TIDMAAF

RNS Number : 0768B

Airtel Africa PLC

07 June 2021

Airtel Africa plc

("Airtel Africa", or the "Group")

The 2021 Annual Report and Notice of Annual General Meeting

London and Lagos, 7 June 2021: Airtel Africa, a leading provider

of telecommunications and mobile money services, with a presence in

14 countries across Africa, today announces that its Annual Report

and financial statements for the year ended 31 March 2021 (the

"Annual Report"), Notice of Annual General Meeting (the "AGM"), and

Form of Proxy for the AGM have each been sent to shareholders,

under the cover of a letter from our Chairman, Mr Sunil Bharti

Mittal.

The Annual Report, Notice of AGM and Chairman's Letter are

available to view or download from the Company's website at

https://airtel.africa/investors

The Company's AGM will be held at 11.00am (UK time) on 15 July

2021 at First Floor, 53/54 Grosvenor Street, London, W1K 3HU.

PLEASE NOTE THAT DUE TO INTERNATIONAL TRAVEL RESTRICTIONS THERE

WILL BE LIMITED IN-PERSON BOARD ATTANCE AT THE VENUE. SUBJECT TO UK

COVID-19 REGULATIONS AND GOVERNMENT GUIDANCE, SHAREHOLDERS MAY ATT

IN-PERSON BUT NOTWITHSTANDING THIS ARE ENCOURAGED TO ATT AND VOTE

AT THE AGM ELECTRONICALLY THROUGH THE LUMI PLATFORM. FURTHER

INFORMATION ON HOW TO JOIN THE MEETING ELECTRONICALLY CAN BE FOUND

ON PAGE 8 OF THE NOTICE OF MEETING.

The Company's full year results announcement on 12 May 2021

highlighted continued strong revenue growth, increased

profitability and cash flow, and continued deleveraging.

The appendix to this announcement sets out the required

disclosures with regard to the principal risks as contained in the

Annual Report. This information is provided in accordance with

Disclosure & Transparency Rule 6.3.5(2). This information is

not a substitute for reading the full Annual Report for the year

ended 31 March 2021.

The Company confirms that, in compliance with Listing Rule

9.6.1, an electronic copy of each of the Company's Annual Report

for the year ended 31 March 2021, Notice of AGM and Form of Proxy

for the AGM have been submitted to the National Storage Mechanism,

appointed by the Financial Conduct Authority, and will be available

shortly for inspection at

https://www.fca.org.uk/markets/primary-markets/regulatory-disclosures/national-storage-mechanism

.

-S-

Enquiries

Airtel Africa

Simon O'Hara

Investor.relations@africa.airtel.com +44 207 493 9315

Hudson Sandler

Nick Lyon

Bertie Berger

airtelafrica@hudsonsandler.com +44 207 796 4133

APPIX

How we classify our risks

We classify our risks using the below categorisation

methodology. The risk classification allows for a consistent

approach for risk identification across the Group.

Strategic risks

External risks such as changes in market dynamics or risks to

strategic partnerships.

Operational risks

Risks affecting our ability to effectively operate our business

model across a variety of functional areas.

Financial risks

Risks impacting our liquidity or solvency, financial reporting

or capital structure.

Governance and compliance risks

Risks affecting our ability to comply with our legal, regulatory

and governance obligations.

strategic RISKS

Adverse competition and market disruption

Link to strategy

Win with customers -- Win with data -- Win with mobile money

Risk owner

Chief sales and marketing officer

Description

We operate in an increasingly competitive environment across our

markets and segments, particularly with respect to pricing and

market share. Aggressive competition by existing players or the

entry of a new player could put a downward pressure on prices,

adversely affecting our revenue and margins, as well as our

profitability and long-term survival. The nature and level of the

competition we face varies for each of our markets, products and

services.

Mitigation

1. Ongoing monitoring of competitive landscape and competitor

activities

2. Driving penetration of bundle offerings to lock in customers,

increase affordability and reduce churn

3. The continued growth of our Airtel Money business and the

increased penetration of our GSM customers using Airtel Money

services helps to increase customer stickiness on our network

4. Simplifying customer experience through self-care and other

customer touchpoints

Digitisation and innovation

Link to strategy

Win with customers -- Win with data -- Win with mobile money

Risk owner

Chief information officer

Description

Failure to innovate through simplifying the customer experience,

developing adequate digital touchpoints in line with changing

customer needs and competitive landscape could lead to loss of

customers and market share. We need to continually innovate to

simplify our user experience, make our business processes more

agile, and develop more digital touchpoints to reach our customers

and meet their changing needs.

Mitigation

1. Roll out of digital apps and self-care channels to simplify

customer experience

2. Set up of Airtel Africa Digital Labs focused on developing

cutting edge digital solutions to address customer needs and solve

complex problems using the latest technologies

3. Simplifying our core IT systems and integration capabilities

to allow for faster deployment of new products and services and

integration with third-party applications

COVID-19

Risk owner

Chief executive officer

Description

Covid-19 continues to be both a healthcare crisis and a major

disruptor in the lives of people and the economic activities of

businesses and governments across the world. The pandemic has

underlined how critical telecoms are to the countries in which we

operate, and throughout the crisis we have maintained our services

as well as supporting communities, including by coordinating

medical relief with respective governments. While the pandemic has

shown the continued resilience of our operating model, we continue

to monitor the evolution of the pandemic to prevent any negative

adverse impact on the Group's ability to operate its business

effectively.

Mitigation

1. The Group's business continuity plans continue to be in place

ensuring minimal disruption in our abilities to provide critical

telecom services

2. Ongoing crisis monitoring by the crisis management team at

the Group office through regular engagement with the OpCo crisis

management teams with overall oversight by the Executive

Committee

3. To protect the health and safety of our employees, the

Group's operations continue to adopt a work from home policy with a

predominant number of the Group's employees working remotely

4. Availability of digital self-care channels through which

customers can access the company's products and services and

resolve basic customer queries

operational RISKs

Technology obsolescence

Link to strategy

Win with data -- Win with mobile money -- Win with network --

Win with customers -- Win with cost

Risk owners

Chief technology officer

Chief information officer

Description

An inability to effectively and efficiently invest and upgrade

our network and IT infrastructure would affect our ability to

compete effectively in the market. While we continually invest in

improving and maintaining our networks and IT systems to address

current levels of volume and capacity growth, we need to continue

to commit substantial capital to keep pace with rapid changes in

technology and the competitive landscape.

Mitigation

1. Refreshing our IT infrastructure with focus on cloud

technology

2. Network modernisation project involving upgrades to our core

(mobile switching) and packet (mobile data) networks

3. Reducing the cost of network operations by adopting radio

agnostic technology, 'single RAN', which allows easy switching of

network resources and spectrum between 2G, 3G and 4G networks at

minimal marginal costs

Cyber and information security threats

Link to strategy

Win with customers -- Win with data -- Win with network

Risk owner

Chief information officer

Description

Cybersecurity threats through internal or external sabotage or

system vulnerabilities could potentially result in customer data

breaches and/or service downtimes. Like any other business, we are

increasingly exposed to the risk that third parties or malicious

insiders may attempt to use cyber-crime techniques, including

distributed denial of service attacks, to disrupt the availability,

confidentiality and integrity of our IT systems. This could disrupt

our key operations, make it difficult to recover critical services

and damage our assets.

Mitigation

1. Ongoing review and implementation of security controls to

mitigate possible system vulnerabilities

2. Awareness campaign and training of employees on IT and

cybersecurity risks and control measures

3. Continuing to identify risk and assess vulnerability

Increase in cost structure

Link to strategy

Win with cost

Risk owner

Chief supply chain officer

Description

Adverse changes in our external business environment and/or

supply chain processes could lead to a significant increase in our

operating cost structure and negatively impacting profitability.

Our operating costs are subject to supply chain risks including

fluctuations in global commodity prices, market uncertainty, energy

costs (such as diesel and electricity), and the cost of obtaining

and maintaining licences, spectrum and other regulatory

requirements. Prevailing macroeconomic conditions and a variety of

other factors beyond our control also contribute to this risk. We

need to continually re-evaluate our operating model and cost

structure to identify innovative ways to optimise our costs.

Mitigation

1. Continuous review of our operating model and supply chain

processes to identify cost optimisation opportunities

2. Rolling out various initiatives to optimise our operating

structure to improve business performance

Leadership succession planning

Link to strategy

Win with customers

Risk owner

Chief human resources officer

Description

We need to continually identify and develop successors for key

leadership positions across our organisation to ensure minimal

disruption to the execution of our corporate strategy. Our ability

to execute our business strategies depends in large part on the

efforts of our key people. In some of the countries in which we

operate, there's a shortage of skilled telecommunications

professionals. Any failure to successfully recruit, train,

integrate, retain and motivate key skilled employees could have a

material adverse effect on our business, the results of our

operations, financial condition and prospects.

Mitigation

1. Defined functional and leadership development plans for the

leadership and critical roles within Airtel Africa

2. Ongoing identification of high potential employees for talent

development

3. Long term incentive arrangements to encourage employee

retention and alignment to long term company objectives

Internal controls and compliance

Risk owner

Chief financial officer

Description

Gaps in our internal control and compliance environment could

affect our reputation and lead to financial losses. Our financial

reporting is subject to the risk that controls may become

inadequate due to changes in internal or external conditions, new

accounting requirements, or delays or inaccuracies in reporting. We

continue to implement internal risk management and reporting

procedures at Group and OpCo levels to protect against risks of

internal control weaknesses and inadequate control over financial

reporting.

Mitigation

1. Ongoing review and strengthening of the Group's internal

controls over financial reporting and compliance processes

2. Review process for addressing and mitigating findings from

internal audit, with oversight from the Audit and Risk

Committee

3. Continually identifying and mitigating risks

Network resilience and business continuity

Link to strategy

Win with data -- Win with network

Risk owners

Chief technology officer

Chief information officer

Description

Our ability to provide unparalleled quality of service to our

customers and meet quality of service (QoS) requirements depends on

the robustness and resilience of our network and IT infrastructure

and our ability to respond appropriately to any disruptions. Our

telecommunications networks are subject to risks of technical

failures, aging infrastructure, human error, wilful acts of

destruction or natural disasters. This can include equipment

failures, energy or fuel shortages, software errors, damage to

fibres, lack of redundancy plans and inadequate disaster recovery

plans.

Mitigation

1. Implementing geographically redundant disaster recovery sites

for our networks and IT infrastructure across our OpCos

2. Regular testing of fallback plans for network and IT systems

to ensure reliability of switch over from active to redundant nodes

in the event of a disaster

FINANCIAL RISK

Exchange rate fluctuation

Link to strategy

Win with data

Risk owner

Chief financial officer

Description

Our multinational footprint means we're constantly exposed to

the risk of adverse currency fluctuations and the macroeconomic

conditions in the markets where we operate. We derive revenue and

incur costs in local currencies where we operate, but we also incur

costs in foreign currencies, mainly from buying equipment and

services from manufacturers and technology service providers. That

means adverse movements in exchange rates between the currencies in

our OpCos and the US dollar could have a negative effect on our

liquidity and financial condition. Furthermore, in some of our

markets, triggered by broader macroeconomic conditions, we are

faced with instances of limited supply of foreign currency within

the local monetary system. This constrains the ability to fully

benefit at the Group level from the strong cash generation of those

few OpCos.

Mitigation

1. Renegotiating Forex denominated contracts to local currency

contracts

2. Hedging foreign currency denominated payables and loans, and

matching assets and liabilities, where possible

3. Availability of adequate funding arrangements to mitigate any

short-term liquidity constraints caused by fluctuations in Forex

supply within our OpCos

4. Geographical diversification allows us to continue to access

liquidity broadly across our footprint

GOVERNANCE AND COMPLIANCE RISKS

Compliance to legal requirements

Risk owner

Chief legal officer

Chief regulatory officer

Description

We operate in diverse legal and regulatory environments both in

terms of the countries, where we operate, and the regulators for

the services we provide. Establishing and maintaining adequate

procedures, systems and controls enables us to comply with our

obligations in all the jurisdictions where we operate and for the

services we provide to our customers. We are required to comply

with Know Your Customer, anti-money laundering, anti-bribery and

corruption, sanctions, data privacy, quality of service and other

laws and regulations. A failure to comply could lead to

unanticipated regulatory penalties and sanctions or tax levies, as

well as damage to our reputation.

Mitigation

1. Instituting various policies across the Group to comply with

the legal requirements in the jurisdictions where we operate

2. Continuing engagement with regulators and industry bodies on

key policy matters across our operating footprint

3. Implementing a regular compliance tracking process,

identifying root causes for cases of non-compliance and taking

corrective actions

4. Implementing an escalation process for reporting significant

matters to the Group office

5. Communicating with and training employees on relevant company

policies

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACSSSDFIWEFSESM

(END) Dow Jones Newswires

June 07, 2021 11:08 ET (15:08 GMT)

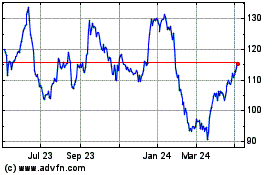

Airtel Africa (LSE:AAF)

Historical Stock Chart

From Mar 2024 to Apr 2024

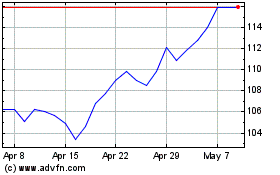

Airtel Africa (LSE:AAF)

Historical Stock Chart

From Apr 2023 to Apr 2024