Clariant significantly increased profitability in the third quarter

of 2021 on the back of double-digit sales growth

AD HOC ANNOUNCEMENT PURSUANT TO ART. 53 LR

-

Third quarter 2021 sales from continuing operations

increased by 23 % in local currency to

CHF 1.096 billion

-

Third quarter continuing operations EBITDA at

CHF 180 million

-

Third quarter 2021 EBITDA margin increased to 16.4 %

versus 14.2 % in the third quarter of 2020

-

Outlook 2021: increased local currency sales growth of

9 % – 11 % and a confirmed EBITDA margin range of

16.0 % – 17.0 %

“In the third quarter of 2021, Clariant

delivered particularly high year-on-year revenue growth and also

successfully increased performance. The completed construction of

our first commercial sunliquid® cellulosic ethanol plant represents

a major milestone for Clariant and is a further key proof point of

our ambitious growth strategy,” said Conrad Keijzer, CEO of

Clariant. “Clariant’s ability to clearly increase the profitability

level was attributable to strong growth in our relevant end markets

and our ability to partially offset the effects of raw material

cost inflation, logistics challenges and rising energy cost through

strong pricing. Our full year 2021 outlook remains positive. Based

on the strong performance in the first nine months, we are

increasing our full year local currency sales growth expectation

and continue to forecast a step up in EBITDA margins to above

pre-COVID-19 pandemic levels.”

Key Financial Data

|

Continuing operations |

Third Quarter |

Nine Months |

|

in CHF million |

2021 |

2020 |

% CHF |

% LC |

2021 |

2020 |

% CHF |

% LC |

| Sales |

1 096 |

893 |

23 |

23 |

3 130 |

2 838 |

10 |

12 |

| EBITDA |

180 |

127 |

42 |

|

517 |

419 |

23 |

|

| - margin |

16.4 % |

14.2 % |

|

|

16.5 % |

14.8 % |

|

|

| EBITDA before

exceptional items |

190 |

137 |

39 |

|

536 |

446 |

20 |

|

|

- margin |

17.3 % |

15.3 % |

|

|

17.1 % |

15.7 % |

|

|

Third Quarter 2021

– Particularly strong,

double-digit sales growth

facilitates significant

profitability improvement

Muttenz, October 28, 2021 - Clariant, a focused,

sustainable, and innovative specialty chemical company, today

announced that the third quarter 2021 sales from continuing

operations increased by a lofty 23 % in local currency and in

Swiss francs to CHF 1.096 billion. The sales expansion

was achieved via higher volumes and strong pricing in all Business

Areas and all regions.

Clariant grew sales in almost all regions in the

third quarter of 2021, thus reflecting a continuing, clear demand

recovery. In Europe, the very strong 27 % growth in local

currency was supported by strong demand in industrial and consumer

applications, and Latin America grew at the same pace. Asia and

North America followed closely with 23 % and 22 % higher

sales, respectively. The development in the Middle

East & Africa region was flat.

In the third quarter, Care Chemicals increased

sales by 31 % in local currency, supported by organic

double-digit expansion in Industrial Applications and Consumer Care

as well as the first-time consolidation of Clariant IGL Specialty

Chemicals Private Limited (CISC). Catalysis sales rose by 5 %

in local currency primarily due to the strong sales development in

Syngas and the emission-control catalyst businesses. Natural

Resources sales increased by a resounding 25 % in local

currency due to the strong growth in Additives and Functional

Minerals as well as the year-on-year improvement in

Oil and Mining Services and the lower comparison

base.

The continuing operations EBITDA increased to

CHF 180 million and a corresponding margin of

16.4 %, outperforming the 14.2 % reported in the third

quarter of the previous year. This development was positively

influenced by strong volume expansion, improving operating leverage

together with pricing measures, and the continued successful

execution of Clariant’s efficiency programs, which resulted in

additional cost savings of CHF 8 million in the third

quarter. Negative influences on the Group profitability included

continuing raw material cost inflation, the difficult logistic

situation, as well as increasing energy cost.

First Nine

Months

2021

– Higher sales in all

Business Areas and

over-proportional

profitability improvement

In the first nine months of 2021 continuing

operations sales increased by 12 % in local currency and by

10 % in Swiss francs to CHF 3.130 billion, compared

to CHF 2.838 billion in the first nine months of

2020.

In the first nine months of 2021, sales rose in

almost all geographic regions. The developments in Europe and Asia

were particularly robust with strong growth of 19 % and

17 %, respectively, whereby China grew by 16 % in local

currency. Latin American sales expanded by 12 %, followed by

the Middle East & Africa with 2 % growth. The

sales gap diminished in North America, and the region is now only

5 % below previous year levels.

In the first nine months, Care Chemicals sales

rose by 16 % in local currency primarily due to the market

recovery in Industrial Applications. The top-line of Catalysis

increased by 7 % in local currency, bolstered by higher sales

in Syngas and the emission-control catalyst businesses. Natural

Resources sales were 10 % higher in local currency due to

double-digit growth in Additives and Functional Minerals.

The continuing operations EBITDA increased to

CHF 517 million as the Group improved margins on the back

of sales expansion and operating leverage in tandem with the

continued effective execution of efficiency improvement programs,

which resulted in additional cost savings of

CHF 23 million in the first nine months of 2021. The

EBITDA margin increased to 16.5 % from 14.8 % in the

previous year due to the higher profitability in Care Chemicals and

Natural Resources and continued cost discipline across the

Group.

Discontinued

Operations

In the third quarter of 2021, Pigments sales

increased by 17 % in local currency and by 18 % in Swiss

francs. In the first nine months of 2021, on a like-for-like basis,

excluding Masterbatches sales from the first half of 2020, sales in

discontinued operations (Pigments) rose by 12 % in local

currency and in Swiss francs, buoyed by the stronger economic

environment.

In the third quarter, the underlying EBITDA

margin in discontinued operations increased to 15.7 % due to

the higher sales levels and the corresponding operating leverage

improvement in Pigments as well as positive effects from other

discontinued operations.

Clariant announced that definitive agreements

have been signed with Heubach Group and SK Capital Partners to

divest its Pigments business, with closing expected to take place

in the beginning of 2022.

Outlook –

Full year 2021

sales forecast

increased; EBITDA

margin range

confirmed

Clariant aims to grow above the market to

achieve higher profitability through sustainability and innovation.

The Group is significantly reshaping its portfolio through the

divestment of Healthcare Packaging in 2019, the sale of

Masterbatches in 2020, and the signed agreements for the divestment

of its Pigments business.

For the fourth quarter of 2021, Clariant expects

continued strong growth for the Group in local currency versus the

prior year, underpinned by expansion in Care Chemicals and Natural

Resources. Clariant aims to slightly improve its year-on-year

margin levels in the fourth quarter of 2021 via volume growth,

continued cost discipline, and pricing actions to overcome the rise

in raw material, logistics, and energy cost.

Based on the strong performance in the first

nine months, Clariant has increased the sales guidance for the full

year 2021 and expects to achieve local currency sales growth in

continuing operations within a range of 9 % – 11 %

(previously: 7 % – 9 %), while confirming the EBITDA

margin range of 16.0 % – 17.0 % on the back of the sales

growth, the improved profitability of its specialty portfolio, and

the positive impact of the performance programs, while the

challenges regarding raw material, logistics, and energy cost

remain. This is based on the assumption of a continued economic

recovery, while uncertainty remains unprecedently high.

Clariant will be holding a virtual Capital

Markets Day (CMD) on November 23, 2021. Please use the following

link to register for the event: Registration Clariant

CMD

Q3 2021 Media Release EN

|

CORPORATE MEDIA RELATIONS |

INVESTOR RELATIONS |

|

|

| Jochen

Dubiel Phone +41 61 469 63

63jochen.dubiel@clariant.com |

Andreas

Schwarzwälder Phone +41 61 469 63

73andreas.schwarzwaelder@clariant.com |

|

|

|

Claudia Kamensky Phone +41 61 469 63

63claudia.kamensky@clariant.com |

Maria

Ivek Phone +41 61 469 63 73maria.ivek@clariant.com |

|

|

|

|

Alexander Kamb Phone +41 61 469 63

73alexander.kamb@clariant.com |

|

|

|

Follow us on Twitter, Facebook, LinkedIn,

Instagram. |

|

|

This media release contains certain statements that are neither

reported financial results nor other historical information. This

document also includes forward-looking statements. Because these

forward-looking statements are subject to risks and uncertainties,

actual future results may differ materially from those expressed in

or implied by the statements. Many of these risks and uncertainties

relate to factors that are beyond Clariant’s ability to control or

estimate precisely, such as future market conditions, currency

fluctuations, the behavior of other market participants, the

actions of governmental regulators and other risk factors such as:

the timing and strength of new product offerings; pricing

strategies of competitors; the Company’s ability to continue to

receive adequate products from its vendors on acceptable terms, or

at all, and to continue to obtain sufficient financing to meet its

liquidity needs; and changes in the political, social and

regulatory framework in which the Company operates or in economic

or technological trends or conditions, including currency

fluctuations, inflation and consumer confidence, on a global,

regional or national basis. Readers are cautioned not to place

undue reliance on these forward-looking statements, which speak

only as of the date of this document. Clariant does not undertake

any obligation to publicly release any revisions to these

forward-looking statements to reflect events or circumstances after

the date of these materials. www.clariant.com

Clariant is a focused, sustainable and

innovative specialty chemical company based in Muttenz, near

Basel/Switzerland. On 31 December 2020, the company employed a

total workforce of 13 235. In the financial year 2020,

Clariant recorded sales of CHF 3.860 billion for its

continuing businesses. The company reports in three business areas:

Care Chemicals, Catalysis and Natural Resources. Clariant’s

corporate strategy is based on five pillars: focus on innovation

and R&D, add value with sustainability, reposition portfolio,

intensify growth, and increase profitability. |

|

|

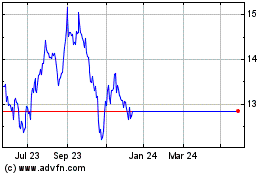

Clariant (LSE:0QJS)

Historical Stock Chart

From Feb 2025 to Mar 2025

Clariant (LSE:0QJS)

Historical Stock Chart

From Mar 2024 to Mar 2025