TIDMABF

RNS Number : 4464S

Associated British Foods PLC

07 November 2013

Associated British Foods plc

Annual Report and Accounts 2013 and associated documents

7 November 2013

Associated British Foods plc announces that a copy of each of

the following documents has been submitted to the National Storage

Mechanism and will shortly be available for inspection at:

www.hemscott.com/nsm.do

- Annual Report and Accounts for the year ended 14 September 2013

- Notice of Annual General Meeting 2013

- Form of Proxy

The 2013 Annual Report and the Notice of Annual General Meeting

2013 are available to download as pdf documents from the Associated

British Foods plc website: www.abf.co.uk

In accordance with Disclosure and Transparency Rule 6.3.5 R (1)

the unedited full text of the Notice of Annual General Meeting 2013

and the Form of Proxy is set out below.

Notice of Annual General Meeting:

ASSOCIATED BRITISH FOODS plc

NOTICE OF ANNUAL GENERAL MEETING

This document is important and requires your immediate

attention

If you are in any doubt as to the action you should take, you

are recommended to seek your own independent financial advice from

a stockbroker, bank manager,

solicitor, accountant, or other financial advisor authorised

under the Financial Services and Markets Act 2000.

If you have sold or otherwise transferred all of your Associated

British Foods plc shares, please send this document, together with

the accompanying documents (but not the personalised Form of

Proxy), as soon as possible to the purchaser or transferee, or to

the stockbroker, bank or other agent through whom the sale or

transfer was effected, for delivery to the purchaser or

transferee.

Notice of the annual general meeting of Associated British Foods

plc to be held at 11.00 am on Friday 6 December 2013 at Congress

Centre, 28 Great Russell Street, London WC1B 3LS is set out in this

document.

A Form of Proxy for use at the annual general meeting is

enclosed. To be valid, the Form of Proxy should be completed and

returned in accordance with the instructions to Equiniti at Aspect

House, Spencer Road, Lancing, BN99 6DA as soon as possible but in

any event so as to arrive not later than 11.00 am on Wednesday, 4

December 2013.

Associated British Foods plc (incorporated and registered in

England and Wales under number 00293262)

Notice of Annual General Meeting

NOTICE IS HEREBY GIVEN that the seventy-eighth annual general

meeting

of Associated British Foods plc (the 'Company') will be held at

Congress Centre,

28 Great Russell Street, London WC1B 3LS on Friday 6 December

2013 at 11.00 am to transact the following business:

Ordinary business

To consider and, if thought fit, to pass the following

resolutions as ordinary resolutions:

Resolution 1

To receive the accounts and the reports of the directors and the

auditors thereon

for the year ended 14 September 2013.

Resolution 2

To receive and approve the directors' Remuneration report for

the year ended

14 September 2013.

Resolution 3

That a final dividend of 22.65p per ordinary share be paid on 10

January 2014 to holders of ordinary shares on the register of

shareholders of the Company at the close of business on 6 December

2013.

Resolution 4

To elect Emma Adamo as a director.

Resolution 5

To re-elect John Bason as a director.

Resolution 6

To re-elect Timothy Clarke as a director.

Resolution 7

To re-elect Lord Jay of Ewelme as a director.

Resolution 8

To re-elect Javier Ferrán as a director.

Resolution 9

To re-elect Charles Sinclair as a director.

Resolution 10

To re-elect Peter Smith as a director.

Resolution 11

To re-elect George Weston as a director.

Resolution 12

To appoint KPMG LLP as auditors of the Company (the 'Auditors')

to hold office from the conclusion of this meeting until the

conclusion of the next general meeting at which accounts are laid

before the shareholders.

Resolution 13

To authorise the directors to determine the Auditors'

remuneration.

Special business

To consider and, if thought fit, to pass the following

resolution as an ordinary resolution:

Resolution 14

THAT the directors be and they are hereby generally and

unconditionally authorised in accordance with section 551 of the

Companies Act 2006 to exercise all the powers of the Company to

allot shares in the Company and to grant rights to subscribe for,

or to convert any security into, shares in the Company

('Rights'):

(a) up to an aggregate nominal amount of GBP14,900,000; and

(b) up to a further aggregate nominal amount of GBP14,900,000

provided that (i) they are equity securities (within the meaning of

section 560(1) of the Companies Act 2006) and (ii) they are offered

by way of a rights issue to holders of ordinary shares on the

register of members at such record dates as the directors may

determine where the equity securities respectively attributable to

the interests of the ordinary shareholders are proportionate (as

nearly as may be practicable) to the respective numbers of ordinary

shares held by them on any such record dates, subject to such

exclusions or other arrangements as the directors may deem

necessary or expedient

to deal with treasury shares, fractional entitlements or legal

or practical problems arising under the laws of any overseas

territory or the requirements of any regulatory body or stock

exchange or by virtue of shares being represented by depositary

receipts or any other matter,

provided that this authority shall expire on the date of the

next annual general

meeting of the Company or, if earlier, on 31 December 2014, save

that the

Company shall be entitled to make offers or agreements before

the expiry of

such authority which would or might require shares to be

allotted or Rights to be

granted after such expiry and the directors shall be entitled to

allot shares and grant Rights pursuant to any such offer or

agreement as if this authority had not expired; and all unexercised

authorities previously granted to the directors to allot shares and

grant Rights be and are hereby revoked.

To consider and, if thought fit, to pass the following two

resolutions as special resolutions:

Resolution 15

THAT, subject to the passing or Resolution 14 above, the

directors be and they are hereby empowered pursuant to section 570

and section 573 of the Companies Act 2006 to allot equity

securities (within the meaning of section 560 of that Act) for cash

either pursuant to the authority conferred by Resolution 14 above

or by way of a sale of treasury shares as if section 561(1) of that

Act did not apply to any such allotment provided that this power

shall be limited to:

(a) the allotment of equity securities in connection with an

offer of securities (but in the case of the authority granted under

paragraph (b) of Resolution 14 by way of rights issue only) in

favour of the holders of ordinary shares on the register of members

at such record date as the directors may determine where the equity

securities respectively attributable to the interests of the

ordinary shareholders are proportionate (as nearly as may be

practicable) to the respective numbers of ordinary shares held by

them on any such record dates, subject to such exclusions or other

arrangements as the directors may deem necessary or expedient to

deal with treasury shares, fractional entitlements or legal or

practical problems arising under the laws of any overseas territory

or the requirements of any regulatory body or stock exchange or by

virtue of shares being represented by depositary receipts or any

other matter; and

(b) the allotment (otherwise than pursuant to sub-paragraph (a)

of this Resolution 15) to any person or persons of equity

securities up to an aggregate nominal amount of GBP2,200,000,

and shall expire upon the expiry of the general authority

conferred by Resolution 14 above, save that the Company shall be

entitled to make offers or agreements before the expiry of such

power which would or might require equity securities to be allotted

after such expiry and the directors shall be entitled to allot

equity securities pursuant to any such offer or agreement as if the

power conferred hereby had not expired.

Resolution 16

THAT a general meeting, other than an annual general meeting,

may be called

on not less than 14 clear days' notice.

To consider and, if thought fit, to pass the following

resolution as an ordinary resolution:

Resolution 17

THAT:

(a) the rules of the Associated British Foods Long Term

Incentive Plan ('LTIP'), in the form produced at the annual general

meeting and initialled by the Chairman of the annual general

meeting for the purposes of identification (a summary of which is

set out in the Appendix to the Notice of annual general meeting),

be and are hereby approved; and

(b) the board of the Company be and is hereby authorised to

establish further schemes based on the LTIP for the benefit of

directors and employees of the Company and/or its subsidiaries who

are located outside the United Kingdom, with such modifications as

may be necessary or desirable in order to take account of local

tax, exchange control or securities laws as they consider

appropriate, provided that any ordinary shares made available under

such other schemes shall be treated as counting against any

individual or overall limits contained in the LTIP.

By order of the board

Paul Lister

Company Secretary

5 November 2013

Weston Centre

l0 Grosvenor Street

London W1K 4QY

Registered in England and Wales

Company No. 00293262

Notes

1. Resolution 3 (Dividend)

A final dividend for the year ended 14 September 2013 of 22.65p

per ordinary share is recommended by the directors and is put to

shareholders for their approval. If approved, the dividend will be

paid on 10 January 2014 to holders of ordinary shares on the

register of shareholders of the Company at the close of business on

6 December 2013 making a total dividend in respect of the year

ended 14 September 2013 of 32.0p per ordinary share. In accordance

with the Articles of Association of the Company, the shareholders

cannot resolve to pay an amount greater than that recommended by

the directors.

2. Resolutions 4 to 11 (Re-election of directors)

In accordance with the UK Corporate Governance Code (the 'Code')

which recommends that all directors should be subject to annual

election by shareholders, all of the Company' directors will be

subject to re-election at this year's annual general meeting.

In proposing the re-election of the non-executive directors, the

Chairman has confirmed that, following formal performance

evaluation, each individual continues to make an effective and

valuable contribution to the board and demonstrates commitment to

the role. Details of the board evaluation process in relation to

the directors can be found on page 49 of the annual report for the

financial year ended 14 September 2013.

This year, when reviewing the independence of non-executive

directors, the board took account of the fact that, as at 3

November 2013, Tim Clarke has served nine years as a director of

the Company. The Code provides that length of service is a factor

to consider when determining the independence of non-executive

directors. The board has given careful consideration to this matter

and has concluded that Tim Clarke remains independent. The length

of Tim Clarke's service and the consequent knowledge and experience

he brings to the role are greatly valued by the board. It is the

board's view that Tim Clarke continues to demonstrate the qualities

of independence in carrying out his role as a non-executive

director and Senior Independent Director, supporting the executive

team in an objective and independent manner.

Biographical details of all the directors can be found on pages

44 and 45 of the annual report for the financial year ended 14

September 2013.

3. Resolutions 14 and 15 (Renewal of directors' powers to allot

shares and

disapplication of statutory pre-emption rights)

Resolution 14 deals with the directors' authority to allot

shares.

At the last annual general meeting of the Company held on Friday

7 December 2012, the directors were given authority to allot

ordinary shares in the capital of the Company

(a) up to an aggregate nominal amount of GBP14,900,000; and

(b) up to a further aggregate nominal amount of GBP14,900,000

provided that (i) they were equity securities (within the meaning

of section 560(1) of the Companies Act 2006) and (ii) they were

offered by way of a rights issue to holders of ordinary shares on

the register of members at such record dates as the directors

determined where the equity securities respectively attributable to

the interests of the ordinary shareholders were proportionate (as

nearly as may be practicable) to the respective numbers of ordinary

shares held by them on any such record dates, subject to such

exclusions or other arrangements as the directors deemed necessary

or expedient to deal with treasury shares, fractional entitlements

or legal or practical problems arising under the laws of any

overseas territory or the requirements of any regulatory body or

stock exchange or by virtue of shares being represented by

depositary receipts or any other matter.

The authority granted on Friday 7 December 2012 expires at the

end of this year's annual general meeting.

In December 2008, the Association of British Insurers ('ABI')

revised its guidelines

on directors' authority to allot shares (in line with the

recommendations of the report issued in November 2008 by the Rights

Issue Review Group). The guidelines state that ABI members will

permit, and treat as routine, resolutions seeking authority to

allot shares representing up to two-thirds of the Company's issued

share capital. The guidelines provide that the extra routine

authority (that is the authority to allot shares representing the

additional one third of the Company's issued share capital) can

only be used to allot shares pursuant to a fully pre-emptive rights

issue.

In light of these guidelines, the board considers it appropriate

that directors be granted authority to allot shares in the capital

of the Company up to a maximum nominal amount of GBP29,800,000

representing the guideline limit of approximately two- thirds of

the Company's issued ordinary share capital as at 4 November 2013

(the latest practicable date prior to publication of this Notice).

Of this amount, GBP14,900,000 (representing approximately one-third

of the Company's issued ordinary share capital) can only be

allotted pursuant to a rights issue. The power will last until the

conclusion of the next annual general meeting in 2014 or, if

earlier, 31 December 2014.

The directors have no present intention of exercising this

authority.

As at the date of this Notice the Company does not hold any

ordinary shares in the

capital of the Company in treasury.

Resolution 15 will give the directors authority to allot shares

in the capital of the

Company pursuant to the authority granted under Resolution 14

above for cash without complying with the pre-emption rights in the

Companies Act 2006 in certain circumstances. In the light of the

ABI guidelines described in relation to Resolution 14 above, this

authority will permit the directors to allot:

(a) shares up to a nominal amount of GBP29,800,000 (representing

approximately two- thirds of the Company's issued ordinary share

capital) on an offer to existing shareholders on a pre-emptive

basis. However unless the shares are allotted pursuant to a rights

issue (rather than an open offer), the directors may only allot

shares up to a nominal amount of GBP14,900,000 (representing

approximately one-third of the Company's issued ordinary share

capital) (in each case subject to any adjustments, such as for

fractional entitlements and overseas shareholders, as the directors

see fit); and

(b) shares up to a maximum nominal value of GBP2,200,000,

representing approximately 5% of the issued ordinary share capital

of the Company as at 4 November 2013 (the latest practicable date

prior to publication of this Notice) otherwise than in connection

with an offer to existing shareholders.

The directors have no present intention of exercising this

authority. This authority will expire as with the general authority

in Resolution 14 other than for pre-existing entitlements.

4. Resolution 16 (Length of notice of meeting)

Resolution 16 is a resolution to allow the Company to hold

general meetings

(other than annual general meetings) on 14 days' notice.

Before the introduction of the Companies (Shareholders' Rights)

Regulations

2009 in August 2009, the minimum notice period permitted by the

Companies Act 2006 for general meetings (other than annual general

meetings) was 14 days. One of the amendments made to the Companies

Act 2006 by the Regulations was to increase the minimum notice

period for general meetings of listed companies to 21 days, but

with an ability for companies to reduce this period back to 14 days

(other than for annual general meetings) provided that two

conditions are met. The first condition is that the company offers

a facility for shareholders to vote by electronic means. This

condition is met if the company offers a facility, accessible to

all shareholders, to appoint a proxy by means of a website. (Please

refer below to note 7 of this Notice of Meeting on page 5 of this

document for details of the Company's arrangements for electronic

proxy appointment.) The second condition is that there is an annual

resolution of shareholders approving the reduction of the minimum

notice period from 21 days to 14 days.

The board is therefore proposing Resolution 16 as a special

resolution to approve 14 days as the minimum period of notice for

all general meetings of the Company other than annual general

meetings. The approval will be effective until the Company's next

annual general meeting, when it is intended that the approval be

renewed. The board will consider on a case-by-case basis whether

the use of the flexibility offered by the shorter notice period is

merited, taking into account the circumstances, including whether

the business of the meeting is time-sensitive.

5. Resolution 17 (Approval of the Associated British Foods Long

Term Incentive Plan)

Review of remuneration structure

The existing Associated British Foods Executive Share Incentive

Plan 2003 (the 'ESIP 2003'), the Company's only executive share

plan, expires in December 2013. The last grant of allocations under

the ESIP 2003 will be made in November 2013. The Company is

therefore proposing to introduce the new Associated British Foods

Long Term Incentive Plan (the 'LTIP') to replace the ESIP 2003.

A summary of the rules of the LTIP is set out in the Appendix to

this document on pages 7 and 8.

The rules of the LTIP will be available for inspection during

the hours and at the locations set out in note 11 of this Notice of

Meeting on page 6 below.

6. Recommendation

The board considers the Resolutions are likely to promote the

success of the Company and are in the best interests of the Company

and its shareholders as a whole. The directors unanimously

recommend that you vote in favour of the Resolutions as they intend

to do in respect of their own beneficial holdings which amount in

aggregate to 3,954,594 shares representing approximately 0.5% of

the existing issued ordinary share capital of the Company.

7. Voting by proxy

A member entitled to attend and vote at the meeting may appoint

another person(s) (who need not be a member of the Company) to

exercise all or any of his/her rights to attend, speak and vote at

the meeting. A member can appoint more than one proxy in relation

to the meeting, provided that each proxy is appointed to exercise

the rights attaching to different shares held by him.

A proxy does not need to be a member of the Company but must

attend the meeting to represent you. Your proxy could be the

Chairman, another director of the Company or another person who has

agreed to attend to represent you. Your proxy will vote as you

instruct and must attend the meeting for your vote to be counted.

Appointing a proxy does not preclude you from attending the meeting

and voting in person.

A Form of Proxy (or notification of availability if registered

to receive shareholder communications electronically) which may be

used to make this appointment and give proxy instructions has been

sent to all members who appeared on the register of members at the

close of business on 30 October 2013. Details of how to appoint a

proxy are set out in the notes to the Form of Proxy. If you do not

have a Form of Proxy and believe that you should have one, or if

you require additional forms, please contact Equiniti, Aspect

House, Spencer Road, Lancing BN99 6DA (Tel: 0871 384 2282 (UK only

- calls to this number cost 8p per minute (excluding VAT) plus

network extras) or +44 (0)121 415 7047 (from outside the UK);

Textel: 0871 384 2255. Lines open 8.30 am to 5.30 pm, Monday to

Friday). As an alternative to completing a hard copy Form of Proxy,

proxies may be appointed electronically in accordance with the

paragraph below.

In order to be valid, an appointment of proxy must be returned

(together with any

authority under which it is executed or a copy of the authority

certified or in some other way approved by the directors) by one of

the following methods:

-- in hard copy form by post, by courier or by hand to the

Company's registered

office or the Company's Registrars;

-- by completing it online at www.sharevote.co.uk by following

the on-screen

instructions to submit it - shareholders will need to identify

themselves with the voting ID, task ID and shareholder reference

number printed on the hard copy Form of Proxy;

-- in the case of shareholders who have already registered with

Equiniti's online

portfolio service, Shareview, they can appoint their proxy

electronically by

logging on to their portfolio at www.shareview.co.uk and

clicking on the link to

vote under your Associated British Foods plc holding details;

or

-- in the case of CREST members, by utilising the CREST

electronic proxy

appointment service in accordance with the procedures set out

below,

and in each case must be received by the Company not less than

48 hours before

the time of the meeting, excluding non-working days.

Please note that the Company takes all reasonable precautions to

ensure no viruses are present in any electronic communication it

sends out, but the Company cannot accept responsibility for loss or

damage arising from the opening or use of any email or attachments

from the Company and recommends that shareholders subject all

messages to virus checking procedures prior to use. Any electronic

communication received by the Company, including the lodgement of

an electronic proxy form, that is found to contain any virus will

not be accepted.

To change your proxy instructions you may return a new proxy

appointment using

the methods set out above. Where you have appointed a proxy

using the hard copy Form of Proxy and would like to change the

instructions using another hard copy Form of Proxy, please contact

Equiniti, Aspect House, Spencer Road, Lancing BN99 6DA (Tel: 0871

384 2282 (UK only - calls to this number cost 8p per minute

(excluding VAT) plus network extras) or +44 (0)121 415 7047 (from

outside the UK); Textel: 0871 384 2255. Lines open 8.30am to 5.30

pm, Monday to Friday). Where two or more valid separate

appointments of proxy are received in respect of the same share in

respect of the same meeting, the one which is last sent shall be

treated as replacing and revoking the other or others.

CREST members who wish to appoint a proxy or proxies by

utilising the CREST

electronic proxy appointment service may do so by utilising the

procedures described in the CREST Manual on the Euroclear website

(www.euroclear.com). CREST personal members or other CREST

sponsored members, and those CREST members who have appointed (a)

voting service provider(s), should refer to their CREST sponsor or

voting service provider(s), who will be able to take the

appropriate action on their behalf. In order for a proxy

appointment made by means of CREST to be valid, the appropriate

CREST message (a 'CREST Proxy Instruction') must be properly

authenticated in accordance with Euroclear UK & Ireland

Limited's ('EUI') specifications and must contain the information

required for such instructions, as described in the CREST Manual.

Regardless of whether it constitutes the appointment of a proxy or

an amendment to the instruction given to a previously appointed

proxy, in order to be valid, the CREST message must be transmitted

so as to be received by the issuer's agent (ID number - RA19) by

the latest time(s) for receipt of proxy appointments specified in

the Notice of meeting. For this purpose, the time of receipt will

be taken to be the time (as determined by the timestamp applied to

the message by the CREST Applications Host) from which the issuer's

agent is able to retrieve the message by enquiry to CREST in the

manner prescribed by CREST. The Company may treat as invalid a

CREST Proxy Instruction in the circumstances set out in regulation

35(5)(a) of the Uncertificated Securities Regulations 2001.

CREST members and, where applicable, their CREST sponsors or

voting service

providers should note that EUI does not make available special

procedures in

CREST for any particular messages. Normal system timings and

limitations will

therefore apply in relation to the input of CREST Proxy

Instructions. It is the responsibility of the CREST member

concerned to take (or, if the CREST member is a CREST Personal

Member or sponsored member or has appointed a voting service

provider(s), to procure that his CREST sponsor or voting service

provider(s) take(s)) such action as shall be necessary to ensure

that a message is transmitted by means of the CREST system by any

particular time. In this connection, CREST members and, where

applicable, their CREST sponsors or voting service providers are

referred, in particular, to those sections of the CREST Manual

concerning practical limitations of the CREST system and

timings.

8. Issued share capital and total voting rights

As at 4 November 2013 (being the latest business day prior to

the publication of this Notice), the Company's issued voting share

capital consists of 791,674,183 ordinary shares, carrying one vote

each. Therefore the total voting rights in the Company are

791,674,183.

9. Nominated persons

A copy of this Notice has been sent for information only to

persons who have been nominated by a member to enjoy information

rights under section 146 of the Companies Act 2006 (a 'Nominated

Person'). The rights to appoint a proxy cannot be exercised by a

Nominated Person: they can only be exercised by the member.

However, a Nominated Person may have a right under an agreement

between him and the member by whom he was nominated to be appointed

as a proxy for the meeting or to have someone else so appointed. If

a Nominated Person does not have such a right or does not wish to

exercise it, he may have a right under such an agreement to give

instructions to the member as to the exercise of voting rights.

10. Voting by corporate representatives

A member of the Company which is a corporation may authorise a

person or persons to act as its representative(s) at the annual

general meeting. In accordance with the provisions of the Companies

Act 2006, each such representative may exercise (on behalf of the

corporation) the same powers as the corporation could exercise if

it were an individual member of the Company, provided that they do

not do so in relation to the same shares. It is no longer necessary

to nominate a designated corporate representative.

11. Documents available for inspection

The following documents will be available for inspection during

normal business hours (Saturdays, Sundays and public holidays

excepted) at the registered office

of the Company and will be available at the place of the meeting

from 15 minutes

before the start of the meeting until its conclusion:

-- copies of the directors' service contracts with the Company

and the terms and conditions of the appointment of non-executive

directors; and

-- the rules of the new Associated British Foods Long Term

Incentive Plan (see note 5 of this Notice of Meeting on page 5

above).

The content of this Notice of Meeting, details of the total

number of shares in respect of which members are entitled to

exercise voting rights at the meeting, the total voting rights that

members are entitled to exercise at the meeting, and, if

applicable, any members' statements, members' resolutions or

members' matters of business received by the Company after the date

of this Notice will be available on the Company's website

(www.abf.co.uk).

12. Shareholders entitled to attend and vote

To be entitled to attend and vote at the meeting, members must

be registered in the register of members of the Company at 6.00 pm

on Wednesday 4 December 2013 (or, if the meeting is adjourned, at

6.00 pm on the date which is two days prior to the adjourned

meeting). Changes to entries on the register after this time shall

be disregarded in determining the rights of persons to attend or

vote (and the number of votes they may cast) at the meeting or

adjourned meeting.

13. Audit statements

Members satisfying the thresholds in section 527 of the

Companies Act 2006 can require the Company to publish a statement

on its website setting out any matter relating to (a) the audit of

the Company's accounts (including the auditors' report and the

conduct of the audit) that are to be laid before the meeting; or

(b) any circumstances connected with an auditor of the Company

ceasing to hold office since the last annual general meeting, that

the members propose to raise at the meeting. The Company cannot

require the members requesting the publication to pay its expenses.

Any statement placed on the website must also be sent to the

Company's auditors no later than the time it makes its statement

available on the website. The business which may be dealt with at

the meeting includes any statement that the Company has been

required to publish on its website.

14. Members' questions

The Company must cause to be answered at the meeting any

question relating to the business being dealt with at the meeting

which is put by a member attending the meeting, except in certain

circumstances, including if it is undesirable in the interests of

the Company or the good order of the meeting that the question be

answered or if to do so would involve the disclosure of

confidential information.

15. Electronic voting

Voting on all resolutions will be conducted by way of a poll

rather than a show of hands. This is a more transparent method of

voting as member votes are to be

counted according to the number of shares held. In line with

many other public companies we will be asking shareholders who

attend the annual general meeting in person or by proxy to vote on

the resolutions at the annual general meeting using a hand-held

electronic voting system. This will record all votes cast for each

resolution and display them on a screen providing immediate

detailed results for shareholders to see. As soon as practicable

following the annual general meeting, the results of the voting at

the meeting and the numbers of proxy votes cast for and against and

the number of votes actively withheld in respect of each of the

resolutions will be announced via a Regulatory Information Service

and also placed on the Company's website (www.abf.co.uk).

You may not use any electronic address provided in this Notice

of meeting to

communicate with the Company for any purposes other than those

expressly stated.

APPENDIX

Summary of the Associated British Foods plc Long Term Incentive

Plan

1. Eligibility

Employees (including executive directors) of the Company and its

subsidiaries ('Participants') may be granted conditional rights to

receive ordinary shares in the Company ('Shares') which will be

transferred to the Participant following vesting

('Allocations').

2. Grant of allocations

Allocations may only be granted within a period of 42 days

commencing on (i) the date on which the LTIP is adopted or (ii) the

date of announcement by the Company of its interim or final results

(or as soon as practicable thereafter if the Company is restricted

from being able to grant Allocations during such period). An

Allocation may be granted at other times to a new employee, or if

the board determines that exceptional circumstances exist which

justify the grant of the Allocation.

Allocations may not be granted more than ten years after the

LTIP is adopted.

Nothing is payable by Participants for the grant of

Allocations.

3. Allocations

Allocations are non-transferable (other than to a Participant's

personal representatives following his death).

Participants are not entitled to receive any dividends declared

in respect of Shares subject to an Allocation (or equivalent

payments prior to Shares being transferred to the individual

following vesting.

4. Limits

4.1 Individual limit

The maximum market value of the Shares over which a Participant

may be granted an Allocation in any financial year of the Company

shall not exceed an amount equal to three times the Participant's

basic salary, normally calculated as at the start of the financial

year (or the date on which a new employee commences

employment).

4.2 Plan limits

The number of Shares that may be subject to Allocations and

other outstanding options or awards granted within the previous ten

years and the number of Shares issued for the purpose of options

and awards granted within the previous ten years under any

employees' share scheme adopted by the Company, may not exceed 10%

of the Company's ordinary share capital in issue immediately prior

to the proposed date of grant. This limit is reduced to 5% for

Allocations, options and awards granted under discretionary

schemes.

Any Allocation, option or award which the board has determined

or which is granted on terms that will only be satisfied with

existing Shares will not be subject to or counted in calculating

this limit. Treasury shares will count as new issue shares for the

purposes of this limit for so long as institutional investor bodies

consider that they should be so counted.

5. Performance targets

The board will specify prior to the date of grant the

performance measures and targets which are to apply to Allocations.

The performance measures will be assessed over a period of not less

than three years. There will be no provision for retesting. If the

board determines that the level of vesting based on the performance

measures is not appropriate in the circumstances it may reduce the

vesting amount.

The board may alter a performance target if events happen that

cause it to consider that the performance target is no longer a

fair measure of the Company's performance, or if the Participant

changes role such that the board determines that the performance

target is no longer appropriate, provided that the revised target

may not be materially less challenging.

6. Vesting

6.1 Normal vesting

In normal circumstances, Allocations will vest three years after

the date of grant, provided that the Participant remains in office

or employment with the Company or any subsidiary (the 'Group'), and

to the extent that the relevant performance targets have been met.

Where a first Allocation is granted to a new employee, that

Allocation may be granted on terms that it will vest at the same

time as other Allocations granted in the same financial year.

Where the vesting of an Allocation would be prohibited due to

regulatory or other legal reasons, vesting shall be delayed.

If the board so determines, the vesting of an Allocation may be

satisfied in whole or in part by a cash payment as an alternative

to the issue or transfer of Shares.

6.2 Leavers

In the event of a Participant ceasing to hold office or

employment with the Group, or giving or receiving notice of

cessation, prior to the start of the final year of the Performance

Period the Allocation shall lapse, unless the board determines

otherwise.

Where the date of cessation or notice occurs on or after the

start of the final year of the Performance Period the board may

determine that the Allocation shall not lapse where the reason for

the cessation or notice is permanent disability, redundancy,

retirement, the sale of a business or subsidiary, or death.

In the event that a Participant ceases to hold office or

employment or gives or receives notice in circumstances where the

Allocation does not lapse, an Allocation will normally continue and

vest on the normal vesting date, unless the board brings forward

vesting to the date of cessation. The extent of vesting shall be

determined by reference to the Company's achievement of the

performance measures, and the number of Shares in respect of which

an Allocation vests will, unless the board determines otherwise, be

prorated to reflect the time elapsed to the date of cessation.

7. Corporate actions

The board may determine that Allocations will vest on the

occurrence of certain corporate events, including a change of

control of the Company, by way of offer or scheme of arrangement,

and the voluntary winding-up of the Company.

In the event of a demerger of a substantial part of the Group's

business, a special dividend or a similar event affecting the value

of the Shares to a material extent, Allocations may vest or may be

adjusted accordingly.

The extent of vesting shall be determined by reference to the

Company's achievement of the performance measures, and the number

of Shares in respect of which an Allocation vests will, unless the

board determines otherwise, be prorated to reflect the time elapsed

to the date of the relevant event.

In the event of an internal reorganisation or where the board so

agrees with an acquiring company, Allocations will be rolled over

into awards over shares in the acquiring company of equivalent

value.

8. Variation of capital

Allocations may be adjusted following any variation of share

capital of the Company.

9. Clawback

The board may apply claw-back where at any time within two years

of vesting it determines that the financial results of the Company

were misstated, or an error was made in assessing performance, that

caused an Allocation to vest to a greater degree than it should

have done. The board may also apply a clawback if it is discovered

that the Participant committed, at any time prior to vesting, an

act or omission that justified, or would have justified, summary

dismissal.

10. Alterations

The board may at any time alter or add to all or any of the

provisions of the LTIP in any respect, provided that any change to

the advantage of present or future Participants relating to

eligibility, scheme limits, the basis of individual entitlement to,

and the terms of, Shares or cash provided under the plan or the

provisions for the adjustment of Allocations in the event of a

variation of the Company's share capital must be approved in

advance by the Company's shareholders in general meeting.

Any alteration or addition which is necessary or desirable in

order to comply with or take account of the provisions of any

proposed or existing legislation, law or other regulatory

requirements or to take advantage of any changes in legislation,

law or other regulatory requirements, or to obtain or maintain

favourable taxation, exchange control or regulatory treatment of

the Company, any subsidiary or any Participant or to make minor

amendments to benefit the administration of the LTIP do not need

prior approval of the Company's shareholders. No alterations to the

disadvantage of Participants' subsisting rights can be made by the

board without the approval of Participants holding Allocations over

75% of the total Shares subject to Allocations, or 75% of

Participants attending a meeting called in respect of the proposed

alteration.

11. Benefits are non-pensionable

Benefits under the LTIP are non-pensionable.

Annual general meeting venue details:

Congress Centre

28 Great Russell Street, London WC1B 3LS

T +44 (0) 20 7467 1318

F +44 (0) 20 7467 1313

congress.centre@tuc.org.uk

www.congresscentre.co.uk

Associated British Foods plc

Weston Centre

10 Grosvenor Street

London

W1K 4QY

Tel: +44 (0) 20 7399 6500

Fax: +44 (0) 7399 6580

www.abf.co.uk

Form of Proxy:

Associated British Foods plc annual general meeting,

Friday 6 December 2013

Please see notes overleaf for completion of this Form of

Proxy.

Voting ID Task ID Shareholder reference number

I/We, being a member/members of Associated British Foods plc

(the 'Company') entitled to attend and vote at general meetings of

the Company, hereby appoint

the Chairman of the meeting (see note 1 overleaf)

as my/our proxy to exercise all or any of my/our rights to

attend, speak and

vote for me/us on my/our behalf at the annual general meeting of

the Company

to be held on Friday 6 December 2013 and at any adjournment

thereof.

Please tick here if this proxy appointment is one of multiple

appointments

being made (see note 2 overleaf).

Signed

2013

---------------------------------

Date

Resolutions For Against Vote withheld

1. Report and accounts 2013

2. Directors' Remuneration report

2013

3. Declaration of final dividend

4.Re-election of Emma Adamo

as a director

5. Re-election of John Bason

as a director

6. Re-election of Timothy Clarke

as a director(1)

7. Re-election of Lord Jay of

Ewelme as a director(2)

8. Re-election of Javier Ferrán

as a director(2)

9. Re-election of Charles Sinclair

as a director(1)

10. Re-election of Peter Smith

as a director(2)

11. Re-election of George Weston

as a director

12. Appointment of auditors

13. Remuneration or auditors

14. Authority to allot shares

15. Disapplication of pre-emption

rights

16. Reduced notice of a general

meeting other than an annual

general meeting

17. Approval of new Long Term

Incentive Plan

1 Member of the Nomination and

Remuneration committees

2 Member of the Audit, Nomination

and Remuneration committees

0851-044-S

Notes for completion of Form of Proxy

1. Every holder has the right to appoint some other person(s) of

their choice, who need not be a shareholder, as his proxy to

exercise all or any of their rights to attend, speak and vote on

their behalf at the meeting. If you wish to appoint a person other

than the Chairman, please delete the words 'the Chairman of the

meeting' and insert the name of your chosen proxy holder in the

space provided. Please initial the amendment (unless you are

completing an email or online version). If the proxy is being

appointed in relation to less than your full voting entitlement,

please enter in the box next to the proxy holder's name the number

of shares in relation to which they are authorised to act as your

proxy. If left blank your proxy will be deemed to be authorised in

respect of your full voting entitlement (or, if this proxy form has

been issued in respect of a designated account for a shareholder,

the full voting entitlement for that designated account).

2. A shareholder can appoint more than one proxy in relation to

the meeting, provided that each proxy is appointed to exercise the

rights attaching to different shares held by him/her. To appoint

more than one proxy, (an) additional proxy form(s) may be obtained

by contacting the Registrars' helpline on 0871 384 2282 (UK only -

calls cost 8p per minute (excluding VAT) plus network extras) or

+44 (0) 121 415 7047 (from outside the UK); lines open 8.30 am to

5.30 pm, Monday to Friday or you may photocopy this form. Please

indicate in the box next to the proxy holder's name (see reverse)

the number of shares in relation to which they are authorised to

act as your proxy. Please also indicate by ticking the box provided

if the proxy instruction is one of multiple instructions being

given. All forms must be signed and should be returned together in

the same envelope.

3. The proxy must attend the meeting in person to represent you.

The completion of

a form of proxy does not preclude the shareholder from attending

or voting in person.

4. Please indicate with an X in the appropriate space on the

Form of Proxy how you wish your votes to be cast in respect of the

resolution to be proposed. If the Form of Proxy is returned duly

signed but without specific direction as to how the proxy is to

vote or abstain from voting on any particular matter the proxy will

vote or abstain at his/her discretion. Your proxy will also have

discretion to vote as he/she sees fit on any business which may

properly come before the meeting.

5. To be valid, the Form of Proxy should be lodged with Equiniti

at the address on the enclosed envelope, or at the registered

office of the Company, not less than 48 hours (excluding

non-working days) before the time fixed for the meeting or any

adjournment thereof (as the case may be) together (unless you are

completing an electronic appointment) with any authority (or a

notarially certified copy of such authority) under which it is

signed.

6. Unless you are completing an electronic appointment, in the

case of an appointment by a corporation, the Form of Proxy must be

under its common seal (if any) or the hand of its duly authorised

agent or officer and, in the case of an appointment by an

individual, the Form of Proxy must be signed by the appointor or

his duly authorised agent.

7. In the case of joint holders, only one of the named holders

on the share register

need sign but, if more than one votes, the vote of the first

named on the register

of members will be accepted to the exclusion of other joint

holders.

8. Please note that 'Vote withheld' has no legal effect and will

count neither in the

votes 'For' or 'Against' a resolution.

9. You can register the appointment of your proxy electronically

via the internet at www.sharevote.co.uk. The voting ID, task ID and

shareholder reference number printed on the Form of Proxy will be

required. Alternatively, if you have registered with Equiniti's

online portfolio service, Shareview, you can appoint your proxy at

www.shareview.co.uk. Full details and instructions are given on the

relevant website. The deadline for submission of a proxy

appointment in this way is the same as in note 5 above. An

electronic proxy appointment will be invalid unless it is lodged at

either of the electronic addresses specified in this note 9. Please

note that any electronic communication received by or on behalf of

the Company, including the lodgement of an electronic proxy form,

that is found to contain any virus will not be accepted. You may

not use any electronic address provided in the Notice of annual

general meeting or in these Notes for completion of Form of Proxy

to communicate with the Company for any purposes other than those

expressly stated.

10. CREST members who wish to appoint a proxy or proxies through

the CREST

electronic proxy appointment service should first read note 7 of

the Notice of annual general meeting.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCBRBLTMBMMMLJ

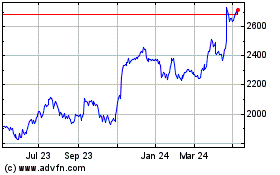

Associated British Foods (LSE:ABF)

Historical Stock Chart

From Jan 2025 to Feb 2025

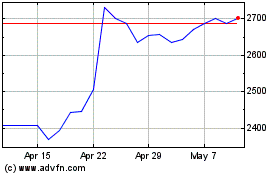

Associated British Foods (LSE:ABF)

Historical Stock Chart

From Feb 2024 to Feb 2025