultantsAndAdvisorsMember

2021-04-23

0001410738

VPLM:DirectorsOfficersEmployeesConsultantsAndAdvisorsMember

2023-04-24

0001410738

2020-10-01

2021-09-30

0001410738

VPLM:StockOptionThreeMember

2023-10-01

2024-09-30

0001410738

VPLM:StockOptionThreeMember

2022-10-01

2023-09-30

0001410738

us-gaap:EmployeeStockOptionMember

2022-10-01

2023-09-30

0001410738

VPLM:StockOptionFourMember

2023-10-01

2024-09-30

0001410738

VPLM:StockOptionFourMember

2022-10-01

2023-09-30

0001410738

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2023-10-01

2024-09-30

0001410738

VPLM:WarrantOneMember

2024-09-30

0001410738

VPLM:WarrantTwoMember

2024-09-30

0001410738

VPLM:WarrantThreeMember

2024-09-30

0001410738

VPLM:WarrantFourMember

2024-09-30

0001410738

VPLM:WarrantFiveMember

2024-09-30

0001410738

VPLM:WarrantSixMember

2023-10-01

2024-09-30

0001410738

VPLM:WarrantSixMember

2024-09-30

0001410738

VPLM:WarrantSevenMember

2023-10-01

2024-09-30

0001410738

VPLM:WarrantSevenMember

2024-09-30

0001410738

VPLM:WarrantEightMember

2023-10-01

2024-09-30

0001410738

VPLM:WarrantEightMember

2024-09-30

0001410738

VPLM:WarrantNineMember

2023-10-01

2024-09-30

0001410738

VPLM:WarrantNineMember

2024-09-30

0001410738

VPLM:WarrantTenMember

2023-10-01

2024-09-30

0001410738

VPLM:WarrantTenMember

2024-09-30

0001410738

VPLM:WarrantElevenMember

2023-10-01

2024-09-30

0001410738

VPLM:WarrantElevenMember

2024-09-30

0001410738

VPLM:RangeOneMember

2024-09-30

0001410738

VPLM:RangeOneMember

2023-10-01

2024-09-30

0001410738

VPLM:RangeTwoMember

2024-09-30

0001410738

VPLM:RangeTwoMember

2023-10-01

2024-09-30

0001410738

VPLM:RangeThreeMember

2024-09-30

0001410738

VPLM:RangeThreeMember

2023-10-01

2024-09-30

0001410738

VPLM:RangeFourMember

2024-09-30

0001410738

VPLM:RangeFourMember

2023-10-01

2024-09-30

0001410738

VPLM:IntangibleAssetsMember

2024-09-30

0001410738

VPLM:IntangibleAssetsMember

2023-10-01

2024-09-30

0001410738

VPLM:IntangibleAssetsMember

2023-09-30

0001410738

VPLM:IntangibleAssetsMember

2022-10-01

2023-09-30

0001410738

2020-01-01

2020-01-01

0001410738

us-gaap:RestrictedStockUnitsRSUMember

2024-08-19

2024-08-20

0001410738

us-gaap:RestrictedStockUnitsRSUMember

us-gaap:SubsequentEventMember

2024-10-01

2024-10-01

0001410738

VPLM:BoardOfDirectorsMember

srt:MaximumMember

2015-10-01

2016-09-30

0001410738

VPLM:BoardOfDirectorsMember

srt:MaximumMember

2018-10-01

2019-09-30

0001410738

VPLM:BoardOfDirectorsMember

2018-10-01

2019-09-30

0001410738

VPLM:DirectorAndSeveralConsultantsMember

VPLM:BonusSharesMember

2018-10-01

2019-09-30

0001410738

VPLM:BonusSharesMember

2018-10-01

2019-09-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

VPLM:Segments

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K

☒

Annual Report Pursuant to Section 13 or 15 (d) of the Securities Exchange Act of 1934

For

the fiscal year ended: September 30, 2024

or

☐

Transition Report Pursuant to Section 13 or 15 (d) of the Securities Exchange Act of 1934

Commission

File Number: 000-55613

VoIP-PAL.COM

INC.

(Exact

name of Registrant as specified in its charter)

| Nevada |

|

980184110 |

(State

or other jurisdiction of

incorporation or organization) |

|

(I.R.S.

Employer

Identification Number) |

7215

Bosque Boulevard, Suite 102

Waco,

TX 76710-4020

(Address

of principal executive offices)

954-495-4600

(Registrant’s

telephone number, including area code)

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

symbol(s) |

|

Name

of each exchange on which registered |

| N/A |

|

N/A |

|

N/A |

Securities

registered pursuant to Section 12(g) of the Act:

Common

Stock, $0.001 par value

(Title

of class)

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act Yes ☐ No☒

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate

by check mark whether the Registrant (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the

past 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to the filing

requirements for at least the past 90 days. Yes ☒ No ☐

Indicate

by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant

was required to submit and post such files). Yes ☒ No ☐

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained

herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated

by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate

by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting

company. See definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company”

in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer ☐ |

|

Accelerated

filer ☐ |

|

Non-accelerated

filer ☐ |

|

Smaller

reporting company ☒ |

|

Emerging

growth company ☒ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. Yes ☐ ☒

If

securities are registered pursuant

to Section

12(b) of the Act, indicate by check mark whether

the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial

statements. ☒

Indicate

by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation

received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b).

☒

Indicate

by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The

market value of the voting stock held by non-affiliates was $101,208,134 based on 2,381,367,863 shares held by non-affiliates. These

computations are based upon the closing sales price of $0.0199 per share of the Company on OTC Markets, Inc. on March 31, 2023.

Indicate

the number of shares outstanding of each of the Registrant’s classes of common equity, as of the latest practicable date:

| Class |

|

Outstanding

as of December 23, 2024 |

| Common

Stock, $0.001 par value per share |

|

3,624,945,275 |

TABLE

OF CONTENTS

PART

I

CAUTIONARY

NOTE REGARDING FORWARD LOOKING STATEMENTS

In

this Annual Report, references to “VoIP-Pal,” “VPLM,” the “Company,” “we,” “us,”

and “our” refer to VoIP-Pal.Com Inc., the Registrant.

This

Annual Report on Form 10-K (this “Annual Report” or this “Report”) contains certain forward-looking statements

within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act of 1934, as amended (the “Exchange

Act”). All statements, other than statements of historical facts, included in this Annual report are forward looking statements,

including, without limitation, statements regarding our strategy, future operations, financial position, estimated revenues and losses,

projected costs, prospects, plans and objectives of management. These forward-looking statements may be, but are not always, identified

by their use of terms and phrases such as “anticipate,” “believe,” “estimate,” “expect,”

“intend,” “may,” “project,” “plan,” “will,” “shall,” “should,”

“could” and “potential,” and similar terms and phrases, including when used in the negative. Although we believe

that the expectations reflected in these forward-looking statements are reasonable, they do involve certain assumptions, risks and uncertainties.

Actual results could differ materially from those anticipated in these forward-looking statements. You should consider carefully the

risks described under the “Risk Factors” section of this Annual Report and other sections of this report, which describe

factors that could cause our actual results to differ from those anticipated in the forward-looking statements. All forward-looking statements

are expressly qualified in their entirety by the cautionary statements in this paragraph and elsewhere in this Annual Report. Other than

as required under the securities laws, we do not assume a duty to update these forward-looking statements, whether because of new information,

subsequent events or circumstances, changes in expectations or otherwise.

Item

1. Business.

The

Company was incorporated in the state of Nevada in September 1997 as All American Casting International, Inc. and changed its name to

VOIP MDU.com in 2004 and subsequently to VoIP-Pal.Com Inc. in 2006. Since March 2004, the Company has been in the development stage of

becoming a Voice-over-Internet Protocol (“VoIP”) re-seller, a provider of a proprietary transactional billing platform tailored

to the points and air mile business, and a provider of anti-virus applications for smartphones.

In

2013, Voip-Pal acquired Digifonica International (DIL) Limited (“Digifonica”), to fund and co-develop Digifonica’s

patent suite. Digifonica had been founded in 2003 with the vision that the internet would be the future of all forms of telecommunications

- a team of top twenty engineers with expertise in Linux and Internet telephony developed and wrote a software suite with applications

that provided solutions for several core areas of internet connectivity. In order to properly test the applications, Digifonica built

and operated three production nodes in Vancouver, Canada (Peer 1), London, UK (Teliasonera), and Denmark. Upon successfully developing

the technology, Digifonica filed for patents with the United States Patent and Trademark Office (“USPTO”).

The

Digifonica patents formed the basis for Voip-Pal’s current intellectual property, now a worldwide portfolio of issued and pending

patents primarily designed for the broadband VoIP market.

The

Issuer’s primary and secondary SIC Codes are 4813 and 4899.

The

Issuer’s fiscal year end date is September 30.

Principal

Products or Services

VoIP-PAL

owns a worldwide portfolio of issued patents covering numerous inventions, including, but not limited to the following technology areas:

| |

1. |

classification

and routing of communications over different networks and over geographically distributed nodes; |

| |

2. |

lawful

intercept of such communications; |

| |

3. |

enhanced

emergency calling support (e.g., E911); |

| |

4. |

mobile

gateways; |

| |

5. |

uninterrupted

transmission during endpoint changes; and |

| |

6. |

metering

and billing, including the reselling of “white label” telecommunication services. |

VoIP-PAL

continues to have some patent applications pending.

VoIP-Pal

is actively pursuing patent infringement lawsuits in Waco, Texas, against several Fortune 500 companies, alleging that these companies

are utilizing its patented technologies without authorization. Additionally, VoIP-Pal is engaged in two antitrust lawsuits: one filed

directly by VoIP-Pal and another as part of a class action, with VoIP-Pal as a lead plaintiff, against several Fortune 500 companies.

Both lawsuits allege antitrust violations related to practices VoIP-Pal views as restrictive to fair competition in the telecommunications

industry.

VoIP-Pal’s

Patent Portfolio

A

brief summary of the Company’s patents is provided below, focusing primarily on patents which have been issued in the U.S. (however

only limited discussion is provided regarding the Company’s related pending U.S. patent applications and foreign patent assets).

The brief summaries below are provided for convenience only and without prejudice to the Company’s rights; it will be appreciated

that the scope of the Company’s patents can only be discerned by conducting a full legal analysis under the applicable legal standards

and is subject to Court decisions.

VoIP-PAL’s

patent portfolio covers the following technologies:

| 1. |

Classification/routing

of communications |

| |

● |

U.S.

Patent Nos. 8,542,815; 9,179,005; 9,537,762; 9,813,330; 9,826,002; 9,935,872; 9,948,549; European Patent No. 2,084,868; Indian Patent

No. 287,412, Brazil Patent No. PI 0718312-7, and Canadian Patents 2,668,025; 3,032,707; 3,045,672; 3,045,681; 3,045,683; 3,045,694,

among others, generally relate to classification/routing of communications. |

| |

|

|

| |

● |

The

‘815 Patent was the subject of four Inter Partes Review (IPR) challenges before the U.S. Patent Office by Apple, Unified

Patents, and AT&T Services, one of which was instituted and resulted in a final written decision confirming the patentability

of all challenged claims. The ‘005 Patent was the subject of four IPR challenges by Apple and AT&T Services, one of which

was instituted and resulted in a final written decision confirming the patentability of all challenged claims. The ‘762, ‘330,

‘002 and ‘549 Patents were each subject to IPR challenges by Apple, but none of these IPRs was instituted. However, some

of the claims of each of these patents been found patent-ineligible in court proceedings under §101. |

| |

|

|

| |

● |

Brief

descriptions of these patents are provided below. |

1.1

U.S. Patent No. 8,542,815, issued September 24, 2013, generally relates to, among other things, classifying a call as pertaining

to a public network or a private network based on a match of one or more attributes associated with a caller and an identifier associated

with a callee and network classification criteria.

1.2

U.S. Patent No. 9,179,005, issued November 3, 2015, generally relates to, among other things, routing communications by producing

a public or private routing message based on a classification criteria of one or more attributes associated with a caller and an identifier

associated with a callee.

1.3

U.S. Patent No. 9,537,762, issued January 3, 2017, generally relates to, among other things, classifying a communication as pertaining

to a first or second network based on attributes associated with a first participant to the communication and classification criteria

which may include whether a second participant to the communication is registered with the system.

1.4

U.S. Patent No. 9,813,330, issued November 7, 2017, generally relates to, among other things, classifying a communication as a system

communication or external network communication based at least in part on comparing attributes associated with a first participant in

a communication with an identifier associated with a second participant.

1.5

U.S. Patent No. 9,826,002, issued November 21, 2017, generally relates to, among other things, classifying a communication as a system

communication or external network communication based at least in part on a new second participant identifier produced by processing

a second participant identifier based on a first participant’s attributes.

1.6

U.S. Patent No. 9,948,549, issued on April 17, 2018, generally relates to, among other things, classifying a communication as a system

communication or external network communication and producing a routing message based at least in part on a new second participant identifier

produced by processing a second participant identifier based on a first participant’s attributes.

1.7

U.S. Patent No. 9,935,872, issued April 3, 2018, generally relates to, among other things, using at least one first participant attribute

to determine whether a communication initiated from a first participant device to a second participant device is allowed to proceed,

and if it is allowed to proceed, whether it should be routed to its destination via a first network element or a second network element.

1.8

U.S. Patent No. 10,218,606, issued February 26, 2019, relates to, among other things, processing at least one first participant attribute

and a second participant identifier to determine whether a communication initiated from a first participant device to a second participant

device in a packet switched or Internet Protocol (IP) based communication system can be routed using either a local cluster/node or a

remote cluster/node.

1.9

European Patent No. 2,084,868, granted May 30, 2018, relates to, among other things, the classification/routing of communications

and is similar to the counterpart U.S. patents directed to this subject matter (see descriptions of U.S. patents above).

1.10

Indian Patent No. 287,412, granted September 15, 2017, relates to, among other things, the classification/routing of communications

and is similar to the counterpart U.S. patents directed to this subject matter (see descriptions of U.S. patents above).

1.11

Indonesian Patent No. IDP000040412 similarly relates to classification/routing (see above patent descriptions).

1.12

Brazil Patent No. PI 0718312-7, granted May 19, 2020, similarly relates to classification/routing (see above).

1.13

Canadian Patent No. 2,668,025, issued February 25, 2020, relates to classification/routing, similarly to the counterpart U.S. patents

described above.

1.14

Canadian Patent No. 3,045,672, issued January 19, 2021, relates to classification/routing, similarly to the counterpart U.S. patents

described above.

1.15

Canadian Patent No. 3,032,707, issued February 9, 2021, relates to classification/routing, similarly to the counterpart U.S. patents

described above.

1.16

Canadian Patent No. 3,045,694, issued September 7, 2021, relates to classification/routing, similarly to the counterpart U.S. patents

described above.

1.17

Canadian Patent No. 3,045,681, issued October 12, 2021, relates to classification/routing, similarly to the counterpart U.S. patents

described above.

1.18

Canadian Patent No. 3,045,683, issued October 26, 2021, relates to classification/routing, similarly to the counterpart U.S. patents

described above.

| |

● |

U.S.

Patent Nos. 8,422,507; 9,143,608; 9,549,071; and 10,038,779, Canadian Patent No. 2,670,510 and European Patent No. 2,090,024 generally

relate to, for example, lawfully intercepting Voice Over IP (VoIP) and other data communications (e.g., when required by law enforcement

agencies). |

| |

|

|

| |

● |

None

of these patents are currently asserted in litigation. |

2.1

U.S. Patent No. 8,422,507, issued April 16, 2013, applies, for example, to lawful intercept scenarios in which communications originating

in an Internet Protocol (IP) network system from a subscriber to another party occur through a media relay, where information associated

with the subscriber profile meets intercept criteria, such that a routing message is produced to cause the media relay to send a copy

of the communications to a mediation device.

2.2

U.S. Patent No. 9,143,608, issued September 22, 2015, applies, for example, to lawful intercept scenarios in which communications

originating in an Internet Protocol (IP) network system from a subscriber to another party occur through a media relay, and where a profile

associated with the subscriber includes intercept determination information and destination information indicating where to send monitored

communications. For example, when intercept criteria are met, at least some of the intercept determination information and the destination

information are included in a routing message.

2.3

U.S. Patent No. 9,549,071, issued January 17, 2017, generally relates to, among other things, lawfully intercepting Internet Protocol

(IP) communications between a first party and a second party, where a profile associated with the first or second party includes intercept

determination information and destination information for one of the first or second party that is to be monitored, the destination information

indicating where to send the monitored communications. For example, when an intercept criterion is met, at least some of the intercept

determination information and the destination information is included in a routing message.

2.4

U.S. Patent No. 10,038,779, issued July 31, 2018, generally relates to lawfully intercepting VoIP or other data communications between

a first party and a second party, based on an intercept request message that contains (a) an identification of at least one party whose

communications are to be monitored, (b) intercept determination information, and (c) destination information indicating where copies

of intercepted communications are to be sent. For example, when an intercept criterion is met, at least some intercept determination

information and destination information is included in a routing message.

2.5

Canadian Patent No. 2,670,510, granted December 22, 2020, also relates to lawful intercept of communication.

2.6

European Patent No. 2,090,024, granted March 4, 2020, similarly relates to lawful intercept of communications.

| |

● |

U.S.

Patent No. 8,630,234, U.S. Patent No. 10,880,721, European Patent 2,311,292, and Canadian Patent No. 2,732,148 generally relate to,

among other things, methods for channeling communications into distributed VoIP gateways (e.g., allowing roaming mobile devices to

establish communications using optimal infrastructure based on a location associated with the mobile devices). |

| |

|

|

| |

● |

The

litigation status of these patents is described elsewhere in this report. |

3.1

U.S. Patent No. 8,630,234, issued January 14, 2014, generally relates to, among other things, a method of roaming with a mobile phone.

For example, the mobile phone could receive an access code reply message from the access server that includes a temporary access code

allowing the mobile phone to initiate a call to the callee using the access code, allowing the mobile phone to avoid incurring long-distance

roaming charges. The access code may be a phone number or an IP address.

3.2.

U.S. Patent No. 10,880,721, issued December 29, 2020, relates among other things, to apparatuses, servers and methods for providing

an access code (e.g., IP address) to roaming mobile communication devices such as smartphones, to enable access to suitable communication

routing infrastructure, wherein the selection of the communication channel for a call can be optimized based on the calling device’s

location.

3.3

Canadian Patent No. 2,732,148, issued April 25, 2018, is directed to, among other things, subject-matter similar to the counterpart

U.S. patents (see description above).

3.4

European Patent No. 2,311,292, issued December 16, 2020, is directed to subject-matter similar to the counterpart U.S. patents above.

| 4. |

Emergency

assistance calling |

| |

● |

U.S.

Pat. Nos. 8,537,805 and 9,565,307 and Canadian Patent No. 2,681,984 generally relate to emergency assistance calling and are applicable,

for example, to certain E911 scenarios. |

| |

|

|

| |

● |

None

of these patents are currently asserted in litigation. |

4.1

U.S. Patent No. 8,537,805, issued September 17, 2013, relates to, among other things, handling emergency calls from a caller in a

voice over IP (VoIP) system. The ‘805 Patent could apply, for example, when a routing request message is received and the contents

of an emergency call identifier field of a profile match the callee identifier. In this example, if the caller identifier is not associated

with a pre-associated identifier, a temporary identifier is associated with the caller. When the emergency call flag is active, for example,

a routing message establishes a route between the caller and an emergency response center, the routing message including an emergency

response center identifier from a profile associated with the caller and the DID identifier associated with the caller.

4.2

U.S. Patent No. 9,565,307, issued February 7, 2017, relates to, among other things, routing emergency communications. The ‘307

Patent could apply, for example, when a routing request includes the caller identifier and the callee identifier, and where the caller

identifier identifies a profile associated with the caller that includes an emergency call identifier (e.g., “911”) and an

emergency response center identifier. In this example, when the callee identifier matches the emergency call identifier, a routing message

establishes the call, the routing message having a first portion including the emergency response center identifier and a second portion,

which portion may include either a temporary or pre-assigned identifier associated with the caller, for example.

4.3

Canadian Patent No. 2,681,984, issued April 2, 2019 also relates to routing emergency communications.

4.4

U.S. Patent No. 11,172,064 relates to similar subject matter. An Issue Notification has been received from the U.S. Patent Office

indicating that U.S. Patent No. 11,172,064 will issue on November 9, 2021.

| |

● |

U.S.

Patent Nos. 8,774,378 and 9,998,363 both generally relate to allocating charges for communication services. |

| |

|

|

| |

● |

None

of these patents are currently asserted in litigation. |

5.1

U.S. Patent No. 8,774,378, issued July 8, 2014, could apply, for example, to scenarios where a communication system operator and

a reseller of communication services allocate charges incurred by a user. In this example, the process for attributing charges may involve

determining a user cost based on a chargeable time and free time associated with the user, where the chargeable time is based on communication

session time and a pre-defined billing pattern—then account balances for the user, reseller and system operator are updated accordingly.

5.2

U.S. Patent No. 9,998,363, issued June 12, 2018, relates to, among other things, attributing charges for communications services

provided in a communications system for a communication session between a user’s device and a destination device.

5.3

Canadian Patent No. 2,916,220, granted November 26, 2019, also relates to allocating charges.

| 6. |

Determining

a time for permitting a communication session |

| |

● |

None

of these patents are currently asserted in litigation. |

6.1

U.S. Patent No. 9,137,385, issued September 15, 2015, generally relates to, among other things, determining a time for permitting

a communication session to be conducted (e.g., a time-to-live or TTL).

6.2

Canadian Patent No. 2,916,217, issued April 16, 2019, also relates to determining a time for permitting a communication session to

be conducted (e.g., a time-to-live or TTL).

6.3.

U.S. Patent No. 11,171,864 relates to similar subject matter. An Issue Notification has been received from the U.S. Patent Office

indicating that U.S. Patent No. 11,171,864 will issue on November 9, 2021.

| 7. |

Uninterrupted

transmission during endpoint changes |

| |

● |

U.S.

Patent Nos. 8,675,566; 9,154,417; 10,021,729; European Patent No. 2478678; and Canadian Patent No. 2,812,174 all generally relate

to, among other things, uninterrupted transmission during endpoint changes (e.g., station handoffs). |

| |

|

|

| |

● |

None

of these patents are currently asserted in litigation. |

7.1

U.S. Patent No. 8,675,566, issued March 18, 2014, generally relates to, among other things, uninterrupted transmission of internet

protocol (IP) transmissions during endpoint changes.

7.2

U.S. Patent No. 9,154,417, issued October 6, 2015, generally relates to, among other things, uninterrupted transmission, where in

response to an IP transmission at a media relay, a session information record is processed in a certain manner.

7.3

U.S. Patent No. 10,021,729, issued July 10, 2018, generally relates to, among other things, facilitating an uninterrupted internet

protocol (IP) communication session, involving internet protocol transmissions between a first entity and a second entity, during endpoint

changes.

7.4

European Patent No. 2,478,678 and Canadian Patent No. 2,812,174 relate to subject matter similar to the aforesaid U.S. patents

(see above descriptions).

NOTE

BENE: While the above generalized descriptions of the Company’s patents have been provided for convenience, they are provided merely

as a rough guide and are not intended to fully characterize the scope of the Company’s legal rights. Reviewers are therefore advised

to conduct their own legal analysis of the Company’s patents and not merely to rely on the above cursory descriptions.

Amount

Spent on Research and Development

For

the two years ended September 30, 2024 and 2023, the Company has incurred no research and development expenses.

Employees

We

have one full-time employee. The Company utilizes various consultants and contractors for other services.

Emerging

Growth Company Status

We

are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012 (the “JOBS

Act”) and, as such, have elected to comply with certain reduced public company reporting requirements for future filings.

In

April 2012, the Jumpstart Our Business Startups Act (“JOBS Act”) was enacted into law. The JOBS Act provides, among other

things:

| |

- |

Exemptions

for “emerging growth companies” from certain financial disclosure and governance requirements for up to five years and

provides a new form of financing to small companies; |

| |

|

|

| |

- |

Amendments

to certain provisions of the federal securities laws to simplify the sale of securities and increase the threshold number of record

holders required to trigger the reporting requirements of the Securities Exchange Act of 1934, as amended; |

| |

|

|

| |

- |

Relaxation

of the general solicitation and general advertising prohibition for Rule 506 offerings; |

| |

|

|

| |

- |

Adoption

of a new exemption for public offerings of securities in amounts not exceeding $50 million; and |

| |

|

|

| |

- |

Exemption

from registration by a non-reporting company of offers and sales of securities of up to $1,000,000 that comply with rules to be adopted

by the SEC pursuant to Section 4(6) of the Securities Act and exemption of such sales from state law registration, documentation

or offering requirements. |

In

general, under the JOBS Act a company is an “emerging growth company” if its initial public offering (“IPO”)

of common equity securities was effected after December 8, 2011 and the company had less than $1 billion of total annual gross revenues

during its last completed fiscal year. We will retain “emerging growth company” status until the earliest of:

| |

(i) |

the

completion of the fiscal year in which the company has total annual gross revenues of $1 billion or more, |

| |

|

|

| |

(ii) |

the

completion of the fiscal year of the fifth anniversary of the company’s IPO; |

| |

|

|

| |

(iii) |

the

company’s issuance of more than $1 billion in nonconvertible debt in the prior three-year period, or |

| |

|

|

| |

(iv) |

the

company becoming a “larger accelerated filer” as defined under the Securities Exchange Act of 1934, as amended. |

The

JOBS Act provides additional new guidelines and exemptions for non-reporting companies and for non-public offerings. Those exemptions

that impact the Company are discussed below.

Financial

Disclosure. The financial disclosure in a registration statement filed by an “emerging growth company” pursuant to the

Securities Act of 1933, as amended, will differ from registration statements filed by other companies as follows:

| |

(i) |

audited

financial statements required for only two fiscal years (provided that “smaller reporting companies” such as the Company

are only required to provide two years of financial statements); |

| |

(ii) |

selected

financial data required for only the fiscal years that were audited (provided that “smaller reporting companies” such

as the Company are not required to provide selected financial data as required by Item 301 of Regulation S-K); and |

| |

(iii) |

executive

compensation only needs to be presented in the limited format now required for “smaller reporting companies” |

However,

the requirements for financial disclosure provided by Regulation S-K promulgated by the Rules and Regulations of the SEC already provide

certain of these exemptions for smaller reporting companies. The Company is a smaller reporting company. Currently a smaller reporting

company is not required to file as part of its registration statement selected financial data and only needs to include audited financial

statements for its two most current fiscal years with no required tabular disclosure of contractual obligations.

The

JOBS Act also exempts the Company’s independent registered public accounting firm from having to comply with any rules adopted

by the Public Company Accounting Oversight Board (“PCAOB”) after the date of the JOBS Act’s enactment, except as otherwise

required by SEC rule.

The

JOBS Act further exempts an “emerging growth company” from any requirement adopted by the PCAOB for mandatory rotation of

the Company’s accounting firm or for a supplemental auditor report about the audit.

Internal

Control Attestation. The JOBS Act also provides an exemption from the requirement of the Company’s independent registered public

accounting firm to file a report on the Company’s internal control over financial reporting, although management of the Company

is still required to file its report on the adequacy of the Company’s internal control over financial reporting. Section 102(a)

of the JOBS Act exempts “emerging growth companies” from the requirements in §14A(e) of the Securities Exchange Act

of 1934 for companies with a class of securities registered under the Securities Exchange Act of 1934, as amended, to hold shareholder

votes for executive compensation and golden parachutes.

Other

Items of the JOBS Act. The JOBS Act also provides that an “emerging growth company” can communicate with potential investors

that are qualified institutional buyers or institutions that are accredited to determine interest in a contemplated offering either prior

to or after the date of filing the respective registration statement. The JOBS Act also permits research reports by a broker or dealer

about an “emerging growth company” regardless of whether such report provides sufficient information for an investment decision.

In addition, the JOBS Act precludes the SEC and FINRA from adopting certain restrictive rules or regulations regarding brokers, dealers

and potential investors, communications with management and distribution of research reports on the “emerging growth company’s”

IPOs.

Section

106 of the JOBS Act permits “emerging growth companies” to submit registration statements under the Securities Act of 1933,

as amended, on a confidential basis provided that the registration statement and all amendments thereto are publicly filed at least 21

days before the issuer conducts any road show. This is intended to allow “emerging growth companies” to explore the IPO option

without disclosing to the market the fact that it is seeking to go public or disclosing the information contained in its registration

statement until the company is ready to conduct a roadshow.

Election

to Opt Out of Transition Period. Section 102(b)(1) of the JOBS Act exempts “emerging growth companies” from being required

to comply with new or revised financial accounting standards until private companies (that is, those that have not had a Securities Act

of 1933, as amended, registration statement declared effective or do not have a class of securities registered under the Securities Exchange

Act of 1934, as amended) are required to comply with the new or revised financial accounting standard.

The

JOBS Act provides that a company can elect to opt out of the extended transition period and comply with the requirements that apply to

non-emerging growth companies but any such election to opt out is irrevocable. The Company has elected not to opt out of the transition

period. This may make comparison of the Company’s financial statements with any other public company which is not either an “emerging

growth company” nor an “emerging growth company” which has opted out of using the extended transition period difficult

or impossible as possible different or revised standards may be used.

For

so long as we remain an “emerging growth company” as defined in the JOBS Act, we may take advantage of certain exemptions

from various reporting requirements that are applicable to other public companies that are not “emerging growth companies”

as described above. We cannot predict if investors will find our common stock less attractive because we will rely on some or all of

these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for

our common stock and our stock price may be more volatile. If we avail ourselves of certain exemptions from various reporting requirements,

as is currently our plan, our reduced disclosure may make it more difficult for investors and securities analysts to evaluate us and

may result in less investor confidence.

Item

1A. Risk Factors.

The

Company qualifies as a smaller reporting company and is not required to provide the information required by this Item.

Item

2. Properties.

The

Company does not own any properties or facilities. The Company leases office space for operations and administrative purposes.

Item

3. Legal Proceedings.

The

Company is party to the following legal proceedings:

Patent

Litigation

The

Company is party to patent and patent-related litigation cases as follows:

| i. | VoIP-Pal.com

Inc. v. Amazon.com, Inc. et al. Case No. 6-20-cv-00272 in the U.S. District Court, Western

District of Texas. |

In

April 2020, the Company filed a lawsuit in the United States District Court, Western District of Texas, against Amazon.com, Inc. and

certain related entities, alleging infringement of U.S. Patent No. 10,218,606. The case is pending.

| ii. | VoIP-Pal.com,

Inc. v. Verizon Comms., Inc. et al. Case No. 6-21-cv-672 in the U.S. District Court, Western

District of Texas |

On

September 25, 2021, the Company filed a lawsuit in the U.S. District Court, Western District of Texas, against Verizon and related entities

alleging infringement of U.S. Patent Nos. 8,630,234 and 10,880,721. On July 29, 2024, the Court issued an order granting T-Mobile’s

motion for summary judgment of non-infringement. On August 15, 2024, the Court entered final judgment of non-infringement. On August

29, 2024, Verizon filed a motion for attorneys’ fees. On September 12, 2024, VoIP-Pal filed a motion for reconsideration of the

final judgment. On September 19, Verizon filed a motion for entry of bill of costs. The case is pending.

| iii. | VoIP-Pal.com,

Inc. v. T-Mobile US, Inc. et al. Case No. 6-21-cv-674 in the U.S. District Court, Western

District of Texas |

On

September 25, 2021, the Company filed a lawsuit in the U.S. District Court, Western District of Texas, against T-Mobile and related entities

alleging infringement of U.S. Patent Nos. 8,630,234 and 10,880,721. On July 29, 2024, the Court issued an order granting T-Mobile’s

motion for summary judgment of non-infringement. On August 15, 2024, the Court entered final judgment of non-infringement. On September

12, 2024, VoIP-Pal filed a motion for reconsideration of the final judgment. On September 12, 2024, T-Mobile filed a motion for attorneys’

fees and entry of bill of costs. The case is pending.

| iv. | VoIP-Pal.com,

Inc. v. T-Mobile USA, Inc. Case No. 6-24-cv-298 in the U.S. District Court, Western District

of Texas |

On

May 20, 2024, the Company filed a lawsuit in the U.S. District Court, Western District of Texas, against T-Mobile alleging infringement

of U.S. Patent Nos. 8,542,815, 9,179,005, and 10,218,606. On October 15, 2024, the Court dismissed the case based on VoIP-Pal filing

a Notice of Voluntary Dismissal.

| v. | VoIP-Pal.com,

Inc. v. Verizon Comms., Inc. et al. Case No. 6-21-cv-299 in the U.S. District Court, Western

District of Texas |

On

May 20, 2024, the Company filed a lawsuit in the U.S. District Court, Western District of Texas, against Verizon and related entities

alleging infringement of U.S. Patent Nos. 8,542,815 and 9,179,005. On October 15, 2024, the Court dismissed the case based on VoIP-Pal

filing a Notice of Voluntary Dismissal.

Non-Patent

Litigation

The

Company is party to non-patent litigation cases as follows:

Locksmith

Financial Corporation, Inc. et al. (Plaintiff(s)) v VoIP-Pal.com Inc. et al (Defendant(s)) (Case No A-20-807745-C) filed in Clark County

District Court.

On

January 1, 2020, the Plaintiffs filed suit in Nevada District Court claiming that they were owed 95,832,000 Voip-Pal common shares from

a previous case involving the Plaintiff and the Defendant that had been through a jury trial in 2019, in which the jury had made an award

to the Plaintiff that was monetary only, and did not include said shares - following the jury’s decision in the 2019 trial, the

Plaintiff accepted the award and waived their right to appeal. Voip-Pal vigorously disputed the Plaintiff’s 2020 claims on the

basis of claim preclusion (the 2020 claims were addressed in the previous action in 2019 and are now precluded); that Plaintiffs’

claims are untimely, and that the Plaintiffs no longer have standing to bring their claims.

During

the year ended September 30, 2022, the Court entered a judgment in favor of VoIP-Pal.com Inc and co-defendants, dismissing the 2020 case.

The Plaintiffs filed an appeal with the Nevada Supreme Court.

During

the year ended September 30, 2023, following a hearing of the appeal, the Nevada Supreme Court ruled to reverse the lower court’s

judgment and remanded the case back to the lower court for further proceedings. The Defendants (Voip-Pal et al) filed a motion to the

Supreme Court for reconsideration, however that motion was denied, and a trial date was set for November 28, 2023.

During

the year ended September 30, 2024, on November 30, 2023, after the completion of trial, the Eighth Judicial District Court for the

State of Nevada rendered its decision in favor of VoIP-Pal upon all claims in the case, ruling that the Plaintiffs had not met their

burden of proof with respect to any of its claims against VoIP-Pal et al, awarding no damages to Locksmith and specifically ruling

that Locksmith take nothing as a result of the litigation.

During

the year ended September 30, 2024, on August 20, 2024, and then amended on September 10, 2024, the Company reached a settlement and

release agreement with the Plaintiff. Pursuant to the settlement and release agreement, the Company agreed to issue 30,000,000

restricted common shares of the Company, with a value of $351,000, and in consideration of the agreement, the Plaintiff shall file a

voluntary dismissal of its appeal immediately upon delivery of the certificates. Subsequent to the year end, on October 1, 2024, a

share certificate of 30,000,000 was issued to the Plaintiff. The case is closed.

Item

4. Mine Safety Disclosures.

Not

applicable.

PART

II

Item

5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Market

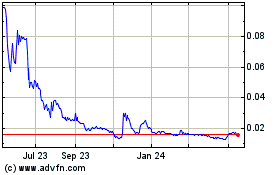

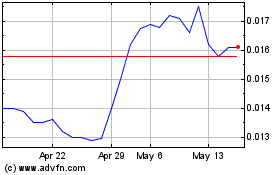

Our

common stock is quoted on the OTCQB with the OTC Markets Group, Inc. under the symbol “VPLM”. The OTCQB is an inter- dealer

quotation and trading system where market makers apply to quote securities. Accordingly, the OTCQB is not considered a market, and there

is, therefore, no public market for our Common Stock.

Holders

We

had approximately 576 holders of record of our common stock as of September 30, 2024 according to the books of our transfer agent. The

number of our stockholders of record excludes any estimate by us of the number of beneficial owners of shares held in street name, the

accuracy of which cannot be guaranteed.

Dividends

We

have not declared a dividend on our common stock, and we do not anticipate the payment of dividends in the near future as we intend to

reinvest our profits to grow our business. There are no restrictions in our articles of incorporation or bylaws that restrict us from

declaring dividends. The Nevada Revised Statutes, however, prohibit us from declaring dividends where, after giving effect to the distribution

of the dividend:

| |

● |

we

would not be able to pay our debts as they become due in the usual course of business; or |

| |

|

|

| |

● |

our

total assets would be less than the sum of our total liabilities, plus the amount that would be needed to satisfy the rights of shareholders

who have preferential rights superior to those receiving the distribution. |

Securities

Authorized for Issuance Under Equity Compensation Plans

In

order to provide incentive to its directors, officers, management, employees, consultants and others who provide services to the Company

or any subsidiary (the “Service Providers”) to act in the best interests of the Company, and to retain such Service Providers,

the Company has in place an incentive Stock Option Plan (the “Plan”). Under the Plan, the Company is authorized to issue

up to 10% of its issued and outstanding share capital in options to purchase common shares of the Company. The maximum term of options

granted under the Plan cannot exceed ten years, with vesting terms determined at the discretion of the Board of Directors.

During

the year ended September 30, 2022, the Company granted 77,000,000 options to purchase 77,000,000 common shares at a price of $0.025 to

its consultants and advisors, of which 77,000,000 are currently outstanding and exercisable. On April 24, 2023, the stock options issued

on May 30, 2022 were re-priced from $0.025 to $0.005. The options have varied vesting provisions and are exercisable for a period of

five years from the date of grant.

During

the year ended September 30, 2023, the Company granted 75,000,000 options to purchase 75,000,000 common shares at a price of $0.005 per

share to its directors, consultants and advisors, of which 75,000,000 are currently exercisable. The options have varied vesting provisions

and are exercisable for a period of five years from the date of grant.

During

the year ended September 30, 2024, the Company granted 115,000,000 options to purchase 115,000,000 common shares at a price of $0.005

to its consultants and advisors, of which 115,000,000 are currently exercisable. The options have varied vesting provisions and are exercisable

for a period of five years from the date of grant.

As

at September 30, 2024, the Company has 279,500,000 stock options outstanding at an average exercise price of $0.005 per share, with a

remaining contractual life of an average of 3.38 years, of which 279,500,000 are vested and exercisable.

Recent

Sales of Unregistered Securities

The

transactions described in this section were exempt from securities registration as provided by Section 4(a)(2) of the Securities Act

for transactions not involving a public offering.

Securities

Issued for Services Rendered

During

the year ended September 30, 2018, the Company issued 104,313,833 shares of common stock at prices between $0.02 and $0.06 per share

to various individuals or entities for services valued at $4,461,789.

During

the year ended September 30, 2019, the Company issued 17,410,000 shares of common stock at prices between $0.02 and $0.04 per share to

various individuals or entities for services valued at $540,200 and 127,000,000 common shares as bonus compensation, recorded as an expense

to the Company of $5,080,000.

During

the year ended September 30, 2020, the Company issued 33,250,000 shares of common stock at prices between $0.005 and $0.03 per share

to various individuals or entities for services with an aggregate value of $534,500.

During

the year ended September 30, 2021, the Company issued 17,800,000 shares of common stock at prices between $0.005 and $0.02 per share

to various individuals or entities for services with an aggregate value of $298,900.

During

the year ended September 30, 2022, the Company issued 9,000,000 shares of common stock at prices between $0.011 and $0.012 per share

to various individuals or entities for services with an aggregate value of $101,600.

During

the year ended September 30, 2023, the Company issued 14,500,000 shares of common stock at a price of $0.005 per share to various individuals

or entities for services with an aggregate value of $72,500.

During

the year ended September 30, 2024, the Company issued 5,000,000 shares of common stock at a price of $0.005 per share to various individuals

or entities for services with an aggregate value of $25,000.

Securities

Issued for Convertible Debt or in Settlement of Debt

During

the year ended September 30, 2018, the Company issued 174,983,685 shares of common stock at a price of $0.038 per share pursuant to the

anti-dilution clause of the Digifonica share purchase agreement dated June 25, 2013 for an aggregate value of $6,684,377.

During

the year ended September 30, 2019, the Company issued 225,184,791 shares of common stock priced between $0.003 and $0.04 per share pursuant

to the anti-dilution clause of the Digifonica share purchase agreement dated June 25, 2013 for an aggregate value of $5,124,641.

Securities

Issued for Cash Proceeds

During

the year ended September 30, 2018, the Company issued:

| - |

108,147,749

shares of common stock at prices between $0.015 and $0.06 per common share to various individuals or entities for cash proceeds of

$3,343,940 from the private placement of common shares; |

| |

|

| - |

6,306,000

units at prices between $0.0125 and $0.02 per unit to various individuals or entities for cash proceeds of $98,120 from the private

placement of units of the Company’s common stock. Each unit consists of one common share and one common share purchase warrant.

Each common share purchase warrant allows the holder to purchase one common share for $0.04 for a period of twelve months from the

date of issuance; and |

| |

|

| - |

50,125,000

common shares at $0.04 per common share to various individuals or entities for cash proceeds of $2,005,000 on the exercise of 50,125,000

common share purchase warrants. |

During

the year ended September 30, 2019, the Company issued:

| - |

5,475,000

shares of common stock at $0.04 per common share to various individuals or entities for cash proceeds of $219,000 from the private

placement of common shares; |

| |

|

| - |

6,306,000

common shares at $0.04 per common share to various individuals or entities for cash proceeds of $252,240 on the exercise of 6,306,000

common share purchase warrants. |

During

the year ended September 30, 2020, the Company issued 44,354,000 common shares priced between $0.005 and $0.015 per common share to various

individuals or entities for cash proceeds of $299,310 from private placements of common shares.

During

the year ended September 30, 2021, the Company issued 193,201,500 common shares priced between $0.005 and $0.01 per share for cash proceeds

of $1,018,515 from a private placement of common shares.

During

the year ended September 30, 2022, the Company issued 246,550,000 common shares priced at $0.005 per common share to various individuals

or entities for cash proceeds of $1,232,750 from the private placement of common shares.

During

the year ended September 30, 2023, the Company issued 983,720,000 common shares priced at $0.005 per common share to various individuals

or entities for cash proceeds of $4,918,600 from the private placement of common shares.

During

the year ended September 30, 2024, the Company issued 551,974,976 common shares priced at $0.005 per common share to various individuals

or entities for cash proceeds of $2,759,875 from the private placement of common shares.

Item

6. Selected Financial Data.

As

a smaller reporting company, we are not required to provide the information required by this Item.

Item

7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The

following management’s discussion and analysis (MD&A) should be read in conjunction with our audited consolidated financial

statements for the year ended September 30, 2024 and notes thereto appearing elsewhere in this report, and our audited consolidated financial

statements for the year ended September 30, 2023 and notes thereto.

CAUTIONARY

STATEMENT REGARDING FORWARD-LOOKING INFORMATION

This

MD&A for the year ending September 30, 2024 contains forward-looking statements within the meaning of Section 27A of the Securities

Act of 1933, as amending, and Section 21E of the Securities Exchange Act of 1934, as amending. Forward-looking statements may be identified

by the use of forward-looking terminology, such as “may”, “shall”, “could”, “expect”,

“estimate”, “anticipate”, “predict”, “probable”, “possible”, “should”,

“continue”, or similar terms, variations of those terms or the negative of those terms. The forward-looking statements specified

in the following information have been compiled by our management based on assumptions made by management and are considered by management

to be reasonable. Our future operating results, however, are impossible to predict and no representation, guaranty, or warranty is to

be inferred from those forward-looking statements.

The

assumptions used for purposes of the forward-looking statements specified in the following information represent estimates of future

events and are subject to uncertainty as to possible changes in economic, legislative, industry, and other circumstances. As a result,

the identification and interpretation of data and other information and their use in developing and selecting assumptions from and among

reasonable alternatives require the exercise of judgment. To the extent that the assumed events do not occur, the outcome may vary substantially

from anticipated or projected results, and, accordingly, no opinion is expressed on the achievability of those forward- looking statements.

No assurance can be given that any of the assumptions relating to the forward-looking statements specified in the following information

are accurate, and we assume no obligation to update any such forward-looking statements.

CORPORATE

HISTORY, OVERVIEW AND PRINCIPAL BUSINESS

VoIP-PAL.com

Inc. (the “Company”) was incorporated in the state of Nevada in September 1997 as All American Casting International, Inc.

and changed its name to VOIP MDI.com in 2004 and subsequently to Voip-Pal.Com Inc. in 2006. Since March 2004, the Company has been in

the development stage of becoming a Voice-over-Internet Protocol (“VoIP”) re-seller, a provider of a proprietary transactional

billing platform tailored to the points and air mile business, and a provider of anti-virus applications for smartphones. All business

activities prior to March 2004 have been abandoned and written off to deficit.

In